Understanding who you’re doing business with is more critical than ever, especially in today’s interconnected world. One group that requires special attention in the financial sector is Politically Exposed Persons (PEPs). But who exactly are these individuals, and why is it important to conduct thorough KYC (Know Your Customer) procedures for them? This article aims to shed light on these questions in a simple, easy-to-understand manner.

What is a Politically Exposed Person (PEP)?

A Politically Exposed Person, or PEP, is someone who holds or has held a prominent public position. These individuals are often in positions of significant influence and power, which can potentially make them more susceptible to being involved in financial crimes such as bribery, corruption, and money laundering. The category of PEPs isn’t limited to just the individuals themselves but can also extend to their immediate family members and close associates.

Types of PEPs

PEPs typically include:

- Heads of State or Government: These are the highest-ranking officials in a country.

- Senior Politicians: Members of parliaments, ministers, and other high-ranking political figures.

- Senior Government Officials: Top-ranking officers in government departments and agencies.

- Judicial or Military Officials: Judges, senior military personnel, and other high-level officials in the judiciary or armed forces.

- Senior Executives of State-Owned Corporations: Top executives in government-owned companies.

- Important Political Party Officials: Key figures in political parties who have influence and decision-making power.

The reason for this categorization is simple: these positions can be abused for illicit gains, which poses significant risks to financial institutions dealing with them.

Why are PEPs high-risk customers?

PEPs are considered high-risk customers because of their potential to engage in corruption and other illegal activities. Here are some reasons why PEPs are flagged:

- Corruption: Due to their positions, PEPs might have more opportunities to solicit or accept bribes.

- Money Laundering: Illicit gains can be funneled through financial systems.

- Reputation Risks: Associations with corrupt activities can damage the reputation of financial institutions.

- Legal and Regulatory Risks: Institutions can face severe penalties for non-compliance with anti-money laundering (AML) regulations.

In 2023 alone, global penalties for non-compliance exceeded $6.6 billion, highlighting the financial and reputational stakes involved.

What is KYC?

KYC, or Know Your Customer, is a critical process for banks & other financial institutions. It involves verifying the customers’ identity and assessing their suitability and risks associated with maintaining a business relationship.

The main objective of KYC is to prevent financial institutions from being used, intentionally or unintentionally, by criminal elements for money laundering or any similar fraudulent activities.

Steps to Conduct KYC for PEPs

Conducting KYC for PEPs involves several additional steps compared to regular customers due to the higher risk they present. Here’s how financial institutions and fintechs can effectively conduct KYC for PEPs:

Customer Due Diligence (CDD)

The first step in KYC is Customer Due Diligence, which involves:

- Verifying Identity: Collecting and verifying information such as name, address, date of birth, and government-issued identity.

- Assessing Risk: Determining the risk level associated with the customer based on their profile and potential for conducting financial fraud.

Enhanced Due Diligence (EDD)

For PEPs, Enhanced Due Diligence is necessary. This involves:

- In-depth Verification: Collecting additional information about the PEP’s position, influence, and potential involvement in financial crimes.

- Source of Wealth: Understanding how the PEP has acquired their wealth and ensuring it comes from legitimate sources.

- Ongoing Monitoring: Continuously monitoring the PEP’s transactions and behavior for any suspicious activity.

Screening and Identification

PEPs need to be identified and screened against multiple government and international databases. This can include:

- Sanction Lists: Checking curated lists maintained by governments and international bodies that includes individuals, entities, or countries involved in actions deemed unacceptable by the international community. These actions often involve violations of international laws, human rights abuses, or security threats.

For example, the United Nations, the U.S. Treasury Department, and the European Union maintain accessible lists. These can be found on their respective websites:

- UN Sanctions List: United Nations Security Council

- US Treasury SDN List: Office of Foreign Assets Control (OFAC)

- EU Sanctions List: European Union

For other sanctions lists, access may vary, and some may require specific permissions or subscriptions.

- Public Records: Reviewing public records for any adverse media or legal issues.

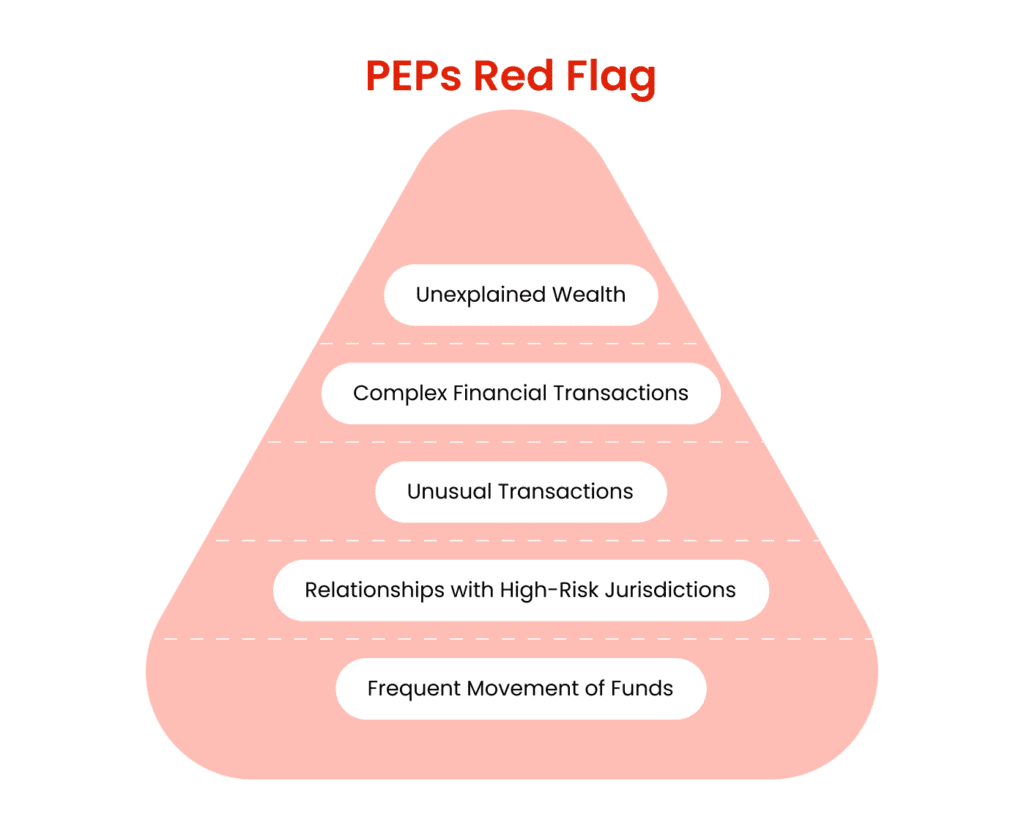

PEP Risk Levels Based on FATF Guidelines of Red Flags

The Financial Action Task Force (FATF) provides guidelines on red flags that help in assessing the risk levels associated with PEPs. These red flags include:

- Unexplained Wealth: PEPs whose wealth or lifestyle cannot be explained by their known sources of income.

- Complex Financial Transactions: Use of complex corporate structures, offshore accounts, or other mechanisms to obscure ownership or source of funds.

- Unusual Transactions: Transactions that do not match the PEP’s profile or usual behavior, including large cash deposits or withdrawals.

- Relationships with High-Risk Jurisdictions: Involvement with countries known for high levels of corruption or money laundering.

- Frequent Movement of Funds: Rapid movement of funds between accounts or across borders.

These red flags help financial institutions in determining the level of scrutiny and monitoring required for different PEPs.

Why is PEP Screening Important?

PEP screening is a critical component of AML and KYC procedures. Here are several reasons why it is important:

- Mitigating Financial Crime Risks: Identifying and monitoring PEPs helps in preventing financial crimes such as money laundering, bribery, and corruption.

- Compliance with Regulations: Regulatory bodies around the world require financial institutions & fintechs to conduct thorough KYC and PEP screening to comply with AML laws.

- Protecting Reputation: Engaging with high-risk individuals without proper screening can lead to significant reputational damage and loss of trust from customers and stakeholders.

- Avoiding Penalties: Non-compliance with AML regulations can result in hefty fines and legal actions against financial institutions.

- Ensuring Business Integrity: Conducting proper due diligence helps in maintaining the integrity and transparency of financial transactions.

How to Screen PEPs Effectively

Using advanced tools and technologies can significantly enhance the efficiency and effectiveness of PEP screening. For example, Deepvue.tech offers API solutions that integrate with various databases to provide comprehensive profiles of PEPs. Here are some features of effective PEP screening tools:

- Single-Window Visibility: Access to all relevant information about the PEP in one place.

- Regular Data Updates: Ensuring the data is up-to-date and accurate.

- Easy API Integration: Seamless integration with existing systems to reduce costs and implementation time.

- Advanced Filtering: Accurate name matching and filtering capabilities to minimize false positives.

- Bulk Handling: Ability to process large volumes of data efficiently.

Best Practices for Dealing with PEPs

Once a PEP has been identified, financial institutions should follow best practices to mitigate risks:

- Assess AML Risk: Conduct a thorough risk assessment at the beginning of the relationship.

- Enhanced Monitoring: Implement ongoing enhanced monitoring to detect suspicious activities.

- Senior Management Approval: Ensure that the decision to engage with a PEP is made at a senior management level.

- Document and Report: Keep detailed records of all interactions and transactions involving PEPs, and report any suspicious activities to relevant authorities.

Conclusion

Understanding who Politically Exposed Persons are and how to conduct KYC for them is crucial for financial institutions. By implementing robust KYC procedures and leveraging advanced screening tools, institutions can mitigate the risks associated with PEPs and ensure compliance with global AML regulations.

Effective KYC is not just about compliance; it’s about protecting your business from financial crimes and maintaining its reputation in the industry.

FAQs

Who is considered a Politically Exposed Person (PEP)?

A Politically Exposed Person (PEP) is an individual who holds or has held a prominent public position, such as a head of state, senior politician, government official, judicial or military officer, senior executive of a state-owned corporation, or an important political party official. This classification can also extend to their immediate family members and close associates.

Why are PEPs considered high-risk customers?

PEPs are considered high-risk customers because their positions of power and influence can potentially be abused for corrupt activities, such as bribery and money laundering. This poses significant financial, legal, and reputational risks to financial institutions that engage with them.

What is the difference between Customer Due Diligence (CDD) and Enhanced Due Diligence (EDD) for PEPs?

Customer Due Diligence (CDD) involves basic identity verification and risk assessment for all customers. Enhanced Due Diligence (EDD) is a more rigorous process required for high-risk customers like PEPs. EDD includes in-depth verification, understanding the source of wealth, and ongoing monitoring to detect any suspicious activities.

How do financial institutions effectively conduct KYC for PEPs?

Financial institutions can effectively conduct KYC for PEPs by using advanced tools and technologies that integrate with multiple government and international databases. These tools provide comprehensive profiles, regular data updates, and advanced filtering capabilities. Financial institutions can leverage new-age KYC service providers like Deepvue to streamline their KYC and customer onboarding processes, ensuring robust compliance and risk management.

What are the consequences of failing to conduct proper KYC for PEPs?

Failing to conduct proper KYC for PEPs can lead to severe consequences for financial institutions, including hefty fines, multi-jurisdictional regulatory actions, reputational damage, criminal proceedings, increased operational costs, and personal liability for those involved.