We all hear about dodgy financial transactions on the news – large sums of money seem to disappear and then reappear or suspicious transactions are identified at banks. However, do you ever stop and wonder what happens if the racketeer does finally get caught? Money laundering, the term often associated with organized crime, though a staple of movies, is an extreme reality situation with severe implications. The money laundering fines are staggering: sky-high fines and long prison sentences.

In the blog, we will break down what happens when you get caught in a money laundering scheme, explore the penalties for engaging in money laundering, and give you the inside scoop on how global governments are cracking down on these sneaky operations.

What Is Money Laundering, and Why Does It Happen?

Money laundering is converting illicitly obtained money so that it appears to have been legally earned. It is the crime of transforming the profits of crimes, such as drug trafficking, tax evasion, or fraud, into clean assets. It follows three stages:

- Placement: Securing the illegal money in the legitimate financial system.

- Layering: This obscures the source of the funds by disguising it with several complicated transactions.

- Integration: Recycling that soiled money back into the economy in the guise of “clean” money.

They launder the money to reap fruits from such outlawed activities without raising alarms from the police. Well, the dangers of money laundering are enormous and punishment can be as deadly as financially crippling.

The High Price of Getting Caught: What Are the Penalties for Money Laundering?

So, what is the penalty for money laundering?

Money laundering offenses carry some of the most severe sentences under the legal system, as governments around the world act to combat financial crime. The sentences include a combination of fines for money laundering, jail time, asset seizure, and many more.

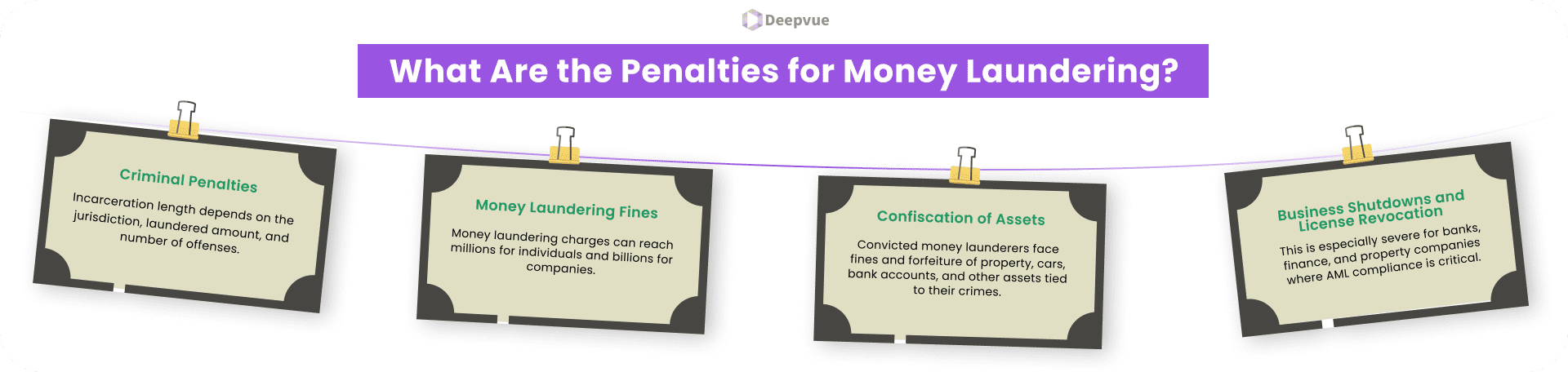

Criminal Penalties: Lengthy Prison Sentences

Long prison sentences are some of the grave consequences one may receive due to money laundering. The length of incarceration varies with jurisdiction and the amount of money laundered, among other reasons, as well as the number of offenses. Apart from serving a sentence, a conviction for money laundering causes permanent damage to one’s personal and professional reputation.

Money Laundering Fines: The Numbers Speak Volumes

Money laundering fines can be economically devastating. Governments impose heavy fines on people and corporate entities who have engaged in money laundering; the idea here is that such activities should not be encouraged by potential criminals. Charges for money laundering can run into hundreds of thousands or even millions of dollars in individuals.

Confiscation of Assets: Losses Beyond Money

Another form of money laundering punishment is asset forfeiture. Often, the government confiscates assets that are suspected to be money from illegal activities. This means that the convicted money launderer is liable not only to fines for money laundering but also to property, cars, bank accounts, and many other valuable resources linked with those crimes.

License Revocation: The Final Nail in the Coffin

Apart from the monetary expense of penalties, it affects companies implicated in money laundering. The regulatory bodies can even shut down a company, convicted of money laundering. This can be especially severe in companies such as banks, finance, and property, where AML compliance is crucial.

Penalties for Corporations vs. Individuals

Although individuals who engage in money laundering are accorded hundreds of millions of dollars in penalties, this is not necessarily the case with corporations. Corporations face massive penalties when they get caught in money laundering.

For individuals, the sanctions typically consist of imprisonment and fines. At a minimum, severe money laundering convictions could also carry with them a lifetime ban from particular business activities, possibly even ones related to finance or banking. Confiscation of personal assets could also be part of the sanctions if those were obtained through money on which tax was not paid.

Banks and any other corporate companies involved in this money laundering scam might end up being fined millions or even billions of dollars. A business may end up losing a license to carry out certain business-related activities thus eventually losing their business operations. Their company’s reputation goes down the drain irreparably and could alter their business transactions with other businesses for years to come.

Global Penalties: How Different Countries Handle Money Laundering

When discussing what is the penalty for money laundering, it is important to understand that the penalties imposed vary depending on the country. Here’s a quick look at how some major countries tackle this issue:

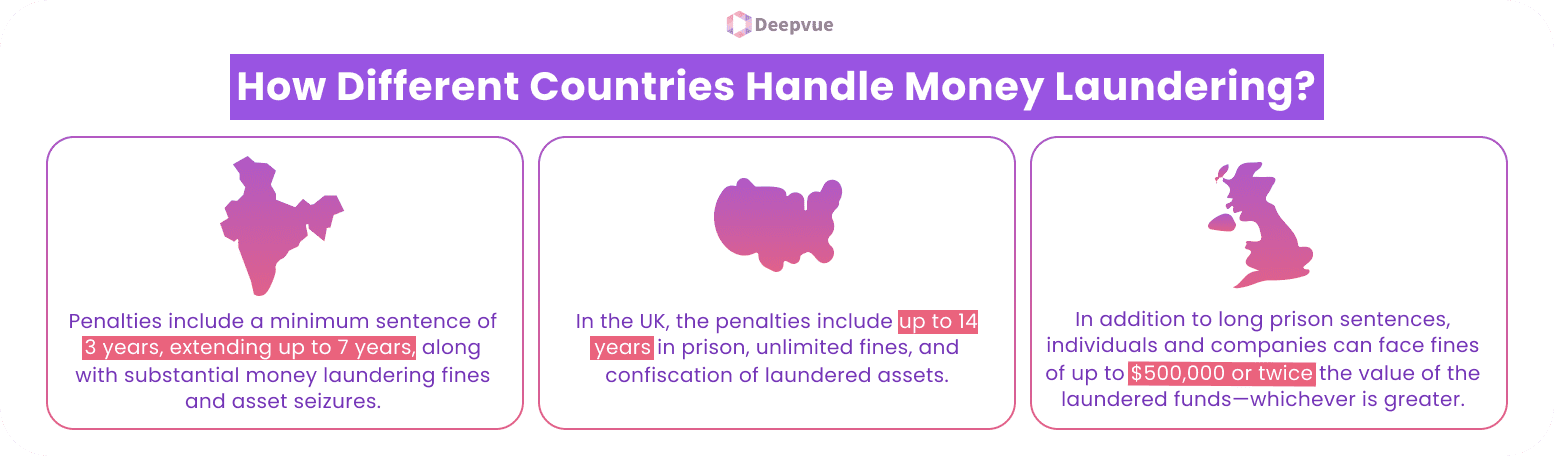

- India

India’s Prevention of Money Laundering Act (PMLA) is the primary legal framework for dealing with money laundering. Penalties include a minimum sentence of three years, extending up to seven years, along with substantial money laundering fines and asset seizures. The Indian government has been proactive in freezing assets linked to laundered funds, particularly in high-profile corporate cases.

- United Kingdom

In the UK, the penalties include up to 14 years in prison, unlimited fines, and confiscation of laundered assets. UK authorities have been aggressive in enforcing AML regulations, with high-profile cases resulting in significant money laundering fines.

- United States

The U.S. has some of the harshest penalties for money laundering. In addition to long prison sentences, individuals and companies can face fines of up to $500,000 or twice the value of the laundered funds—whichever is greater. Asset forfeiture is also highly likely, especially in drug trafficking and organized crime cases.

How to Protect Yourself: The Cost of Compliance vs. The Cost of Getting Caught

- Compliance Programs: Avoiding money laundering penalties starts with a commitment to compliance. Businesses should establish effective AML programs and follow the rules of KYC, a know-your-customer process, to help them avoid getting entangled with illegal finance deals.

- Due Diligence: Firms must carry out detailed background checks on their customers and business partners and the nature of the transaction. This due diligence ensures that such parties are not involved in money laundering schemes.

- Regular Audits and Monitoring: Financial firms, in particular, are expected to have systems that monitor transactions and may report to appropriate authorities.

Famous Money Laundering Scandals: The Fallout

Quite a few high-profile scandals expose the sheer scale of money laundering operations and the punitive measures that have come in their wake. Let us take a look at some high-profile examples:

Standard Chartered Bank

According to sources, this bank was sanctioned because it had a weak Anti-Money Laundering, or AML, policy. In 2012, the bank was fined $670 million after violating the U.S. sanctions by continuing business with Iran. The illegal processes persisted and managed about $265 billion in suspicious transactions. Later, in 2019, the U.S. and the U.K. authorities handed the bank a fine of $1.1 billion for further breaches, which even included breaches on sanctions against Burma, Libya, Sudan, and many more.

Danske Bank

Danske Bank became involved in a massive money laundering scandal after acquiring Sampo Bank’s Estonian branch in 2007. Between 2007 and 2015, the branch processed $228 billion in suspicious transactions, mainly from Russia. Despite warnings in 2010 and 2013, the bank failed to act until public attention in 2017 forced it to shut down operations in Estonia. European Commission filing a lawsuit claiming $228 billion in damages.

The Bottom Line: Stay Informed and Compliant to Reduce Risks

The penalty for money laundering is more than monetary fines and imprisonment. It can destroy a reputation, end a career, and even bring down multinational corporations. As a preventive measure, strict identity verification during the initiation of money laundering will prevent unauthorized access to the potentially laundered funds. It will stop money laundering schemes from thriving at the very beginning, thus ensuring compliance and safety.

The Identity Verification API by Deepvue helps prevent money laundering. Its verification solutions, such as Aadhaar, DigiLocker, PAN, and Passport Verification, safeguard businesses against numerous money laundering instances with proper identity checks. It allows verification to be fast and accurate for businesses, minimizing the risk of not catching fraudulent actors.

FAQ:

What are the penalties for engaging in money laundering?

Some of the punishments involved in money laundering include substantial fines, jail terms that may run from several years to decades, asset seizures, and withdrawal of business licenses.

Can businesses face penalties for money laundering?

Yes, serious penalties may be imposed upon business enterprises in default of the AML provisions. Huge fines, suspension of licenses, reputation damage, and in some cases, imposition of criminal charges on senior management could be some of the penalties.

What happens to the money involved in money laundering?

Illegally obtained money that’s laundered and discovered by authorities is typically seized. Governments may also seize assets purchased with laundered money, such as real estate or luxury goods.

What is the penalty for money laundering in financial institutions?

Financial institutions that violate AML laws can face huge fines, sometimes in the billions, along with stricter regulatory oversight, potential loss of operating licenses, and civil lawsuits.

How can individuals and businesses avoid money laundering penalties?

Individuals and businesses can avoid money laundering penalties by complying with AML regulations, implementing internal controls, conducting audits, following KYC protocols, and reporting suspicious transactions.