With the rise of new payment methods and financial services over the last several decades, global finance has advanced significantly. Nonetheless, since its inception, SWIFT Payments have remained at the core of international payments.

SWIFT is used by banks and other financial organizations to conduct transactions quickly and accurately, as well as to send information securely. Unlike what many might think, SWIFT only facilitates the transport of financial messages during cross-border transactions and subsequently guarantees that international payments are processed correctly. No actual money is sent. So, what is SWIFT precisely, and how does it operate?

In this blog, we will be discussing SWIFT Payments, its functionality, benefits, and challenges in global payments.

A Brief History of the SWIFT Payment System

The SWIFT (Society for Worldwide Interbank Financial Telecommunication) payment system is a cornerstone of international financial transactions. Established in 1973 in Belgium, SWIFT was developed to replace the slower and error-prone telex system that banks previously relied on for cross-border communication. The primary objective was to provide a secure, standardized messaging network for financial institutions worldwide.

Early Development

SWIFT began operations in 1977 with 239 banks from 15 countries. Its initial purpose was to facilitate secure and efficient communication for payment instructions and financial messages between banks. The adoption of standardized message formats revolutionized the global banking landscape by enhancing accuracy and security.

Global Expansion

As international trade and finance grew, so did the demand for robust financial communication. By the 1980s, SWIFT expanded its reach, connecting financial institutions across continents. The system evolved to support a wide range of financial operations, including securities, treasury, and trade finance transactions.

Current Role in Global Finance

Today, SWIFT connects over 11,000 financial institutions across more than 200 countries. It plays a vital role in facilitating global trade, remittances, and financial settlements. Despite its dominance, SWIFT faces challenges from emerging technologies like blockchain and decentralized finance (DeFi) solutions.

What is SWIFT Payment?

In 1973, SWIFT (Society for Worldwide Interbank Financial Telecommunication) was founded in Belgium to address a variety of inefficiencies and a lack of standards in international financial communication. Before SWIFT, international banks communicated using Telex, which was slow, error-prone, and insecure.

Over 11,000 financial institutions use SWIFT in more than 200 countries. It performs its role efficiently by handling millions of messages daily. SWIFT connects thousands of financial institutions worldwide, from payment transfers to trade finance.

The SWIFT standardized a format for financial messaging that enables institutions to correspond and trade more efficiently. Thus, it increases the safety and reliability of international payments and hence reduces errors and frauds much more significantly. Nowadays, SWIFT is considered to be the gold standard for cross-border banking communication.

Key Players in SWIFT

- Banks communicate payment instructions and other financial information using the SWIFT code.

- Large corporations use SWIFT to make sure cross-border transactions are cleared quickly and safely.

- For financial communication inside their operations, brokerage companies and securities dealers, among other non-banking entities, depend on SWIFT.

How SWIFT Payment Works?

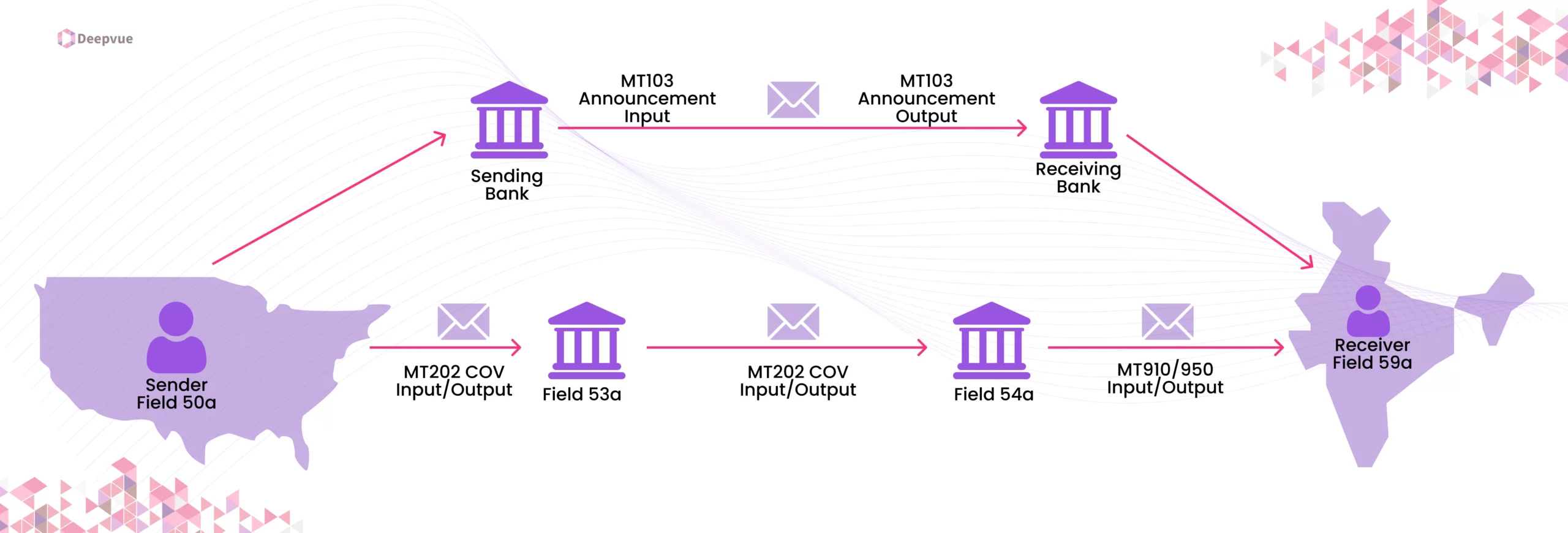

At its core, SWIFT is a messaging system. When one bank or financial institution requires the transfer of an international payment or message, the bank technically operates on the SWIFT network to facilitate secret communication with the recipient bank. Each institution involved in the transaction covers the system with a specific set of codes known as SWIFT codes, also known as BIC codes.

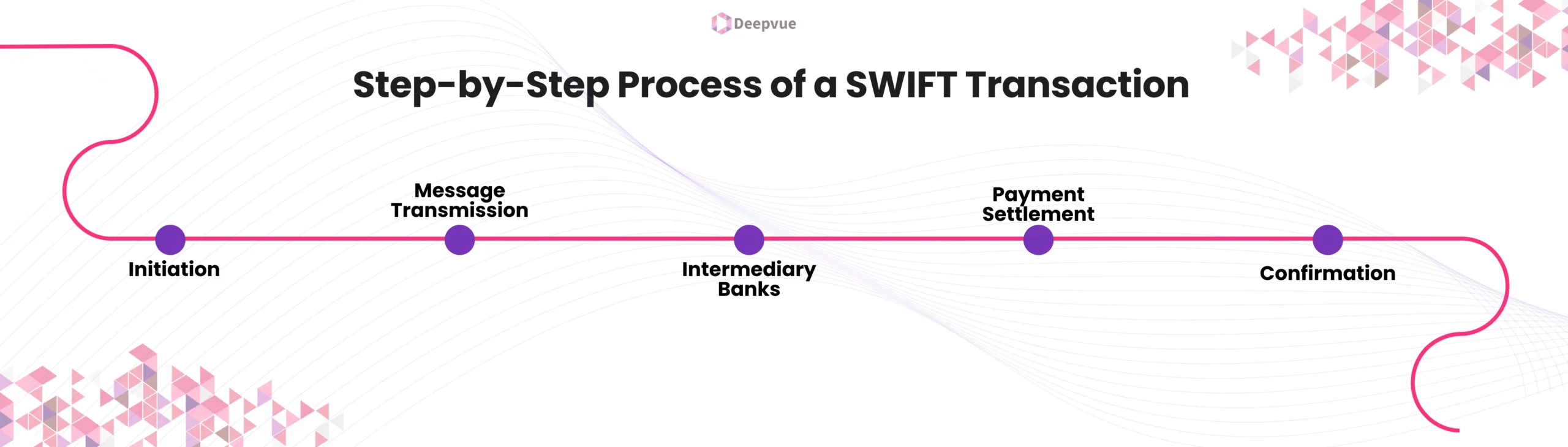

Step-by-Step Process of a SWIFT Transaction

- Initiation: The SWIFT payment is started by the initiator or a bank or financial institution by writing a message that includes the recipient’s data, amount, and currency.

- Message Transmission: The bank of the sender transmits the SWIFT message to the concerned recipient’s bank using its recipient’s SWIFT code through the SWIFT network. Thus, it becomes an auxiliary guarantee as the message reaches the target institution.

- Intermediary Banks: If the sender’s bank and receiver’s bank don’t hold an intermediary relationship, then intermediary banks can be used. In these circumstances, intermediary banks can expedite the entire process by sending a message and processing transactions.

- Payment Settlement: Once the recipient bank receives the SWIFT message, that bank will process the payment and credit the recipient’s account.

- Confirmation: The sender and recipient bank confirm the transaction at both ends to ensure its complete payment.

SWIFT Codes (BIC Codes)

Every SWIFT-enabled bank or financial institution receives a unique SWIFT code, also known as a BIC (Bank Identifier Code). Conventionally, the code will contain eight to eleven characters to identify the specific bank, its location, and the particular branch that carries out a transaction.

Message Types and Formats

SWIFT messages follow a standardized format known as MT (Message Types). These MT messages are categorized based on their purpose. A standardized message enables SWIFT to ensure clarity in communication between banks and agreements with a lesser possibility of miscommunication.

Benefits of SWIFT Payments

SWIFT has revolutionized the way communication among banks across the world operates and facilitates cross-border payment transactions in numerous ways.

- Global Reach

SWIFT is one of the largest networks, covering over 200 countries and ranking top in international money transfers. Whether you are sending money to Europe, Asia, or Africa, SWIFT will always help your payment go through easily.

- Security

SWIFT is provided with a good security framework where any message going through the network is encrypted so that sensitive financial information will not be accessed without authorization. SWIFT’s security methods have therefore won the confidence of nearly every financial institution around the globe.

- Reliability

SWIFT is especially known for reliability. The system processes millions of transactions per day with minimal errors. If a problem comes up, which happens rarely, SWIFT provides tracking capability so that the institutions can trace the messages and rectify the problems promptly.

- Standardization

Standardization of financial messages led SWIFT to overcome confusion and inefficiencies in international payments, which plagued them in the past. Financial institutions can now communicate fluently, no matter how long the distance, borders, and languages seem.

Challenges and Limitations

Although SWIFT offers a lot of advantages, it is not without drawbacks.

- Processing Time

Most SWIFT payments are not real-time. Depending on the interbank relationship and the involvement of one or more intermediary banks, any SWIFT payment process can take anywhere from 1 to 5 business days. This is slower than some new payment schemes that exist, including SEPA in Europe or domestic real-time payments.

- Transaction Fees

With SWIFT, there are several fees: the sending bank, the intermediary bank, and the receiving bank. That is why SWIFT is less practical in low-value transactions.

- Intermediary Banks

In case the sending and receiving banks don’t have accounts, intermediary banks are used. This will further delay the transactions and increase their costs.

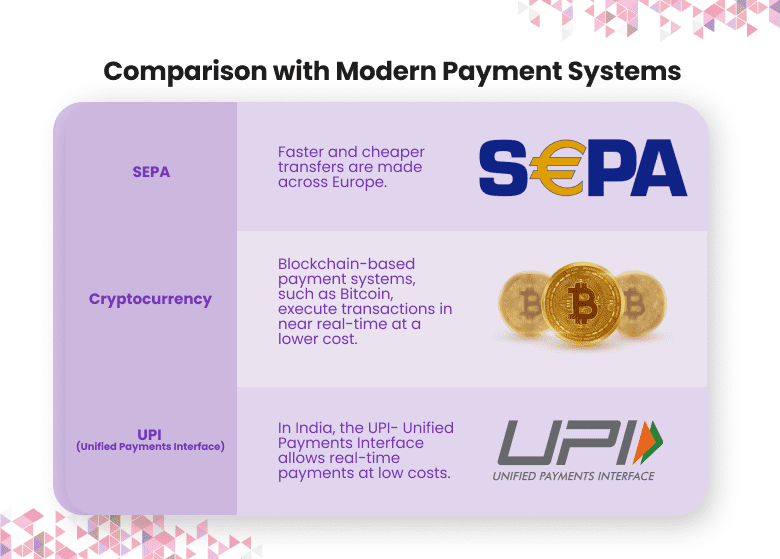

Comparison with Modern Payment Systems

In the past years, SWIFT has experienced competition from other payment systems among them:

- SEPA: Faster and cheaper transfers are made across Europe.

- Cryptocurrency: Blockchain-based payment systems, such as Bitcoin, execute transactions in near real-time at a lower cost.

- UPI (Unified Payments Interface): In India, the UPI- Unified Payments Interface allows real-time payments at low costs.

Newer systems are competitively better, especially with regards to faster and cheaper, which puts pressure on SWIFT to innovate.

The SWIFT Wrap-Up

Today, more than ever, both companies and individual users rely on international payments to perform their business. New systems may promise speed and lower costs. However, with such a massive network and proper security infrastructure, SWIFT will surely continue to be an important and strong player in global payments in the coming years.

In line with SWIFT’s emphasis on secure and reliable financial transactions, businesses can enhance their payment processes by using Deepvue’s Bank Account Verification API. This API ensures the correct beneficiary is verified before any payment is made, reducing errors and preventing fraud, similar to how SWIFT’s global network secures international transfers. It streamlines payments with confidence and accuracy.

FAQ:

What are SWIFT’s cross-border payment benefits?

SWIFT offers worldwide access, secure connectivity, dependable messaging, and standardization of financial transactions, facilitating cross-border collaboration among institutions.

How long does it take for a SWIFT payment to clear?

SWIFT payments normally take 1-5 business days to clear. The time depends on the bank relationships, countries, and intermediate banks.

Do SWIFT payments incur fees?

Sending banks, intermediate banks, and receiving banks may incur fees. Total fees depend on the amount of payment, destination, and parties.

What global payment challenges is SWIFT exposed to?

Some of the problems arise from longer transaction times, higher prices, middleman banks, and competition at the hands of SEPA and crypto-based systems.

What differentiates SWIFT from SEPA?

SWIFT is suited for global payments. SEPA can be utilized for euro-denominated transfers within Europe. SEPA is much quicker and less expensive in terms of costs for eurozone transfers while SWIFT accommodates cross-border transfer of more currencies around the world.