Open banking has revolutionized how we interact with our banks in this digital-first world. At the heart of this change is the open banking API. But what does open banking API mean in simple terms? Let’s break it down and understand why it’s important.

What is an Open Banking API?

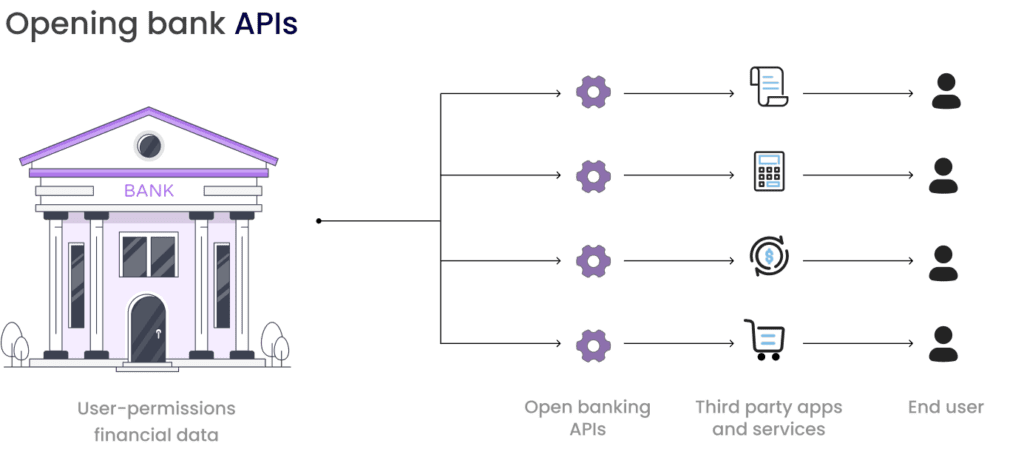

An open banking API is a specific type of API that allows third-party developers to access banking information, such as account details and transaction history, from financial institutions. This access is granted only when the account holder provides their consent.

Open banking APIs enable a wide range of financial services, from budgeting apps to payment services, by providing a secure and standardized way for different financial systems to communicate.

How Open Banking APIs Work

Open banking APIs work by establishing a secure connection between a customer’s bank and a third-party application. Here’s the step-by-step process:

- User Consent: The user gives explicit permission to the third party application to access their banking data.

- API Request: Then, the third-party application sends a request to the bank’s API for specific data, such as account balances or transaction history.

- Data Transfer: The bank’s API retrieves the requested data and sends it back to the third-party application.

- Service Delivery: The third-party application uses this data to provide a service to the user, such as a payment transaction. .

Benefits of Open Banking APIs

Open banking APIs offer many benefits to consumers, banks, and third-party providers:

- Enhanced Customer Experience: By allowing third-party applications to access banking data, customers can enjoy a variety of innovative financial services tailored to their needs. For example, budgeting apps can provide more accurate insights by accessing real-time transaction data.

- Increased Competition and Innovation: Open banking APIs allow new players to enter into the financial ecosystem to encourage competition. This leads to more innovative products and services, ultimately making consumers’ lives easier.

- Better Financial Management: With access to comprehensive financial data, third-party apps can offer better tools for managing finances, such as spending trackers and investment advisors.

- Secure Data Sharing: Open banking APIs use robust security protocols to ensure that data is shared safely and only with the user’s consent. This reduces the risk of data breaches and unauthorized access.

Securing Personal Information & Financial Data in Open Banking APIs

Open Banking APIs have revolutionized the financial landscape, enabling seamless data sharing between banks and third-party service providers. While this fosters innovation and enhances customer experiences, it also poses significant data security and privacy concerns.

To secure sensitive data, encryption plays a pivotal role in protecting information both in transit and at rest. Implementing robust authentication mechanisms such as OAuth 2.0 ensures that only authorized users and applications can access financial data. Role-based access control (RBAC) further limits data exposure by restricting permissions based on user roles.

Moreover, adherence to regulatory frameworks such as GDPR, DEPA, and PSD2 is essential for safeguarding data in open banking ecosystems. Financial institutions must also incorporate regular security audits and API monitoring to detect and mitigate vulnerabilities.

Real-World Applications of Open Banking APIs

Let’s look at a practical example. Imagine a fintech company that wants to create a personal finance app. This app needs access to users’ bank account details and transaction history to provide budgeting advice. With an open banking API, the app can securely connect to the users’ banks, get the necessary data, and offer personalized financial insights.

One real-world example is Google Pay. Google Pay uses open banking APIs to provide a seamless payment experience. When a user adds their bank account to Google Pay, the app uses open banking APIs to verify the account details and initiate transactions directly from the bank account. This ensures secure and quick payments without the need for card details.

Similarly, PhonePe, a popular payment app in India, leverages open banking APIs to offer services like balance checks, fund transfers, and bill payments. By connecting directly to users’ bank accounts through these APIs, PhonePe provides a streamlined and secure way to manage finances and make payments.

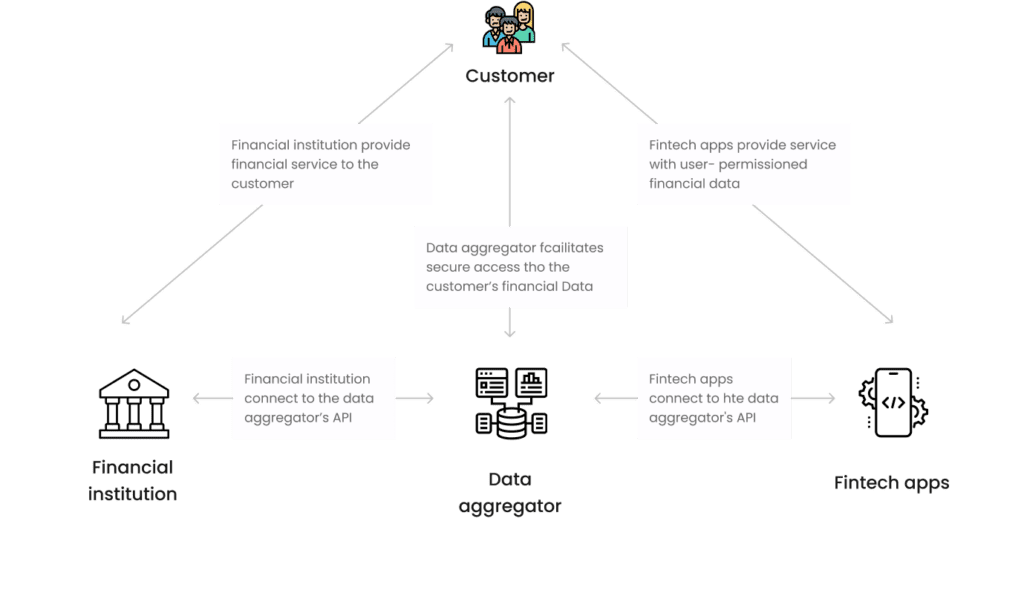

In addition to these, the concept of Account Aggregators is revolutionizing how financial data is managed and utilized. Account Aggregators consolidate financial information from multiple accounts into a single platform, providing a comprehensive view of a user’s financial health. This service enables users to access and share their financial data with authorized third parties securely and efficiently. Account Aggregators have opened a new world of personalized financial services, where users can receive tailored financial advice, customized investment plans, and better loan offers based on their holistic financial profile.

The Architecture of Open Banking APIs

The architecture of open banking APIs is designed to facilitate secure and efficient data exchange. Here’s how it typically works:

API Gateway

Acts as the entry point for all API requests, ensuring that only authorized requests are processed.

Authentication and Authorization

Verifies the identity of the requesting party and ensures they have the necessary permissions to access the data.

Data Processing

Retrieves the requested data from the bank’s database.

Response Delivery

Sends the data back to the third-party application in a secure and standardized format.

How Developers Can Leverage Open Banking APIs for Innovation

Open Banking APIs have revolutionized the financial landscape, enabling developers to build innovative solutions and provide seamless financial services. By leveraging these APIs, developers can access bank data securely, enhance user experiences, and unlock new revenue streams. Here’s how developers can tap into the potential of Open Banking APIs for innovation.

1. Build Personalized Financial Solutions

Open Banking APIs allow developers to access detailed customer financial data, such as spending patterns and account balances. This data can be used to create personalized financial management tools, budgeting apps, and tailored investment advice solutions.

2. Enhance Payment Experiences

APIs facilitate secure and direct payment initiation from bank accounts, bypassing traditional card-based systems. This leads to faster and more cost-effective transactions for both merchants and consumers.

3. Streamline Account Aggregation

Developers can use APIs to aggregate financial information from multiple bank accounts, providing users with a unified view of their finances. This is particularly valuable for financial planning apps and lending platforms.

4. Improve Lending and Credit Assessment

Open Banking APIs provide real-time access to transactional data, helping lenders assess borrower creditworthiness more accurately and efficiently.

5. Foster Fintech Innovation with Ecosystem Integrations

APIs empower developers to build solutions that seamlessly integrate with other financial service providers, fostering a collaborative fintech ecosystem.

6. Enhance Fraud Detection and Security

Access to real-time bank data helps developers create smarter fraud detection systems by identifying unusual patterns and preventing unauthorized transactions.

Are Open Banking APIs Safe?

In India, the security and safety of open banking APIs are governed by a robust regulatory framework overseen by the Reserve Bank of India (RBI) and the Ministry of Electronics and Information Technology (MeitY). These regulations ensure that financial data is shared securely and only with authorized third parties.

For example, the RBI’s guidelines on data localization require that all financial data should be stored and processed within India, adding an extra layer of security. Moreover, the adoption of the Data Empowerment and Protection Architecture (DEPA) provides a consent-based data-sharing framework that empowers users to control their financial data. This framework mandates strong customer authentication (SCA) and ensures that data sharing happens only with the user’s explicit consent.

Challenges and Considerations

While open banking APIs offer numerous benefits, there are also challenges to consider:

- Regulatory Compliance: Different regions have different regulations governing open banking. Financial institutions and third-party providers must ensure they comply with these regulations.

- Security Concerns: Despite high-level security measures, there is always a risk of data breaches. Continuous monitoring and updating of security protocols are essential.

- Consumer Awareness: For open banking to be successful, consumers need to understand and trust the process. Educating users about the benefits and safety of open banking APIs is crucial.

The Future of Open Banking APIs

The future of open banking APIs looks promising. As more financial institutions adopt open banking standards, we can expect an increase in innovative financial services that make managing money easier and more efficient. The integration of AI & ML with open banking APIs could further enhance personalization and automation in the fintech industry.

Conclusion

Open banking APIs are revolutionizing the financial landscape by enabling secure and efficient data sharing between banks and third-party applications. They offer numerous benefits, including enhanced customer experiences, increased competition, and better financial management.

While there are challenges to address, the potential for innovation and improvement in the financial sector is immense. As open banking continues to evolve, it promises to bring even more exciting developments in the world of finance.

By understanding and leveraging open banking APIs, businesses and consumers alike can enjoy a more connected and efficient financial ecosystem.

Ready to explore the possibilities of open banking APIs? Discover how Deepvue’s API, built on robust open banking infrastructure, can transform your financial services. Contact sales for a demo and walkthrough to see firsthand how Deepvue can enhance your offerings and streamline operations.

FAQs

What is an open banking API and how does it work?

An open banking API is a type of Application Programming Interface that allows third-party applications to access banking information, such as account details and transaction history, with the user’s consent. It works by securely connecting the bank’s systems with third-party applications, enabling data sharing and service provision.

Are open banking APIs safe to use?

Yes, open banking APIs are designed with high-level security measures to protect user data. They use strong authentication protocols and require user’s consent for data sharing, ensuring that only authorized parties can access sensitive financial information.

How do open banking APIs benefit consumers?

Open banking APIs provide consumers with access to a wide range of innovative financial services. These services can offer better financial management tools, personalized insights, and more competitive products, enhancing the overall customer experience.

Can any company use open banking APIs?

Some soft data point banking APIs, such as those for banking verification and payment collection, are available for use by any business. However, access to highly sensitive information is restricted to licensed financial institutions. For example, only businesses licensed by the RBI are permitted to use Account Aggregator Services and APIs.

Who can access open banking APIs?

Authorized third-party providers (TPPs) such as fintech companies, payment service providers, and financial institutions can access open banking APIs. Users must give explicit consent for these providers to access their financial data.