Aadhaar bank seeding is an important process in facilitating hassle-free access to government subsidies and financial services in India. Through Aadhaar bank seeding, people can get subsidies, pensions, and welfare payments directly into their bank accounts through the Direct Benefit Transfer (DBT) system. This process not only eliminates middlemen and leakages but also encourages financial inclusion, which enables unbanked and underbanked citizens to get engaged in the formal economy.

What is Aadhaar Bank Seeding?

Aadhaar Bank Seeding is the process of linking one’s Aadhaar number with one’s bank account. This allows the government to make direct benefits like subsidies, pensions, and welfare payments directly to the linked bank account. It avoids fraud, enhances financial inclusion, and gives easy access to government schemes.

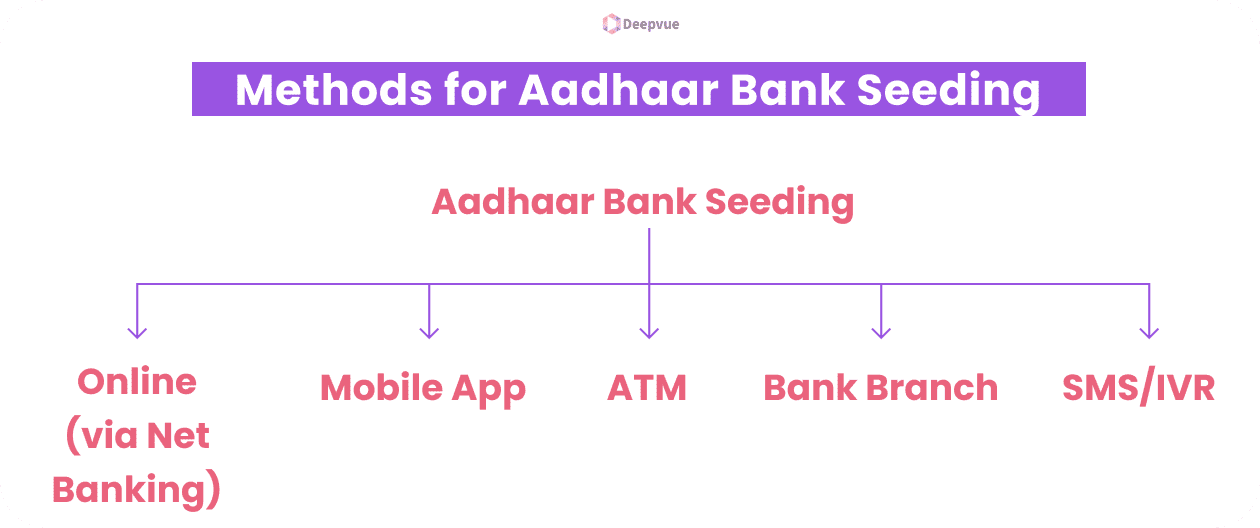

The aadhaar bank seeding can be done through online banking, mobile banking, ATM, or by visiting the bank branch with the necessary documents. After being connected, the Aadhaar number is used as the basic identification for financial transactions under government schemes.

What is Direct Benefit Transfer (DBT)?

Direct Benefit Transfer (DBT) is a scheme of the government to directly transfer subsidies and welfare benefits into the bank account of the beneficiaries. DBT aims to eliminate the middlemen, reduce leakage, and ensure that benefits are transferred to the intended individuals openly and effectively. DBT aims at rationalizing the delivery of government services and promoting financial inclusion through the direct transmission of funds to the beneficiaries.

Benefits of DBT

- Streamlined Access to Government Subsidies: Direct, timely transfer of benefits to eligible recipients, which decreases delays and leakages.

- Improved Account Security: Minimizes the risk of fraud and unauthorized transactions by allowing the deposit of funds directly into the bank accounts verified for the beneficiaries.

- Simplified KYC Compliance: Facilitates linking with the Aadhaar legacy system and identification, which makes the linked transaction smoother and easier for each beneficiary.

The Aadhaar Bank Seeding Process

Process of Linking Aadhaar to Savings Bank Account

- Online (via Net Banking): Log into the bank’s net banking site to update Aadhaar.

- Mobile App: Use the bank’s mobile banking app to link with Aadhaar.

- ATM: Visit an ATM and choose the Aadhaar seeding option.

- Bank Branch: Give a physical form of Aadhaar linking along with a photocopy of the Aadhaar card.

- SMS/IVR: Some banks offer Aadhaar linking via SMS or Interactive Voice Response (IVR).

Role of NPCI and Online Platforms

- NPCI: An agency that brings in Aadhaar-enabled payments and DBT.

- UIDAI: Provides banks with Aadhaar authentication services for verification purposes.

- Online Platforms (Banks, UPI, and Mobile Wallets): Available for linking Aadhaar and validation of online transactions in real-time.

Checking Aadhaar Seeding Status

Online methods for checking

UIDAI Portal

- Go to the official UIDAI website.

- Select “Check Aadhaar & Bank Seeding Status” in the Aadhaar services category.

- Enter your Aadhaar number and the captcha code will be shown.

- Click on “Send OTP”, and put in the OTP received on your registered phone number.

- The screen will indicate if your Aadhaar is connected to your bank account.

mAadhaar App

- Download & Install mAadhaar.

- After opening the Application log in with your Aadhaar number.

- Go to ‘Aadhaar Services’ then select ‘Check Aadhaar-Bank Linking Status’.

- Enter Aadhaar & CAPTCHA and hit submit.

- View Status to see if Aadhaar is associated or not.

Offline methods

- Bank Branch: Go to the bank along with Aadhaar and account number to check the seeding status.

- Call Centers: Check with LPG, telecom, or government service centers for confirmation of Aadhaar linking.

- SMS Service: A few service providers have Aadhaar seeding checks through SMS; inquire with your provider.

Advantages of Linking Aadhaar and Bank Accounts

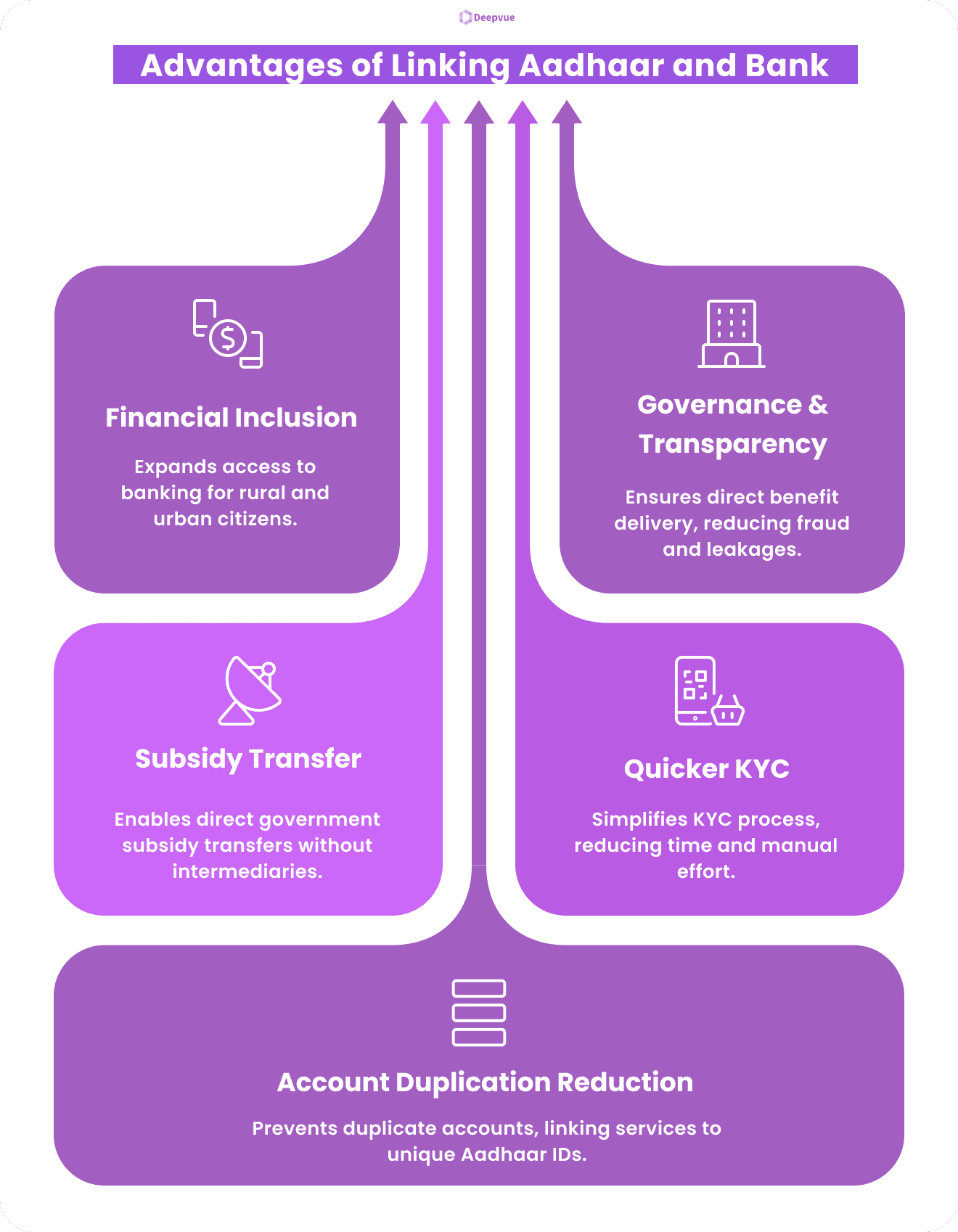

- Improved Financial Inclusion: Facilitates simple access to banking services, subsidies, and government benefits for all citizens, including rural dwellers.

- Better Governance and Transparency: Minimizes frauds and leakages by assuring that the benefits directly go into the Aadhaar-linked accounts of intended beneficiaries.

- Effective Subsidy Transfer: Facilitates direct benefit transfers (DBT) of government subsidies such as LPG, pensions, and scholarships without middlemen.

- Quicker and Trouble-Free KYC: Streamlines the Know Your Customer (KYC) procedure, minimizing manual work and verification time.

- Reduction in Duplicate or Spurious Accounts: Avoids abuse of banking services by tying accounts to a single Aadhaar number.

Government Policies Promoting Financial Inclusion

- Pradhan Mantri Jan Dhan Yojana (PMJDY): Increases bank account availability to the unbanked population.

- Direct Benefit Transfer (DBT): Directs government subsidies and welfare benefits to the beneficiaries.

- Aadhaar-Enabled Payment System (AePS): Facilitates safe, biometric-based banking transactions for everyone.

Predictions For the Future Of DBT and Aadhaar Initiatives

- Expansion of DBT: More welfare programs will see a shift in digital transfers that will reduce the leakages and corruption in program delivery.

- AI-Based Beneficiary Authentication: AI and analytics will help now in the detection of frauds through Aadhaar-based transactions.

- Expanded Financial Inclusion: Rural communities will get easier access to credit, insurance, and digital banking.

- Global Recognition: An Aadhaar-like model might daunt other nations to establish biometric financial inclusion programs.

- Voice & Facial Recognition: Future transactions could use advanced biometric authentication, besides fingerprints.

Conclusion

Aadhaar bank seeding has revolutionized the way beneficiaries receive financial support, introducing transparency, safety, and speed in fund transfers. By minimizing fraud opportunities, eliminating middlemen, and making direct access to government schemes possible, it also strengthens the financial system and millions of Indians. For the economy to become inclusive, broad-based adoption and knowledge of Aadhaar bank seeding will be pivotal in realizing its potential.

Tired of fake identities and never-ending paperwork? Our Aadhaar Verification API is here to save the day!

Our Aadhaar Verification API enables seamless and secure identity authentication by instantly verifying Aadhaar details against the UIDAI database. This API is designed for businesses, banks, and government institutions as it offers accurate KYC compliance, reduces fraud, and streamlines onboarding.

FAQ:

Why is Aadhaar seeding required?

Aadhaar seeding is required to establish a direct linkage between an individual’s bank account and his or her Aadhaar number so that they can directly access government subsidies and benefits.

Is Aadhar mandatory for Direct Benefit Transfer?

Direct Benefit Transfer (DBT) does not require Aadhaar, but it is greatly encouraged. It makes it possible for government benefits and subsidies to directly and efficiently reach the beneficiary in his/her bank account

What is the significance of Direct Benefit Transfer?

Direct Benefit Transfer (DBT) is essential because it allows government subsidies and welfare payments to reach the actual beneficiaries directly without middlemen and minimizes corruption. DBT makes the process more efficient, financial inclusion better, and funds are delivered to the recipients in a timely and safe manner.

Why you should link your Aadhaar with your bank account?

Associating your Aadhaar with your bank account facilitates access to government schemes such as subsidies, pensions, and welfare payouts. It streamlines identity authentication, minimizes paperwork, and directly deposits payments in the right hands, avoiding fraud and unauthorized transactions.

Why should you connect your Aadhaar with NPCI for a bank account?

Connecting Aadhaar with NPCI for your bank account is necessary to enable Aadhaar-based payments, such as DBT. The NPCI develops and maintains national utility systems for service delivery to facilitate fast, effective, and safe transactions via Aadhaar-enabled Payment Systems (AePS), which allow beneficiaries to withdraw money or receive payments without the need for a debit card.