Managing and analyzing bank statements has become essential for both individuals and businesses. A bank statement analyzer can simplify this task, providing valuable insights into financial condition, spending habits, and potential areas of concern.

But with so many options of Bank Statement analyzer available, how do you choose the best one? Here’s a comprehensive guide to help you make an informed decision.

What is a Bank Statement Analyzer?

A bank statement analyzer is a specialized tool designed to check the bank statements, extracting key information and presenting it in an understandable format. It automates the process of analyzing financial transactions, offering a clear view of debits and credits. This tool is invaluable for personal finance management, business accounting, and financial due diligence.

What is a Bank Statement Analyzer?

A bank statement analyzer is a specialized tool designed to check the bank statements, extracting key information and presenting it in an understandable format. It automates the process of analyzing financial transactions, offering a clear view of debits and credits. This tool is invaluable for personal finance management, business accounting, and financial due diligence.

Why You Need a Bank Statement Analyzer

Whether you are an individual looking to better manage your personal finances or a business seeking to improve financial oversight, a bank statement analyzer can be very beneficial. It helps in:

- Tracking Spends: Monitor where the money is going and identify unnecessary expenses.

- Detecting Frauds: Flag unusual transactions that could indicate fraudulent activity.

- Evaluating Creditworthiness: Assess financial instability and risk for lending decisions.

- Improving Budget: Categorize transactions to improve budgeting strategies.

- Credit underwriting: Analyze & categorize spends help businesses to effectively underwrite customers.

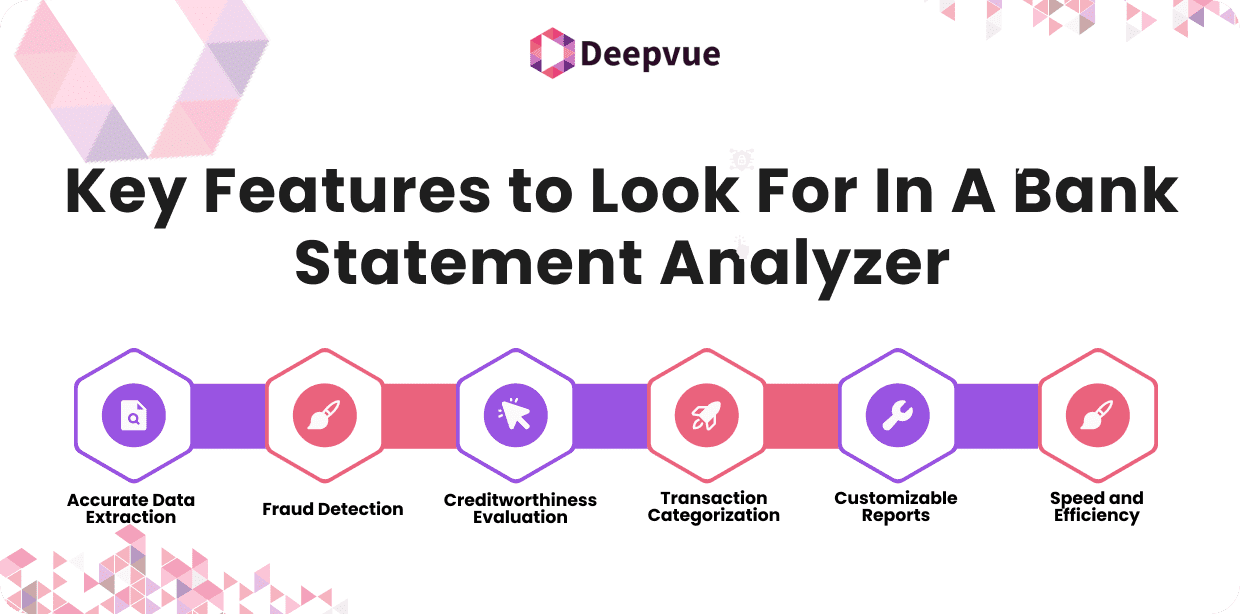

Must-Have Features in a Bank Statement Analyzer

When selecting a bank statement analyzer, consider the following features to ensure you choose the best tool for your needs.

1. Accurate Data Extraction

The primary function of a bank statement analyzer is to extract data accurately from the statements. Look for tools that can handle:

- PDF and Scanned Statements: The ability to process various formats ensures compatibility with different banks and statement types.

- High Accuracy: Ensure the tool can accurately extract data to avoid errors in analysis.

2. Fraud Detection

A good bank statement analyzer should help you detect and flag potential fraud. Look for features like:

- Document Tampering Checks: Verify the authenticity of the bank statements.

- Unusual Transaction Alerts: Identify transactions that differ from the usual spending patterns.

3. Creditworthiness Evaluation

For businesses and lenders, evaluating creditworthiness is crucial. The analyzer should:

- Assess Income Stability: Evaluate regular income streams.

- Analyze Expense Patterns: Understand spending habits and identify potential financial risks.

- Debt Obligations: Check for outstanding debts and payment history.

4. Transaction Categorization

Accurate categorization of transactions helps in detailed financial analysis. The tool should:

- Automate Categorization: Reduce manual effort by automatically classifying transactions.

- Customizable Categories: Allows to create categories that fit the specific needs.

5. Customizable Reports

The ability to generate reports tailored to particular requirements is essential. Look for tools that offer:

- Custom Formats: Choose report formats that suit the needs.

- Comprehensive Insights: Get detailed analysis and insights in an easy-to-understand format.

6. Speed and Efficiency

Time is money, and a good bank statement analyzer should deliver results quickly. Consider tools that offer:

- Fast Processing: Analyze statements in minutes.

- Real-Time Reports: Access up-to-date financial information whenever you need it.

Additional Factors to Consider Before Choosing Bank Statement Analyzer

Beyond the core features, here are some additional factors to keep in mind when choosing a bank statement analyzer.

User-Friendly Interface

A tool that is easy to use will save time and reduce the learning curve. Look for an intuitive interface with clear instructions and helpful tips.

Integration Capabilities

Ensure the analyzer can integrate with the existing financial software and tools. This will streamline the workflow and enhance the overall efficiency of the financial management system.

Security

Your financial data is sensitive, and security is paramount. Choose a tool that offers robust security measures, such as:

- Data Encryption: Protects the information from unauthorized access.

- Compliance: Adheres to industry standards and regulations for data protection.

Customer Support

Reliable customer support can make a significant difference, especially if there are any issues or questions about the tool. Look for companies that offer:

- Responsive Support: Quick and helpful responses to the queries.

- Comprehensive Resources: Access to tutorials, FAQs, and other support materials.

Conclusion

Choosing the best bank statement analyzer involves considering various factors, from accurate data extraction and fraud detection to user-friendliness and security. By evaluating your specific needs and comparing the features of different tools, you can find the perfect analyzer to enhance your financial management.

Remember, the right bank statement analyzer can save you time, improve your financial insights, and help you make better financial decisions. Take the time to research and choose a tool that fits your requirements, and you’ll reap the benefits in no time.

To learn more about how Deepvue’s Bank Statement Analysis API can enhance your bank statement analysis, contact Deepvue Sales Team and explore a range of APIs designed to ensure accuracy and efficiency.

FAQs

What is a bank statement analyzer?

A bank statement analyzer checks and scrutinizes bank statements, providing insights into financial health of an individual or a business. It helps track spending, detect fraud, evaluate creditworthiness, and improve budgeting.

How does a bank statement analyzer detect fraud?

It flags unusual transactions and checks for document tampering, identifying activities that differ from your normal spending patterns.

Can a bank statement analyzer handle different formats of bank statements?

Yes, a good analyzer can process various formats, including PDFs and scanned documents, ensuring accurate data extraction from different banks.

How does a bank statement analyzer evaluate creditworthiness?

It assesses income stability, expense patterns, and debt obligations to provide a comprehensive view of financial health, crucial for lending businesses.

Are bank statement analyzers secure to use?

Yes, good bank statement analyzers use data encryption and adhere to industry standards for data protection, ensuring the financial information remains secure.