Corporate fraud might sound like a serious topic reserved for boardrooms and courtroom dramas, but it’s more relatable than you think. One minute, companies are flourishing; the next, a sneaky move or two reveals they’ve been operating on financial illusions. But corporate fraud isn’t just for Fortune 500 news splashes. It’s a crafty operator that can pop up in any business, from the corner bakery to the most high-tech corporate headquarters.

Corporate fraud in India comes in many flavors, from inflated financial reports that make a company look like a rock star to hidden assets that could rival a treasure chest. The behind-the-scenes scandal can bring even the mightiest corporations to their knees.

But why does it happen? And how do we spot it? In this blog, we will break down the interesting and often shocking world of corporate fraud. We will talk about types of corporate fraud, the consequences involved, and some jaw-dropping real-life cases.

Introduction to Corporate Fraud

Corporate fraud is defined as an illegal act by people or an entire organization with a motive to profit from deceptive practices or cheating. Whether it’s manipulation of financial statements, asset abuse, or corruption-related practice, corporate fraud harms businesses, stakeholders, and the economy. It’s a very serious issue that causes far-reaching damage to the credibility of companies and industries.

A thorough understanding of corporate fraud would not only reveal how it occurs but also make businesses more capable of implementing systems to prevent corporate fraud from arising. It is crucial to be proactive because the side effects of corporate fraud are devastating and very expensive to recover from.

Types of Corporate Fraud

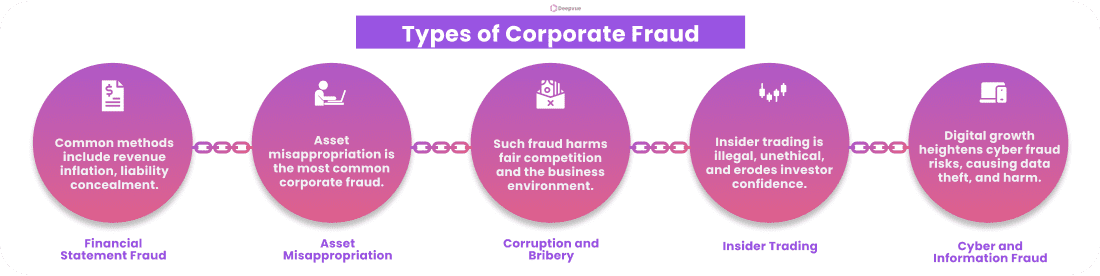

Corporate fraud takes many forms, each with its methods and impact. Here’s a look at some of the most common types of corporate fraud:

- Financial Statement Fraud

Financial statement fraud defines the intentional misreporting of a company’s financial condition to deceive investors, regulators, or the public. Revenue inflation, liability concealment, and asset overstatement are common methods. It is commonly motivated by the requirement of maintaining high stock prices or meeting the expectations of the financial community.

For instance, executives at Enron who were involved in such complicated schemes of hiding their debts and inflating revenues ended up causing only one of the biggest bankruptcies in history.

- Asset Misappropriation

Asset misappropriation is actually the theft or embezzlement of a company’s assets. This includes cash, inventory, and intellectual properties. The most common type of corporate fraud is asset misappropriation; it can occur at virtually all levels of an organization.

For example, a manager may submit false expense reports or personal expenses as business expenses, which would drain company funds gradually.

- Corruption and Bribery

Bribery and corruption are practices undertaken through unethical means in giving or accepting a kickback for acquiring favors in business enterprises or manipulating results. Such fraud has the potential to damage fair competition and destroy a friendly business environment.

The Siemens scandal saw executives bribe various officials from many countries for contracts, which led to severe penalties and great reputational damage.

- Insider Trading

Insider trading involves buying based on material non-public information that gives a company someone inside access to unfair competitive advantages. Insider trading may be considered unethical because it is illegal as this violates the integrity of a market and destroys investors’ confidence.

For example, Martha Stewart’s inside trading case involved her trading of shares using confidential information about the failure of a particular company and ends up in jail.

- Cyber and Information Fraud

With this surge in digital operations, there is a threat of cyber fraud. Cybercrime can be a big threat because criminals may break into systems steal sensitive data, manipulate information, and financial as well as reputational damage.

One of the largest cybersecurity breaches was that of the Equifax data breach, wherein hackers stole the personal information of millions of users, thereby delivering a big blow to the credibility of the company.

Examples of Major Corporate Fraud Cases

Going through historical cases of corporate fraud can also shed insight into the unfolding of these frauds and their repercussions. Here are some of the well-known examples:

- Enron (2001): The enormous energy company, Enron, had been using complex financial structures to hide its debt and inflate profits. When the truth finally came out, the company declared bankruptcy, effectively eliminating shareholder value and landing several executives in prison cells.

- Bernie Madoff Ponzi Scheme (2008): Bernie Madoff has been accused of masterminding one of the largest Ponzi schemes to date, fraudulently taking billions of dollars from investors. It collapsed in the 2008 financial crisis and led to his arrest, with a major regulatory overhaul in the financial sector.

- Volkswagen Emissions Scandal (2015): Volkswagen was charged with the crime of installing software in its vehicles for failing to pass the emissions tests by cheating the regulators and customers. The companies ended up facing billions of dollars in fines, car recalls, and a great loss of public trust.

Consequences of Corporate Fraud

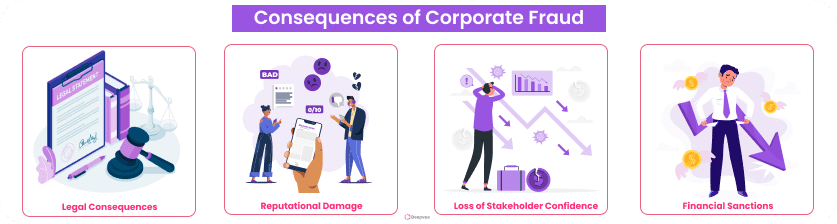

Corporate fraud has wide-ranging ramifications. They may not only be restricted to the parties involved but also have a widespread impact on the business environment.

- Legal Consequences for Persons: A person involved and caught in the act of fraud must be detained in prison, prosecuted for some fines, or disqualified professionally.

- Reputational Damage: One of the greatest assets of any business is trust. A huge impact of fraud on public perception which makes future business and investment impossible.

- Loss of Stakeholder Confidence: Investors, employees, and clients may withdraw support if they lose confidence in a company’s integrity, affecting long-term growth and success.

- Financial Sanctions and Bankruptcy: Financial fraud by companies will lead to penalties in the form of fines and legal fees besides bankruptcy, as Enron and WorldCom have shown.

Fraud Prevention: Because Ignorance Isn’t Bliss!

Corporate fraud is a pressing issue that affects companies, industries, and economies at large. Knowing the types of fraud that exist, why it happens, and what its implications are important for businesses looking to protect themselves. Companies can fight back against the occurrence of employee fraud with good internal controls, a culture of transparency, and technology tools that monitor transactions. Corporate policies must, therefore, respond to changes in business practice and technology to address traditional types of fraud as well as evolve ones.

If you’re looking to strengthen your fraud prevention strategies, reach out to our experts for tailored solutions and guidance. We can help you safeguard your business and maintain trust with your stakeholders.

FAQ:

What is corporate fraud?

Corporate fraud is unethical or illegal practices by a business organization to achieve business gains. It may include any form of financial statement manipulation, theft of assets, and corruption.

Why does corporate fraud occur?

Pressure to make money, greed, failure to monitor, and opportunity motivates corporate fraud. People or organizations perpetuate fraud when they encounter problems or have an easy money-making way.

How can corporate fraud impact a business?

Corporate fraud would most likely drain the companies’ wallets, destroy the reputation of the company, create possible legal issues, and break the trust of the shareholders. It could also add to the increased regulatory scrutiny and compliance.

What are the legal consequences of corporate fraud?

Corporate fraud can result in fines, criminal charges, restitution payments, and civil litigation. Companies may incur regulatory fines.

How can technology help in detecting corporate fraud?

Data analytics, monitoring software, and automated systems help in the detection of corporate fraud by identifying anomalous transactions or behavior. Data theft is controlled by the organization’s cybersecurity.