Digital banking has transformed how we manage our money. With the rise of fintech and digital-only banks, customers expect more personalized experiences from their banks. This shift is leading to the future of banking: hyper-personalization.

But what exactly does this mean, and why is it so important?

What is Hyper-Personalization?

Hyper-personalization involves leveraging data and analytics to gain a deep understanding of each customer’s unique needs, preferences, and behaviors. This allows banks to offer highly targeted services and products, creating a more engaging and satisfactory customer experience.

Unlike traditional personalization, which might use broad demographic data, hyper-personalization uses real-time data and advanced technologies like artificial intelligence (AI) and machine learning (ML) to deliver ultra-precise messaging and services.

Why is Hyper- personalisation in banking important?

Today’s customers expect the same level of personalized engagement from their banks as they do from other industries like retail, entertainment, etc. They have little patience for generic messages and services that don’t address their specific needs.

According to a report by Deloitte, customers are willing to share their data if it means receiving personalized services that add real value to their lives. Yet, many banks still struggle to provide the hyper-personalization that customers now prefer.

Steps to Achieve Hyper-Personalization

Achieving hyper-personalization in banking is a multi-step process that involves understanding customers deeply, analyzing data effectively, and taking actionable insights to enhance customer experience. To achieve hyper-personalization, banks need to follow a few key steps:

1. Knowing Your Customer (KYC)

Traditional KYC processes focus on basic demographic information. However, hyper-personalization requires a much deeper understanding. Banks need to gather and analyze data from various sources, including social media, past interactions, and even external databases. This holistic approach can be described as creating a ‘customer genome,’ which includes factors like age, gender, ethnicity, and life stage.

By understanding the customer at this deeper level, banks can understand their needs and offer tailored solutions. For example, the increasingly popular “buy now, pay later” model can be enhanced by considering a customer’s behavioral and social data, allowing banks to make quick and accurate credit decisions.

2. Analyzing Customer Data

Data is crucial for hyper-personalization. Banks can gain three types of insights from customer data:

- Descriptive Insights: These provide a clear picture of a customer’s transactions, spending patterns, asset holdings, and portfolio performance.

- Diagnostic Insights: These insights explain the ‘how’ and ‘why’ behind customer behaviors, helping banks understand the reasons for certain financial activities.

- Predictive Insights: These insights help banks foresee a customer’s future financial status. Predictive analytics can alert customers about potential cash flow issues, upcoming large payments, or opportunities for early loan closure. They also play a crucial role in fraud detection by identifying unusual patterns in customer behavior.

To support these insights, banks must establish a robust data infrastructure that includes a standardized data model, analytics layer, decision-making layer, and execution-and-measurement layer. Leveraging cloud computing is essential to scale these operations and integrate AI and ML capabilities effectively.

3. Taking Action Based on Insights

The final step is to turn insights into actions that benefit customers. This can be achieved through personalized nudges that guide customers towards better financial decisions. For instance, banks can recommend actions based on the next best step for a customer’s financial journey, such as automated savings plans or customized investment opportunities.

Conversational AI plays a pivotal role here. By using chatbots and voice assistants, banks can offer personalized interactions in real-time, ensuring customers receive the support they need round-the-clock.

Benefits of Hyper-Personalization

Implementing hyper-personalization offers several benefits:

- Better Customer Experience: Personalized services make customers feel valued and understood, leading to higher satisfaction and loyalty.

- Increased Engagement: Tailored messages and offers are more likely to relate with customers, driving higher engagement rates.

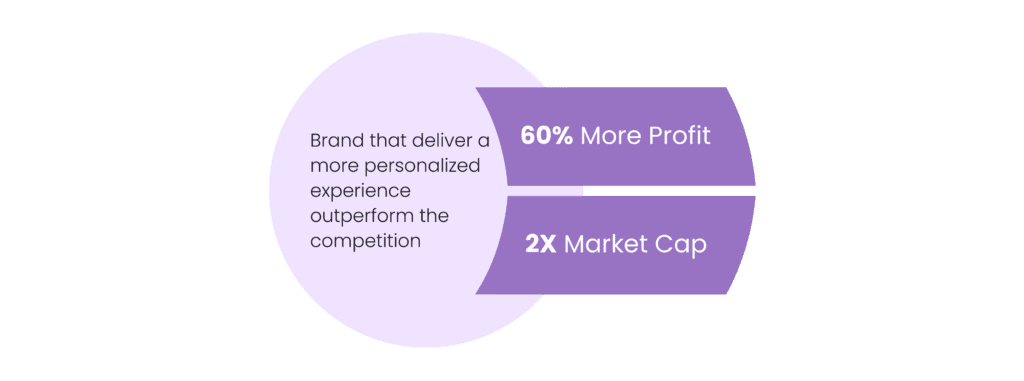

- Competitive Edge: In a crowded market, hyper-personalization helps banks stand out from the competition.

- Improved Financial Health for Customers: Personalized advice and timely alerts can help customers make better financial decisions, improving their overall financial well-being.

Overcoming Challenges of Hyper-Personalization

While the benefits are clear, implementing hyper-personalization can be challenging. Banks must overcome several hurdles:

- Data Privacy Concerns: Ensuring customer data is protected and used ethically is crucial. Banks must be transparent about how they collect and use data to build trust.

- Technology Integration: Incorporating AI, ML, and other advanced technologies into existing systems can be complex and costly.

- Cultural Shift: Moving towards a customer-centric approach requires a cultural shift within the organization, focusing on continuous learning and adaptation.

Conclusion

Hyper-personalization is the future of digital banking. By leveraging data and advanced technologies, banks can offer personalized services that meet the unique needs of each customer. This approach not only enhances customer satisfaction but also provides a significant competitive advantage.

As banks continue to embrace hyper-personalization, they will transform from mere financial service providers to trusted advisors in their customers’ financial journeys.

By focusing on deep customer insights, effective data analysis, and actionable recommendations, banks can successfully navigate the journey towards hyper-personalization. The future of banking is personal, and those who embrace this trend will lead the way in delivering superior customer experiences.

To learn more about how Deepvue’s customer insights can enhance your online verification process, visit Deepvue.tech and explore their range of solutions designed to ensure accuracy and efficiency.

FAQs

What is hyper-personalization in banking?

Hyper-personalization in banking involves using data and advanced technologies like AI and ML to gain a deep understanding of each customer’s needs, preferences, and behaviors. This allows banks to offer highly targeted and personalized services that enhance customer satisfaction and engagement.

How does hyper-personalization benefit customers?

Hyper-personalization benefits customers by providing tailored services and products that meet their unique needs. It enhances the customer experience, increases engagement, and helps customers make better financial decisions through personalized advice and timely alerts.

What technologies are used in hyper-personalization?

Hyper-personalization relies on technologies such as artificial intelligence (AI), machine learning (ML), data analytics, and cloud computing. These technologies enable banks to process large amounts of data in real-time and deliver personalized messages and services to customers.

What are the challenges of implementing hyper-personalization in banks?

Implementing hyper-personalization in banks involves challenges such as ensuring data privacy, integrating advanced technologies into existing systems, and fostering a cultural shift towards customer-centricity within the organization.

How can banks ensure data privacy while using hyper-personalization?

Banks can ensure data privacy by being transparent about how they collect and use customer data, implementing robust security measures, and adhering to regulatory standards. Building trust with customers is crucial for the success of hyper-personalization efforts.