The Unified Payments Interface (UPI) has revolutionized how we transfer money. At the core of UPI lies the Virtual Payment Address (VPA), a simple yet powerful tool that facilitates seamless transactions. In this blog, we’ll understand what VPA in UPI is, how it works, and its benefits for the financial landscape.

What is VPA in UPI?

The term “VPA” stands for “Virtual Payment Address”. This address, which is unique to every user, enables them to send or receive money through any UPI-enabled application. When you have a VPA, there’s no need to provide your account number or IFSC code which makes transactions more secure and convenient.

Key Features of VPA

- Unique Identifier – A virtual payment address acts as a personal ID number for all your UPI-based transactions just like an email address does.

- Linked to Bank Account – A VPA is associated with your bank account so that money can be transferred directly.

- No Bank Details Needed – By using VPA, you don’t have to disclose any banking details like account number, IFSC, etc., thus ensuring higher level of protection against fraudsters.

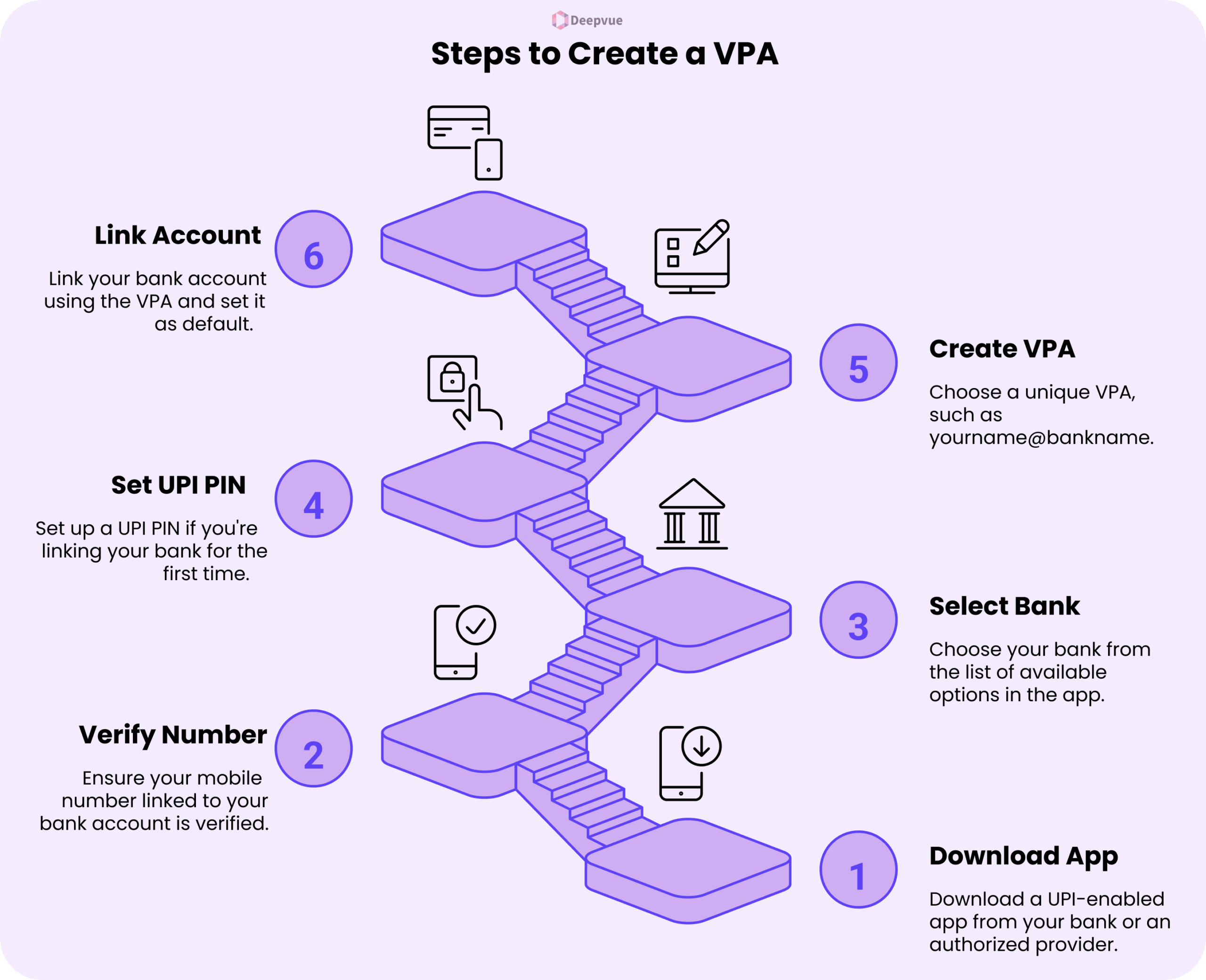

How to Create a VPA (Virtual Payment Address)?

Creating a Virtual Payment Address (VPA) in UPI is simple and can be done through any UPI-enabled app. Follow these steps:

1. Download a UPI-enabled App

Install a UPI app like Google Pay, PhonePe, Paytm, or your bank’s official app from the app store.

2. Register with Your Mobile Number

Open the app and register using the mobile number linked to your bank account.

3. Set Up Bank Account

Select your bank from the list. The app will automatically fetch your account details if the mobile number is linked to the bank account.

4. Create a VPA

Navigate to the “Profile” or “Settings” section and choose the option to create or customize your VPA. Examples include yourname@bank or mobilenumber@upi.

5. Link Bank Account to VPA

After creating the VPA, link it to your bank account to enable transactions.6. Set a UPI PIN

Create a secure UPI PIN by entering your debit card details and verifying via OTP. This PIN will be required for future transactions.

How Does VPA Work?

Understanding the functionality of VPA is essential for appreciating its benefits. Here’s a simple breakdown –

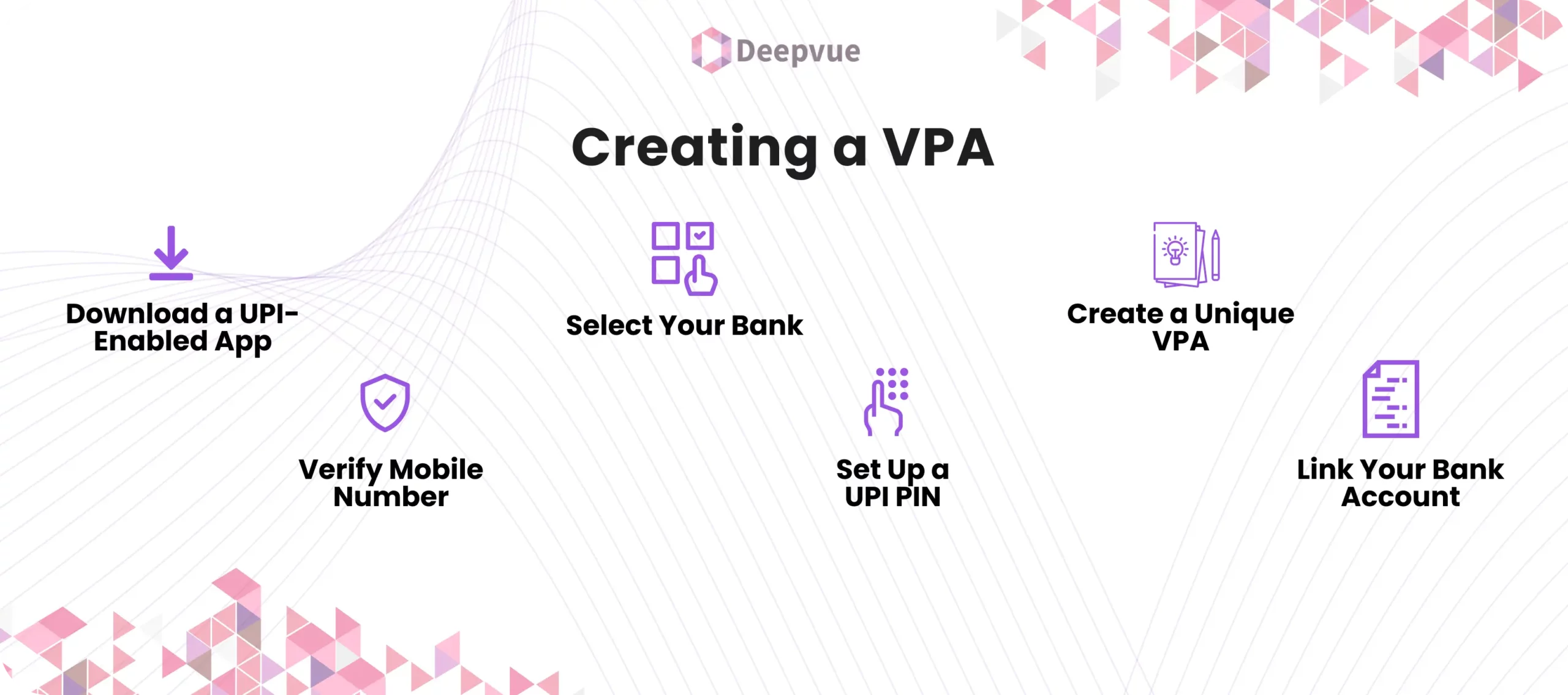

Creating a VPA

- Download a UPI-Enabled App – Download a UPI-enabled app from your bank or any other authorized provider.

- Verify Mobile Number – Make sure that the mobile number linked with your bank account has been verified by the provider.

- Select Your Bank – Choose your bank from the list of available options within the app.

- Set Up a UPI PIN – If you’re linking your bank for the first time, you’ll need to set up a UPI PIN.

- Create a Unique VPA – Choose a unique VPA, such as yourname@bankname.

- Link Your Bank Account – Link your bank account using the VPA and set it as the default transaction account.

Using VPA for Transactions

Sending Money

- Log in to UPI App – Open your UPI-enabled app and sign in using necessary credentials.

- Select ‘Fund Transfer’ – Choose the option to transfer funds via UPI.

- Enter Beneficiary’s VPA – Input the recipient’s VPA and the amount to be sent.

- Confirm Details – Review the transaction details.

- Authorize with UPI PIN – Complete the transaction by entering your UPI PIN.

Receiving Money

- Log in to UPI App – Open the app and log in.

- Select ‘Collect via UPI’ – Choose the option to request money.

- Enter Sender’s VPA – Input the sender’s VPA and the amount requested.

- Authorize the Request – The sender will approve the request using their UPI PIN.

Benefits of Using VPA

Simplified Transactions

With VPA, you no longer need to remember or share bank details. Simply provide your VPA to the sender, and the transaction is processed instantly. This simplification is especially beneficial for frequent transactions.

Enhanced Security

VPAs help safeguard your banking information. Additionally, two-factor authentication is used to verify every single UPI transaction hence making it even safer.

User-Friendly

It is not hard creating VPAs. They are also customizable according to your preferences thus making them user-friendly for both personal and business purposes.

24/7 Access

A Virtual Payment Address enables round-the-clock access through the UPI app where you can always know what you have in your account balance, view your transaction history or make some financial changes whenever required.

Transaction Tracking

Every time you use a virtual payment address (VPA), each transaction is recorded on the system. You can easily keep track of all the payments made by simply visiting the application thereby enhancing transparency and better monitoring of finance.

Common VPA Suffixes in India

Various suffixes are used by different banks and payment service providers (PSPs) for their VPAs. Here are some examples –

- State Bank of India (SBI) – @sbi

- ICICI Bank – @icici

- HDFC Bank – @hdfcbank

- Axis Bank – @axisbank

- Punjab National Bank (PNB) – @pnb

Conclusion

Virtual Payment Address (VPA) has significantly simplified digital transactions in India. By using a VPA, you can enjoy secure, convenient, and hassle-free money transfers without sharing sensitive bank details. Whether for personal use or business transactions, VPAs offer a user-friendly solution that enhances the overall payment experience.

At Deepvue.tech, we are committed to providing cutting-edge API infrastructure for financial integrations and insights, ensuring that you stay ahead in the digital payment landscape. Explore the benefits of VPAs today and make your transactions smoother and more secure.

FAQs

What is the full form of VPA in UPI?

The full form of VPA is Virtual Payment Address which acts as a unique identifier within UPI that enables users to safely send/receive money.

How do I create a VPA?

To create a VPA, you need to download a UPI-enabled app, register your bank account, and then create a unique VPA, such as yourname@bankname. This VPA can be used for all your UPI transactions.

Is it safe to share my VPA?

Yes, it is perfectly fine to share your VPA because it does not have any personal information like bank account numbers or IFSC codes meaning it is a secure way of dealing with your payments.

Can I link multiple bank accounts to one VPA?

Normally this is not allowed but you can still have multiple vpas through different accounts so that you can effectively manage all your transactions.

What happens if I forget my VPA?

If you forget your VPA, you can find it within the UPI section of your banking app or contact your bank’s customer support for assistance. Most UPI apps allow you to view or recover your VPA easily.

Is VPA and UPI ID the Same?

Yes, VPA (Virtual Payment Address) and UPI ID are the same. Both refer to a unique identifier linked to your bank account, used for making and receiving payments through UPI apps.