If there’s one thing HR teams don’t look forward to, it’s the endless back-and-forth of EPF verification. It’s tedious, time-consuming, and let’s not even talk about the paperwork nightmares. But what if there was a way to automate the entire process and get accurate results instantly? That’s exactly what the EPF Verification API brings to the table.

Traditionally, Employee Provident Fund Validation has been a manual and time-consuming task, often leading to errors, delays, and compliance risks. However, with the advent of Employee Provident Fund Validation APIs, businesses can now automate and simplify this process seamlessly. By integrating this API, employers can instantly verify EPF accounts, eliminate fraudulent claims, and ensure smooth payroll processing. This automation not only enhances efficiency but also improves data accuracy and security.

In this blog, we’ll break down how the EPF Verification API works, why businesses need it, and how it can save you from hours of manual labor.

The Importance of EPF Verification for Employers

In India, businesses must stay compliant and follow regulations for commercial activities to avoid heavy fines. The Employee Provident Fund and Miscellaneous Provisions Act requires stringent EPF contributions and reporting. These standards are important for businesses to follow, otherwise, it may cost money and legal trouble.

Infractions of EPF requirements can result in daily penalties of up to ₹5000 for firms. When businesses follow such compliance, it shows employees their financial security and legal rights. This way, employees will establish trust and confidence.

Compliance boosts the credibility of startups and existing organizations. This way, businesses can attract investors and clients seeking ethical partners. Businesses can automate compliance, decrease risks, and focus on growth by using EPF verification APIs.

Understanding EPF Verification API

The EPF verification API digitally streamlines the process of confirming details of employee savings accounts. With this API, businesses can verify employees’ EPF accounts in real-time, ensuring compliance and accuracy. Businesses can retrieve job histories and UAN (Universal Account Number) via secure protocols.

Employee onboarding, payroll, and compliance reporting are streamlined using EPF validation APIs. Additionally, it helps businesses save time, reduce manual errors, and easily comply with EPF laws. Businesses of any size and industry can utilize the Employee Provident Fund Validation API. Furthermore, it can perform verification in real-time, which helps organizations retain transparency and confidence with their employees and regulators with real-time verification.

The Role of the Universal Account Number (UAN) in Verification

With UAN, the EPFO can track the changes that have occurred inside the organization for the companies. When an employee lands a new job, they must add their new PF account to their UAN. This way, the EPFO will update the same into its records. UAN offers a plethora of benefits like withdrawal and transfer of funds. Using the UAN e-Sewa portal, an employee can avail of these capabilities in a few clicks.

Additionally, UAN ensures that all of the employee’s PF accounts are legitimate and authentic. If KYC paperwork is validated, then authentication of employees can be accomplished through their UAN by the employer. UAN is online and is visible for any activity carried out, assuring employees that their employer will not be able to deduct or hold back their PF for any reason.

Employees can view the deposits made by the company by registering on the EPF member portal with the 12-digit UAN number. Additionally, the EPF passbook function can be accessed by sending an SMS with the subject line ‘EPFOHO UAN ENG” to the number 7738299899 from the mobile number registered with the EPFO.

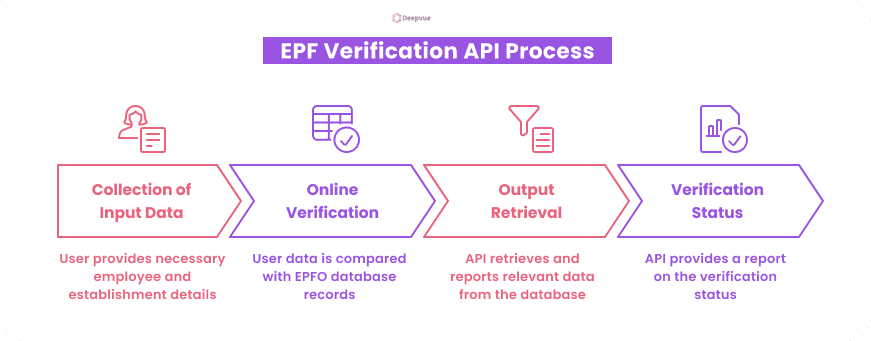

Step-by-Step Process for EPFO Verification Through API

- Collection of Input Data: At this stage, the user needs to communicate what basic information is needed for the EPFO verification. The user has to indicate details such as the establishment name and establishment ID, the name of the employee, the month in which the employee was employed, his duration of service, etc.

- Online Verification: Data entered by the user will be compared with data present in the EPFO database.

- Output Retrieval: Once matched, EPFO verification API will now report data extracted from the database. These outputs will consist of establishment name, establishment ID, office name, address, etc. Payment details, PAN status, ESIC code, establishment status, ownership type, etc. will also be provided.

- Verification Status: Verification status regarding the data will be provided by the API in the form of a report; after inspection of the output, the user will then be able to ascertain that the EPFO verification has been valid and comprehensive.

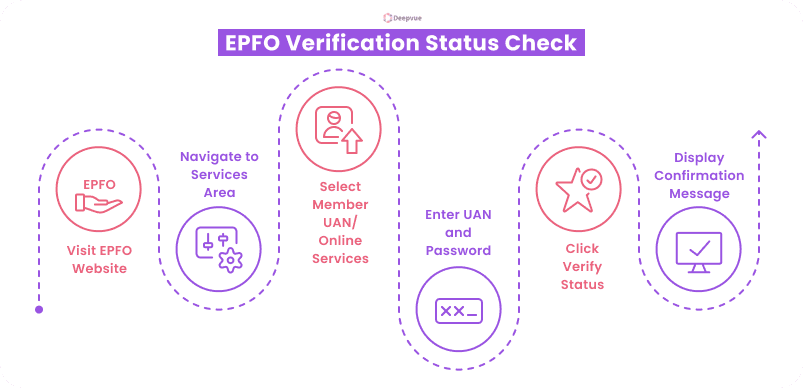

Steps to Verify Your Employee Provident Fund Validation Status

The confirmation of your verification status is an essential step to take after you have finished the EPFO verification process. The following actions should be followed to check the status of your EPFO verification utilizing the online method:

- Check out the official webpage of the EPFO.

- When you are in the “Services” area, navigate to the “For Employees” section.

- Make sure you select “Member UAN/Online Services.”

- Both your Universal Account Number (UAN) and your password must be entered.

- Go to the “Verify Status” option and click on it.

- An indication of the status of your EPFO verification will be displayed in the form of a confirmation message if your account is properly validated.

Data Security and Compliance Considerations

- Data that is at rest should be encrypted using AES-256, the same standard that safeguards government secrets.

- TLS 1.3 encryption guarantees that intruders will only be able to observe nonsensical information while the data is in transit.

- The DPDP Act of India, which is a relative of the GDPR, should be adhered to.

- Conduct audits every quarter. A financial organization was able to circumvent the imposition of penalties totaling ₹50 lakh by identifying a leak during a routine inspection.

- Role-based permissions can be implemented to limit API access. The possession of the keys to the dominion is significant to certain individuals.

Benefits of EPF Validation API

For Employers

- Compliance: Enables corporations to adhere to state regulations while minimizing penalties.

- Reduces Fraud: Its restriction of fraud includes verifying employee details, thus preventing duplicate accounts or any fraudulent claims.

- Payroll Processing: Helps ensure correct PF contributions and deductions along with the usage of a full-featured payroll system.

- Instill Transparency: Builds trust with employees by ensuring correct PF deposits.

- Easier Audits & Inspections: This makes handling EPF-related audits and legal inspections really easy.

- Fostering Employee Retention: This shows the commitment towards employee benefits improved job satisfaction.

Related read: Types of Employee Fraud & How to Prevent Them

For Employees

- Ensures Accurate Contributions: Verifies that the employer is depositing the correct PF amount.

- Speedy Claim Processing: Speeds up EPF withdrawals, transfers, and settlements.

- Reduced Errors: No mismatches in name, date of birth, and UAN details.

- Retirement Savings: Assures every bit of contribution is accounted for.

- Easy Transfer of Funds: Allows simple, no-hassle PF transfers while changing jobs.

- Gives Legal Protection: It ensures that rules under the EPF Act are adopted to protect the employee’s rights.

Importance of UAN in Onboarding

- Unique Employee Identification: The Universal Account Number (UAN) ensures a centralized and consistent identity for employees across multiple employers.

- Easy Checking of PF Info: Employees can check their PF balances, withdrawals, and contributions online anytime.

- No Duplicate Deposit Accounts: UAN ensures that no extra PF accounts are opened, thus preventing misuse of funds.

- Quicker Settlement of Claims: When the UAN is worked along with KYC for verification, the claims for withdrawal are settled quickly thereafter.

- More Security Alerts: When linked with the UAN and Aadhaar PAN and bank information, fraud is avoided.

- Streamlined Employer Verification: Employers get an easy access check to their employees’ PF history, and this is done to authenticate them at the time of onboarding.

Conclusion

Manual EPF verification, undue paperwork, and Excel-induced headaches are as good as history! With the help of the EPF Verification API, companies can now automate the processes while assuring speed, accuracy, and compliance—all with no sweat on their brow. From employee onboarding through payroll and fraud prevention, this API solves inefficiencies while oiling their way to the right operation.

No more delays, no more errors, and certainly no more hunting for missing info with employees. Just validation, streamlined workflows, and stress-free experiences for both HR teams and employees.

FAQs

What is EPF?

The Employee Provident Fund (EPF) is a retirement savings scheme supported by the Indian government, applicable to employees earning salaries. Employees and employers contribute a percentage of their salary into the fund primarily for withdrawal after retirement or at the time of certain specified contingencies.

How does the EPF Verification process work?

EPF verification includes validation of an employee’s UAN, personal details, and contribution records with EPFO. Generally, these details undergo manual verification through the EPFO portal or through the implementation of the automated EPF Verification API that does real-time validation for this process.

What are the benefits of the EPF Verification API?

The EPF validation API manages UAN and EPF validation autonomously, thus eliminating manual work and ensuring a level of accuracy. It provides compliance, prevents fraud, and integrates smoothly with HR and payroll software for seamless processing.

What should I do if my EPF details are wrong?

First, check your UAN portal for the errors you found, and then inform your employer of such mistakes so that they may raise a change request with the EPFO portal. If it is required, file a joint declaration form containing supporting proof and watch for an update online.

How can automated solutions help the EPF verification process?

Automated solutions help eliminate errors, speed up onboarding, and ensure timely EPF verification. They help keep everyone accountable, prevent payroll delays, and improve the overall employee experience.