In the era of GST (Goods and Services Tax), ensuring that the GST Identification Number (GSTIN) of a business entity is authentic and valid is paramount. This process, known as GST number verification, not only helps in maintaining compliance with tax laws but also protects against fraudulent activities.

In this comprehensive guide, we will walk you through the essentials of GST number verification, why it is important, and how you can verify a GST number using different methods.

What is GSTIN?

GSTIN, or Goods and Services Tax Identification Number, is a unique 15-digit identification number assigned to businesses registered under the Goods and Services Tax (GST) system in India. It serves as a vital identifier for taxpayers involved in the supply of goods and services and is used for tracking tax payments, returns filing, and compliance monitoring.

What is GST Number Verification & Why Is It Important?

GST number verification is the process of validating if the GST Identification Number (GSTIN) is authentic or not. The GSTIN is a unique 15-digit alphanumeric number assigned to every registered taxpayer under the GST regime. This verification ensures that the GSTIN provided by a business entity is genuine and registered with the GST authorities.

Legal Compliance:

- Adherence to Tax Laws: Verifying a GST number ensures compliance with Indian tax laws, helping businesses avoid penalties and legal issues.

- Claiming Input Tax Credit (ITC): Only verified GST numbers are eligible for ITC claims, which is crucial for reducing the overall tax burden.

Preventing Fraud

- Authenticity of Business Entities: Verification helps confirm that the businesses you are dealing with are legal and registered, reducing the risk of fraudulent transactions.

- Avoiding Fake Invoices: Ensures that the GSTIN on invoices is valid, preventing the circulation of fake invoices.

Business Credibility

- Building Trust: Verified GST numbers enhance the credibility of your business among partners, vendors, and customers, fostering trust and reliability.

- Transactional Integrity: Ensures that all transactions are conducted with legitimate entities, maintaining the integrity of business operations.

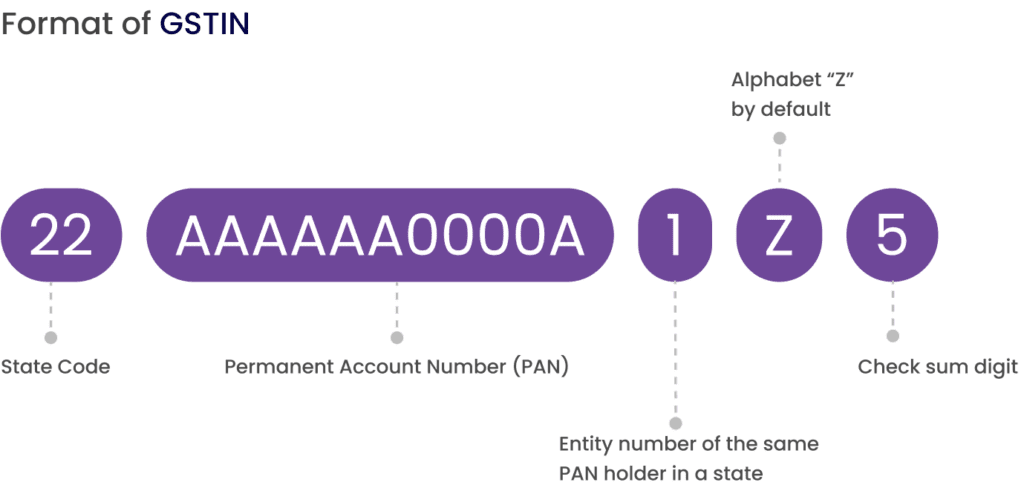

GST Identification Number Format

The GSTIN follows a specific format, each segment of which provides valuable information about the taxpayer:

- First 2 Digits: Represent the state code as per the Indian Census 2011 (e.g., ’27’ for Maharashtra).

- Next 10 Characters: Correspond to the Permanent Account Number (PAN) of the taxpayer.

- 13th Digit: Indicates the number of registrations within a state for the same PAN.

- 14th Digit: Typically ‘Z’ by default.

- 15th Digit: A check code used for error detection.

How to check if a GST number is valid?

Using the Official GST Portal

The official GST portal is the primary and most reliable source for GST number verification. Here’s the step-by-step process to verify a GSTIN through the GST portal:

- Visit the GST Portal: Open your web browser and go to https://www.gst.gov.in.

- Navigate to Search Taxpayer: From the main menu, select ‘Services’ -> ‘Search Taxpayer’ -> ‘Search by GSTIN/UIN’.

- Enter GSTIN: Input the GSTIN you wish to verify in the search box.

- View Details: Click on the ‘Search’ button to view the details of the GSTIN, which will include the business name, state, registration status, and more.

Using Third-Party Verification Tools

Apart from the official GST portal, several third-party tools provide GST number verification services. These tools offer additional features like bulk verification and detailed reporting. For example, GST Verification API by Deepvue – it provides real-time verification and integration capabilities for seamless verification processes.

Steps to Verify GST Number Using Third-Party Tools

- Access the Tool: Open the web portal or mobile app of the third-party verification tool.

- Input GSTIN: Enter the GSTIN in the designated field provided by the tool.

- Submit: Click the ‘Verify’ button to initiate the verification process.

- Review Results: The tool will fetch data from the GST Network to confirm the validity and details of the GSTIN.

Deepvue GST Verification API: A Comprehensive Solution

Deepvue offers a robust GST Verification API that simplifies and automates the GST number verification process. Here’s a detailed look at how the Deepvue GST Verification API works:

1. Obtain API Key: Start by obtaining an API key from the Deepvue dashboard. This key will be used to authenticate your requests to the API.

2. Access API Documentation: The developers’ API documentation provided by DeepVue outlines the endpoints, request parameters, and response formats for the API.

3. Set Up API Request: Use the API key to set up your API request, including necessary parameters such as the GSTIN you want to verify.

4. Make API Call: Execute the API call using your preferred programming language or tool. Send the API request to the designated endpoint and wait for the response.

5. Retrieve and Validate Response: Once you receive the API response, retrieve the data related to the GST registration status of the entity. Validate this information to ensure it meets your requirements.

6. Integrate API Data: Integrate the verified GST data into your existing software or platform. Use this data to streamline your GST compliance processes and ensure you are dealing with GST-compliant entities.

Advantages of Deepvue GST Verification API

1. Real-Time Verification: Verify GSTIN numbers in real-time to avoid fraudulent transactions and ensure compliance.

2. Accurate Data Retrieval: Access validated data such as GSTIN, Business Name, Business Nature, Address, and more with the API.

3. Streamlined Compliance Process: Automate the verification process to reduce time and effort required to verify GST registration numbers manually.

4. Comprehensive Data: Obtain comprehensive reports that include the business name, state code, PAN, and other details.

5. Integration: The API supports easy integration into your existing business tools, enhancing efficiency.

Key Benefits of GST Number Verification

1. Enhanced Compliance: Ensures that your business transactions comply with GST regulations, minimizing the risk of penalties.

2. Fraud Prevention: By verifying GST numbers, you can avoid dealing with fraudulent entities, protecting your business from potential scams.

3. Improved Business Relationships: Verification builds trust and credibility with business partners, vendors, and customers, fostering stronger relationships.

4. Efficient ITC Claims: Verified GSTINs ensure smooth and hassle-free claims of Input Tax Credit, optimizing your tax benefits.

5. Streamlined Operations: Automated verification tools enhance operational efficiency by reducing manual effort and time spent on verification processes.

How Different Industries Use GST Verification

1. E-commerce Platforms:

- Vendor Verification: E-commerce companies can verify the GST registration status of their vendors to ensure they are dealing with authentic businesses. This builds trust and transparency within the supply chain.

2. Manufacturing Industry:

- Supplier Verification: Manufacturing companies can verify the GST registration status of their raw material suppliers, ensuring compliance with tax regulations and avoiding legal issues.

3. Retail Industry:

- Distributor Verification: Retail businesses can verify the GST registration status of their distributors and wholesalers. This helps maintain accurate tax records and avoid discrepancies in tax filings.

4. Financial Services Industry:

- Loan Applicant Verification: Financial institutions can use GST online verification to check the GST registration status of loan applicants or businesses seeking financial services, assessing their credibility and reliability.

5. Government Agencies:

- Vendor Compliance: Government agencies can verify that vendors and contractors are GST-compliant, promoting transparency and accountability in government transactions.

Conclusion

GST number verification is an essential practice for businesses to ensure compliance with GST regulations, prevent fraud, and maintain credibility. Whether you choose to verify GST numbers through the official GST portal or use advanced third-party tools like Deepvue’s GST Verification API, the process is straightforward and highly beneficial.

By integrating these verification steps into your business operations, you can safeguard your transactions, claim rightful tax credits, and build a trustworthy business environment.

Deepvue.tech offers a powerful GST Verification API that simplifies and automates the GST verification process, making it an invaluable tool for businesses aiming for compliance and efficiency. Embrace these tools to enhance your business operations and ensure a seamless GST compliance journey.

FAQs

What is GST number verification?

GST number verification is the process of validating the authenticity of a GST Identification Number (GSTIN) to ensure it is genuine and registered with the GST authorities.

Why is verifying a GST number important?

Verifying a GST number is crucial for legal compliance, fraud prevention, building business credibility, and ensuring smooth ITC claims.

How can I verify a GST number online?

You can verify a GST number online using the official GST portal or third-party verification tools like Deepvue GST Verification API.

What information is needed to verify a GST number?

To verify a GST number, you need the 15-digit GSTIN. This can be entered on the GST portal or a third-party verification tool to check its validity.

What are the benefits of using Deepvue GST Verification API?

Deepvue GST Verification API offers real-time verification, accurate data retrieval, streamlined compliance processes, and seamless integration into existing business tools.

How to check GST number is valid or not?

To check if a GST number is valid, use a GST Verification API. Enter the GST number, send a request, and process the response to confirm its validity. Test and deploy for seamless verification.