Conventional loan approval processes were typically cumbersome, with much paperwork and manual verification, leading to delays and inefficiencies. However, with the advent of digital verification, lenders can now verify borrower identities, confirm creditworthiness, and approve loans faster and more securely.

Digital verification employs advanced technologies such as AI, machine learning, and blockchain to verify documents, detect fraud, and expedite decision-making. It enables lenders to carry out real-time identity checks, check financial history, and ensure compliance with regulatory standards.

In this blog, we will talk about the significant benefits of digital verification in lending and how it is transforming the fintech sector.

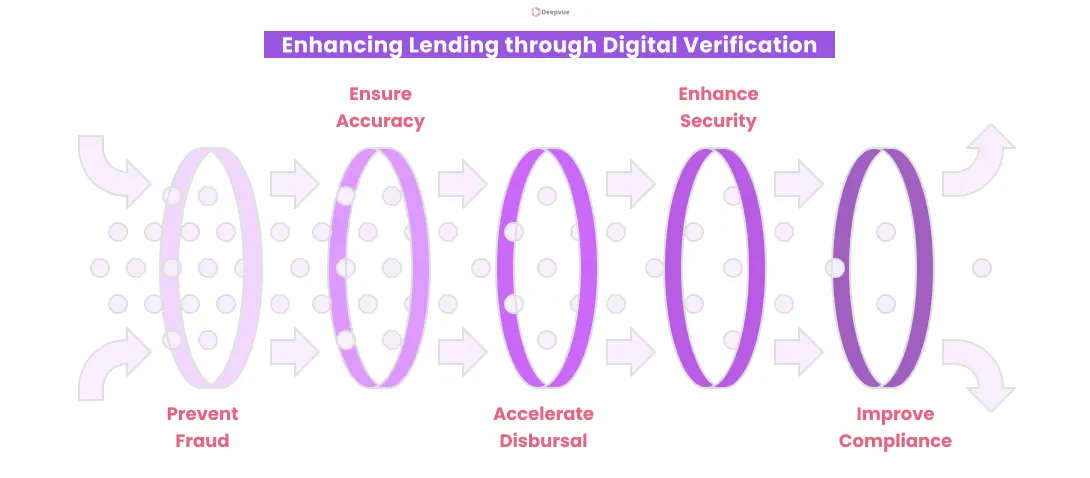

Importance of Digital Verification in Lending

- Prevents Fraud: Digital verification eschews and identifies identity theft, document fraud, and inaccurate loan applications.

- Ensures Accuracy: Digital verification avoids errors in borrower data and financial reports.

- Accelerates Loan Disbursal: Digital verification in lending dispenses with paper checks and thus accelerates the disbursal and approval process.

- Enhances Security: Encrypted and biometric authentication ensures that sensitive borrower data is protected.

- ImprovesCompliance: Digital KYC and AML validation help lenders comply with compliance obligations.

- Saves Costs: Automating verification processes reduces labor and operational costs.

- Reduce the Risk of Defaulting: The bank can determine the creditworthiness of the borrower based on verified records of income.

- Improved Convenience to Customers: In the convenience of their own homes, the customer can check their income and identity through online services provided by lenders.

- Fosters Trust & Credibility: Secure digital verification fosters trust between lenders and borrowers and promotes good lending practices.

Related Read: Digital Lending – What It Is and How It Works?

Key Features of Loan Verification Software

Loan verification software significantly facilitates the loan approval process by automating the verification process, minimizing manual intervention, and expediting decision-making. It interfaces well with the credit bureaus to instantly auto-evaluate applicants’ creditworthiness, greatly streamlining the approval process.

In a similar vein, the loan verification software seeks to minimize fraud risks. It uses AI and machine learning to catch anomalies in applications, alert suspicious transactions, and detect inconsistencies in verifying identities. The software cross-verifies applicant information against more than one database, thus reducing fraudulent activities.

Strong document validation is an important part of loan verification software that ensures all the documents submitted are authentic and valid. With Optical Character Recognition (OCR) and AI, the software reads data from documents and verifies it, comparing it to official records.

Technologies Transforming Digital Verification

- E-Invoicing in Loan Processing: It streamlines the income and financial history verification, thus making loan approvals quicker and more efficient. It minimizes paperwork and fraud attempts by directly connecting with financial institutions. Real-time invoice validation ensures higher accuracy and reduces errors in loan processing.

- AI-based Identity Verification: It is based on machine learning to detect duplicate documents and irregular behavior. AI performs identity verification automatically through face checking, document verification, and behavioral analysis. It is very precise, eliminating the human factor from verifying.

- Biometric Solutions for Identity Verification: It utilizes fingerprints, facial recognition, and iris scanning to provide secure and transparent verification. The methods do not involve the use of traditional passwords, thereby reducing the threat of identity theft.

Benefits of Digital Verification for Borrowers

- Faster Processing Times: Electronic verification bypasses identity and document verification, reducing paperwork and significantly reducing loan processing time. Borrowers can have verification completed in minutes instead of days.

- Enhanced Security Measures: Secure encryption, biometric authentication, and fraud management software safeguard borrowers’ data from identity theft and illicit access, rendering the loan transaction secure.

- Improving the Overall Borrower Experience: An effective, paperless digital verification in lending eliminates errors, saves time, and provides borrowers with a smooth, convenient loan application experience.

Addressing Challenges in the Lending Industry

- Fighting Identity Theft: Lenders must employ biometric verification, AI-based fraud detection, and multi-factor authentication to authenticate identities. Monitoring for suspicious behavior, cooperation with law enforcement, and customer education on fraud prevention are critical measures.

- Avoiding Loan Application Fraud: AI-based fraud detection, identity verification in real-time, and cross-verifying applications with fraud databases prevent fraud on loans. Educating employees to spot red flags and applying sophisticated document verification tools further protect against security risks.

Conclusion: The Future Landscape of Lending and Verification

Digital technology has made the lending process faster, more secure, and more efficient. New technologies such as AI, machine learning, and blockchain empower lenders with real-time verification of the borrower, thereby lessening or fully eliminating the risks of fraudulency and human error.

Our Identity Verification API goes a long way delivering instantaneous KYC verification alongside biometric authentication and AI-driven fraud detection. It integrates seamlessly with lending platforms to enable immediate verification of identity within the ambit of global compliance and regulations.

The future of lending is digital, and financial institutions really have to integrate intelligent verification solutions to remain competitive in an increasingly technology-driven world. Reach us today and see how our Identity Verification API can perform a miracle on the lending process and improve security.

FAQs:

How is AI loan management transforming the lending industry?

Artificial intelligence is revolutionizing loan management through the ability to make automatic credit decisions, increased processing speed, and error reduction. Machine learning algorithms scan large databases to estimate the borrower’s risk, enabling lenders to accelerate and optimize lending decisions.

What is digital identity verification and how does it work?

Digital identity confirmation is the process of verifying an individual’s identity online through the use of sophisticated technologies like biometrics, AI, and document verification.

Why is digital identity verification important?

Digital identity verification is crucial in checking against identity theft, ensuring compliance with laws, and enhancing financial transaction security. Digital identity authentication protects companies and consumers by reducing unauthorized access, money laundering, and loan application fraud.

How does identity verification differ from authentication?

Identity verification confirms an individual’s identity at the initial level using official documents, biometrics, or databases. Authentication is a persistent process that confirms the individual who has been authenticated is the one logging into an account or service, typically using passwords, OTPs, or biometric scans.