Peer-to-peer (P2P) lending is something you’ve already dabbled in if you’ve ever borrowed money from a friend and agreed to “totally pay it back next week.” P2P lending makes loans quicker, easier to obtain, and occasionally even more palatable by eschewing traditional banks and putting borrowers and lenders directly in contact via online platforms. Initially, it was designed as a substitute for conventional banking. In this model, borrowers are linked directly to lenders through digital platforms.

But it’s not all sunshine and easy money. From regulatory hurdles to concerns about the security of the data, twists and turns litter the journey that P2P lending in emerging markets has encountered. This blog discusses the path that P2P took in emerging market lending, the catalysts for such growth, and the challenges P2P faces.

What is Peer-to-Peer Lending?

Peer-to-peer or P2P lending is simply an online marketplace where directly the borrowers go to individual lenders instead of any conventional banking channel. It happens that it might be effective in the interest of both parties in this system- the borrower to access funds way before and sometimes on more competitively favorable rates of interest rather than they get in the old conventional savings or bonds.

P2P lending primarily occurs through online channels meant to connect borrowers and investors. Borrowers request loans, providing the information concerning their credit history, and needs. Investors browse through all those listings, choosing which loans to fund by working with filters such as interest rate and risk level. After funding a loan, the borrower pays back with a set interest rate, after which the investors get returns according to the contributions.

Regulatory Frameworks Governing P2P Lending in India

Ban on Guaranteed Returns and Liquidity Features: Liquidity features and guaranteed returns that NBFC-P2P used to offer have been banned. This move pushes participants to make well-informed decisions by increasing openness and enhanced risk communication.

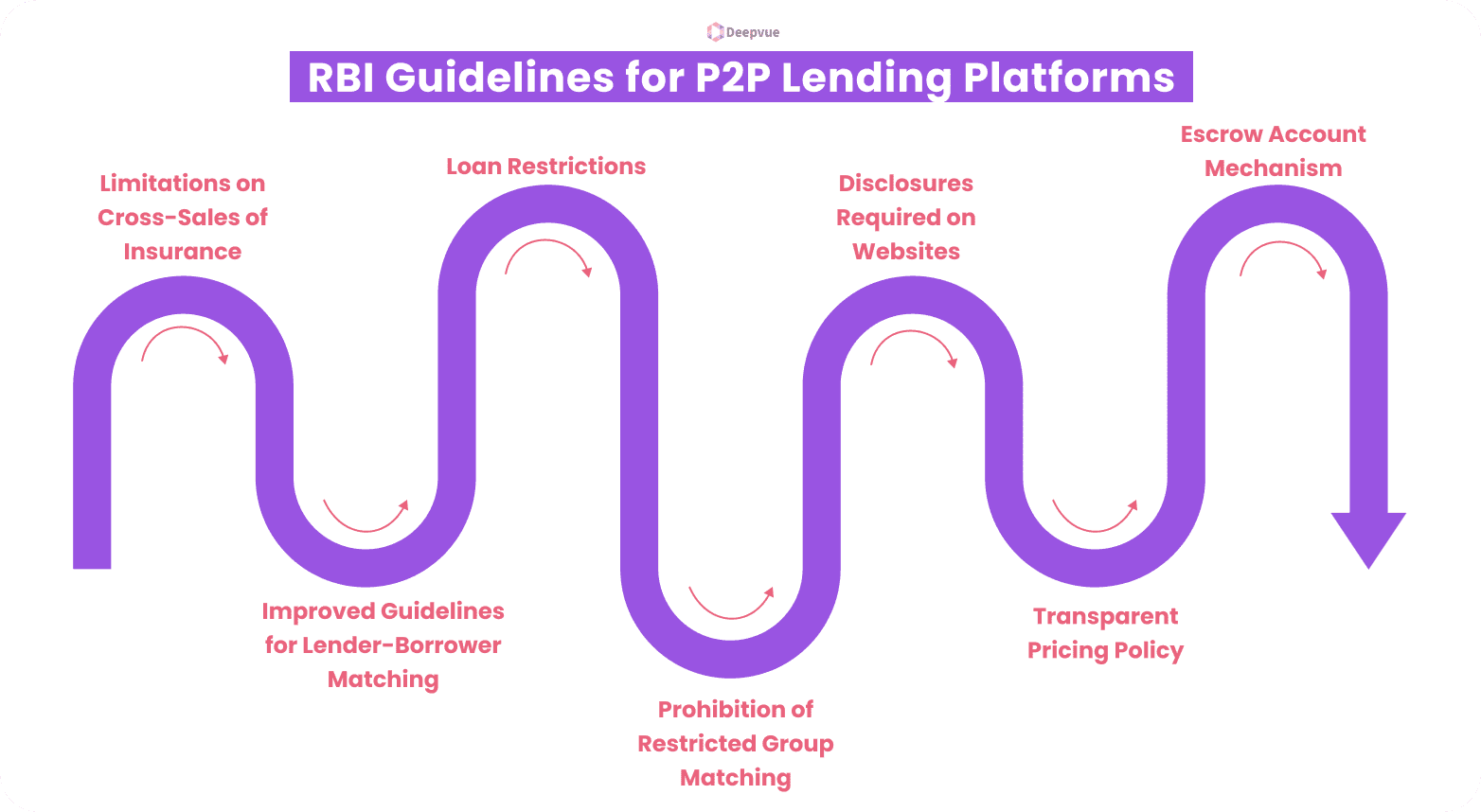

RBI Guidelines for P2P Lending Platforms

- Limitations on Cross-Sales of Insurance: It is not acceptable for platforms to bundle non-loan-related insurance; for example, credit guarantees when transactions are in order and other core lending services are maintained with emphasis.

- Improved Guidelines for Lender-Borrower Matching: Tighter regulations ensure fair and transparent matching between borrowers and lenders. Closed user groups are not allowed to promote equality of access and inclusiveness.

- Loan Restrictions: Participants on P2P platforms are limited to a maximum exposure of ₹50 lakh. A financial certificate issued by a chartered accountant attesting to assets of at least ₹50 lakh is required for investments above ₹10 lakh.

- Prohibition of Restricted Group Matching: In this policy, it is prohibited for lenders or borrowers to link using third-party affiliates or exclusive groups.

- Disclosures Required on Websites: Platforms should inform lenders of losses and report monthly performance to the lenders with NPA details. The disclaimer on the website should clearly state that RBI registration does not guarantee that the loan repayment will be made.

- Transparent Pricing Policy: Fees should be disclosed beforehand and not depend on the performance of borrowers in repaying their debts.

- Escrow Account Mechanism: Escrow account management will require two different accounts, a borrower repayment account and another for cash received from lenders before disbursal.

Comparison with Traditional Lending Methods

The primary difference between P2P lending and bank loans is the source of funds. In P2P lending, an individual or firm lends money to another through a web-based site, which subsequently manages the payback process by returning funds back to the lender.

With a traditional loan, one deals directly with a bank, which both provides the loan and takes the repayment. Below are the crucial differences between the two lending models:

| Particular | P2P Lenders | Traditional Lenders (Banks) |

| Application Process | The application process is simple and convenient, allowing you to complete it entirely online. | The application process can be completed online, by phone, or in person. |

| Qualifications | Flexibility in application criteria and requirements. | Stricter borrower and credit requirements. |

| Approval Timing | Quick application, approval, and funding process. | The process may be longer due to stricter requirements. |

| Interest Rates | Generally lower due to competitive lending | Higher, includes bank overheads |

| Loan Amount | Maximum 50 lakh rupees in special cases. | Banks offer 1,000 to 40 lakh rupees. |

| Interest rates | Competitive rates, potentially lower for those with good credit scores without bank involvement | Competitive rates are often lower for borrowers with strong credit |

Types of Peer-to-Peer (P2P) Loans Available

- Personal Loans: These loans are often sought for a variety of purposes, including paying medical expenses, purchasing a vehicle, or renovating a home. Many borrowers use the platforms also for consolidating already existing debts.

- Business Loans: Business owners can use these loans to cover various operational expenses such as marketing campaigns, facility upgrades, or product development. One of the main advantages of P2P lending is that borrowers can pitch their funding needs to numerous lenders.

- Student Loans: P2P student loans often offer a one-time lump sum that can help pay for the different expenses in school, like tuition, books, and other living expenses.

Safety and Risks in P2P Lending

- Default Risk: In this aspect, the P2P lending model is not very safe. The borrower may default on the loan, and the investors suffer losses. For example, one can invest in a few loans by partitioning the amount among the several loans.

- Credit Risk: Evaluating how creditworthy those borrowers are matters. Some debtors have crummier histories, making them more likely than not to default. Generally, P2P lending will offer credit scores and assessment scores for borrowers with which to go by in that decision.

- Platform Risk: It matters whether the P2P lending platform is financially healthy and stable. If the platform itself has financial troubles or regulatory challenges, this can have a direct impact on your investments.

- Liquidity Risk: Unlike stocks, P2P loans usually have locked-in terms. This means it will be relatively hard to obtain access to your funds until the loan matures. Make sure your investment adequately meets your liquidity requirements.

- Interest Rate Risk: P2P loans usually offer fixed interest rates. When the market rate rises, your return will become relatively less competitive. You can avoid this risk by diversifying across different loan periods and monitoring emerging market lending trends.

- Regulatory Risk: Changes in regulations may affect the operations and legal framework of P2P lending platforms. Stay informed about regulatory updates in your region to safeguard your investments.

Top P2P Lending Platforms in India

- LenDenClub is the biggest P2P lending platform in India, established in 2015, which is known for quick disbursals of loans and a wide variety of loan products it offers, including business, education, and personal loans. As per public data, company has 20 million registered users and has successfully processed over 15,000 loan applications.

- Faircent is one of the first P2P lending platforms in India. Faircent offers a marketplace where individuals connect for credit and offers loans under personal, business, and property loans. As of FY21 public data, it has over 200,000 lenders on its books, making it an important contributor to the burgeoning P2P lending ecosystem in India.

- CRED Mint is a peer-to-peer (P2P) lending feature introduced by CRED. CRED Mint allows members to lend money to other creditworthy individuals and earn interest rates of up to 9% annually. As of 2024 public data, CRED has a user base of approximately 25 million members.

Tax Implications for P2P Investments

1. Taxation of Interest Income:

- Taxable Earnings: According to the Income Tax Act of 1961, the money you receive via peer-to-peer (P2P) lending falls under the category of “Income from Other Sources” and needs to be declared as such.

- Applicable Tax Rate: Your current income tax slab determines how this money is taxed. For example, your P2P interest income will be taxed at 30% if you are in the 30% tax bracket.

2. TDS (Tax Deducted at Source):

- TDS Application: When the total interest paid in a fiscal year surpasses ₹10,000, some P2P platforms may deduct TDS at a rate of 10%.

- Taxpayer Responsibility: Interest income must be reported and taxes must be reconciled at the time of filing, even if TDS is withheld.

3. Filing and Reporting Requirements:

- Selecting the Correct Form: Depending on your overall income and other sources of income, you can report interest income from P2P lending using Form ITR-1 or ITR-2.

- Correct Documentation: Verify that all interest income is documented truthfully. When submitting your return, make sure to include any TDS certificates that the P2P platform may have given you.

Conclusion: The Transformative Impact of P2P Lending on India’s Financial Ecosystem

P2P lending in the developing world is like a plot twist in the financial world. It is shocking but, after all, drastically changing. By bypassing conventional banks, these platforms are democratizing loan access and aiding businesses in growing while giving lenders an avenue to earn returns. If anyone abides by the rules and stays informed about changing regulations, then it’s a sweet end for everyone.

If you want more information or are looking for state-of-the-art banking verification APIs to integrate with your platform, reach out to our experts and stay ahead of this ever-changing game.

FAQ:

What is Peer-to-Peer Lending?

P2P lending allows the online connecting of a borrower directly to the lender outside of the regular banks.

How does P2P Lending Work?

Loan applications are made and submitted on a P2P platform, and the platform and/or lenders assess and approve the corresponding loans based on credit ratings. It also enables repayment and connects loans to investors.

What are the Trends in the India Peer-to-Peer Lending Market?

Some of the major trends followed are digital lending platforms, growing clarity on regulation, and better use of artificial intelligence for improving credit risk analysis and fraud mitigation.

What are the Challenges in the India Peer-to-Peer Lending Market?

The main challenges are regulation, borrower defaults, data security issues, and lesser awareness about the P2P lending service by the borrower.

What are the Major Drivers for the India Peer-to-Peer Lending Market?

They include increasing digital adoption, limited access of small borrowers to traditional credit, friendly regulations, and advancements in technology such as AI and data analytics.