This process of identity verification has changed from long queues and never-ending paperwork with the arrival of Video KYC- Know Your Customer, developing customer verification into a seamless, secure experience that is highly efficient in the digital world.

So, what’s Video KYC all about? To cut a long story short, it is an electronic way to help businesses validate their customers via live video interaction. It is more like FaceTime but to secure your identity and compliance. With Video KYC, you get instant online verification, and it’s done within a few minutes as you sit comfortably at home.

In this blog, we will take an in-depth look at Video KYC and see how it is changing the face of customer verification in the country and around the world.

An Introduction to Video KYC

Video-based KYC is a digital approach that financial institutions employ to verify the identities of their customers through video calls. It is a preferable alternative to the traditional and time-consuming KYC procedure that is typically conducted at the branch. Customers can check in remotely through video KYC which makes it virtually very easy.

The process entails a live, in-person video interview with the consumer, during which they are required to submit their identification documents for verification. The process allows the institutions to compare the live image of the customer with the photograph on their ID, thus creating a complete identity record.

As an emerging technology, it provides many advantages over traditional verification methods, such as improved customer experience, faster onboarding, and improved security. With video verification technology, banks and other NBFCs can easily verify their customers which helps avert identity and fraud.

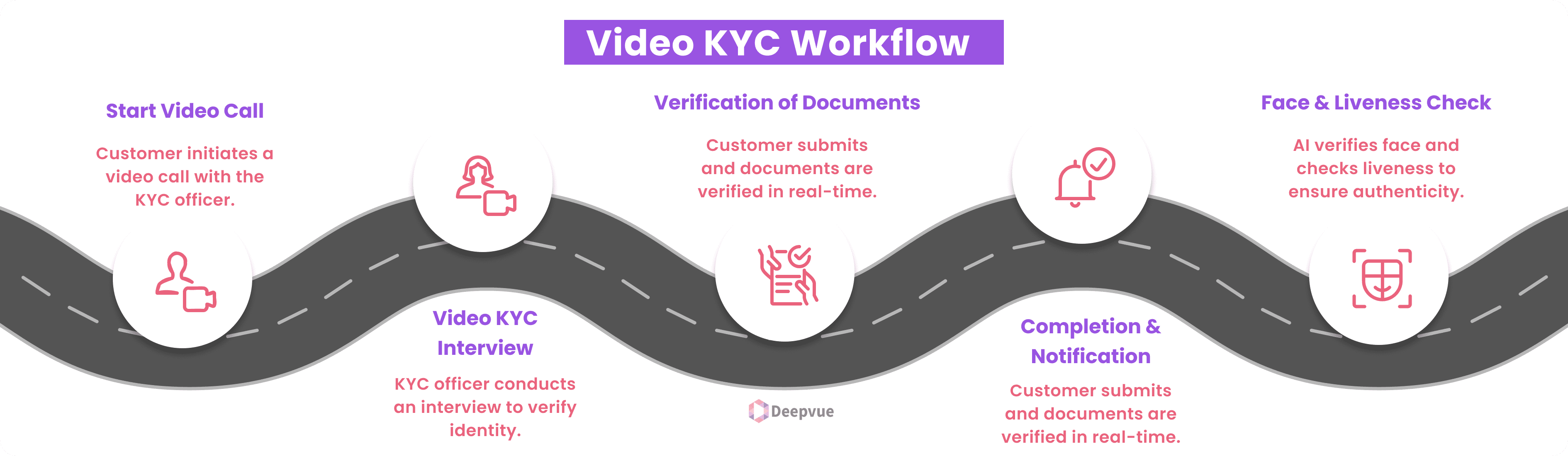

Breaking Down the Video KYC Workflow

The Video KYC process is designed to provide a safe and highly efficient way of confirming the identity of customers. Here is a step-by-step guide in detail to the process:

- Start a Video Call: A customer can initiate a video call with the KYC officer by clicking on a link sent through by the KYC officer.

- Video KYC Interview: The officer will verify the customer’s identification by asking standard questions and properly presenting their proof of identity during a designated period. AI matches the customer’s visage with the ID and conducts various levels of checks to verify the individual’s liveness, ensuring that they are present and not a photograph.

- Verification of Documents: Verifying and capturing the documents of the surveyed consumer in real time. Customers are required to submit specific authentication documents, such as a government-issued photo ID (e.g., an Aadhaar card, passport, or PAN card).

- Completion and Validation: The consumer gets notified after finishing the verification procedure. The verification process will continue and it will be used in compliance logging as well.

- Face Verification and Liveness Detection: A person should be present and alive, not just a picture or video. This is done to ensure the authenticity of the KYC process and avoid spoofing of the information.

Streamlining Customer Verification with Video KYC

Enhanced Customer Experience, Lower Churn Rate

Video KYC lets customers complete the verification process from a remote location, thus bypassing the need to visit a physical location. The necessity for physical documentation and manual form-filling is diminished by the digital acceptance of documents and the extraction of data through optical character recognition (OCR).

Reduced High Cost and Low Efficiency

Video KYC eliminates cost issues relating to physical infrastructures and manpower needed for facial identification. Banks can efficiently follow compliance mandates with uniformized risk profiled and identity-checked customer verifications seamlessly.

Increased Customer Base

Video KYC facility can be accessed from anywhere where an internet connection exists, which means that people staying in rural areas can access it. In addition, financial institutions can easily expand their customer base and reach new markets by interacting with people without having a tangible branch or office.

Improved Security

Video KYC often combines AI/ML and biometric verification, which means higher security than a traditional method that depends on the physical ID. This can be particularly beneficial for financial institutions with improved effectiveness in fraud detection and prevention and in reducing losses to financial gain as well as reputational harm.

Framework for Compliance

Robust KYC solutions are crucial to adhering to industry standards and compliance frameworks to avoid legal trouble or penalties.

Speed, Security, and Simplicity in Customer Verification

Video KYC is a digital solution that is both innovative and has the potential to transform the KYC process for financial institutions worldwide. Banks, NBFCs, mutual funds, insurance, logistics, telecom companies, mobile wallets, and P2P marketplaces can implement video KYC to enhance the customer experience and help identify identity and financial fraud even before the enlistment of the customer.

Video KYC is likely to become more accurate and reliable with the advancement of face recognition and AI-driven verification technologies, further alleviating fraud risks. Video KYC is a groundbreaking solution that delivers ease, rapidity, and safety in the identity verification of consumers.

Discover how Deepvue’s KYC/AML solutions can elevate your verification process. Uncover a range of tools built for precision and efficiency at Deepvue.tech.

Have questions or want to book an eKYC demo? Connect with our experts today!

FAQ:

What are the advantages of video KYC?

KYC video facilitates an effective onboarding process, reduces most paperwork, provides security, enhances compliance, and makes it a very smooth customer experience. This also helps in reducing operational costs for enterprises.

Is Video KYC in compliance with regulations?

Yes, the majority of Video KYC solutions are engineered to adhere to the regulatory standards established by regulatory bodies such as the RBI, SEBI, and others, which are contingent upon the country or industry.

What distinguishes Video KYC from traditional KYC?

All these traditional KYCs require manual verification, physical documents, and, sometimes, a personal visit. However, video KYC is fully digital, quicker, and handy in terms of verifying identity from remote locations.

Does Video KYC have the potential to prevent fraud?

Indeed, video KYC systems employ sophisticated technologies such as artificial intelligence (AI) and facial recognition to identify suspicious activities and prevent identity fraud during the verification process.

What industries can capitalize on video KYC?

Industries such as banking, fintech, insurance, telecommunications, and any sector that necessitates consumer verification can capitalize on Video KYC.