Onboarding is more than a bureaucratic procedure; it serves as an opportunity for business in terms of setting that lasting first impression. Earning customer trust is what a seamless onboarding experience entails. However, this completely depends upon correct ID verification. Lacking it increases the likelihood of fraud, inefficiencies, and non-compliance, bringing about ineffective customer experiences for businesses.

Accurate identification verification ensures secure, fast, and smooth onboarding journeys. It minimizes manual errors, reduces identity theft, and ensures businesses stay within the lines of KYC and AML rules to protect themselves and their customers.

This blog looks into the importance of ID verification accuracy in digital onboarding and how it can transform your onboarding process, making it faster, safer, and more reliable.

What is Digital Onboarding?

Digital onboarding means signing up new customers or users online. The entire digital onboarding process utilizes internet-based tools and technologies to identify identities, collect mandatory documents for verification purposes, and open accounts online. The concept of digital onboarding is taking over industries such as banking, insurance, and finance because of its efficiency in filling the growing demand for smooth digital experiences.

Digital onboarding in corporate banking saves time and effort for the banks and their clients. It ensures safety with real-time identity verification and fraud detection tools. It gives corporate clients a smooth, frictionless experience when trying to manage their financial activities with the least amount of hassle. In addition, it also complies with regulatory standards such as KYC and AML (Anti-Money Laundering) in reducing the risk of financial crimes.

Key Reasons Identity Verification Is Crucial for Onboarding

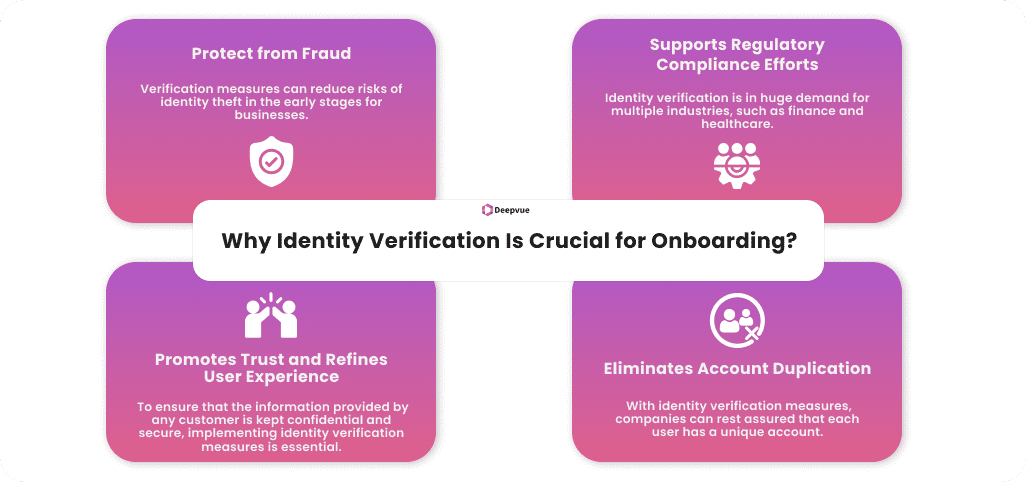

- Protect from Fraud

Combating fraud is possible with identity verification in digital onboarding. Identity theft and other fraudulent activities have increased over time, so it is essential to check the identity of any user. Verification measures can reduce risks of identity theft in the early stages for businesses.

- Supports Regulatory Compliance Efforts

Identity verification is in huge demand for multiple industries, such as finance and healthcare. These business sectors require maintaining reputations to avoid fines and penalties. They have to abide by regulatory requirements regarding customer identification and verification.

- Promotes Trust and Refines User Experience

Identity verification is equally important for businesses and customers. Verification gives customers a certain level of protection and confidence when they sign up for online services. To ensure that the information provided by any customer is kept confidential and secure, implementing identity verification measures is essential. While interacting with legitimate entities, businesses need to provide a sense of security and trust to have a long enduring relationship, fostering long-term growth.

- Eliminates Account Duplication

Duplicate accounts may have a prevailing impact on the growth of businesses. To ensure that users don’t create multiple accounts identity verification is important. With identity verification measures, companies can rest assured that each user has a unique account. This will refrain users from performing unauthorized and fraudulent activities.

Types of Digital Identity Verification Methods

- Document Verification: It requires verification of an official document issued by a government that is mapped into official records. With the help of our identity verification API, businesses can ensure the accuracy and compliance of documents against official records.

- Biometric Verification: It is a more advanced verification method with a higher security level. Biometric verification includes facial recognition, iris scans, fingerprints, and other biological features. Through our face match API, businesses can minimize fraud risks and ensure secure onboarding. Our API provides correct results by perfectly scanning and matching images.

- Two-factor Authentication: Two-factor authentication (2FA) is a two-layered verification process that provides one extra layer of security in fighting against unauthorized access. The 2FA uses time-sensitive one-time passcodes that act as a powerful identity theft prevention system.

- Credit Bureau-based Verification: In this verification, the check is against the credit history of the user with the records of the credit bureaus. Normally, it takes 3-4 months, but our Equifax Credit Report API will do the entire process in less than 30 minutes. Businesses can have an efficient onboarding process through informed decisions with our detailed credit reports.

The Crucial Impact of ID Verification Accuracy on Digital Onboarding

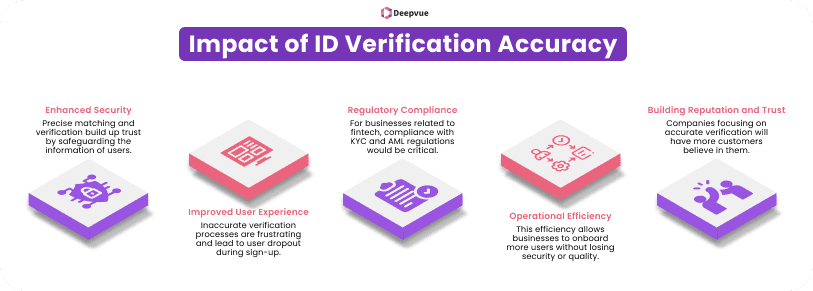

- Enhanced Security: ID verification ensures that no fraudulent transactions occur and protects the identity theft of any sensitive information that might have been provided during registration. Precise matching and verification build up trust by safeguarding the information of users.

- Improved User Experience: Inaccurate verification processes are frustrating and lead to user dropout during sign-up. Simplicity in the verification process is crucial for a smooth, quicker approval of users, which will help in retaining them.

- Regulatory Compliance: For businesses related to fintech, compliance with KYC and AML regulations would be critical. Increased accuracy in verification will ensure the minimum legal risks concerning regulation compliance.

- Operational Efficiency: It increases operational efficiency by reducing manual interventions because of accurate verification, thereby saving time and resources. This efficiency allows businesses to onboard more users without losing security or quality.

- Building Reputation and Trust: Companies focusing on accurate verification will have more customers believe in them. Customers have greater confidence in businesses that prioritize secure and reliable procedures, improving brand reputation.

The Pitfalls of Failing to Implement Identity Verification in Onboarding

- Fraud Susceptibility

Businesses that have not introduced identity verification suffer a greater extent of experiencing fraud. During the onboarding of customers, fraudsters go unnoticed and are seen to be valid clients. Without proper methods of verification, businesses incur enormous financial losses. Additionally, this may cause harm to the company’s brand, causing legal problems.

- Sanctions and Legal Issues

Identity verification is a crucial component of protocols. If businesses ignore identity verification then it violates laws on Know Your Customer (KYC) and Anti-Money Laundering (AML). This might lead to penalties and other legal problems.

- Waste of Resources and Time

When businesses don’t incorporate identity verification in their onboarding process, then they have to manually deal with identity theft and other dangers. This becomes time-consuming and expensive for businesses. Furthermore, when the clientele grows, the manual process becomes inefficient. The time and resources involved in investigating and fixing fraud cases can be efficiently used on more important business tasks.

Why Trust Deepvue for Your Solutions?

- Deepvue’s ID verification API builds trust with high accuracy, reducing the possibility of errors and fraud.

- With fast and seamless onboarding through real-time verification, our solution accelerates onboarding with a frictionless customer experience.

- Directly integrate with your existing systems, tailored to meet your business needs.

- Stay ahead of KYC and AML requirements with Deepvue’s reliable technology.

Conclusion

Accurate ID verification is the building block for efficient digital onboarding. It guards against fraud, speeds up the process, and even enhances the customer experience. By using the ID verification API of Deepvue, your business will be best placed to provide secure, frictionless onboarding that builds long-term customer trust.

Get ready to revolutionize your onboarding. Contact us today to transform your onboarding!

FAQ:

How is ID verification useful in digital onboarding?

ID verification is a security feature for protecting the data of users, fraud prevention, and complying with the regulations and guidelines of KYC and AML. It helps make the onboarding process smooth by raising the customer’s level of satisfaction and trust.

What are the accuracy features of ID verification solutions?

These are some features including AI-powered document scanning, biometric checks, cross-reference with trusted databases, and real-time data updates for higher accuracy in ID verification.

How does an ID verification process affect regulatory compliance?

ID verification prevents legal problems and fines, thereby ensuring proper and legitimate Know Your Customer and Anti-Money Laundering.

What ID verification methods are used the most in digital onboarding?

Companies can implement real-time ID verification through APIs or from other third-party solutions that work seamlessly with their current systems.

How can businesses integrate ID verification in onboarding workflows?

Other standard methods include face recognition, biometric data matching, and cross-checking with governments’ data storage.