As more cyber threats emerge, it’s vital to be equipped with secure systems that authenticate the identities of the people accessing your platform. That’s where identity verification software fits in. By confirming that you’re dealing with an authentic individual, these software tools guard against scams, ensure sensitive information, and uphold trust with clients.

With so many options to choose from, selecting the most effective identity verification software can be overwhelming. To guide you through the intricate process, we have taken a snapshot of the top solutions that offer the best accuracy, security, and integration ease.

The Importance of Identity Verification

Identity verification is crucial in avoiding fraud, safeguarding sensitive information, and maintaining security in online transactions. It assists businesses in meeting KYC and AML requirements, lowering the risk of financial crimes. Identity verification prevents unauthorized access, reduces financial losses, and establishes trust by confirming identities. It also improves customer experience through secure and quick transactions.

For companies, legitimate identity verification mitigates legal and financial risks, safeguarding them against possible consequences of fraud. It also promotes a better customer experience through efficient and secure digital service access. By ensuring that only verified individuals can access services, customer identity verification software safeguards both consumers and businesses from cyber threats and financial fraud.

What is ID Verification Software?

Identity verification software helps businesses and organizations confirm the identity of individuals by using various technologies and data sources. It is predominantly utilized in e-commerce, government services, health care, financial institutions, and fintech organizations to fight against fraud, safeguard regulatory compliance, and provide protection.

Automated vs Human-Supervised ID Verification

Automated ID Verification uses software, AI, and machine learning to verify identity documents, selfies, and other data without human involvement. Human-supervised ID Verification involves manual review by trained agents who validate the same documents and data, either fully or as a secondary step.

Automation offers speed and scalability, verifying thousands of identities in real-time. Human-supervised methods are slower but can handle edge cases, blurry documents, or unusual formats better.

Automated systems are ideal for low-risk, high-volume environments like e-commerce or digital onboarding. Human review is more suitable for high-risk industries like finance or legal services, where accuracy and compliance are critical.

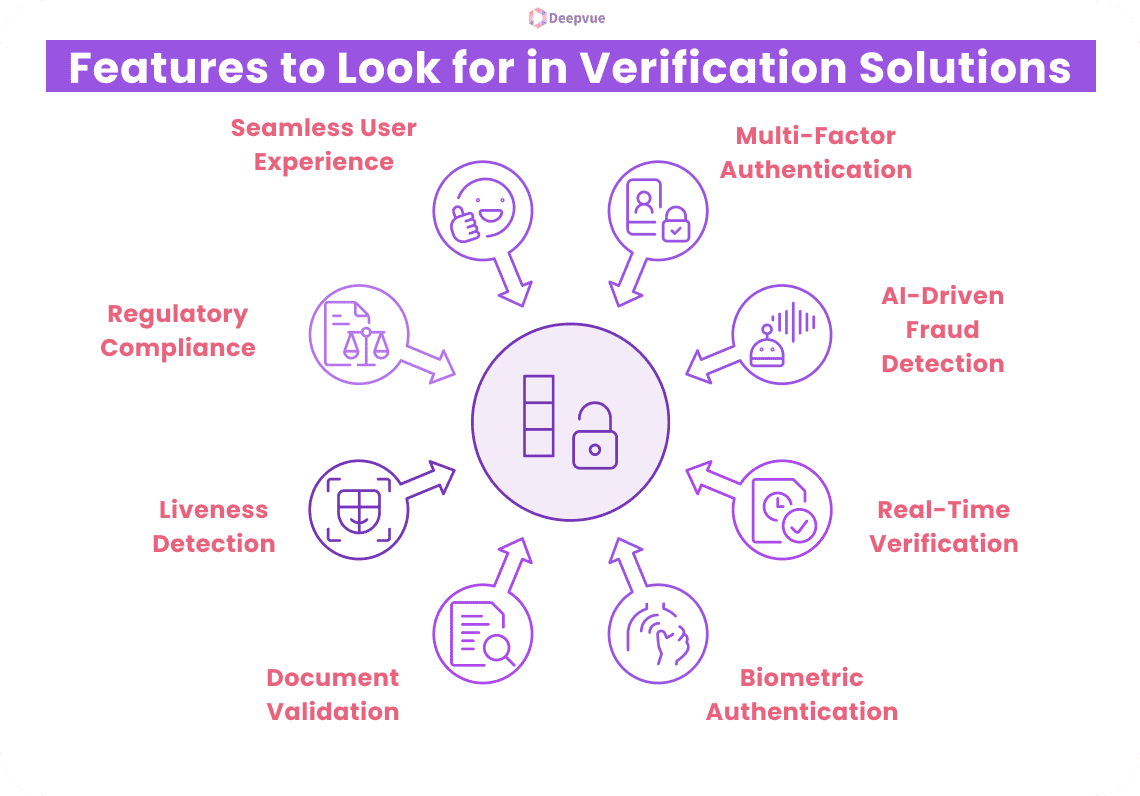

Key Features of the Best Identity Verification Software

- Multi-Factor Authentication (MFA): Offers various methods of verification such as SMS, email, biometrics, or security tokens.

- AI-Driven Fraud Detection: Utilizes machine learning to identify suspicious behavior and stop fraud.

- Real-Time Verification: Verifies user identity in real time to reduce delays and fraud threats.

- Biometric Authentication: Enables fingerprint, facial recognition, or voice recognition for added security.

- Document Validation: Confirms government-issued IDs, passports, or driving licenses as legitimate.

- Liveness Detection: Verifies that an actual person, and not a spoofed face or video, is being checked.

- Regulatory Compliance: Follows KYC (Know Your Customer), AML (Anti-Money Laundering), and GDPR regulations.

- Seamless User Experience: Offers a simple and frictionless verification experience for users.

How Identity Verification Works?

Customer identity verification software is the process of confirming a customer’s identity to avoid fraud and ensure security in transactions. It typically includes:

- Document Authentication: Scanning government IDs (driver’s license, passport, etc.) to verify genuineness.

- Biometric Authentication: Facial recognition, fingerprint scan, or voice recognition.

- Database Cross-Checks: Verification of user-submitted information with government and banking records.

- Two-Factor Authentication (2FA): Additional layers of security via OTPs or authentication apps.

- Liveness Detection: Confirming the user’s physical presence and avoiding the usage of false images or deepfakes.

- Behavioral Analysis: Tracking speed of typing, device use, and geographic location patterns for anomalies.

Top Identity Verification Software to Stop Fraud on Its Tracks

Deepvue

Deepvue is an enhanced identity verification software aimed at simplifying user authentication. It utilizes machine learning and AI to provide enhanced security with accurate document checking and biometric checks. With features including real-time fraud identification, seamless integration, and global compliance standards (such as KYC and AML), Deepvue simplifies the process of user verification for businesses. It is scalable and flexible, supporting various industry needs.

IDfy

IDfy is also a trusted identity verification tool in India that provides end-to-end solutions for fraud prevention. IDfy provides KYC, document verification, and Aadhaar authentication, with secure verification processes in place. Through machine learning, it identifies suspicious transactions and raises flags, keeping businesses away from fraud.

Signzy

Signzy is one of the prominent identity verification software utilizing artificial intelligence (AI) and machine learning to provide automated KYC (Know Your Customer) and digital onboarding options. It facilitates enterprises in identifying their users with document verification, face matching, and liveness detection. Businesses can effectively conduct background checks and ensure Indian regulations compliance using Signzy.

Onfido

Onfido is an AI-driven identity verification software widely used across the globe, including India. It is an expert in document verification, facial biometrics, and liveness detection, providing businesses with a secure method of remotely verifying customers. Onfido’s solution is very effective at preventing fraud, ensuring that each user is properly verified before accessing services.

Key Considerations When Choosing Software

- Business Needs: Make sure the software suits your unique business requirements and objectives.

- Ease of Use: Select software that is easy to use and has an intuitive interface.

- Scalability: Choose a solution that is scalable and grows with business demands.

- Integration: Ensure the compatibility of existing systems and third-party apps.

- Security & Compliance: Confirm data security controls and regulatory compliance.

- Customization: Search for software that is flexible to adapt to distinct business needs.

- Cost & Budget: Consider the total cost, including licensing, implementation, and maintenance fees.

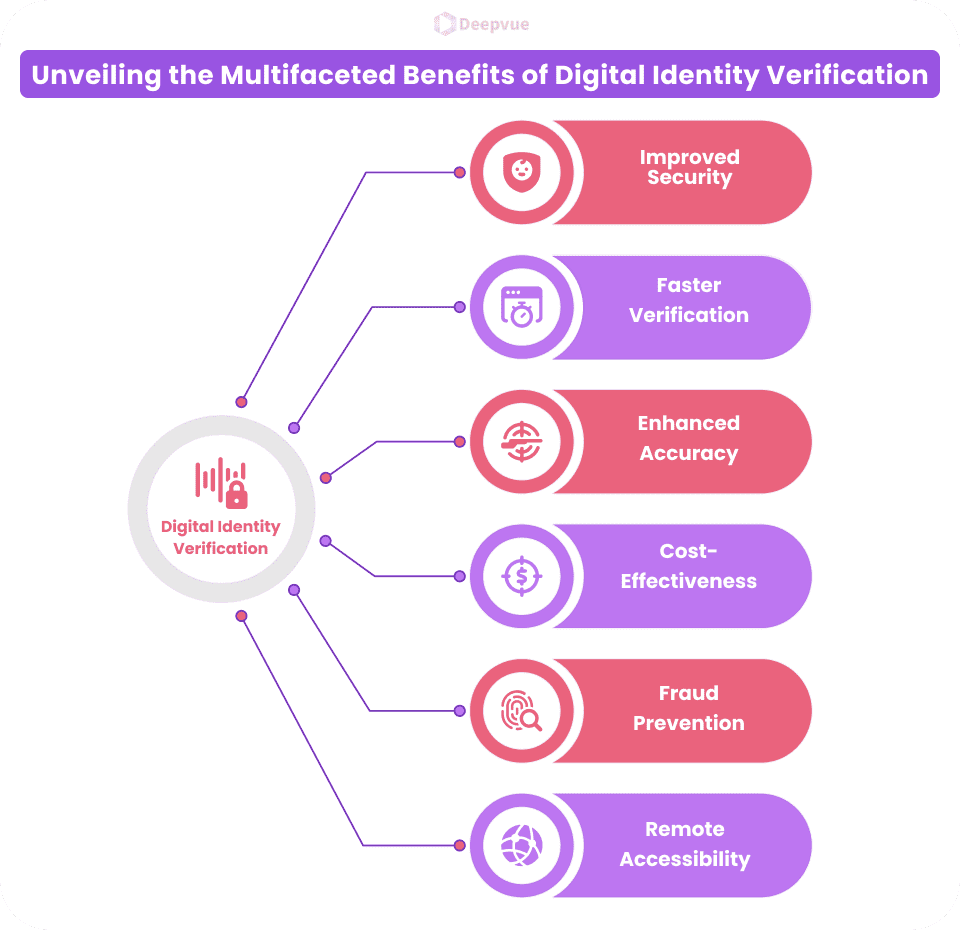

Benefits of Digitalizing Identity Verification

- Improved Security: Minimizes identity fraud through the application of sophisticated encryption, biometrics, and AI-driven authentication.

- Faster Verification: Accelerates identity verification processes, minimizing waiting times for customers and organizations.

- Enhanced Accuracy: Reduces human mistakes through the application of automated data verification and AI-based analysis.

- Cost-Effective: Reduces operation expenses by minimizing paperwork, manual validation, and fraudulent losses.

- Remote Accessibility: Enables users to authenticate identities anywhere, without having to do in-person authentication.

- Fraud Prevention: It detects suspicious activities in real-time and blocks unauthorized access.

Addressing Common Challenges in Identity Verification

- Document Fraud: Use AI-driven document verification and hologram detection to identify forged IDs.

- Synthetic Identity Fraud: Use biometric authentication and cross-verify information with authentic records.

- Stolen Credentials: Implement multi-factor authentication (MFA) and behavioral analytics to identify suspicious activity.

- Deepfake & AI Manipulation: Use liveness detection and video verification to thwart AI-created identities.

- Privacy & Data Protection Issues: Achieve GDPR, CCPA, and other data privacy laws compliance.

- False Positives & User Frustration: Minimize fraud detection models to limit legitimate user rejections.

Conclusion: Choosing the Right Solution for Your Business

Identity verification software has emerged as a vital business tool to combat fraud and guarantee regulatory compliance. Be it fintech, e-commerce, or healthcare, applying the correct identity verification solution can lower the risk of fraudulent activity significantly.

Apart from the solutions we’ve mentioned, our Identity Verification API provides a hassle-free and robust option for companies seeking a scalable and customizable solution. With real-time identity validation, document verification, and biometric authentication, our API provides an efficient way to incorporate fraud prevention directly into your existing workflows.

FAQ:

What is identity verification software?

It is a digital solution that validates the identity of an individual or an entity via biometrics, scanning of documents, and artificial intelligence to help block fraud.

How does fraud prevent identity verification software?

It employs algorithms, biometrics, and document verification to authenticate identities and prevent fraud by matching data against reliable sources.

What are the essential features of the best identity verification software?

The most effective identity verification software usually comes with features such as real-time verification, document scanning, biometric identification, artificial intelligence (AI), machine learning (ML) algorithms, and integration with trusted databases.

What types of identity verification methods does the software use?

Identity verification software uses several methods such as document verification (e.g., passports, driver’s licenses), biometric verification (fingerprint or facial recognition), phone number verification, email verification, and knowledge-based authentication (e.g., security questions).

Can identity verification software be used for online transactions?

Indeed, identity verification software is widely utilized for online transactions. It allows businesses to ascertain whether customers paying for goods or services or performing any financial activities are authentic.