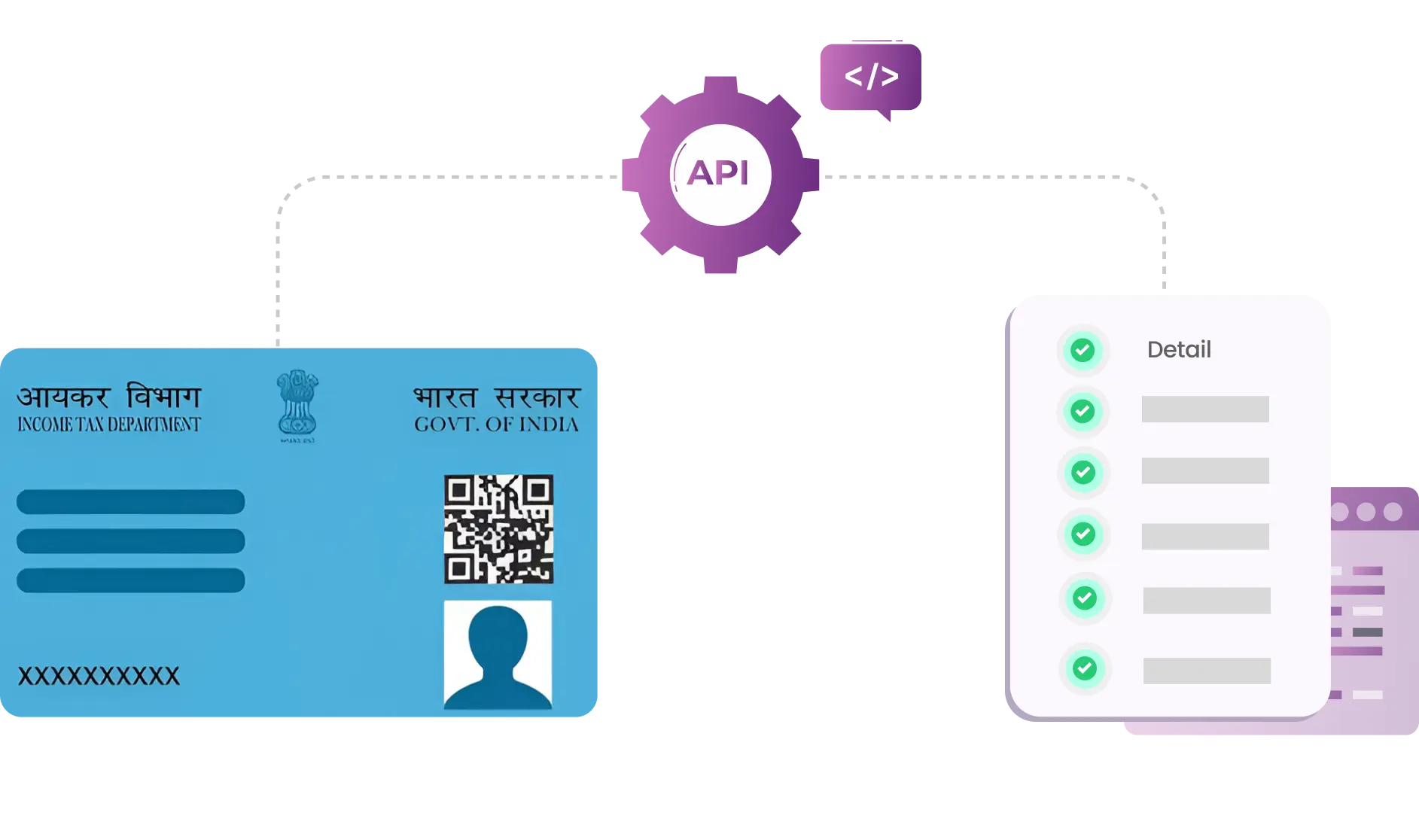

The PAN Verification API connects to government databases to verify the authenticity of PAN cards, ensuring accurate identification and preventing fraudulent activities. Businesses can use PAN Card API to streamline customer onboarding and compliance processes effectively.

The PAN Verification API allows businesses to quickly and accurately verify the authenticity of a PAN card. By connecting to the government database, income tax department, this API can retrieve essential information about the PAN card holder, such as their name, address, and date of birth. This real-time verification process helps businesses prevent fraud and ensure that they are onboarding legitimate customers, vendors, or employees. With the PAN Verification API, businesses can streamline their onboarding processes, reduce the risk of errors, and enhance security measures.

This API simplifies the verification process by eliminating the need for manual verification, which can be time-consuming and prone to errors. By integrating the PAN Verification API into their systems, businesses can access accurate and up-to-date information about PAN card holders, making the onboarding process more efficient and reliable. Additionally, the API offers a fast and secure way to verify PAN card details, giving businesses confidence to deal with genuine individuals or entities.

Quickly validate PAN numbers to ensure the authenticity of customers, employees, and merchants.

The API is fully compliant with KYC, AML, NSDL, and other regulatory requirements, providing a reliable digital verification process.

Ensure accuracy and legitimacy of customer information by verifying data points like name, date of birth, and PAN number with government databases.

By cross-referencing information with IT and government databases, the API helps in preventing fraudulent activities effectively.

Access verified data directly from government databases, ensuring the authenticity of PAN card details.

Streamline the customer onboarding process by quickly verifying PAN details, enabling a faster and smoother experience for customers.

Integrate the NSDL PAN verification API into your existing system or platform. This can be done easily with the following API documentation.

Input the PAN details of the individual or business you want to verify. This includes the PAN number of the entity you are verifying.

Make a request to the API with the PAN details you have inputted in input fields. The API will connect to the government database and retrieve information about the PAN card holder.

The API will verify the authenticity of the PAN card details and return information such as the name, address, verification status and date of birth associated with the PAN card.

Utilise the verified PAN details for various purposes, such as onboarding vendors, employees, or customers, processing payments, or for KYC verification.

If needed, you can also perform bulk verification of up to millions of PANs at a time using the NSDL PAN Verification API. This allows you to verify multiple PAN cards efficiently.

The API connects to the government database in real-time, ensuring accurate and up-to-date verification of PAN card details.

Users can verify beneficiary PAN details for free using Free Credits, allowing them to test the feature without any verification charges.

The API supports bulk verification of more than 10,000 PANs at a time, making it efficient for businesses handling multiple verifications.

With simple API integrations, businesses can go live in just 1 hour, enabling quick implementation of the PAN verification API into their systems.

We offer 24x7 engineering support, ensuring that any issues or queries are promptly addressed.

The PAN Verification API maintains a comprehensive audit trail, recording all verification activities and providing a log of each verification request made. This ensures transparency and accountability in the verification process.

NSDL PAN verification API can be used for KYC verification of customers opening bank accounts, applying for loans, financial transactions, or investing in financial products.

Online retailers can use PAN no verification API to verify the identity of sellers before onboarding them on their platform.

Companies can use PAN no verification API during employee onboarding to verify the PAN details of employees for payroll processing and tax compliance.

Fintech companies can use PAN verification API for customer onboarding, account opening, and transaction processing.

Insurance companies can use PAN Card API for accurate identity verification of policyholders and prevent insurance fraud.

Government agencies can use PAN Card API to authenticate PAN details for various services and benefit distribution.

Real estate developers and agents can use PAN no verification API to verify the PAN details of buyers and sellers in property transactions.

Elevate your development experience with our well-thought-out API documentation.

Seamlessly integrate with Deepvue API in minutes, not months.

Click here to access the documentation now! 👇

99.9% Uptime

Zero Set-Up Fee

Go live in 1 hour

24x7 Tech Support

A PAN Verification API allows businesses to verify and validate the PAN credentials of an individual quickly and accurately. This API helps prevent fraud, streamline customer onboarding processes, and ensure compliance with KYC requirements by checking the authenticity of PAN card details.

PAN card verification is essential for businesses to prevent fraud and ensure they are onboarding legitimate customers. By using a PAN Verification API, businesses can streamline the verification process and maintain compliance with regulations.

Using a PAN Verification API offers benefits such as accurate and real-time verification, prevention of fraudulent activities, simplified onboarding processes, and compliance with KYC requirements.

NSDL, as a direct connection point for PAN verification APIs, ensures maximum uptime and reliability in accessing Indian government databases for accurate verification of PAN card details.

By integrating GST verification capabilities, a PAN Verification API can assist businesses in ensuring compliance with GST regulations by performing PAN number checks and verifying the authenticity of PAN card holders.

PAN Verification APIs offer secure access to government databases, real-time verification processes, and stringent data protection measures, ensuring that businesses can trust the authenticity of their customers’ PAN card details.

If you're looking to enhance your product with more financial APIs, you've come to the right place. Check out the other products below.