Customer satisfaction is the pulse of any thriving business, and for Payment Service Providers (PSPs), it’s a key driver in establishing trust and long-term loyalty. With the digital payment ecosystem growing more competitive, PSPs are being pushed to provide frictionless, secure, and intuitive experiences. One such versatile tool that has been used to measure and maximize customer satisfaction is the Net Promoter Score (NPS). Easy to grasp but perceptive too, NPS allows businesses to gauge the likelihood of their customers to recommend their services, their clear image of customer loyalty, and brand perception.

For PSPs, where even minor problems can mean customer churn or regulatory attention, NPS is not just a measure—it’s a strategic trigger.

NPS Explained: What Is It?

NPS stands for Net Promoter Score, a metric used to measure customer loyalty and satisfaction. It relies on a single question: “How likely are you to recommend our product or service to a friend or colleague?”

Customers rate on the scale of 0 to 10, and depending on the response, customers are classified into three groups

- Promoters (9–10): Your loyal customers who will recommend you.

- Passives (7–8): Satisfied but not enthusiastic customers.

- Detractors (0–6): Dissatisfied customers who will discourage others.

The NPS is derived by subtracting the percentage of Detractors from that of Promoters. The score can vary from -100 to +100.

The greater the NPS, the better the customer satisfaction and loyalty, while a low score might be an indication of issues to be addressed. Companies use NPS to track performance over time and improve customer experience.

According to research, the lifetime value of promoters is 2.5 times higher than that of detractors, with detractors being 2.3 times more likely to switch to another financial provider. In addition, financial institutions boasting an NPS score above 60 see a 26% greater increase in operating income compared to those with a lower score.

Importance of NPS in Customer Loyalty and Satisfaction

- Understanding Customer Loyalty: Net Promoter Score (NPS) helps identify how likely customers are to recommend your business to others. A high NPS means high customer loyalty and a generally positive experience. Repeat business and referrals are more likely to come from loyal customers, and this drives long-term business success.

- Measuring Customer Satisfaction: NPS is a straightforward yet potent instrument to measure overall customer satisfaction with your product or service. It gives direct feedback on customer perception and is thus easy to notice satisfaction problems.

NPS in the Payment Services Industry

Role of NPS Among Online Payment Service Providers

- NPS helps providers identify strengths and weaknesses in their customer journey.

- It enables companies to act quickly on negative feedback to reduce churn and improve retention.

- It delivers insights that can power product innovation, more intuitive user interfaces, and tighter customer support.

- High NPS is linked with customer lifetime value, and so it is an important KPI for strategic planning and investor updates.

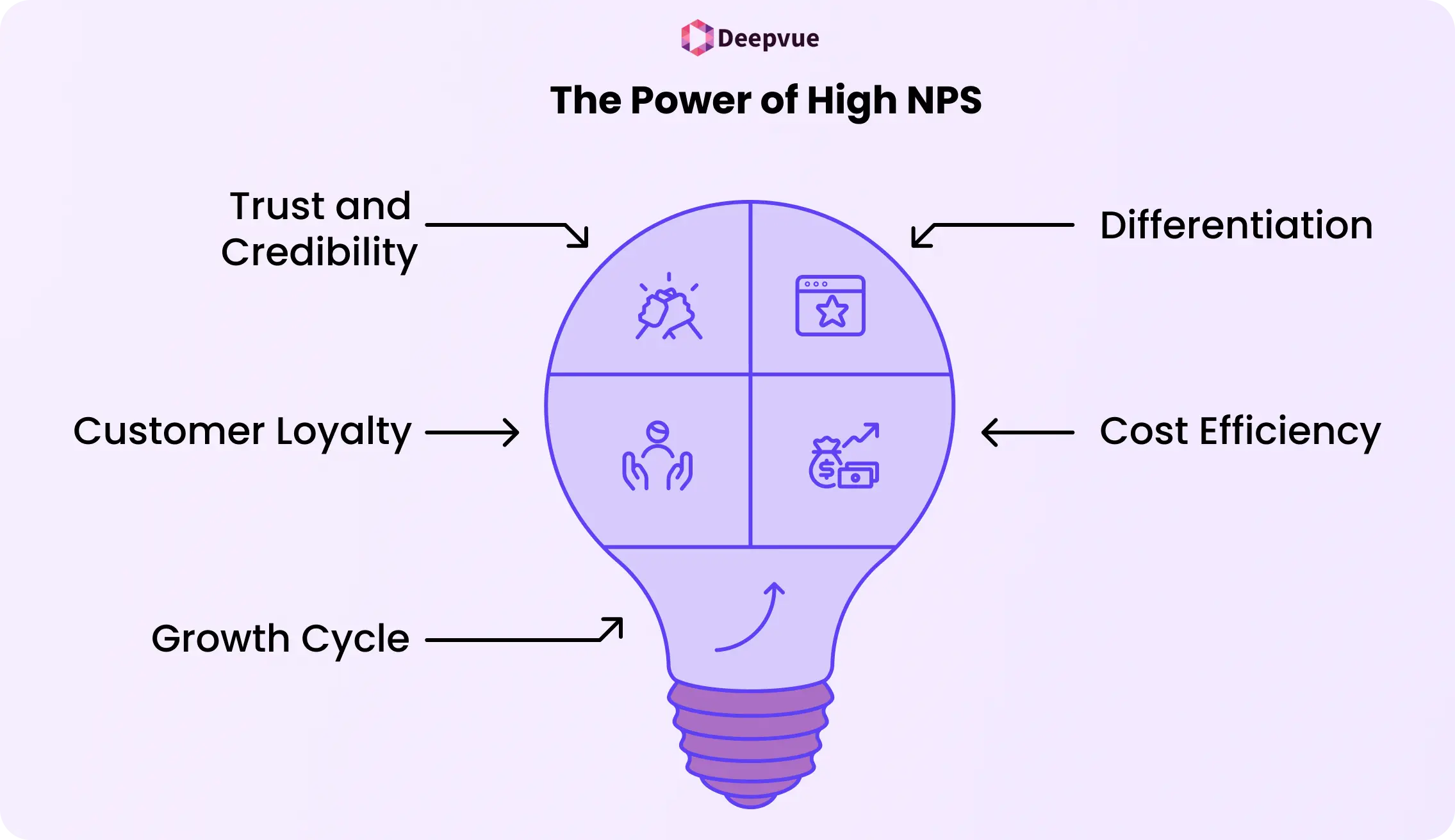

Competitive Advantage through High NPS

- A high NPS places a payment provider on a pedestal and is as trusted as user-centric, acquiring new customers via word of mouth.

- It makes a brand stand out within a crowded field where features and prices might be identical.

- High NPS companies can use customer loyalty to increase services, customer engagement, as well as lower marketing expenses.

- It generates a feedback cycle in which a good customer experience feeds growth and additional loyalty.

Related Read: Ultimate Beneficial Owners (UBO): Compliance for Payment Service Providers.

Implementing NPS Effectively

- Timing the Survey: When to Ask

Send the NPS survey immediately after a crucial customer interaction (e.g., purchase, support call, onboarding of a product) to get recent, relevant responses. For repeat relationships, quarterly or bi-annual checks enable measuring loyalty over time.

- Crafting Effective Survey Questions

Simplify: Ask the essential NPS question — “On a scale of 0 to 10, how likely are you to recommend us to a friend or colleague?” Use plain, neutral words that steer clear of leading or biased language.

- Segmenting Responses for Deeper Insights

Categorize responses by Promoters (9–10), Passives (7–8), and Detractors (0–6) for pattern identification. Break down into demographics, transaction history, usage patterns, or customer segments for insights into exact strengths and hotspots.

Predicting and Reducing Customer Churn with NPS

Using NPS Data for Churn Analysis

- Segment NPS responses to determine dissatisfied customers (detractors) who are most likely to churn.

- Monitor NPS scores over time to identify trends in customer satisfaction and loyalty.

- Segment customers by NPS segment—Promoters, Passives, and Detractors—to assess churn risk.

Creating Retention Strategies

- Target retention activities at detractors by fixing specific issues they’ve complained about.

- Target passives with specific campaigns to win them over as loyal promoters.

- Implement a closed-loop feedback system to follow up with detractors and show commitment to improvement.

Using NPS for Benchmarking and Trend Analysis

- Evaluating Longitudinal Trends: Net Promoter Score (NPS) can be tracked over time to identify changes in customer sentiment and evaluate the effectiveness of strategic improvements.

- Against Industry Standards: NPS can be compared to industry standards to gauge how well a company is doing compared to other businesses and areas where improvement is required.

Challenges and Limitations of NPS

Potential Pitfalls and Biases

- NPS only quantifies customer satisfaction and loyalty, but not the complete range of customer experience or product/service quality.

- If customers are too frequently asked to participate, they become disengaged, resulting in biased outcomes.

- Only respondents with strong sentiments (positive or negative) would be likely to answer, skewing the result.

- NPS does not deliver direct insights to the “why” of the score, and it is more difficult to pin down precise areas for improvement.

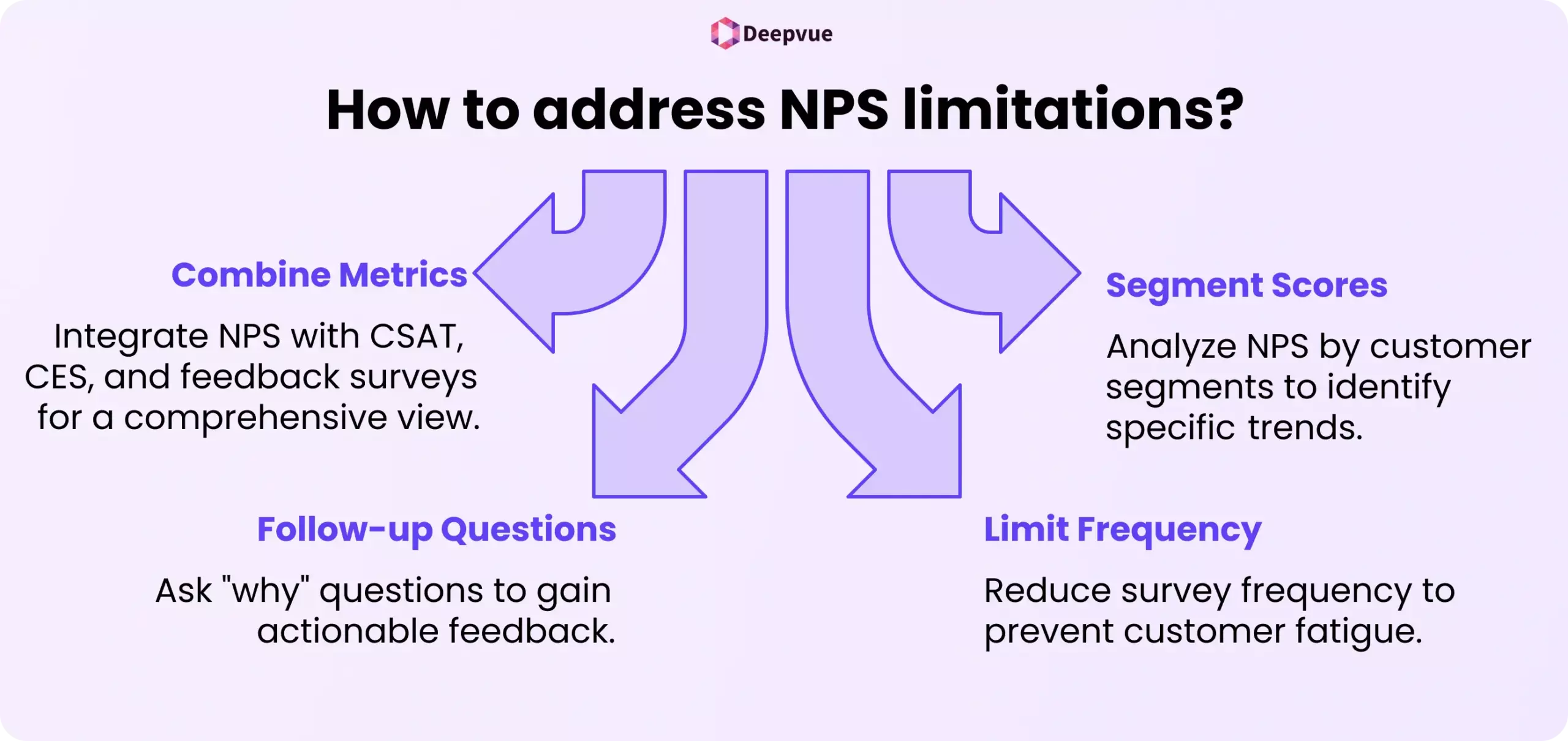

Addressing NPS Limitations

- Combine NPS with other metrics like Customer Satisfaction (CSAT), Customer Effort Score (CES), and specific customer feedback surveys to build a better picture of customer experience.

- Segment NPS scores by customer segment, region, or demographic to avoid sweeping generalities and identify specific trends.

- Request follow-up questions to know the “why” of the score. This gives actionable feedback and addresses particular pain points.

- Prevent survey fatigue by limiting the frequency of NPS surveys and only sending them to a representative subset of customers.

Conclusion

The Net Promoter Score (NPS) provides online Payment Service Providers with an invaluable, actionable score to measure customer satisfaction and loyalty. In a business where trust with customers is key, interpreting and responding to NPS findings can enable PSPs to detect areas of improvement, build stronger customer relationships, and fuel sustainable growth. An elevated NPS indicates a satisfactory user experience, which translates to customer retention and advocacy, while a low score can act as an early warning system to intervene before issues spiral out of control.

FAQ

What is the effect of Net Promoter Score?

NPS assists in quantifying customer satisfaction and loyalty, leading businesses to enhance services, retain customers, and increase growth through areas of improvement.

What is NPS Net Promoter Score?

NPS is a score that measures customer loyalty through an inquiry about how likely they are to recommend a service; the score is derived from subtracting the percentage of Detractors from Promoters.

What is a good NPS score for financial services?

A high NPS score for financial institutions is usually 40-50, above which is viewed as excellent, as a demonstration of very high customer loyalty and confidence.

What constitutes a good telecom NPS score?

In telecommunications, the ideal NPS score is between 30-40, while above 40 shows high customer satisfaction and loyalty in a competitive market.