Today, fraudsters are always inventing new techniques to take advantage of weaknesses in banking systems. Perhaps the most prevalent and devious technique is money mules—people who, either voluntarily or involuntarily, take on the job of transferring illicitly gained money on behalf of fraudsters. As fraudulence evolves, so must our approaches to prevention.

Bank account verification has become a very effective weapon against money mule activity. Through verification that the identity of an account holder and the person who is making transactions is the same, banks are able to catch suspicious activity early and block unauthorized use of accounts.

What is Money Mules?

A money mule is an individual who moves or transfers illegally obtained funds on behalf of another, usually as part of a scam or criminal enterprise. Money mules are used by criminals to launder funds from such activities as fraud, theft, or drug dealing, which becomes more difficult to track. At other times, they’re lured into cooperating using false employment solicitations, dating scams, or get-rich-quick propositions.

Difference Between Unknowing and Knowing Money Mules

The key difference between unknowing and knowing money mules lies in their awareness and intent. Unknowing money mules are individuals who unknowingly transfer or move illegally obtained money on behalf of criminals. They are usually tricked by scams like false job postings, romance scams, or social media scams, thinking they are doing legitimate work. These people usually do not know they are assisting in criminal activity. With money mules, however, they know they are dealing with illegal money. They knowingly assist in the transfer of stolen or fake money for a share of the profits.

How do Money Mule Activities Operate?

Money mule operations include individuals—wittingly or unwittingly—transferring illegally sourced money on behalf of criminals. These mules serve as go-betweens to shift money between countries or accounts to cover its criminal source and escape detection by authorities.

criminals tend to utilize different means for transferring illegal funds, such as bank transfers, wire services (e.g., Western Union or MoneyGram), cryptocurrency wallets, prepaid debit cards, and mobile payment systems. The money tends to be passed through several accounts in order to create a long and complicated path and make tracking challenging.

Illicit financial flows frequently involve proceeds from online fraud (e.g., phishing or romance scams), business email compromise (BEC), identity theft, narcotics trafficking, and other cybercrimes. Money mules may further be used in cashing counterfeit checks, withdrawing funds and transferring them outside the country, or buying goods to be sent overseas to criminals.

Implications for Financial Institutions

- Identity theft can also result in severe financial losses to banks through false transactions and takeover of accounts.

- The financial institutions could experience reputational harm and customer loss of confidence.

- Higher compliance and investigative expenses burden resources and operations.

- Institutions would have to invest significantly in anti-fraud measures and cybersecurity technology.

- Increased regulatory oversight, culminating in penalties or fines against lax fraud controls.

Identifying Red Flags of Money Mule Accounts

- The money mule account demonstrates suspiciously high levels of activity for a new account or dormant account.

- There are periodic large deposits with immediate withdrawals or transfers.

- The account owner does not want to give details or disclose the source of the money.

- Transactions are not in line with the customer’s known profile or job status.

- The account is being funded by more than one unrelated source or foreign source.

- The account is used chiefly for third-party payment, often with vague descriptions of payments.

Related Read: What are the Money Laundering Penalties?

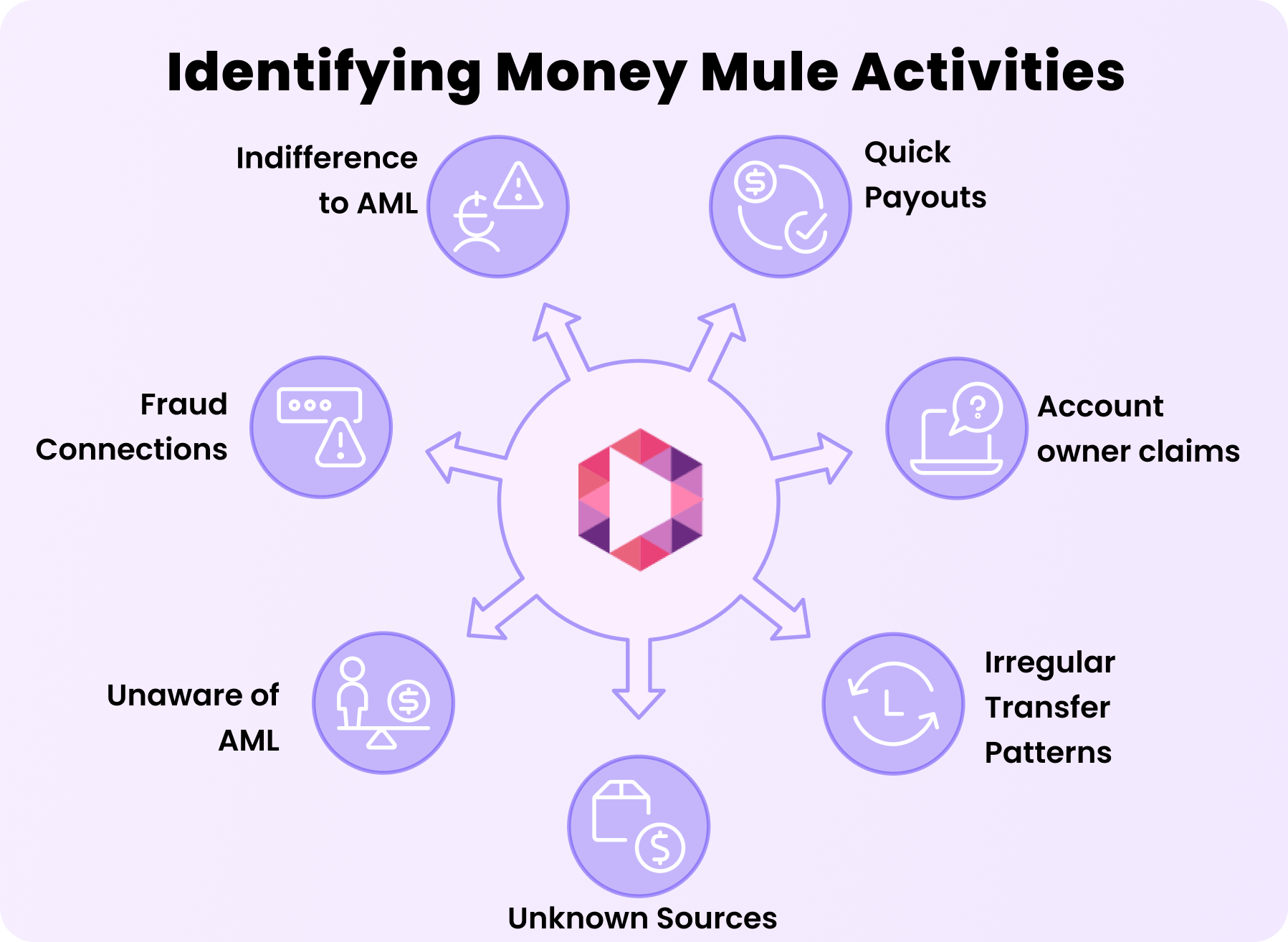

Common Indicators of Mule Activity

- Money comes in and is quickly paid out, typically leaving a small account balance behind.

- Account owner claims they are helping somebody or working as a “work-from-home” job.

- Transfers are carried out at irregular times or patterns indicative of layering in money laundering.

- The account owner receives repeated wire transfers or cryptocurrency deposits from unknown sources.

- There is a suggestion that the person is being instructed or coached by someone else.

- The account has connections to victims of fraud or complaints of scams.

- The customer appears to be unaware of or indifferent to anti-money laundering measures.

Prevention Strategies for Financial Fraud

Robust Identity Verification

- Verify identities using a multi-layered approach that includes government-issued ID checks, biometric verification (e.g., facial recognition or fingerprints), and real-time data validation.

- Enforce two-factor or multi-factor authentication to introduce an additional security measure during account sign-up, login, and risky transactions.

- Enhance KYC processes by integrating dynamic risk profiling, ongoing monitoring, and re-verification of customer identities at regular intervals.

Behavioral Analytics

- Behavioral analytics entails tracking and examining user behavior—like login patterns, device usage, and transaction habits—to identify anomalies that may signal fraud.

- Utilize machine learning and AI to alert on abnormal behavior in real-time, facilitating timely detection of suspicious activity and permitting institutions to take immediate action.

Conclusion

With financial fraud on the rise, money mule networks remain a serious threat, enabling the movement of illicit funds and exposing individuals and institutions to risk. Halting these schemes demands forward-thinking actions—bank account verification is among the most effective. By confirming account ownership and validity, businesses can catch fraud early on and avoid unauthorized transactions.

Our Bank Account Verification API offers a quick, secure, and reliable means of verifying account information in real-time. You’re either signing up users or making payments: our solution ensures lower fraud, compliance, and your platform safety with minimal user friction.

FAQs

How to prevent mule accounts?

Prevent mule accounts by verifying user identity and bank account ownership during onboarding and monitoring for suspicious transaction patterns.

How do banks identify money mules?

The banks use behavior analysis, transaction monitoring, and identity verification tools to mark accounts that present evidence of mule activity.

What steps should banks and fintechs take to prevent money mules?

They must put in place strong KYC, bank account authentication, transactional monitoring, and AI-driven fraud detection systems

What is new account fraud?

New account fraud is the act of fraudsters opening bank accounts via stolen or fabricated identities to perpetuate fraud or launder illegal funds.

How does Deepvue offer AI-driven fraud prevention solutions to combat money mule fraud?

Deepvue applies sophisticated AI models to authenticate bank accounts in real-time, identify suspicious patterns, and alert on potential mule activity before it ramps up.