The Financial Conduct Authority (FCA) is key to forming and sustaining the stability of the UK’s financial markets. Set up to defend consumers, ensure the stability of markets, and maintain fair competition. The FCA oversees a wide range of financial services businesses, including banks, investment firms, fintech firms, and digital lenders. It has independent powers but is answerable to the UK Parliament and holds considerable power to enforce, fine, and withdraw licenses where needed. Knowing the role of the FCA is important to all businesses trying to navigate financial rules and to consumers who want financial transparency and protection when transacting. This article looks at the role of the FCA, some of its main roles, and how its regulatory system affects the financial landscape.

The Origins and Evolution of the FCA

Historical Context of Financial Regulation in the UK

UK financial regulation has its roots in the 19th century, and it was concerned with investor protection and market stability. The Bank of England took a central role in regulating financial markets, especially after the Wall Street Crash of 1929, which pointed to the necessity of tighter controls. The failure of Barings Bank in 1995 and the 2007-2008 financial crisis laid bare the holes in regulation, with a demand for wide-ranging reforms that followed.

Establishment of the FCA

The Financial Conduct Authority (FCA) was established in 2013 as part of the UK government’s response to the financial crisis. It was established under the Financial Services Act 2012, which replaced the Financial Services Authority (FSA), which was seen to be ineffective in avoiding the crisis. The FCA has been provided with a twin mandate – to look after consumers and maintain the stability of the financial system.

Changes and Reforms Over the Years

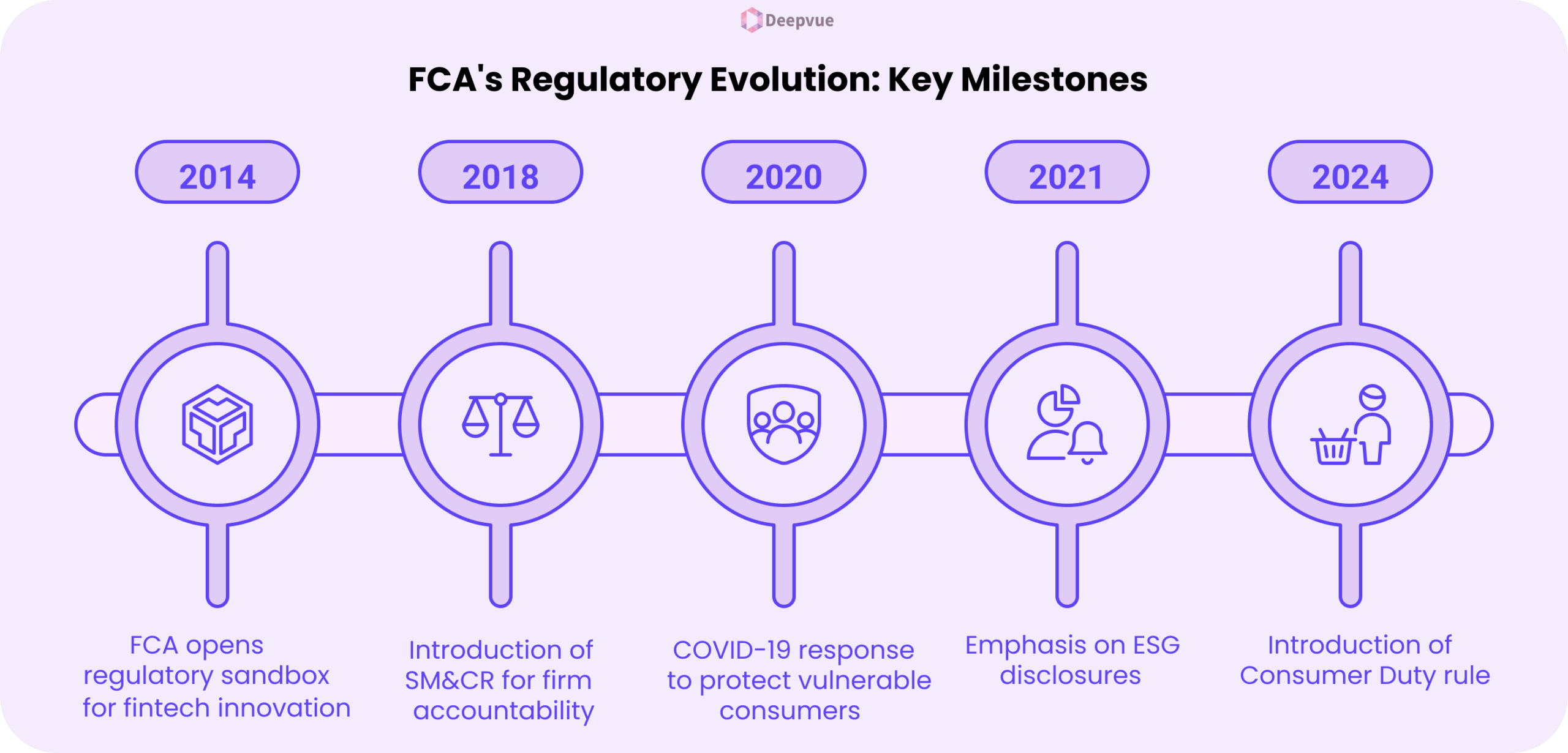

2014 – The FCA opened its first regulatory sandbox to promote fintech innovation with consumer protection.

2018 – The FCA brought in the Senior Managers and Certification Regime (SM&CR) to make financial firms more accountable.

2020 – In the wake of the COVID-19 pandemic, the FCA took steps to safeguard vulnerable consumers against financial detriment.

2021 – The FCA emphasized environmental, social, and governance (ESG) disclosures in line with international regulatory principles.

2024 – The FCA introduced the Consumer Duty rule to enhance consumer outcomes and impose higher standards of treatment from financial institutions.

Core Functions of the FCA

- Consumer Protection: FCA protects consumers by ensuring that financial businesses deal with consumers in a fair manner through rules, overseeing business conduct, and complaint handling to deter fraud and malpractice.

- Market Integrity: It ensures the stability and transparency of financial markets through the oversight of transactions, monitoring market abuse, and ensuring compliance with regulations to forestall financial crime.

- Competition Promotion: The FCA encourages healthy competition among financial services providers through the removal of barriers to market entry, promotion of innovation, and prevention of anti-competitive conduct.

Sectors Regulated by the FCA

- Mutual Communities: The FCA oversees building societies, credit unions, and friendly societies to secure their operation fairly and safeguard the interests of the members.

- Investment Firms: The FCA regulates asset managers, stockbrokers, financial advisers, and investment platforms to ensure they adhere to rules to uphold market integrity and safeguard investors.

- Regulations on Cryptocurrency: The FCA supervises firms involved in cryptocurrencies. It does this to avert financial crime, promote transparency, and protect consumers from risks.

Anti-Money Laundering (AML) and Compliance

AML rules help to avoid money laundering, financing terrorism, and fraud. They protect the integrity of financial institutions and consumers against illegal activities. Failure to comply can result in significant fines, legal action, and damage to the reputation of firms.

Strategies for Compliance

- Apply detailed Know Your Customer (KYC) processes to establish customer identities.

- Perform continuous customer due diligence (CDD) to identify suspicious transactions.

- Establish a strong risk assessment model to detect possible money laundering risks.

- Keep proper and current records of all customer transactions for audit.

- Apply transaction monitoring systems to identify and report abnormal financial behavior.

Firm Adherence and Reporting

- Establish a Money Laundering Reporting Officer (MLRO) to oversee AML compliance.

- Ensure timely reporting of suspicious activities to the National Crime Agency (NCA) through Suspicious Activity Reports (SARs).

- Comply with the FCA’s Financial Crime Guide (FCG) to ensure that internal policies are aligned with the regulatory demands.

- Conduct regular internal audits and third-party examinations to maintain AML program effectiveness.

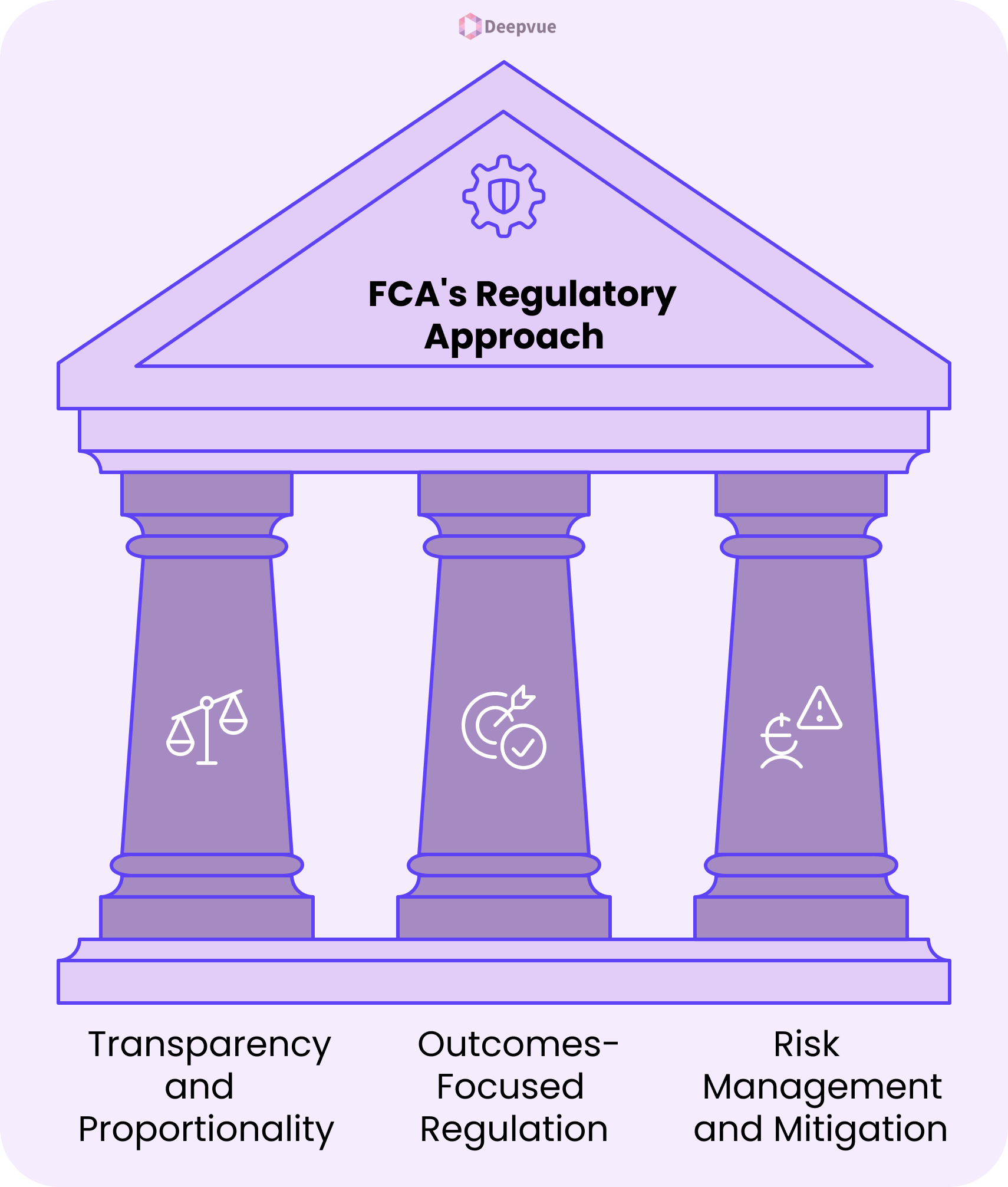

The FCA’s Approach and Principles

- Transparency and Proportionality:

- The FCA (Financial Conduct Authority) promotes transparency by explaining the regulatory expectations in such a way that firms are aware of their compliance obligations. It takes a proportionate approach by varying regulatory requirements according to the size, complexity, and risk profile of a firm so that it does not impose an undue burden on small firms.

- Outcomes-Focused Regulation:

- FCA’s regulatory approach is outcome-based in terms of desired goals such as consumer protection, market integrity, and financial stability. The FCA does not prescribe precise processes but judges how firms achieve these outcomes in a manner that is risk-based, innovative, and consumer-focused.

- Risk Management and Mitigation:

- The FCA mandates firms to adopt strong risk management systems to recognize, evaluate, and control risks appropriately. It monitors companies’ risk environments in order to determine if they are operating within prudent limits, putting a great emphasis on prospective risk analysis to eliminate financial fraud and consumer harm.

Promoting Competition and Financial Inclusion

The FCA institutes practices for the protection of vulnerable consumers through, among other measures, establishing rules for treating customers fairly, promoting financial literacy, and providing accessible financial services. The FCA mandates that firms identify and act on the needs of vulnerable groups, e.g., the elderly, poor individuals, and persons with disabilities.

The FCA promotes competition through establishing regulations against monopolistic conduct and fostering the entry of new players. It promotes open banking, enabling consumers to compare and contrast financial products and services more easily. The FCA collaborates with financial institutions to develop products that are accessible to underserved segments. It promotes digital financial solutions that fill the gap for those who lack access to conventional banking.

Understanding FCA Authorization

Criteria for Requiring FCA Authorization

- Companies carrying out activities such as lending, investment management, payment services, insurance distribution, or consumer credit need authorization.

- Firms trading in assets like shares, bonds, derivatives, or cryptocurrencies might require authorization.

- Firms providing investment advice, broking, or dealing with client assets need to be authorized.

- Firms must meet FCA standards in terms of location, business model, financial resources, and operational controls.

Process for Obtaining Authorization

- Determine the relevant regulated activities for your company.

- Assemble comprehensive business plans, compliance structures, and risk analyses.

- Fill out FCA’s online application and submit the fees payable.

- FCA evaluates financial strength, business model, and top management ability.

- FCA grants authorization, gives limited permissions, or denies the application.

Conclusion

The Financial Conduct Authority (FCA) is an essential regulatory body that oversees the financial services sector in the UK. Its mission is to ensure that financial markets work well for individuals, businesses, and the economy as a whole. Through enforcing rules, supervising financial institutions, and providing fair treatment to consumers, the FCA ensures market integrity and guards against misconduct. Whether you are a consumer, a businessperson, or merely interested in being aware of the regulatory environment, it is significant to know the roles of the FCA.

FAQ

What is the Financial Conduct Authority (FCA)?

The FCA is the government agency that oversees financial markets within the UK to ensure fair consumer treatment and promote market integrity.

What is the FCA’s main function?

The primary responsibility of the FCA is to regulate financial markets, protect consumers, ensure market stability, and prohibit financial malpractices.

What are the FCA’s powers?

The FCA can carry out investigations against companies, enforce rules, impose fines, and, if need be, ban or withdraw the licenses of companies that violate rules.

What is the FCA’s approach to fintech?

The FCA supports innovation in the fintech sector but makes sure that new firms have the same high standards of regulation to protect consumers and maintain market integrity.