In an age where digital security is more critical than ever, the banking industry faces immense pressure to protect customer data and prevent fraud. Traditional methods, such as passwords and PINs, are proving to be increasingly vulnerable to cyber threats.

Enter biometrics, a technology that uses unique physical traits like fingerprints and facial recognition to verify identity. Let’s explore the advantages and use cases of biometrics in banking.

What is Biometrics in Banking?

Biometrics refers to the use of unique physical or behavioral characteristics to verify a person’s identity. In banking, biometric verification include:

- Fingerprint Scanning: Using the unique patterns of ridges and valleys on a person’s fingertip.

- Facial Recognition: Analyzing facial features to confirm identity.

- Voice Recognition: Identifying a person based on vocal characteristics.

- Retina/Iris Scanning: Using the unique patterns in the eyes for verification.

These methods provide a secure and convenient way for customers to access their accounts and perform transactions.

Types of Biometric Verification in Banking

- Fingerprint Recognition: Scans and verifies a person’s unique fingerprint patterns for secure authentication.

- Facial Recognition: Uses AI to analyze facial features for identity verification.

- Iris Recognition: Scans the unique patterns in a person’s iris for high-security authentication.

- Voice Recognition: Identifies individuals based on voice patterns and speech characteristics.

- Retina Scanning: Uses infrared technology to map the blood vessel pattern in the eye.

- Behavioral Biometrics: Analyzes unique behavioral patterns like keystroke dynamics, mouse movements, or signature style.

How Does Biometric Authentication Work in Banking?

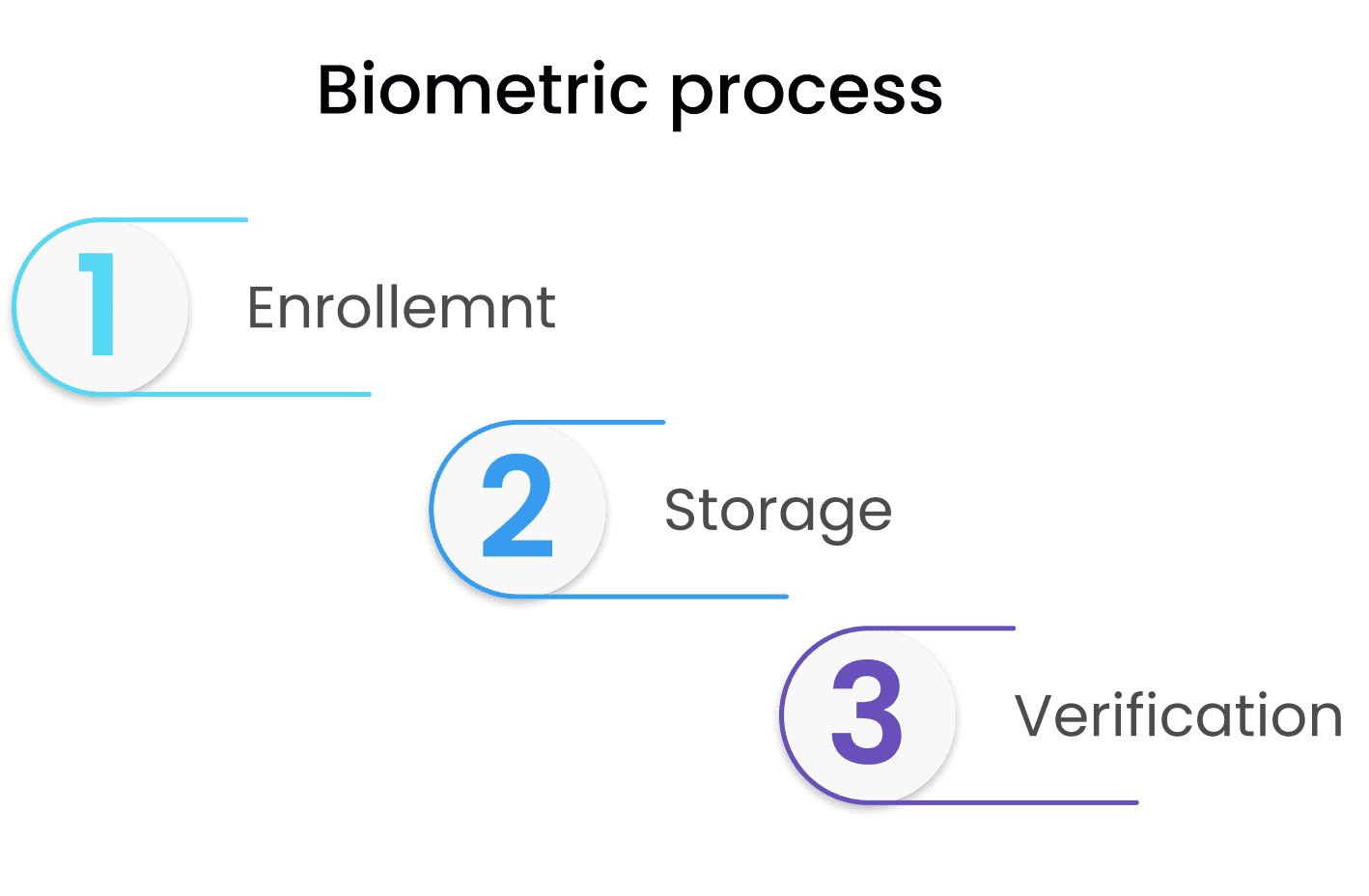

The process of biometric authentication in banking is straightforward and consists of three main steps:

- Enrollment: The bank captures the customer’s biometric data, such as a fingerprint or facial scan. This data is then converted into a digital format and securely stored.

- Storage: The captured biometric data is encrypted and stored in a secure database, ensuring it is protected from unauthorized access.

- Verification: When the customer attempts to access their account or perform a transaction, the system compares the new biometric data with the stored data. If they match, access is granted; if not, access is denied.

Advantages of Biometrics in Banking

Implementing biometrics in banking brings several advantages:

1. Increased Convenience

Biometric authentication eliminates the need for customers to remember complex passwords or carry physical security tokens. Instead, they can simply use their fingerprint, face, or voice to access their accounts. This not only enhances the user experience but also speeds up the authentication process.

2. Enhanced Security

Biometric traits are unique to each individual, making them difficult to replicate or steal. This significantly reduces the risk of fraud and unauthorized access. Traditional authentication methods, such as passwords and PINs, can be easily hacked or stolen, but biometric data provides a much higher level of security.

3. Fraud Reduction

Biometric systems can detect unusual patterns of behavior or biometric data, alerting the bank to potential fraudulent activities in real-time. This allows banks to take immediate action to prevent fraud, protecting both the customer and the institution.

4. Greater Operational Efficiency

Traditional banking processes often require multiple forms of identification, which can be time-consuming. Biometric authentication streamlines these processes, saving time for both customers and bank staff. Additionally, it reduces the need for manual reviews and investigations, further enhancing efficiency.

Use Cases of Biometrics in Banking

Biometric technology is being adopted in various banking applications, enhancing security and user experience across different platforms:

1. ATMs

Some ATMs now use biometric authentication instead of PINs. Customers can access their accounts by scanning their fingerprint or face, providing a faster and more secure way to withdraw money. This reduces the risk of PIN theft and card skimming.

2. Mobile Banking

Mobile banking apps are increasingly incorporating biometric authentication to enhance security. Customers can log into their accounts using fingerprint or facial recognition, ensuring that only authorized users can access sensitive financial information. This is especially useful for preventing unauthorized access if a mobile device is lost or stolen.

3. Customer Onboarding

Opening a new bank account often requires multiple forms of identification and can be a time-consuming process. Biometric verification simplifies this process by allowing customers to verify their identity quickly and securely. This not only speeds up the onboarding process but also ensures a higher level of security.

4. Transaction Authentication

For high-value transactions, biometric authentication provides an additional layer of security. Customers can verify their identity using their fingerprint or face, ensuring that only authorized individuals can approve significant transfers or changes to their accounts.

Implementing Biometrics in Banking: Key Features

For a comprehensive biometric authentication system in banking, several features are essential:

1. Transaction Data Signing

This feature verifies transaction credentials by generating a one-time confirmation code, crucial for high-risk transactions like large monetary transfers or changes to personal details.

2. Multi-Factor Authentication

Combining biometric scanning with additional verification steps, such as a password or phone number, enhances security by adding layers of protection.

3. API for Quick Deployment

APIs facilitate seamless communication between the bank’s server and clients’ devices, making it easier for banks to integrate and deploy biometric security systems.

4. Mobile Security

Ensuring robust mobile security is essential, given the prevalence of mobile banking. Implementing advanced security measures such as anti-debugging, jailbreak detection, and data encryption helps protect biometric data on mobile devices.

Challenges & Concerns in Biometric Authentication

- Security Risks: Biometric data, once compromised, cannot be changed like passwords, making breaches highly risky.

- Spoofing & Hacking: Advanced spoofing techniques, such as deepfake attacks and synthetic fingerprints, can bypass biometric security.

- False Positives & Negatives: Errors in authentication can lead to wrongful access or denial of legitimate users.

- High Implementation Costs: Deploying biometric systems requires expensive hardware, software, and infrastructure.

- Ethical & Legal Issues: Regulations on biometric data collection and usage vary globally, creating compliance challenges.

- User Acceptance & Trust: Some users are hesitant to adopt biometric authentication due to privacy and ethical concerns.

The Future of Biometrics in Banking

Biometric technology is not just a passing trend; it is the future of banking security. As cyber threats continue to evolve, traditional authentication methods will become increasingly inadequate. Biometrics offers a robust and reliable solution, providing a higher level of security and convenience.

1. Continuous Innovation

The field of biometrics is constantly evolving, with new technologies and applications emerging regularly. From behavioral biometrics, which analyze patterns of behavior, to advanced biometric sensors, the future holds exciting possibilities for enhancing security and user experience in banking.

2. Increased Adoption

As more banks adopt biometric technologies, customers will become more familiar with these methods and trust them more. This increased adoption will drive further innovation and development in the field, leading to even more secure and convenient banking solutions.

3. Regulatory Support

Governments and regulatory bodies are increasingly recognizing the importance of biometric security in financial services. This support will help drive the adoption of biometric technologies, ensuring that banks can offer secure and compliant services to their customers.

Conclusion

Biometrics in banking offers numerous advantages, from enhanced security and fraud reduction to improved convenience and operational efficiency. At Deepvue, we are committed to helping banks integrate these technologies seamlessly, providing the infrastructure needed to implement biometric solutions effectively.

By adopting biometric authentication, banks can not only protect their customers but also improve the overall banking experience. As the future of banking security, biometrics will continue to play a crucial role in safeguarding financial transactions and personal data.

With Deepvue.tech’s expertise and cutting-edge solutions, implementing biometric technologies has never been easier. Let us help you enhance your banking security and provide a better experience for your customers.

FAQs

What is biometric authentication in banking?

Biometric authentication in banking uses individuals’ unique physical or behavioral traits—such as fingerprints, facial features, and voice patterns—for identity verification and access control. This method enhances security and provides a more convenient user experience compared to traditional authentication methods like passwords or PINs.

How secure is biometric authentication for banking?

Biometric authentication is highly secure because it relies on unique physical traits that are difficult to replicate or steal. Unlike passwords or PINs, biometric data cannot be easily shared or forgotten, reducing the risk of identity theft and fraud. Additionally, biometric systems often include encryption and other security measures to protect the stored data.

Can biometric data be hacked or stolen?

While no system is entirely immune to hacking, biometric data is typically more secure than traditional authentication methods. Banks use advanced encryption and secure storage methods to protect biometric data. Furthermore, even if biometric data is stolen, it is much harder to use than passwords or PINs because it cannot be easily replicated or altered.

What are the most common types of biometric authentication used in banking?

The most common types of biometric authentication in banking include fingerprint scanning, facial recognition, and voice recognition. These methods are popular because they are relatively easy to implement and use, providing a balance of security and convenience for users.

How do banks ensure the privacy of customers’ biometric data?

Banks ensure the privacy of customers’ biometric data by using encryption, secure storage, and strict access controls. Biometric data is typically converted into a digital format and encrypted before being stored in a secure database. Banks also adhere to regulatory standards and best practices to protect biometric data and maintain customer trust.