Imagine a world where your bank knows you like an old friend, where your financial needs are met with a conversation just as natural as chatting with a neighbor. Conversational banking is revolutionizing how we interact with our finances, and it’s happening now, in 2024.

Gone are the days of robotic calls and never-ending button pushes; conversational banking stands at the intersection of technology and personal touch. It’s a dynamic shift toward customer-centric services that blend human empathy with machine intelligence.

Dive into this article to uncover what conversational banking really is, how it benefits customers and banks alike, and the fascinating channels that bring it to life. We’re about to explore a seamless fusion of convenience and security—a banking experience that talks back, understands, and evolves with you.

What is conversational banking?

Imagine a world where managing your finances is as simple as messaging a friend. Welcome to the future of banking — Conversational Banking — the financial world’s game-changer, offering you the most efficient, user-friendly service experience right at your fingertips.

Conversational banking is the art of enabling real-time interactions between banks and their customers through various communication channels such as text messaging, voice responses, mobile apps, and websites. Picture yourself conducting everyday banking activities like transferring funds, viewing account balances, or paying bills effortlessly through simple dialogue—this is the magic of chat banking.

At its core, conversarial banking seeks to replicate the face-to-face interactions you’d have at a branch, but with the convenience and speed of digital platforms. It’s built on advanced AI and chat technologies, making it possible to have personalized banking services 24/7. This blend of human-like interactions with digital efficiency not only enhances customer experiences but also opens up a pool of data offering insights into customer goals, financial patterns, and potential needs for additional services, enabling banks to serve you—the customer—even better.

Conversational banking isn’t just the future; it’s the now, redefining the customer journey and taking your banking experience to the next level.

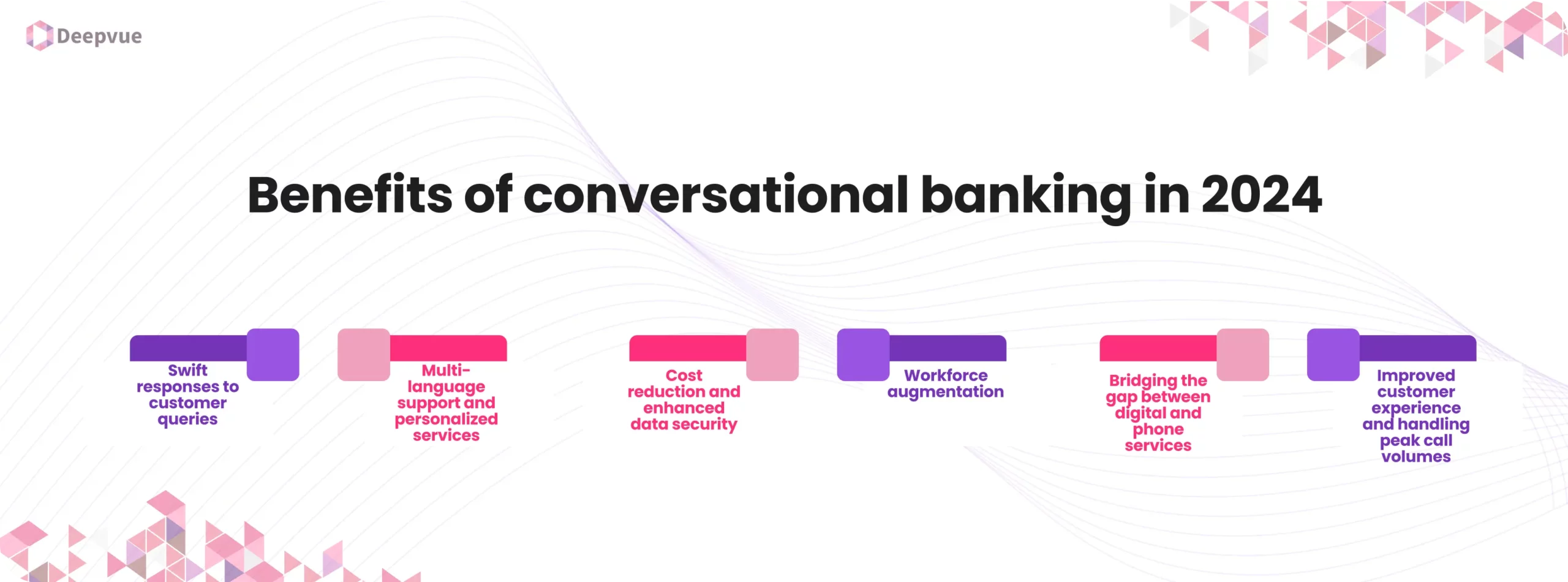

Benefits of conversational banking in 2024

The rapid infusion of Conversational AI into banking ecosystems is transforming customer experiences and fostering an undeniable camaraderie between banks and their clientele. By offering personalized, real-time support replete with chatbots and virtual assistants, Conversational Banking isn’t just sprinkling a handful of glitter on customer satisfaction; it’s unleashing a confetti cannon that keeps customers coming back for more.

The perks of Conversational Banking extend beyond customer delight. The ability to be available 24/7 signifies that whether it’s the crack of dawn or deep in the witching hour, seamless access to banking services remains right at your fingertips. Operational efficiency is on the upswing as AI-powered chatbots tackle routine inquiries, liberating human agents to grapple with more nuanced tasks. Indeed, what we’re witnessing is a finely-tuned symphony where the reduction of customer wait times and streamlining of processes crescendos into an epically efficient customer experience.

The culmination of these advances whispers sweet nothings of cost savings into the ears of banking executives. By automating the mundane, conversational banking slashes operational costs and spotlights human task forces on high-value missions. Thus, what emerges is not just a spectacular customer experience but an opus of operational ingenuity that invigorates the very soul of the banking universe.

Swift responses to customer queries

Gone are the days when customers languished in digital waiting rooms, yearning for a whisper from the banking realm. In 2024, conversational banking deploys AI chatbots that are capable of juggling multiple interactions with the dexterity of a seasoned circus performer, thereby cutting down the average query resolution time dramatically. Picture the triumphant case of IIFL Securities, with their deft virtual assistant slashing query times by a staggering 45 seconds.

This brisk responsiveness is not confined to any single channel or medium; it permeates the entire spectrum of customer interaction—ushering in an era where swift resolution is the norm, not the exception. Thus, for the time-starved citizens of the world, conversational banking stands as a beacon of receptivity and promptness.

Multi-language support and personalized services

Behold the dismantling of Babel as Conversational Banking steps confidently across language divides, embracing diversity with robust multilingual support. Anyone can now converse with their banks in the language that speaks to their heart, ensuring no customer is left behind due to a linguistic mismatch. It’s inclusivity in action, it’s expansion with a personal touch, it’s the global democratization of finance.

Crowning this achievement is the zenith of personalization. Adaptive, shrewd, and considerate, AI-driven systems curate bespoke financial recommendations, deeply informed by an individual’s behavioral patterns and preferences. Whether it’s nudging customers towards that perfect savings plan or cross-selling an insurance product with uncanny timing, the conversarial AI is perpetually in sync with the unique needs of each user.

Cost reduction and enhanced data security

Cut through the noise, forget the frills, and what remains in the world of conversational banking is the stark reduction of unnecessary expenditure. With AI’s ability to automize up to an illustrious 90% of end-to-end tasks, the need for sprawling customer service teams diminishes. Personalized security measures like two-factor authentication messages stand as vigilant guardians over every transaction, ensuring peace of mind alongside fiscal prudence.

Banks that have embraced conversational banking are billing fewer hours while scaling new heights in data security. By wielding sophisticated, intelligent machines, they’re operating leaner, meaner, and with a voracious appetite for efficiency. The result? A fortified digital stronghold where operational costs are vanquished and customer trust reigns supreme.

Workforce augmentation

Step into any forward-thinking bank today, and you’ll bear witness to the harmonious collaboration between humans and AI. Workforce augmentation is the clarion call of the hour. The virtual assistants and chatbots act as tireless co-workers, tirelessly dispensing account information, orchestrating money transfers, and escorting new customers through the onboarding maze with grace.

This adoption of conversational AI is not merely a trend; it’s a strategic evolution. By unburdening the workforce from the clutches of the mundane, these intelligent automation tools have reimagined what customer service in banking can be—an endeavor where satisfaction is measured not just by the solution provided, but by the finesse with which it is delivered.

Bridging the gap between digital and phone services

In Conversational Banking, the gap between digital convenience and the traditional touch of phone services is bridged with an elegance that is nothing short of revolutionary. Gone are the cumbersome journeys through labyrinthine phone menus; in their stead are intuitive SMS directives and notifications, propelling customers towards the exact digital resources they sought.

This harmony between channels is not just about enhancing the user experience; it’s about operational smartness. By directing traffic toward automated, efficient digital solutions, Conversational Banking concurrently alleviates the pressure-cooker atmosphere of congested contact centers and engenders a client-centric future where waiting is a relic of the past.

Improved customer experience and handling peak call volumes

Conversational Banking was born for such a time as this—a moment when surges in demand no longer equate to compromised service. Equipped to manage unexpected spikes, these sophisticated AI solutions offer blissful reprieve from the frustration of endless queues, rendering customer joy in the midst of chaos.

The stats speak for themselves: voice bots decimate wait times by over 90%, while customer satisfaction soars with a staggering 80% increase in first-call resolution. It’s an overture to resourcefulness, where digital communication channels are not just selling points but strategic assets that drive growth and carve paths into the future of banking.

In conclusion, as we embrace such innovations in Conversational Banking, let us revel in the sheer brilliance of a financial sector transformed—an ecosystem where convenience, efficiency, and unparalleled service coalesce to form a symphony of unrivaled customer experience. This, my friends, is Conversational Banking at its zenith in 2024—a realm where conversations are not just heard, but experienced, cherished, and celebrated.

Swift responses to customer queries

Embark on a journey through the paradigm shift in the banking industry with the advent of Conversational Banking in 2024, where swift responses to customer queries aren’t just an expectation but a palpable reality. Thanks to the pioneering fusion of Artificial Intelligence (AI) and chat technology, the face of customer service has been revolutionized, warranting customer satisfaction and engagement unlike any other time in history.

Conversational AI has emerged as a beacon of efficiency in the sea of customer interactions, enabling virtual assistants to conduct multiple dialogues simultaneously, much like a masterful conductor leading an orchestra. This innovation significantly curtails response times, with proven results like the impressive 45-second reduction achieved by IIFL Securities through their intelligent virtual assistant (IVA). Here’s a quick look at how AI chatbots empower the banking sector:

| Advantage | Impact |

| Multi-conversation handling | Faster resolutions |

| Natural language processing | Enhanced understanding |

| 24/7 availability | Continuous customer support |

This seamless experience ensures that whenever a customer raises a query, they are met with a prompt and accurate response, thereby enhancing the overall quality of the customer journey. Fast, precise, and endlessly reliable—conversational banking is defining the new era of customer service in the digital age.

Multi-language support and personalized services

Multi-language Support and Personalized Services in Conversational Banking

The dawn of Conversational AI within the banking industry has been nothing short of a revolution, leading us to a realm where customer satisfaction is immensely enhanced through the power of personalization and multilingual capabilities.

Robust Multilingual Support: Conversational Banking is shattering linguistic limitations, offering formidable multilingual support. Regardless of the channel—be it voice or text—the customer can engage in their language of comfort, ensuring inclusivity and broadening the customer journey on a global scale.

Tailored Customer Experiences: At the core of this transformative wave is the drive for personalization. Banking virtual assistants, powered by Artificial Intelligence (AI), are attuned to the customers’ behavioral attributes, delivering personalized services that resonate on a singular level. This attentive service paves the way to identifying bespoke cross-selling avenues and precisely targeted product recommendations.

Proactive Suggestions: More significantly, these AI-driven systems are not just reactive but proactive. By scrutinizing customer data and behavioral patterns, they can suggest relevant options preemptively, fostering a seamless experience that both satisfies the individual and drives revenue growth.

This tailored approach to customer engagement enriches the conversational banking experiences, ensuring every interaction is both a step towards customer lifetime value and a testament to the transformative capabilities of AI in creating a personalized journey for each user.

| Key Benefits of Multi-language & Personalized Services | Description |

| Inclusivity & Global Reach | Breaking language barriers to serve diverse customer bases |

| Enhanced User Experiences | Providing tailored banking solutions and seamless integrations |

| Cross-Selling Opportunities | Leveraging behavioral insights for tailored product offerings |

| Proactive Customer Engagement | Anticipating customer needs for a superior service delivery |

Cost reduction and enhanced data security

In the world of banking, the quest for efficiency and ironclad data security is relentless. Embracing the transformative power of Conversational AI, banks are heralding a new dawn of operational excellence. With up to a 90% end-to-end automation rate, Conversational AI is not just a technological leap; it’s a cost-reduction powerhouse. By significantly diminishing the reliance on extensive customer service staff, banks can reallocate resources to innovation, slashing through operational costs like a scythe through wheat.

| Aspect | Benefit |

| End-to-end Automation | Substantially cuts down on manpower requirements. |

| AI-driven Chatbots | Delivers instant responses, supercharging efficiency. |

| Personalized Notifications | Bolsters data security with two-factor authentication. |

But it’s not just about saving on the bottom line. Conversational banking wields the dual blades of advanced authentication methods—biometrics and two-factor authentication—to safeguard customer data with unmatched fervor. No longer a mere checkpoint, security in the conversational banking realm is an unassailable fortress designed to protect and serve, ensuring transaction information remains shielded when interfacing with third parties. Banks can now promise their customers a fortress for their finances, delivering peace of mind alongside unparalleled personalized services. This dynamic duo of cost reduction and enhanced data security isn’t just revolutionizing customer experiences—it’s redefining them.

Workforce augmentation

In the thrilling epoch of 2024, the banking industry is witnessing a formidable revolution, thanks to the advent of Conversational AI. The fusion of Artificial Intelligence (AI) with customer interactions has heralded a new era of Workforce Augmentation that’s not just enhancing customer experiences but is radically transforming them. Imagine, if you will, the seamless ballet of human agents and virtual assistants collaborating to give rise to unprecedented customer satisfaction.

The heart of this transformation beats with chatbots and virtual assistants, the tireless digital workhorses automating essential customer service tasks. From providing real-time account balances to executing lightning-fast money transfers, their capabilities are bountiful. Here’s a glance at their role in Workforce Augmentation:

- Automated Customer Service: Reducing operational costs, chatbots handle a wide range of routine inquiries, freeing up human agents to resolve more complex customer issues.

- Customer Onboarding: AI chatbots proficiently onboard new customers, meticulously gathering data, ensuring no detail is missed, leading to a frictionless start to the customer journey.

- Intelligent Automation: As the number of virtual assistants grows, so does the efficiency, delivering answers to customer queries with precision, contributing to delightful conversational banking experiences.

The upshot? Banks now deploy AI solutions as strategic allies in their conversational banking strategy, crafting personalized services that elevate the user experiences to sublime heights, ensuring engagement and loyalty for a customer’s lifetime. Conversational banking is no longer a mere concept; it’s a living, breathing, and evolving digital symphony orchestrated for optimal customer engagement and streamlined operations.

The rise of conversational chatbots is not just a trend; it is the bedrock of modern banking’s future – serving, satisfying, and strategizing for tomorrow’s world.

Bridging the gap between digital and phone services

Bridging the Gap Between Digital and Phone Services

In the ever-evolving banking industry, the fusion of digital and phone channels through conversational banking is a game-changer. Customers no longer have to navigate convoluted paths for assistance; conversational banking guides them to precisely what they need with a simple SMS or push notification. This innovation is a true bridge-builder, providing a seamless customer journey that enriches the user experience.

| Service Type | Improvement |

| Digital and Phone | Seamless bridge |

| Customer Interaction | More efficient, less time-consuming |

The beauty of this approach is its ability to reduce call volume significantly. It offloads interactions that once burdened human agents to sophisticated virtual assistants enabled by Natural Language Processing. Consequently, up to 50% of calls are automated, granting a reprieve to contact centers and allowing them to concentrate on more complex customer issues.

Rather than navigating the maze of traditional phone menus, customers are now swiftly directed to relevant digital platforms. This ensures a swift and efficient engagement, which translates into higher customer satisfaction.

Conversational banking isn’t just a strategy; it’s the future of personalized services, and it’s redefining the customer engagement model one interaction at a time.

Improved customer experience and handling peak call volumes

In the transformative landscape of the banking industry, the advent of conversational banking has been nothing short of a revelation. This incredible fusion of Conversational AI and natural language processing has revolutionized customer experiences, propelling the sector towards new heights of efficiency and engagement.

Imagine a world where banking is as simple as having a conversation. That’s the reality in 2024, where conversational banking, empowered by seamless experience design and advanced digital platforms, has significantly minimized wait times. Customers no longer dread the endless loops of hold music; instead, they are greeted by conversational chatbots and voice bots—courteous virtual assistants equipped to tackle an extensive range of customer queries with personalized service, around the clock.

During spikes in call volume, which once overwhelmed human agents and led to customer frustration, banks are now managing with unprecedented swiftness, ensuring that each customer interaction results in a swift and satisfactory resolution. Integrated voice bots have astonishingly slashed customer wait time by a staggering 92% and have amped up the rate of first call resolution to an impressive 80%.

Notably, this focus on optimizing communication via conversational interfaces has yielded more than happier customers; it has also translated into tangible benefits for the banks themselves, such as revenue growth and notable reductions in operational costs, proving that a well-executed conversational banking strategy is a win-win for both banks and customers.

Impact of Conversational Banking

| Metric | Improvement |

| Customer Wait Time | Reduced by 92% |

| First Call Resolution | Increased by 80% |

| Customer Satisfaction | Significantly Enhanced |

| Agent Satisfaction | Noticeably Improved |

| Operational Costs | Reduced |

| Revenue Growth | Accelerated |

Indisputably, conversational banking has not just improved user experiences; it has redefined the customer journey to be more human, responsive, and utterly seamless.

Channels for implementing conversational banking

The future of the banking industry is buzzing with the harmonious symphony of Conversational AI and the endless potential of multi-channel access. With conversational banking, financial institutions are not just breaking barriers but are also artfully crafting bridges across diverse communication platforms. Customers are now engaging with their banks across a suite of digital channels, including Facebook, WhatsApp, customized mobile apps, and slickly designed websites that promise an omnichannel support system.

Say goodbye to the days when a customer’s communication with their bank was restricted by channel or geography. The power of messaging platforms coupled with trailblazing AI technologies facilitates real-time, engaging communication in the customer’s preferred language. This technological marvel doesn’t stop there; it enhances every stage of the customer experience, creating an enthralling narrative of convenience and efficiency.

Automating routine queries and empowering live agents to handle intricate financial nuances, conversational banking solutions are optimizing customer support to an unprecedented degree. Text messaging automation solutions like App0 have soared in popularity in the worlds of banks and financial institutions, transforming customer communications into a dance of precision and grace.

| Channels | Communication Style | Accessibility | User Experience |

| Facebook, WhatsApp, etc. | Text-based | 24/7 | Personalized, Omnichannel |

| Website | Text/Voice | 24/7 | Seamless Navigation |

| Mobile Apps | Text/Voice | 24/7 | Personalized, Feature-rich |

| SMS | Text | 24/7 | Convenient, Quick |

Chatbots

The realm of online and mobile banking platforms has been set aglow with the advent of chatbots, those tireless entities powered by the heart of conversational AI. Sweeping across the interactive landscape, chatbots answer a myriad of inquiries, conduct transactions, and provide bespoke product recommendations, all with the intelligence and charm of a knowledgeable banking assistant.

The surge in their capabilities is palpable—the once simple chatbots have now become the cornerstone of intelligent automation, dealing with customer issues tirelessly, day and night. Generative AI has become the painter’s brush that has cut human-assisted contacts by a dazzling 50%, showcasing how operational efficiency can be seamlessly married to reduced workload on human agents.

The influence of AI and natural language processing (NLP) in conversational banking stands monumental, serving as the bedrock upon which the chatbots of today draw their strength. These innovative interfaces don’t just understand queries; they respond in kind with a natural and human-like manner, delighting customers and setting new benchmarks in customer service.

Telephone

The voice of innovation rings clear through the telephone lines as AI-driven voice assistants turn routine banking calls into experiences marked by ease and familiarity. Far surpassing the rudimentary abilities of traditional IVR systems, today’s conversational banking by telephone harnesses AI to decipher and respond effectively to a plethora of customer expressions.

Gone are the days when the synonym for phone banking was frustration. Now, thanks to conversational AI technology, immersive phone services are readily accessible, flaunting round-the-clock availability. Customers are immersed in comfort, speaking to their bank as they would a trusted friend, and receiving the personalized, efficient support they’ve always deserved.

SMS

In the era of conversational banking, SMS has emerged as a shining beacon of connectivity, remolding the way financial institutions and customers converse. Through this deeply entrenched communication method, customers are reveling in the joys of performing an array of banking tasks with nothing but text messages. From checking account balances to transferring funds, and from setting up alerts to receiving sagely financial advice—all through a few taps on their trusty mobile devices.

The power of SMS in conversational banking lies in its ability to facilitate real-time, unobtrusive interactions, mirroring the simplicity and ease of a conversation with close ones. The outcome? A customer experience that’s not just fast, but genuinely satisfying—a clear reflection of a banking system that listens, understands, and responds with precision, any hour of the day.

In 2024, conversational banking isn’t just a fleeting trend; it is a must-have, a staple in the diet of modern financial services, and a testament to the power of authentic, personalized banking experiences.

Chatbots

Embrace the future of banking with the power of Conversational AI—chatbots. These digital maestros are revolutionizing the banking industry, offering personalized services that cater to every customer’s need. Imagine a world where your banking virtual assistant not only handles mundane inquiries but offers nuanced product recommendations and support round-the-clock, ensuring a seamless experience for users at every point in their customer journey.

Thanks to advancements in Artificial Intelligence (AI) and Natural Language Processing (NLP), chatbots are now capable of understanding and engaging in dialogues with the finesse of human agents. The result? A dramatic decrease in human-assisted contacts by up to 50%, propelling the banking sector into a new era of efficiency and lowering operational costs significantly.

Key Chatbot Contributions to Banking:

- 24/7 support eases customer queries and concerns.

- Accurate, immediate responses enhance customer satisfaction.

- Reduction of long waiting times uplifts user experiences.

- Intelligent automation of routine tasks boosts productivity.

Prepare to be wooed by personalized conversational banking experiences that not only simplify your life but also demonstrate the transformative impact of AI on your customer interactions and engagements—a true companion in your financial journey.

Telephone

The landscape of conversational banking is rapidly transforming with the integration of AI-driven voice assistants, and it’s pivotal for us all to embrace this change, especially when it comes to telephone interactions. Gone are the days when we wrestled with the monotonous and clunky traditional IVR systems that could comprehend only basic commands. Today, the heart of a seamless experience pulses strongly through the veins of AI technology.

Now, imagine contacting your bank and being greeted by a voice assistant that not only understands your language but also the nuances of your queries, regardless of how you express them. The marvel of natural language processing has bridon-shaped our customer experiences over the telephone, offering an astounding 24/7 availability. Customer satisfaction has been hoisted to paramount heights as these conversational interfaces engage with us humanly and resolve our issues efficiently.

Banks have been empowered to widen customer engagement and support through these AI-powered systems, providing personalized services and a customer journey that feels more like a dialogue than a transaction. The result? A drastic drop in operational costs for banks and a rich increment in customer lifetime value.

Undoubtedly, the advanced capabilities of AI-driven voice assistants have redefined conversational banking, making it more interactive, accessible, and, most importantly, tailored to elevate your user experiences to the zenith of satisfaction.

SMS

The era of conversational banking has escalated customer satisfaction and experiences to unprecedented heights. Among the mediums driving this revolution is the ubiquitous SMS – a powerful channel that breathes life into the banking industry through effortless, text-based interactions.

Conversational Banking via SMS – Your Banking Companion

- 24/7 Availability: Never again be constrained by banking hours! SMS allows for continuous, uninterrupted access to your bank, making sure support is always a simple text away.

- Real-Time Interactions: Say goodbye to delayed responses. Engage in dynamic, real-time conversations and receive swift replies, mirroring the immediacy of a chat with a friend.

- Versatility in Transactions: From balance inquiries to fund transfers, and setting up alerts to bill payments, manage your finance at your fingertips.

- Efficiency and Speed: Resolve your banking queries faster than ever. With SMS, customer issues are addressed with remarkable speed, making every customer journey a breeze.

In this intimate, conversational space, you are not just a number but a valued client deserving personalized services. The beauty of SMS lies not only in its simplicity but also in its potential to enhance customer interactions, making your entire banking experience feel like a dialogue with a trusted confidant. Embrace the seamless, user-friendly conversational banking experiences SMS brings to your daily life, where your financial empowerment is just a text away.

Use cases of conversational banking in 2024

Conversational banking is propelling the banking industry to glittering new heights, with breathtaking advancements that promise personalized experiences and operational excellence. The fusion of Artificial Intelligence (AI) and virtual assistants offers a sweeping array of use cases that are reshaping the very fabric of customer-bank interaction and the broader customer journey.

Addressing frequently asked questions

In the pulsating heart of the banking industry, conversational AI is revolutionizing the way financial institutions engage with their customers. By integrating state-of-the-art chatbots equipped with natural language processing, banks are triumphing in providing instantaneous and reliable responses to the most frequently asked questions. This digital marvel streamlines customer experiences, forging a path to high customer satisfaction.

Imagine a world where your banking queries are answered within seconds, round-the-clock. That’s the seamless experience conversational banking offers. What’s more, with multilingual capabilities, these virtual assistants ensure no language barriers stand between customers and their banking needs.

The wonders of Artificial Intelligence don’t end there:

- Enhanced Customer Satisfaction:

- Rapid response times

- Reliable query resolution

- Workforce Augmentation:

- Human agents focus on complex tasks

- Chatbots handle routine inquiries

- Operational Efficiency:

- Automated responses

- Fraud frequency reduction

This cogent synergy between human agents and conversational chatbots ensures a smooth customer journey, from mundane questions to sophisticated discussions. Embracing a conversational banking strategy means embodying a visionary stance in customer interaction, amplifying customer engagement and loyalty while optimizing operational costs. In essence, conversational banking experiences craft a digital ecosystem that customers can’t help but adore!

Tailored customer support

Experience the future of personalized financial guidance with Conversational AI in banking—where every chat is tailored to your unique financial journey. Picture a world where virtual assistants not only respond to your needs but anticipate them, suggesting the perfect banking products and enhancing your financial well-being with every interaction.

Tailored Customer Support with Conversational AI:

- 24/7 Personalized Service: Chatbots infused with Conversational AI cater to your every financial whim without rest or delay.

- Intelligent Product Suggestions: Based on your spending habits and goals, get recommendations for credit cards, savings accounts, and more.

- Fraud Prevention: Stay secure with AI vigilant in detecting suspicious activities and sending real-time alerts.

- Custom Notifications: Enjoy bespoke alerts about the latest credit card bonuses and a neatly organized transaction history.

- Revenue Boost for Banks: Subtle and smart cross-selling increases your banking options while enhancing the institution’s bottom line.

With these AI-driven tools, prepare for a world where banking is not just a task, but a personalized journey towards a secure financial future. Chatbots are not just answering queries; they’re becoming your trusted financial ally, offering a seamless, conversational banking experience tailored to YOU.

Conversation-based authentication

In the dynamic world of the banking industry, where customer satisfaction reigns supreme, conversational banking has ushered in a revolution, particularly when it comes to security through conversation-based authentication. This innovative leap employs conversational AI technologies to provide a verification process that feels as natural and reassuring as chatting with your trusted local bank teller.

Imagine dropping by your bank’s mobile app or digital platform and being recognized simply through a natural language conversation. As you type out or voice your concerns, the underlying AI seamlessly validates vital details such as your name, address, and date of birth, all within the flow of dialogue. This is conversational banking at its finest – crafting personalized experiences that blend security with comfort.

With customer encounters designed to mirror those with human agents, conversational banking technologies are elevating customer experiences without ever compromising on security. The priority here is twofold: safeguarding customer data while delivering a seamless experience that feels engaging and effortless.

Let’s bullet out why conversation-based authentication in conversational banking is setting a new standard:

- Provides secure identification akin to human interactions.

- Validates customer information through natural, easy dialogues.

- Prioritizes security without sacrificing the seamless user experience.

- Employs conversational AI for a reliable and secure authentication process.

Banks employing this conversational AI not only boost their customer engagement and trust but also pave the way for a brighter, more secure customer journey – one conversation at a time.

Understanding the customer journey

To truly grasp the essence of conversational banking, we must dive into the heart of the customer journey. It begins with mapping out each interaction, pinpointing moments where the sublime blend of human agents and conversational AI can elevate the experience. Envisioning chatbots that not only understand natural language but respond with the finesse of a personal banker is our modern reality.

Developing a robust response guideline is non-negotiable; this ensures consistency across all channels, nurturing customer satisfaction and loyalty. A seamless experience is the cornerstone of conversational banking, and data-driven strategies help banks align their digital platforms with customer preferences, offering a truly personalized service.

The trends are clear – generational shifts dictate that banks pivot to platforms favored by the young, like WhatsApp, over the likes of Facebook Messenger. It’s an agile response to diverse needs.

Fostering lasting relationships comes down to fine-tuning interactions throughout the customer journey. It’s about creating those personalized, seamless experiences that resonate deeply, securing a bank’s place as a customer’s lifelong financial ally. With each step thoughtfully considered, banks stand to not only inspire customer engagement but to redefine the standards of the banking industry.

- Identify interaction points

- Anticipate support needs

- Integrate AI chatbots judiciously

- Develop consistent response guidelines

- Align services with digital platform preferences

- Recognize generational platform trends

- Personalize the customer experience

Using distinct mobile verification methods

In the world of conversational banking, securing customer journeys and maintaining trust is paramount. Mobile verification methods are the gatekeepers, ensuring a safe passage for users as they navigate the vast seas of the banking industry.

Two-factor authentication (2FA) and SMS text alerts stand like vigilant watchtowers against fraud. These proactive defenses are more than just barriers; they’re a sign to customers that their treasures are well-guarded. And there’s real beauty in the simplicity of mobile verification solutions—they enhance the seamless experience by streamlining access and minimizing the need to summon human agents for support.

But the allure doesn’t stop there. The modern banking saga features a plethora of verification methods—voice, data, and beyond—each playing their part in the grand symphony of security. These varied tools not only accelerate the customer onboarding process but by deploying them at strategic points in the customer journey, the risk of fraud dwindles and customer satisfaction soars.

Here’s the golden truth—quick and easy mobile verification isn’t just a convenience. It’s the cornerstone of a trust-filled relationship between the bank and its customers, keeping transactions secure and the customer engagement flourishing.

Distinct Mobile Verification Methods:

- Two-factor Authentication (2FA): A formidable layer of security requiring two forms of identification.

- SMS Text Alerts: Timely notifications to alert customers to account activities.

- Voice Verification: Combines convenience with a personal touch for identification.

- Data Verification: Ensures integrity and accuracy in customer information.

Embrace these methods, and conversational banking becomes not just a utility, but a fortress of trust and excellence.

Enabling efficient automation

Embrace the future with Conversational Banking; it is revolutionizing the banking industry, propelling customer experiences into uncharted territories of convenience and satisfaction. Imagine an ecosystem where automation bridges the gap between you and your bank, creating a symphony of efficiency through the magic of Conversational AI.

Enabling Efficient Automation

Conversational banking is an exhilarating leap forward, offering automation of account services via powerful AI interfaces. This isn’t just about checking balances; it’s about empowering customers to command their finances with their voice or a simple message.

- Transaction Initiation: Effortlessly trigger actions such as fund transfers or bill payments—just by expressing your intent. Conversational AI understands and executes, for a seamless journey from intent to transaction.

- Fraud Alerts: In the unnerving event of fraudulent activities, the lightning-fast reflexes of conversational AI provide real-time alerts. It doesn’t just stop there; it guides you through immediate protective actions.

- Streamlined Tasks: Mundane becomes manageable as routine banking tasks are streamlined, leading to breathtaking operational efficiency and rapid resolution of customer issues.

By automating conversational interfaces, human agents are now the elite task force dealing with complex customer queries. The benefits are twofold: customers relish personalized services and human agents find fulfillment in tackling challenging issues. Conversational AI is not just changing banking—it’s changing lives.

Seeking customer feedback

Embarking on a journey within the vibrant landscape of conversational banking, it’s crucial to underscore one undeniably precious asset: customer feedback. Integrating feedback mechanisms within the conversational interface is like setting sails in the right direction in an ocean of digital communication, ensuring a seamless harmonic fusion between customer insight and service refinement.

Customers are your compass—through their experiences, they chart a course towards an ever-improving conversational banking journey. By harnessing the power of feedback collected right at the heart of customer interactions, we transform the very fabric of customer service into a living, breathing organism that learns and adapts in real-time.

Ways to Leverage Customer Feedback in Conversational Banking

- Real-time Analysis: Scrutinize insights to unveil improvement opportunities and customize the conversational flow.

- Continuous Adaptation: Evolve based on customer interactions to transform every digital touchpoint into a delight.

- Feedback Loop: Create a perpetual motion of feedback and enhancements for an evergreen conversational experience.

Victory in the banking industry belongs to those who listen and adapt. Regularly collecting feedback is essential in sensitively tuning the symphony of customer interactions to resonate with satisfaction, engagement, and ultimately, customer lifetime loyalty. Your conversational banking strategy’s success hinges on this pivotal act of solicitude and attention to customer voice.

Embracing conversational banking for a seamless and personalized experience in 2024

Embrace Conversational Banking in 2024 for an unparalleled seamless and personalized experience. This innovative arena blends Conversational AI and natural language processing to foster real-time, engaging interactions via virtual assistants and chatbots. Pivot to personalization; conversational banking excels in molding services to each customer’s unique journey, enhancing satisfaction and engagement.

Key Players in Enhancing Conversations | Link to Experience:

- AI-powered Chatbots: Immediate, context-aware, bespoke communication.

- Infobip Answers: Cross-platform AI solutions bolstering customer interaction.

Its beauty lies in its capacity to harmonize the customer experience across digital platforms, whether through mobile apps or online portals. By integrating AI with human agents, it creates a synergy that feels both cutting-edge and warmly familiar. Plus, it’s a win-win; operational costs take a dive while user experiences soar.

Expectations in Conversational Banking | Customer Benefits:

- Personalized Services: Offers insights aligned with customer behavior.

- Seamless Integration: Effortless transition between bots to human support.

- Customer Unity: Feedback loops refine the customer lifetime journey.

- Revenue Growth: Driven by tailored upselling and lead generation.

Conversational interfaces embody the future of the banking industry, underpinning every step from loan applications to customer queries. The strategy? Hear the customer, treat them as individuals, and watch loyalty grow. Welcome to the conversational banking revolution – banking that speaks your language.

FAQ

What is conversational banking?

Conversational banking is an innovative approach that utilizes artificial intelligence (AI) and natural language processing (NLP) to enable real-time and personalized interactions between customers and virtual assistants or chatbots. It aims to provide a seamless and engaging customer experience.

How does conversational banking benefit customers?

Conversational banking offers personalized services tailored to individual customer behavior, seamless integration between bots and human support, refined customer journeys through feedback loops, and revenue growth through tailored upselling and lead generation. It enhances satisfaction, engagement, and loyalty.

What are the key players in enhancing conversational banking experiences?

AI-powered chatbots and platforms like Infobip Answers are key players in enhancing conversational banking experiences. These technologies provide immediate, context-aware, and customized communication, leading to improved customer interactions.

How does conversational banking integrate AI with human agents?

Conversational banking integrates AI with human agents by leveraging AI-powered chatbots or virtual assistants to handle routine and repetitive tasks, while humans step in when more complex or sensitive issues arise. This combination creates a harmonious synergy that feels both cutting-edge and familiar.

Does conversational banking reduce operational costs for banks?

Yes, conversational banking has the potential to reduce operational costs for banks. By automating routine tasks and providing self-service options, banks can streamline their processes, reducing the need for extensive human resources and cutting down on operational expenses.

How does conversational banking improve the customer experience?

Conversational banking improves the customer experience by offering personalized and context-aware interactions. It allows customers to access relevant information and services quickly and efficiently, leading to increased satisfaction and engagement.

Is conversational banking secure?

Yes, conversational banking strives to maintain security and protect customer data. Banks implement robust security measures, such as encryption and authentication protocols, to ensure the privacy and integrity of customer information during conversational interactions.

How does conversational banking impact revenue growth for banks?

Conversational banking drives revenue growth for banks through tailored upselling and lead generation. By analyzing customer behavior and preferences, banks can offer personalized recommendations that result in increased cross-sell and upsell opportunities, ultimately boosting revenue.

Is conversational banking the future of the banking industry?

Yes, conversational banking is considered the future of the banking industry. With advancements in AI and NLP, conversational interfaces are revolutionizing processes such as customer service, loan applications, and account management. It is a customer-centric approach that aligns with evolving consumer expectations.

How can customers provide feedback for improving conversational banking experiences?

Customers can provide feedback for improving conversational banking experiences through various channels such as in-app surveys, live chat support, or dedicated feedback forms. Banks actively listen to customer feedback to refine and enhance the conversational banking journey, providing an even better user experience.