It is remarkable how profoundly India has undergone the transition toward a digital-first economy, especially in the financial technology and payment systems. Digital payments have become so convenient that cashlessness seems to be the new norm of our daily lives, but such blistering change does raise critical questions about online financial transaction’s safety and trustworthiness.

At this point, digital escrow services have emerged as an important solution because they act as neutral intermediaries in financial transactions. Ensuring the transparent and secure conduct of transactions plays a vital role in creating trust among the parties involved. This blog explores the growing importance of digital escrow accounts in India’s payment ecosystem and their economic impact, taking lessons from global models.

Overview of Digital Payments in India

The digital payment scenario in India has seen a total transformation from a cash-based approach to streamlined digital payment solutions. With the diminishing reliance on cash, technology solutions such as QR codes and UPI have developed with a focus on secure, efficient, and rapid transactions. This is testimony to the rapid strides India is making toward becoming a digitally empowered economy with increased financial inclusion.

Emergence of Digital Payment Systems

India’s financial ecosystem has been transformed with the emergence of digital wallets, payment banks, and contactless cards. Going cashless became a government requirement, and then fintech got on the digital payment bandwagon. Today, digital payments have become a way of life.

Role of Unified Payments Interface (UPI)

UPI lies at the heart of this transformation. In a matter of a few years, UPI has effortlessly made transactions as easy as sharing memes on WhatsApp by facilitating real-time money transfers and easy usage. India is now setting global benchmarks in digital payments adoption. UPI verification is crucial to ensuring the safety of financial transactions for businesses of all types.

Impact on Digital Payments

- Advancing Financial Inclusion: UPI, or Unified Payment Interface, is considered a great step forward towards achieving financial inclusion. It helped close the gaps that existed across Indian society because of the differences in socio-economic levels. People who lacked access in the past to bank services can now seamlessly take part in the digital economy.

- Driving a Cashless Economy: UPI encourages digital payments and, in the process, helps the government achieve a cashless economy. Gradual decline in cash transactions leads to lower costs and less hassle in managing physical currency. Digital shift enhances greater transparency, accountability, and efficiency in financial transactions for private enterprises as well as public services.

- Growth of E-Commerce: E-commerce has been boosted by the popularity of UPI. It gives confidence to the customers for online transactions because of its secure and fast payment process. UPI has facilitated seamlessness in every possible manner with online platforms that have opened up avenues for the business side, allowing smoother and faster digital transactions.

- Empowering Small and Micro Businesses: UPI has thus been an enablement tool at the grassroots, allowing small and micro enterprises not to require even complex point-of-sale setups as a prerequisite before embracing digital payments. Simplicity and ease of use while being cost-efficient have enhanced consumer experiences while digitally propelling a grassroots movement as these businesses prepare to meet an increasingly digital-friendly customer base more effectively.

The Importance of Trust in Financial Transactions

Counterparty risk refers to the potential that one of the parties to a transaction will not meet its financial obligation. This is especially a concern in online transactions, where one party is unknown.

- Understanding Counterparty Risk: Counterparty risk refers to the potential that one party does not fulfill its obligation to deliver funds in a transaction. This risk is a huge problem when dealing with unknown parties in an online transaction.

- Building Trust in Digital Payments: Building trust in digital payments would require having more secure systems as well as transparent processes with a little dash of healthy skepticism. To encourage the increase of digital transactions both buyers and sellers must be secure.

Digital Escrow Services: Definition and Functionality

Digital escrow services offer a solution to the trust problem by acting as impartial third parties in financial transactions.

What is Digital Escrow?

Digital escrow service is the holding of funds by a trusted intermediary until the contractual obligations by both parties are fulfilled. Here, it acts as an independent third party to ensure that neither side defaults on the contract and thus protects the interests of both buyers and sellers.

This mechanism is of utmost importance in high-value or sensitive transactions. Digital escrow accounts are becoming increasingly important as part of maintaining transparency and ensuring trust in online financial exchanges that are now experiencing more adoption in India’s digital economy.

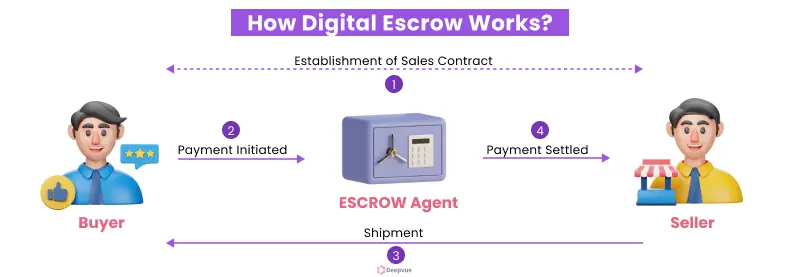

How Digital Escrow Works?

- Agreement: The buyer and seller agree on the terms of the transaction.

- Payment: The buyer deposits the funds into an escrow account.

- Verification: The seller provides the product or service.

- Release: The money is given to the seller after the buyer approves.

Economic Impact of Digital Escrow Services

Digital escrow services can therefore revolutionize the economy by securing it and accelerating growth.

- Improving Transaction Security: Digital escrows minimize fraud while building confidence in online transactions. They act as a safeguard because they ensure the transactions are performed securely and with transparency, therefore building trust in digital commerce.

- Facilitating Small Business Growth: Digital escrow accounts, particularly for small businesses and freelancers, become that lifeline. It gives users a guarantee of timely payment, minimizes disputes, and allows entrepreneurs to focus on expansion instead of having to worry about overdue invoices.

International Comparisons: Lessons from Global Models

M-Pesa: A Case Study from Africa

M-Pesa transformed financial inclusion in Kenya by providing secure mobile payment solutions. Escrow-like services played an important role in establishing trust among users, especially in e-commerce and service-based transactions.

The power of escrow-like solutions is transformative with the ability of a service that allows secure payment in a region where traditional banking infrastructure is weak. The M-Pesa model shows how secure financial services can cross the trust gap within emerging economies.

Digital Payment Innovations in China

Giant escrow features by Alipay and WeChat Pay have dominated China’s digital payment landscape. Escrow services help to act as an intermediary that holds funds between the parties, waiting for their satisfaction with the deal.

They set the global benchmark in secure digital commerce by incorporating escrow services, which keep both online and offline transactions secure. This would continue to keep consumer confidence at its highest and drive fast digital payment adoption.

Successes in Brazil’s Mobile Payment Systems

Brazil’s PIX system, launched by the Central Bank of Brazil, has transformed mobile payments with instant, secure transactions. One of its features is to temporarily hold funds until both parties to a transaction meet certain predefined conditions.

This has ensured fraud reduction and brought trust into the digital transactional system. Success with PIX by Brazil exemplifies how the right, reliable payment mechanism contributes to a digital economy.

The Dynamics of Two-Sided Markets in Digital Payments

Two-sided markets are where buyers and sellers interact on a platform, and digital payments thrive on this model.

- Understanding Market Interactions: Successful business platforms must engage both buyers and sellers while promoting secure and smooth transactions.

- Implications for Platform Development: The digital escrow service increases the confidence of the users and decreases friction, thereby making the platforms more attractive for both sides.

Future of Digital Payments in India

The future of digital payments in India is bright, and digital escrow services will play a crucial role in it. As the economy continues to digitalize, transaction mechanisms that are secure and trustworthy will be very important. When India progresses more into a digital-first economy, digital escrow services will inevitably become the pillar of secure financial transactions. Their ability to promote trust and ease of exchange makes them indispensable for businesses and the consumers themselves.

Contact Deepvue to learn how digital escrow accounts can transform the nature of your financial transactions. We are here to give you insights and support that suit your business needs.

FAQ:

What is an Escrow Account and Who Can Use It?

An escrow account is a form of bank account whereby funds are held by a third party pending the agreed terms of a transaction. This protects both the buyer and the seller. Anyone involved in transactions requiring security, such as real estate deals, freelance contracts, e-commerce purchases, or corporate agreements, can use an escrow account.

How does Digital Escrow work?

In a digital escrow transaction, the buyer pays the payment to the escrow service, and the latter will ensure that the goods or services meet the agreed-upon terms before it releases the payment to the seller, therefore giving protection to both parties.

What types of transactions benefit from Digital Escrow?

Digital escrow is most commonly applied to high-value transactions, real estate deals, marketplace purchases on the Internet, freelance contracts, as well as other cases that both parties feel will be fulfilled before completing a final deal.

Can Digital Escrow be used for international transactions?

Yes, digital escrow services may be used to execute international transactions. They serve to minimize cross-border payment-related risks, especially those associated with currency conversion and legal compliance issues, and assure the protection of both parties involved.

What happens if there is a disagreement during the Digital Escrow process?

If a dispute is found, then the escrow service provider will offer mediation and arbitration to both parties involved, or may just hold the funds until such an agreement is made or reached between the two.