The Account Aggregator (AA) framework was introduced to simplify access to financial data. Its primary use so far has been during onboarding, when lenders evaluate income, liabilities, and creditworthiness to make loan decisions. However, the real power of AA lies in its ability to offer real-time visibility into a borrower’s financial life, even after the loan is disbursed.

Income can fluctuate. Jobs can change. Expenses can rise unexpectedly. A one-time credit evaluation does not capture these changes. As a result, lenders either take on more risk than intended or miss the chance to serve customers better. This is where AA changes the game.

This blog explores how AA data can be used beyond onboarding—specifically for restructuring EMIs, avoiding over-lending, offering responsible credit, and monitoring borrower health over time.

The Limitations of One-Time Underwriting

The Reserve Bank of India (RBI) underscores that in the first half of FY25, bank frauds escalated dramatically, with 18,461 cases amounting to ₹21,367 crore, compared to 14,480 cases involving ₹2,623 crore in the same period of the previous year.

Traditional lending models are constructed based on a point-in-time snapshot of the borrower’s financial state. The assessment usually includes payslips, bank statements, tax returns, and credit bureau scores. This model suits onboarding well, but loses its usefulness as the borrower’s finances evolve.

For example, a salaried employee can lose employment or change to a lower-paying job. A shop owner can face seasonal fluctuations in sales. In these situations, the initial risk profile is no longer valid. Lenders who are not aware of these changes might still anticipate the same repayment trend, resulting in skipped EMIs and subsequent defaults.

What it lacks is a feedback loop—a system that constantly informs the lender about the lender’s economic well-being. That’s where the AA model can come into its own.

The Case for Continuous Financial Monitoring

The AA framework allows individuals to share their financial information (like bank statements, income flows, and spending patterns) directly from their accounts with Financial Information Providers (FIPs) to Financial Information Users (FIUs), such as lenders. This is done through a secure, consent-driven system that dispenses with the need for people to collect documents manually.

Yet, the true power of AA is its capacity to provide repeated exposure to financial information, not only at the time of onboarding. With occasional refreshes, lenders can:

- Track salary credits to confirm income stability.

- Track spending patterns and financial obligations.

- Evaluate savings, balance, and liability changes.

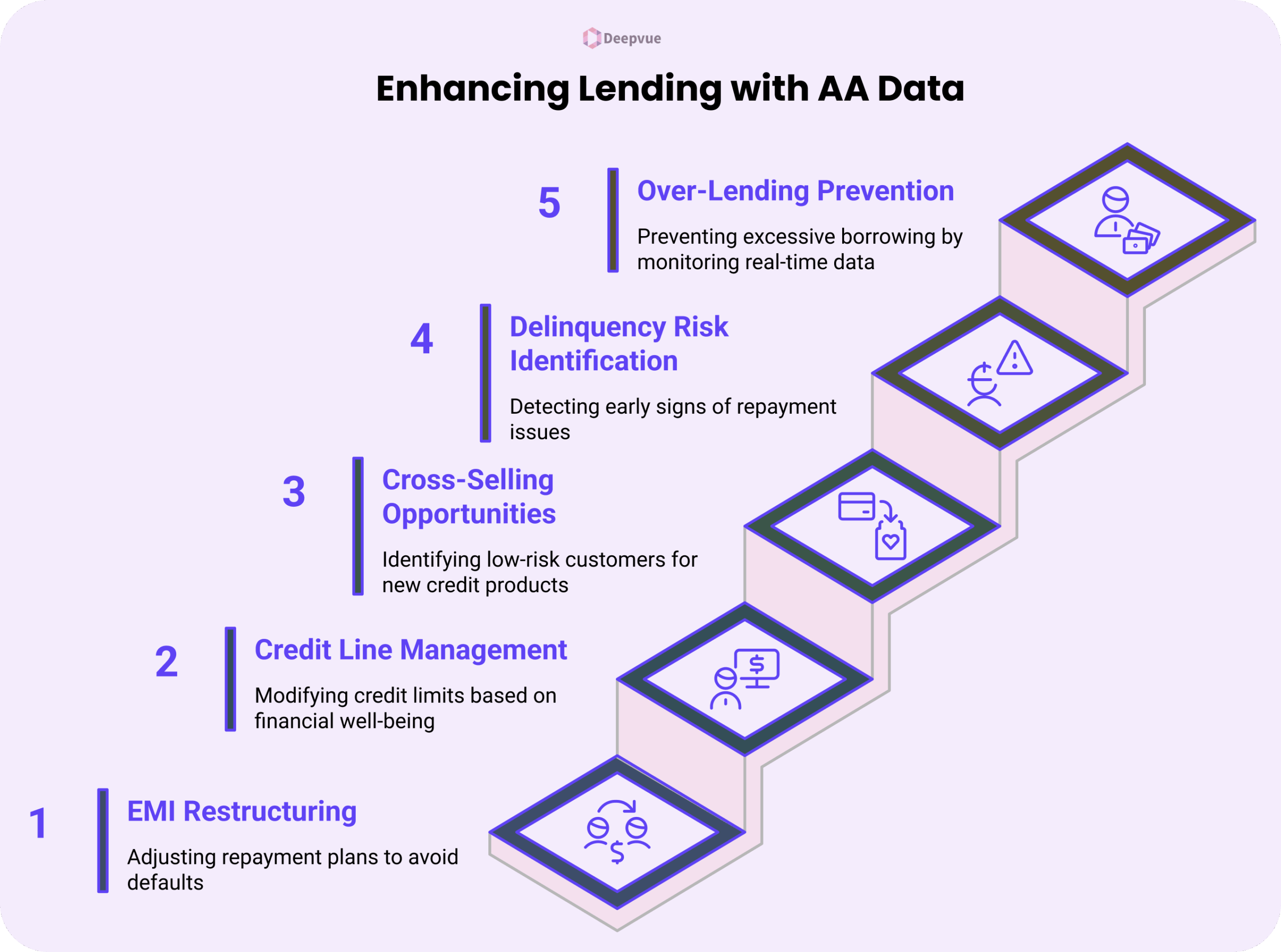

Key Use Cases for AA Data Beyond Onboarding

EMI Restructuring

Borrowers sometimes face temporary or permanent financial setbacks. With AA, the lenders are able to identify income decreases through lower salary credits or higher withdrawals. This invites constructive dialogue with the borrower, providing revised repayment plans, longer tenures, or decreased EMIs based on revised affordability.

These interventions save the lender and the borrower as well. They avoid defaults, cut the cost of collection, and enable the borrower to keep their credit rating intact without unnecessary pressure.

Credit Line Management

Open credit lines like overdrafts or credit cards have recurring exposure. AA data allows lenders to review periodically the financial well-being of a borrower and modify these limits. If a borrower’s monthly inflow is down sharply or outlays have increased, it might be a good idea to cut back the available limit for a while. A borrower evidencing increasing income and managed expenditure might, on the other hand, qualify for an increase in limit.

Cross-Selling Opportunities

Timely EMI payment and good account balance are excellent pointers to financial control. Using AA information, lenders can spot low-risk customers and pre-qualify them for fresh credit products such as top-up loans, short-term personal loans, or even credit cards.

In contrast to more conventional lead generation practices, AA-powered targeting is built on actual, verified financial conduct. It’s cost-effective, efficient, and enhances the customer experience by minimizing friction during the application process.

Delinquency Risk Identification

AA data helps flag early signs of repayment issues. A bounced salary deposit or dwindling balances close to EMI dates or rising dependency on credit cards are signals of financial strain. These signals can prompt lenders to issue alerts so that they can communicate with the borrower before default.

Instead of waiting for a late payment, lenders can actively extend restructuring, grace periods, or financial counseling. This lightens collection pressure and saves customers who might be experiencing only a temporary drop in income.

Over-Lending Prevention

AA also helps curb a growing issue in the lending space—credit stacking. Borrowers can apply for several loans from various lenders in quick succession, with none of them being aware of the involvement of the other. As not all loans are reported on credit bureau information in real time, lenders tend to approve new loans based on historic data.

With AA, it is possible for lenders to see real-time financial flows and latest loan inflows and identify whether borrowers are already over-leveraged. This avoids reckless credit growth and ensures portfolio quality.

Strategic Benefits for Lenders

- Lower Default Rates: With real-time risk insights, lenders can act before a missed EMI turns into a delinquent loan.

- Improved Customer Retention: Providing EMI flexibility and quick support enhances customer satisfaction.

- Enhanced Credit Decisioning: Data-driven offers guarantee the correct product is presented to the correct customer.

Regulatory and Ethical Considerations

- Consent Management: Consent should be purpose-specific, informed, and explicit. In adherence to the fair usage(Sahamati Fair Use Template Library), separate consents are required for monitoring (up to 5 times/month) and for collections (daily account balance checks post-default).

- Data Minimization: Collect only data pertaining to the use case, don’t overstep. This ensures transparency, compliance, and alignment with borrower rights.

- Alignment of compliance: Align your practices with RBI guidelines and the pending Digital Personal Data Protection (DPDP) Act.

- Audit Trails: Keep records of consent and data usage for auditing.

How Our Platform Helps Lenders Use AA Data Beyond Onboarding?

To truly leverage the potential of Account Aggregator (AA) data, lenders require tools that consume this data as well as interpret it into usable insights. Our platform is designed with precisely that intent in mind—enabling financial institutions to act dynamically against a borrower’s changing financial situation. Below are four fundamental capabilities of our product that directly assist the use cases discussed in this blog:

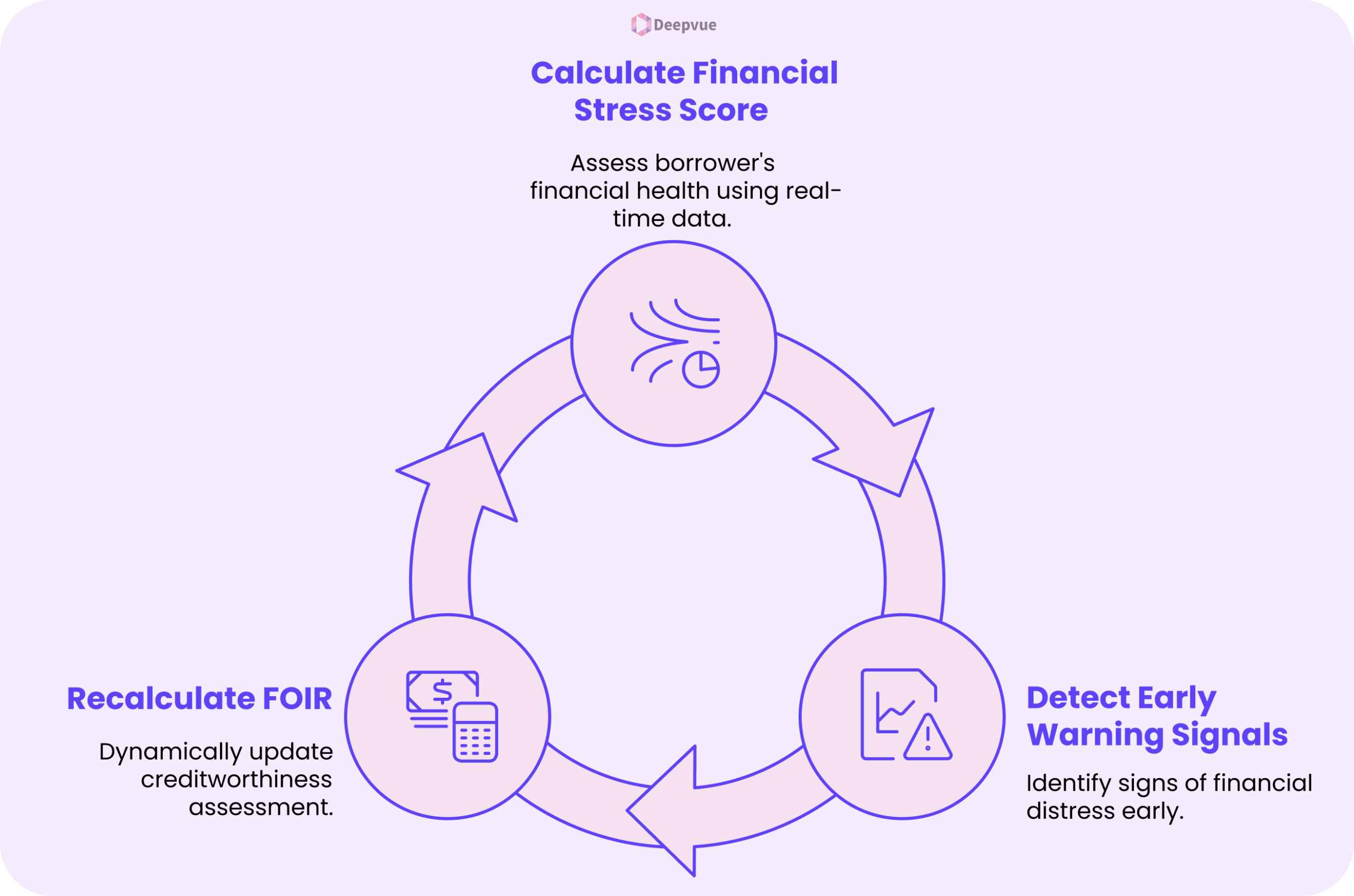

1. Financial Stress Score Calculation

One-time risk scores are no longer sufficient. Our platform assesses a borrower’s financial well-being constantly with a blend of real-time salary inflows, expenditure behavior, withdrawal activity, and EMI performance. This is especially useful when borrowers face life events such as dips in income or increased obligations, enabling lenders to make informed, on-time decisions about restructuring, support, or collections.

2. Early Warning Signals Post-Disbursal

Responding to a defaulted EMI is usually too late. Our system detects subtle early signs of financial distress, such as salary credits being missed, cheque bounces, large withdrawals before EMI dates, or increasing reliance on credit cards. These early warning systems empower lenders to intervene proactively with tailored communication, grace periods, or restructuring options, often before any formal delinquency occurs.

3. Accurate FOIR Calculations

Our platform calculates the Fixed Obligation to Income Ratio (FOIR) dynamically, based on the borrower’s actual financial flows captured through AA. This allows lenders to assess creditworthiness not just at onboarding but throughout the loan lifecycle. At the core of this capability is our advanced Bank Statement Transaction Categoriser, which accurately classifies every bank transaction into detailed categories such as Food, Rent, Loans, Groceries, Utilities, Insurance, Entertainment, Education, Medical, Transfers, Travel, Investments, Shopping, Salary, and more. When used alongside AA data, these insights are powerful for underwriting borrowers who are new to credit since there is no(or limited) traditional data available for them.

To learn more about our solutions, contact our business team.

Conclusion

Account Aggregator data is not just for onboarding. It allows lenders to create real-time, flexible, and prudent credit systems that react to the borrower’s changing financial circumstances. It’s time to break free from static underwriting and embrace a dynamic, data-based strategy, one where the lender doesn’t merely evaluate creditworthiness at inception, but tracks and facilitates it throughout the loan’s life.

FAQ:

What is the Account Aggregator (AA) ecosystem?

The AA model enables one to exchange financial information across institutions with lenders or other parties, securely and by permission. It provides real-time financial transparency without physical documents.

Why would lenders use AA data following onboarding?

A borrower’s financial condition may undergo changes in the future. AA allows lenders to track income and expenses after disbursal and modify approaches to managing EMI, risk management, or upselling.

How can AA data contribute to EMI restructuring?

When a borrower’s income decreases, lenders are able to identify this in advance and provide alternatives such as lower EMIs, loan extensions, or short-term relief, avoiding defaults and safeguarding both.

Is AA data able to distinguish good borrowers for further loans?

Yes. Borrowers with regular income and timely EMIs can be marked as low-risk borrowers and hence are good targets for pre-approved top-up or new loan propositions.

In what ways does AA prevent over-lending or fraud?

AA offers current financial information, allowing lenders to identify recent lending, high utilization, or income irregularities that may not be visible in bureau data.