Sending money across borders requires more than just knowing a bank account number. To ensure that international payments reach the correct financial institution, the global banking system uses the Bank Identifier Code (BIC). Alternatively referred to as the Bank Identifier Code SWIFT code, the BIC is a distinctive alphanumeric number used to recognize banks and other financial institutions across the globe. Whether you are making a wire payment to an overseas supplier or getting paid by an international customer, the BIC is key in routing the payment securely and accurately.

Learning how BICs function is crucial for companies and individuals who deal with global finance. This blog post will demystify what a Bank Identifier Code is, how it differs from other codes such as IBAN, and why it’s an important piece of the puzzle in today’s global financial system.

Understanding the Bank Identifier Code (BIC)

A Bank Identifier Code (BIC) is an exclusive code used to identify a particular bank or financial institution during international financial transactions. It provides a guarantee that payments are properly routed across borders by indicating the receiving bank’s identity. The code is standardized under ISO 9362 and utilized by the SWIFT network to enable international financial messaging. A BIC usually consists of information like the name of the bank, country, branch, and even a particular branch. Its design enables efficient communication between banks to minimize errors and delays in international transactions.

Difference Between BIC and SWIFT Code

There is no real distinction between a BIC and a SWIFT code—just two names for the same thing. “SWIFT” is the name of the messaging network (Society for Worldwide Interbank Financial Telecommunication), and “BIC” is the official term for the code used in it.

How is a SWIFT/BIC code formatted?

A SWIFT/BIC code is 8 or 11 characters long, formatted thus: the first 4 characters define the bank, the next 2 characters represent the country, the next 2 define the location, and the final 3 (optional) identify the branch. Example: ABCDINBBXXX.

Components of a BIC Code

An 8-character BIC code or an 11-character BIC code, in the following structure:

- Bank Code (4 letters): It signifies the bank

- Country Code (2 letters): Specifies the country

- Location Code (2 letters or digits): Describes the location of the bank

- Branch Code (3 characters or numbers, optional): Indicates a particular branch

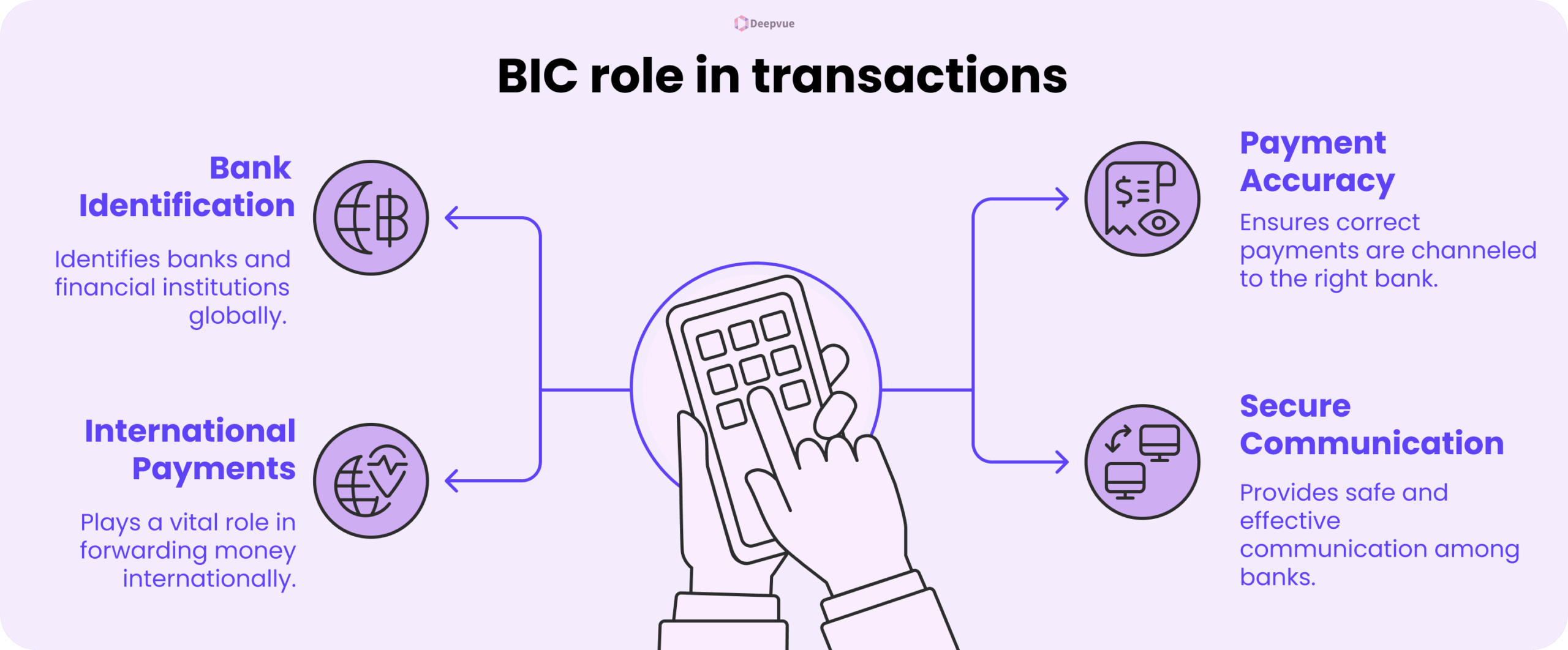

The Role of BIC in International Transactions

- The Bank Identifier Code (BIC) is a unique code used to identify banks and financial institutions globally in international financial transactions.

- It ensures correct payments are channeled to the right bank, reducing delays and errors.

- In international payments, the BIC plays a vital role in forwarding money from banks located in various nations.

- It provides safe and effective communication among banks in the SWIFT network.

BIC and IBAN: How They Work Together

- The BIC locates the recipient bank, and the IBAN locates the recipient’s individual account.

- Together, IBAN and BIC guarantee that cross-border payments find their way to the correct account at the proper bank without human intervention.

BIC in Wire Transfers

- When making an international wire transfer, the sender generally must give the recipient’s IBAN and the BIC of the bank.

- The BIC directs the transfer via the SWIFT system to the payee financial institution.

BIC Codes and SEPA Transactions

SEPA (Single Euro Payments Area) is a European Union initiative that simplifies and standardizes euro-denominated bank transfers across member countries. It allows people and companies to make cashless euro payments throughout Europe as easily as they would make them domestically, from a single bank account and a common set of payment rules.

How BIC Facilitates SEPA Transactions?

The BIC (Bank Identifier Code), also known as the SWIFT code, identifies a specific bank in international transactions. In SEPA payments, the BIC operates in conjunction with the IBAN (International Bank Account Number) to ensure the correct routing of payments to the receiving bank. Even though current SEPA rules permit some payments by the IBAN alone, the BIC continues to be employed in some cross-border situations or in onboarding processes to confirm bank information.

Benefits of Using BIC in European Payments

- Precision: Minimizes mistakes by confirming funds to the right bank.

- Velocity: Simplifies transaction processing among SEPA countries.

- Security: Includes an extra check, preventing misrouting or fraud.

- Cost-Savings: Facilitates cost-free or minimal-cost transfers within the SEPA region.

- Compliance: Complies with European banking regulations, guaranteeing seamless interoperability among institutions.

How to Find Your BIC Code?

- Check Your Bank Statements: Your BIC (Bank Identifier Code) is often printed on paper or digital bank statements, usually near your account details.

- Search the Official Bank Website: Go to your bank’s official website and search for the BIC/SWIFT code in the “Contact,” “FAQs,” or “International Transfers” sections.

- Contact Your Bank: Telephone or walk into your bank’s branch to ask a representative for your BIC code.

Security and Reliability of BIC Codes

- Function in Transaction Validation: BIC (Bank Identifier Code) verifies that foreign financial transactions are being sent to the right financial institution, performing a vital function of validating the recipient bank’s authenticity and correctness.

- Significance for Fraud Prevention: By uniquely identifying banks, BIC codes minimize the risk of incorrect payment routing and can indicate suspicious routing attempts, serving as an underlying layer of protection against fraud in cross-border payments.

Limitations of BIC Codes

- Possible Challenges in Non-Standardized Areas:

Where banking infrastructures are not as standardized or do not integrate with the international systems, the usage of BIC codes is in some places inconsistent or redundant, leading to the risk of transaction errors or delays.

- Shifting to Alternative Payment Means:

With the advent of real-time payments and decentralized financial systems, conventional BIC-based transactions can be limited in terms of speed and compatibility, leading to a move towards newer alternatives such as IBANs, payment APIs, or blockchain-based identifiers.

Conclusion

Bank Identifier Code (BIC) is a crucial part of the world’s financial infrastructure, allowing payments to be delivered internationally to the correct financial institution. Its universal format, overseen by SWIFT, makes it easy to communicate with other banks, strengthens security in transactions, and reduces errors. Whether you’re a company making cross-border transactions or an individual remitting money overseas, knowing how the BIC functions gives you the power to better control cross-border payments.

FAQ

What is a SWIFT/BIC code?

A SWIFT/BIC code is a standardized international identifier used to specify a particular bank during cross-border transactions. It usually consists of 8 to 11 characters for the bank, country, location, and branch. It assists in ensuring that funds are transferred to the right institution.

Is BIC the same as SWIFT code?

Yes, BIC and SWIFT codes are the same. “SWIFT” is the network that operates the codes, whereas “BIC” is the official ISO name.

What does a BIC code look like?

A BIC usually contains 8 or 11 characters: 4 for the bank, 2 for the country, 2 for the location, and 3 optional for the branch.

Do all banks have a SWIFT/BIC code for international transactions?

Not all banks possess SWIFT/BIC codes. Regional or smaller banks might use an intermediary bank or correspondent that does possess a BIC for international transactions on their behalf. You should inquire with your bank if you’re not sure.

What is card issuing for businesses, and how does it work?

Business card issuing is a procedure in which companies issue branded debit, credit, or prepaid cards for staff use or as customer rewards. The cards are tied to business accounts and governed using a platform that monitors spending limits, activity tracking, and compatibility with financial systems.