With the continual growth of e-commerce and the use of online payment transactions, there has never been a more important time to know who you are doing business with. KYM (Know Your Merchant) is a critical process that enables companies to onboard merchants securely, compliantly, and with customer trust.

KYM is more than a regulatory requirement; it’s an essential risk management aspect within the financial framework. Through its identification and authentication of a business and merchant and business conduct, organizations can rule out fraud, money laundering, and other such criminal practices. For payment service providers, fintech companies, and financial institutions, KYM plays a crucial role in building a secure and trustworthy marketplace.

What is KYM?

KYM (Know Your Merchant) refers to a set of procedures and guidelines that financial institutions, payment processors, and other involved parties use to verify the identity and legitimacy of merchants or businesses accepting payments. It serves the same function as “Know Your Customer” (KYC) but for merchants.

The Importance of KYM in Modern Business

- Prevents illicit or fraudulent merchants from operating and providing fraudulent services or products.

- Ensures merchants are legitimate, which lowers the risk of chargebacks, fraud, and financial crime.

- Protect financial institutions using KYM to remain compliant with locally and internationally imposed financial regulations and legislation avoiding fines or penalties.

Distinguishing KYM from KYC and KYB

| Aspect | KYM (Know Your Member) | KYC (Know Your Customer) | KYB (Know Your Business) |

| Definition | A process of verifying the identity of members, often used in membership-based organizations or online platforms. | A process of verifying the identity of individual customers to prevent fraud and money laundering. | A process of verifying the legitimacy and ownership structure of a business entity. |

| Primary Focus | Individual members or users of a platform. | Individual customers who engage in financial transactions. | Business clients or companies. |

| Entities Involved | Individuals who are part of a group, organization, or platform. | Individual persons who are customers of a financial institution or service. | Legal entities, corporations, or partnerships. |

| Use Cases | Online platforms, membership organizations, communities. | Banks, financial services, and fintech platforms. | Corporate banking, business loans, investment firms, and legal matters. |

| Regulation & Compliance | Varies by platform, often less regulated. | Regulated by financial authorities (e.g., FATF, local financial regulators). | Regulated by business laws and financial regulations. |

How KYM Enhances Security and Compliance?

KYM enhances security and compliance through the use of existing encryption methods in safeguarding sensitive information and the use of robust authorization processes like document authentication and biometric identification. It supports global regulation, like adherence to GDPR and AML, through operation under industry principles and privacy principles. KYM’s monitoring system, which runs in real-time, identifies malicious activity, minimizing the risk of account takeover and fraud. It also has comprehensive audit trails for transparency and multi-factor authentication for secure access. Periodic updates and cross-border compliance functionalities ensure KYM is secure against future security threats and changing regulations.

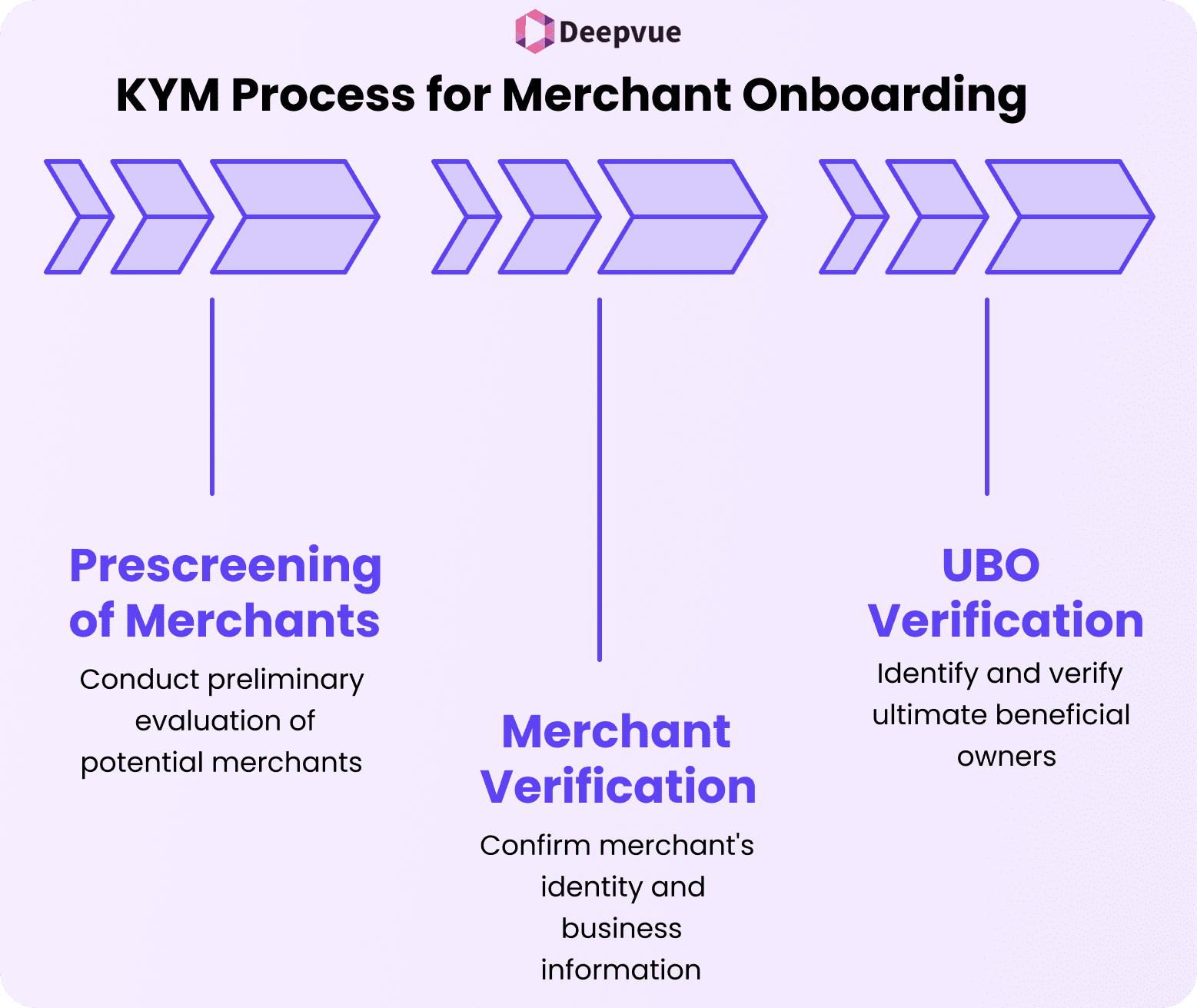

The KYM Process

- Prescreening of Merchants: Conduct a preliminary evaluation of potential merchants to ascertain their reputation and business conduct. Verify compliance with relevant legislation and regulations before proceeding with formal agreements.

- Merchant Verification: Confirm the merchant’s identity by cross-verification of business information like registration, tax returns, and authenticity. Cross-check their virtual and physical presence to check if they are legally and transparently operating.

- Ultimate Beneficial Owner (UBO) Verification: Identify and verify the ultimate owners or controllers of the merchant entity. Capture all UBOs and ensure compliance with legal requirements with a perspective toward reducing ownership structure-related risks.

The Role of Automation in KYM

- Simplification of KYM Steps with Technology: Automation streamlines the KYM process to be quicker and more convenient by making onboarding, data collection, and verification digital. It allows organizations to quickly capture member data, electronically verify identities, and maintain records with minimal human intervention.

- Reduction of Human Errors and Increasing Efficiency: Through automating repetitive processes, KYM systems minimize the occurrences of human errors, like data entry errors or omitted verification processes. This not only enhances precision but also enhances overall operational efficiency, being regulatory compliant, and conserving time and resources.

Comparing KYM with KY3P

- KYM (Know Your Merchant) is all about assessing and verifying the merchant’s identity, legitimacy, and risk, particularly in the context of payment processing and e-commerce.

- KY3P (Know Your Third Party), however, is a more extensive framework applied to evaluate all types of third-party relationships, ranging from vendors, suppliers, and service providers, to risk areas including cybersecurity, compliance, and operational resilience.

- While KYM is merchant relationship-specific, KY3P is a more generic third-party risk management strategy.

Understanding Similarities and Differences

Both KYM and KY3P aim to minimize risk by guaranteeing compliance, transparency, and trust and following relevant regulations. They have processes like due diligence, ongoing monitoring, and risk classification.

The primary difference is scope: KYM is merchant-focused and generally used in payments and financial services, while KY3P is applied to a wider category of third-party parties and types of risk.

Integration of KYM in an All-Risk Management Framework

To successfully embed KYM, organizations need to embed it in their overall third-party risk management program. This involves the use of a shared set of risk assessment requirements, based on shared data and monitoring systems, and adherence to regulations like AML, PCI DSS, and data protection laws.

KYM must be fed into centralized risk dashboards and governance systems so that organizations can administer merchant risks as part of an enterprise-wide risk management strategy.

Best Practices for KYM

- Establish Sound KYM Policies: Establish sound KYM policies that establish clear guidelines for member identification, risk analysis, and due diligence procedures according to your firm’s structure and business.

- Ensure Consistent Application Across the Organization: Implement standardized processes and training to ensure KYM policies are applied uniformly across all departments, locations, and teams to maintain compliance and reduce risk.

- Standard KYM Procedures Updates: Regularly update KYM procedures to account for regulatory changes, emerging threats, and findings from internal audits or incidents.

Benefits of Effective KYM Implementation

- Fraud Protection: A strong KYM process will rigorously vet their identification and background, lowering the risk of identity theft, money laundering, and other fraud.

- Regulatory Compliance: A robust KYM system ensures compliance with regulatory and legal obligations, avoiding penalties, fines, and legal issues resulting from a lack of compliance.

- Preservation of Business Reputation: By staying away from association with criminals or high-risk individuals, KYM ensures that trust, credibility, and a good brand image are preserved in the perception of stakeholders and the public.

Conclusion: Protecting Merchant Onboarding for Business Success

KYM (Know Your Merchant) is a central component of secure and compliant merchant onboarding. Through adequate merchant screening, businesses not only protect themselves against fraud and compliance threats but also establish a safe environment for customers and partners. Contact us for seamless KYM solutions today — we are here to help.

FAQs

What is KYM (Know Your Merchant)?

KYM is the procedure of establishing the identity, authenticity, and business of a merchant prior to enrolling him for payment services. It minimizes risks like fraud and money laundering.

Why is KYM relevant to business?

It guards businesses against the risk of doing business with deceptive or non-compliant merchants and provides a secure and safe marketplace for consumers.

What is the difference between KYM and KYC (Know Your Customer)?

While KYC is focused on verifying individual customers, KYM is merchant-oriented and takes into consideration the merchant’s business practices, ownership, and compliance history.

What is the role of KYM in compliance?

KYM is subject to AML (Anti-Money Laundering), CFT (Countering the Financing of Terrorism), and other regulatory requirements.

Are there any automated KYM tools?

Yes, some RegTech solutions provide automated KYM verification that simplifies onboarding and minimizes labor.