In the modern financial landscape, digital payments have become an integral part of business operations. As transactions increase in volume and complexity, the need for accurate and efficient payment reconciliation has never been more crucial.

Payment reconciliation ensures that a company’s financial records match its actual transactions, enabling better financial management and preventing errors. This article will explore what payment reconciliation is, its types, and how it works.

What is Payment Reconciliation?

Payment reconciliation is the process of verifying that the transactions recorded in a company’s financial system match the payments that have actually been made or received. This process involves comparing internal records, such as invoices and receipts, with external records, such as bank statements or payment processor reports. By ensuring consistency between these records, businesses can avoid errors, detect fraud, and maintain accurate financial statements.

For instance, if a business invoices a client for Rs 1,00,000 payment reconciliation ensures that the corresponding Rs 1,00,000 payment is recorded correctly in both the company’s books and the bank’s records.

Why is Payment Reconciliation Important for Business?

- Error Detection: Payment reconciliation helps identify discrepancies, such as missing payments or incorrect amounts, ensuring that all transactions are recorded accurately.

- Fraud Prevention: Regular reconciliation can detect unauthorized transactions or fraudulent activity, safeguarding the business’s financial integrity.

- Cash Flow Management: By reconciling payments, businesses can gain a clear picture of their cash flow, helping them make informed financial decisions and manage their resources effectively.

- Regulatory Compliance: Accurate financial records are essential for meeting legal and regulatory requirements, and payment reconciliation plays a vital role in maintaining compliance.

Types of Payment Reconciliation

There are several types of payment reconciliation, each serving a specific purpose. Understanding these types can help businesses choose the right approach for their needs.

- Bank Reconciliation: This is the most common type, where a business compares its internal records with the bank’s statement to ensure that all transactions are accounted for correctly.

- Credit Card Reconciliation: For businesses that rely on credit cards for transactions, reconciling credit card statements with internal records is essential to avoid discrepancies and ensure accurate accounting.

- Cash Reconciliation: In physical stores, cash reconciliation involves matching the cash collected with sales receipts. This process helps detect potential issues like employee theft or accounting inaccuracies.

- Digital Wallet Reconciliation: As digital wallets become more popular, businesses must reconcile transactions made through these platforms. This type of reconciliation ensures that digital payments are accurately recorded and matched with internal records.

- Invoice Reconciliation: This involves matching invoices issued by a business with the payments received, ensuring that all outstanding invoices are paid and recorded correctly.

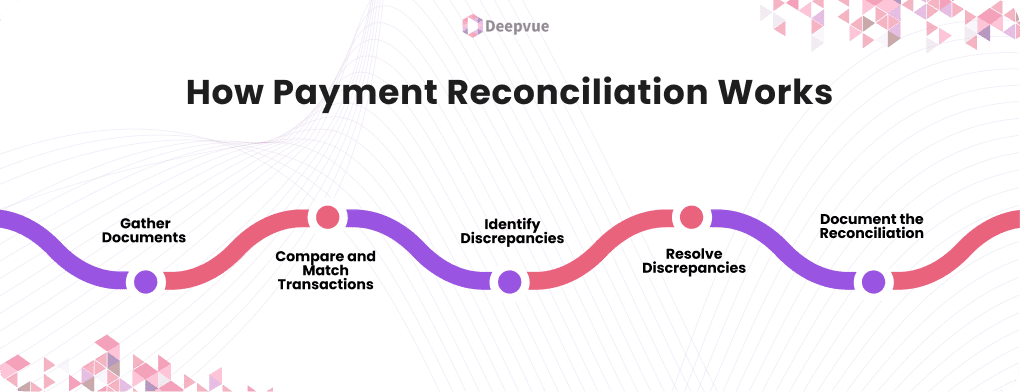

How Payment Reconciliation Works

Payment reconciliation is a systematic process that can be broken down into several steps. Here’s a simplified guide:

Step 1 – Gather Documents: Collect all necessary documents, including internal records (invoices, receipts, accounting software data) and external records (bank statements, payment processor reports).

Step 2 – Compare and Match Transactions: Review each transaction in the internal records and find the corresponding entry in the external records. Check that details such as date, amount, and description match.

Step 3 – Identify Discrepancies: If there are mismatches between records, investigate the cause. Common reasons include timing differences, data entry errors, missing transactions, or unrecorded bank fees.

Step 4 – Resolve Discrepancies: Correct any errors by updating the records, contacting the bank for clarification, or adjusting for bank fees.

Step 5 – Document the Reconciliation: Once all discrepancies are resolved, ensure that the final balances in both the internal and external records match. Document the process, including any adjustments made and explanations for discrepancies.

Risks of Manual Payment Reconciliation

While manual reconciliation is a traditional approach, it comes with several risks:

- Human Error: Manual data entry and comparison are prone to mistakes, which can lead to financial discrepancies and inaccurate records.

- Time-Consuming: Manually reconciling payments can be labor-intensive, especially for businesses with a high volume of transactions. This process can lead to delays in financial reporting.

- Delayed Financial Statements: If reconciliation is not completed promptly, it can delay the preparation of financial statements, affecting decision-making and regulatory compliance.

Benefits of Automating Payment Reconciliation

To overcome the limitations of manual reconciliation, many businesses are turning to automation. Here are some key benefits:

- Increased Accuracy: Automated systems minimize human error, ensuring that transactions are recorded and reconciled accurately.

- Faster Reconciliation: Automation speeds up the reconciliation process, allowing businesses to close their books more quickly and maintain up-to-date financial records.

- Real-Time Monitoring: Automated reconciliation systems can provide real-time insights into cash flow and financial status, helping businesses make informed decisions.

- Scalability: As businesses grow, so does the volume of transactions. Automation can easily handle this increase, ensuring that reconciliation remains efficient and accurate.

- Fraud Detection: Automated systems can quickly identify discrepancies and flag suspicious transactions, enhancing fraud detection and prevention.

Payment Reconciliation Best Practices

To ensure effective payment reconciliation, businesses should follow these best practices:

- Establish Clear Policies: Develop standardized procedures for reconciliation, ensuring that all employees follow the same process.

- Regular Reconciliation: Conduct reconciliation frequently, whether daily, weekly, or monthly, to catch discrepancies early and avoid larger issues later.

- Set Tolerances: Define acceptable margins of error for reconciliation. This allows businesses to focus on significant discrepancies rather than minor differences.

- Embrace Automation: Where possible, automate the reconciliation process to improve accuracy and efficiency.

- Continuous Improvement: Regularly review and refine reconciliation processes to ensure they remain effective as the business evolves.

Conclusion

Payment reconciliation is a crucial process for businesses, ensuring that financial records are accurate and up-to-date. By understanding the different types of reconciliation, following a systematic process, and embracing automation, businesses can streamline their reconciliation efforts and maintain financial integrity. As digital payments continue to grow, payment reconciliation will remain a key component of successful financial management.

FAQs

What is payment reconciliation?

Payment reconciliation is the process of verifying that a business’s internal financial records match external statements from banks or payment processors, ensuring accuracy in accounting.

Why is payment reconciliation important?

Payment reconciliation helps detect errors, prevent fraud, and maintain accurate financial records, which are essential for effective cash flow management and regulatory compliance.

What are the types of payment reconciliation?

Common types of payment reconciliation include bank reconciliation, credit card reconciliation, cash reconciliation, digital wallet reconciliation, and invoice reconciliation.

How can payment reconciliation be automated?

Automation involves using specialized software to compare and match financial records automatically, reducing the need for manual intervention and increasing efficiency.

What are the benefits of automating payment reconciliation?

Automating payment reconciliation improves accuracy, speeds up the process, provides real-time insights, and enhances fraud detection, making it an essential tool for modern businesses.