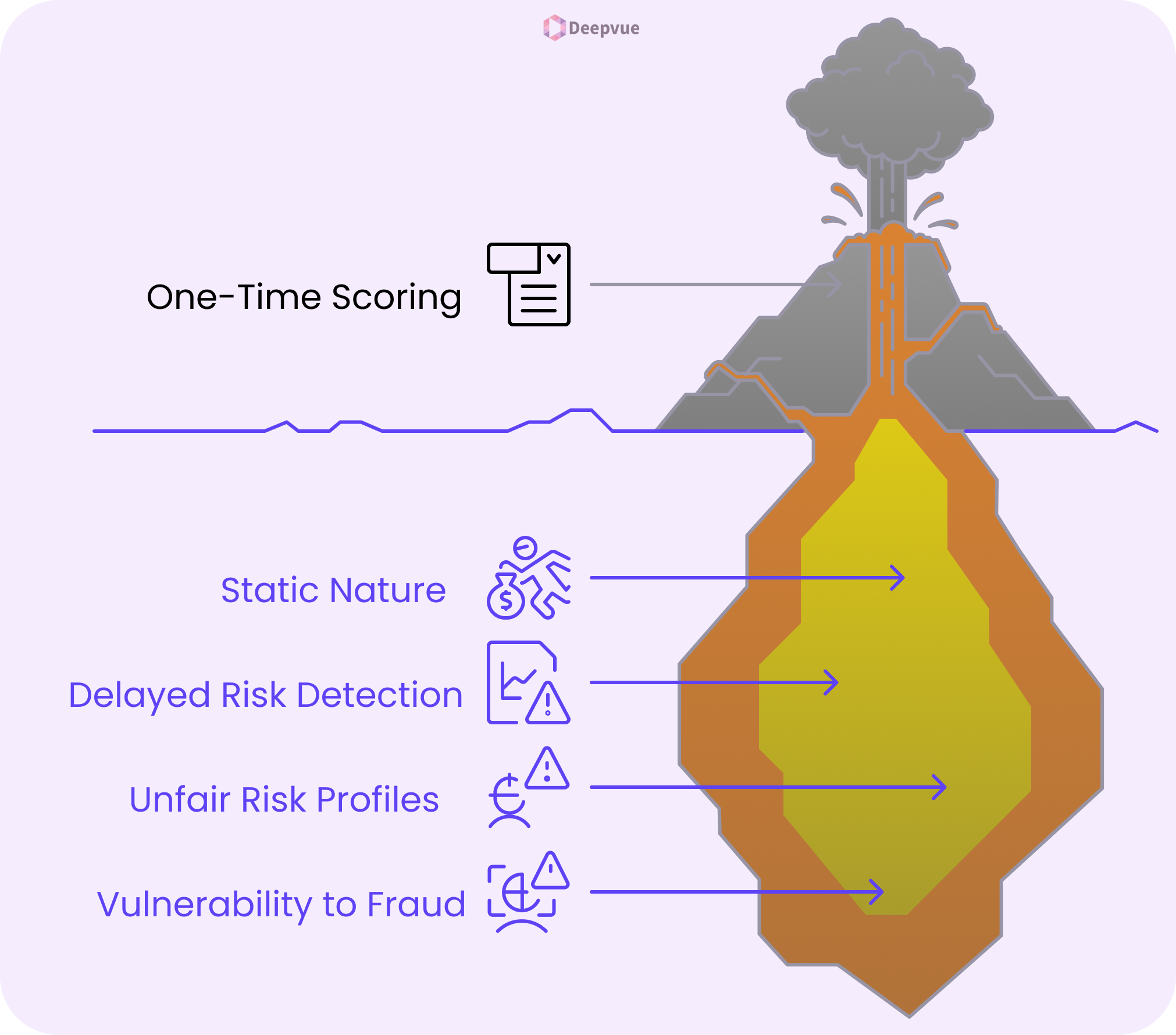

Credit risk scoring has long been the foundation of lending decisions. Conventionally, this involves assessing a borrower’s financial well-being at a moment in time, typically at loan origination, and making a decision based on what amounts to a snapshot. Perhaps this approach succeeded in slower, more stable credit environments, but it no longer keeps up with the pace of today’s financial behavior. Particularly when fraud and risk are concerned, looking at one-off credit scores is risky.

Let us dissect the issues that arise from this strategy, especially from a fraud prevention and risk management viewpoint.

What Is One-Time Credit Risk Scoring?

One-time credit risk scoring is a snapshot analysis of a borrower’s creditworthiness at one moment. This score is usually calculated using historical data like repayment history, outstanding debt, credit utilization, and sometimes income or employment information. Once calculated, the score is used to approve or deny credit and to set loan terms.

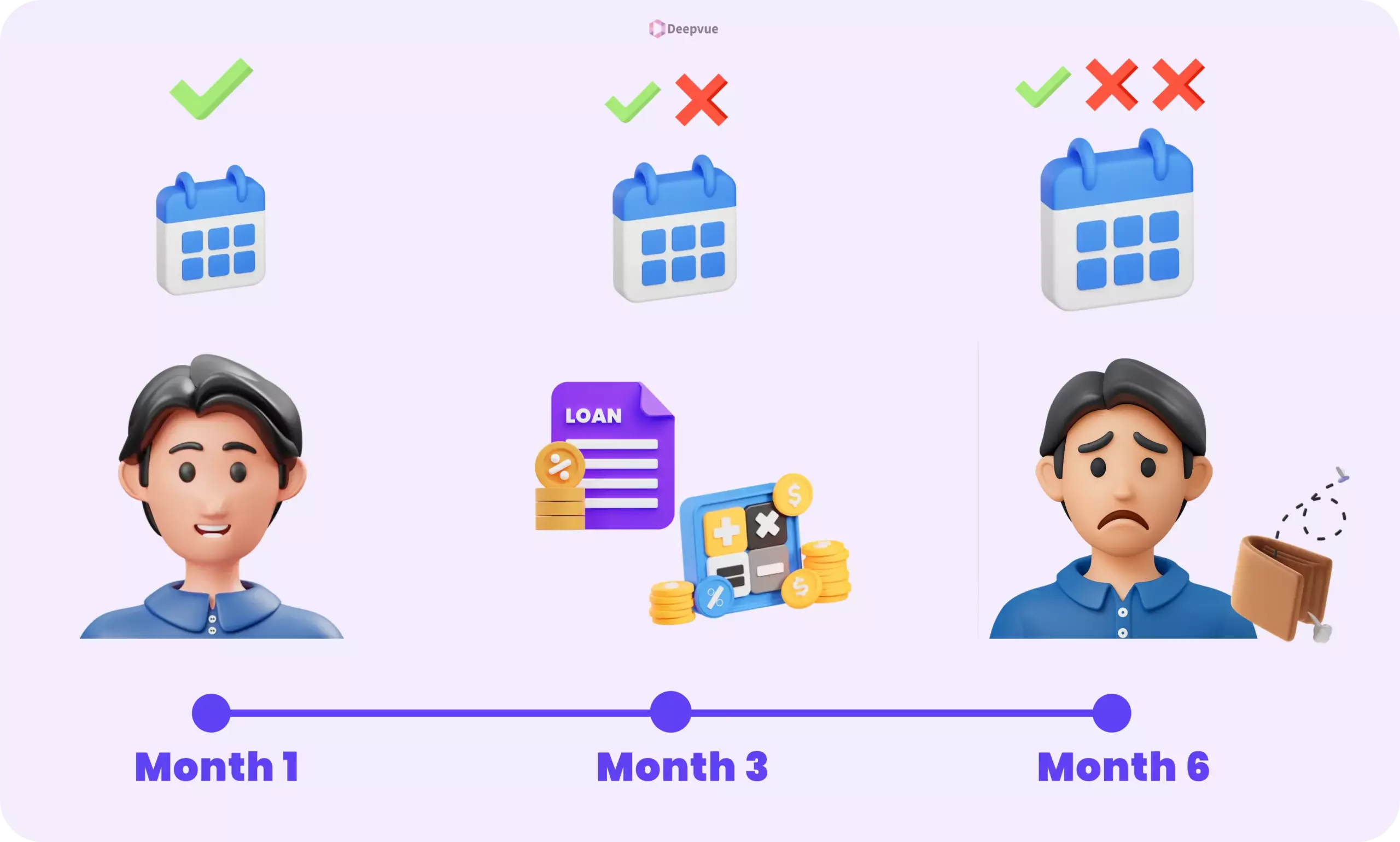

The problem is simple: this assessment doesn’t update over time. A person who was creditworthy three months ago might now be overleveraged or unemployed, and the lender wouldn’t know. A borrower who struggled six months ago may have since stabilized their finances, but still faces higher interest rates due to an outdated score.

The Core Problems With One-Time Scoring

Static Nature in a Dynamic World

Personal finances aren’t fixed. A borrower might take out a new loan, lose a job, get a raise, or face an unexpected medical expense, all within a matter of weeks. One-time scoring doesn’t factor in any of this. Lenders base their decisions on old data, taking on risks that might be irrelevant now.

This inflexibility harms lenders and borrowers alike. Lenders may unknowingly assume more risk than they had in mind. Borrowers who make an improvement in their credit conduct aren’t rewarded immediately. What happens is a decoupling between actual credit conduct and risk modeling.

Delayed Risk Detection

A borrower may appear creditworthy at the time of application but start missing payments or accumulating debt shortly afterward. Without any method of identifying this until default, lenders don’t have much opportunity to act early or reduce losses. This is especially risky in unsecured lending, where there is no collateral to resort to.

Real-time or periodic risk assessment can highlight problems before they arise. A sharp jump in credit usage, regularly bounced checks, or a fall in income, all these are likely to be early warning signs. One-off scoring misses them.

Unfair Risk Profiles

Static credit scoring too frequently penalizes past behavior, even where there has been real change. Someone who missed payments a year ago but has since stabilized may still be stuck with a poor score. Lenders using outdated data are likely to offer higher interest rates or reject the application altogether.

On the flip side, someone with a high score might be struggling financially at the time of a new credit application, but the system wouldn’t catch it. The existing scoring framework, in practice, incentivizes appearances over current financial health.

Vulnerability to Fraud and Ghost Loans

Single-point scoring provides an opportunity for manipulation. Scammers can make up synthetic identities or cheat to become loan-qualifying. If identity, income, or risk is only checked once, it provides a large window of opportunity for exploitation.

There is also the issue of ghost loans, where there is a seemingly valid applicant who vanishes after disbursal. Through no regular monitoring or data refresh, lenders realize this problem only at the time of default. Recovery then becomes expensive and challenging.

Lack of Real-Time Risk Detection

A one-time score doesn’t track a borrower’s financial behavior post-approval. That’s a serious flaw.

Imagine a borrower who takes on multiple loans immediately after securing one. Or someone who loses their job and begins missing EMI payments on other obligations. A static model lender does not have a way of realizing that this is occurring. The risk profile degrades insidiously until it appears as a late payment, delinquency, or outright default.

This blind spot can’t be addressed after the fact. Static-based lenders are always behind the windshield, reacting to danger instead of looking ahead. This lag in detecting risk is particularly dangerous for unsecured lending, where there’s no collateral to absorb losses.

Higher Operational Burden and Expenses

- Manual Reviews: Risk teams need to manually check documents, cross-validate credit history, and seek out inconsistencies in borrowers’ profiles. This delays approval and raises operating expenses.

- Repeat Scoring: A few lenders try to re-score applicants periodically, but this is not efficient and does not pick up on changes in behavior between those time periods.

- Aggressive Collections: With no warning signs, most lenders find out only when payments are missed. They then have to go into recovery mode, using collection agents, legal notices, and write-offs.

Why Does the Industry Need Continuous Credit Risk Assessment?

The RBI imposed monetary penalties totaling ₹86.11 crore on regulated entities in FY24, more than double the ₹40.39 crore in FY23, highlighting increased regulatory scrutiny. To fix these issues, the credit ecosystem needs to shift toward continuous assessment. This model uses real-time or periodic updates to track changes in borrower behavior and recalibrate risk profiles accordingly.

Instead of relying on a single score at loan origination, lenders can access updated data through APIs, account aggregators, and alternative data sources. This allows them to spot trends, detect risks earlier, and adjust credit exposure as needed.

How Does it Work?

- A borrower’s income drops significantly? The lender gets an alert.

- Their bank balance regularly hits zero before payday? That’s flagged.

- They take out a high-interest personal loan elsewhere? The risk score updates.

What Makes Continuous Risk Scoring Possible?

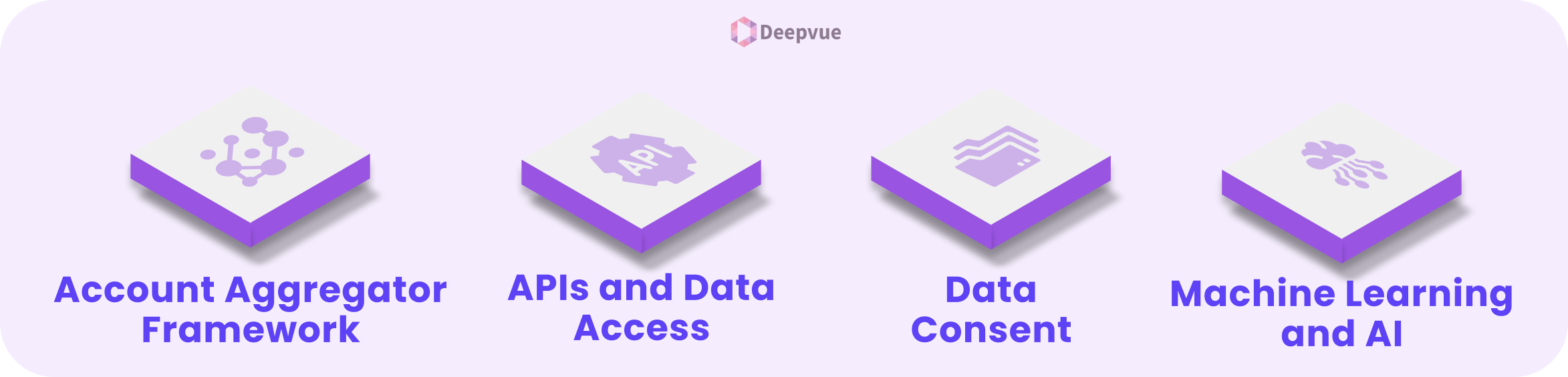

- Account Aggregator Framework: In India, Account Aggregator (AA) framework enables individuals and business entities to securely and with permission share their financial information. This framework facilitates real-time cash flow access, income patterns, and consumption behavior—all of which are important for continuous credit risk assessment.

- APIs and Data Access: Lenders can now integrate with data sources via secure APIs. This covers bank transaction history, GST returns, bill payments, and job platforms. Rather than receiving credit reports, lenders have access to data on a weekly or daily basis.

- Data Consents: The AA framework offers purpose-specific consents tailored to different lending needs. For instance, lenders can request access to bank transactions for credit evaluation, periodic access (up to 5 times/month) for ongoing monitoring, or daily balance checks post-default for collections. Other consents cover GST return data for small businesses and salary account monitoring for payroll-linked lending. These consents ensure data access is limited, contextual, and always under borrower control.

- Machine Learning and AI: Algorithms can now analyze massive data sets to detect patterns that traditional scoring models miss. For instance, AI identifies early warnings of financial stress by analyzing transaction categorization, behavioral changes, or credit line utilization. Such insights make predictions more accurate and interventions quicker.

Regulatory Shifts and Market Adoption

Regulators are starting to see the limitations of conventional credit scoring. In India, the RBI has encouraged the Account Aggregator ecosystem as a primary driver of consent-led, data-rich financial products. The DEPA (Data Empowerment and Protection Architecture) program is based on the same assumptions: individuals need to own their financial data, and institutions need to look after it responsibly and actively.

Lenders using continuous scoring models not only manage risk but are also better aligned with these new regulatory regimes. They can serve new-to-credit borrowers more effectively, promote responsible lending, and rely less on older bureau scores.

How Our Platform Tackles These Credit Risk Challenges?

As the lending business shifts away from one-time scoring towards dynamic, data-driven models, our platform provides solutions directly addressing the needs described above. Below are important capabilities that assist in overcoming the drawbacks of static credit risk scoring:

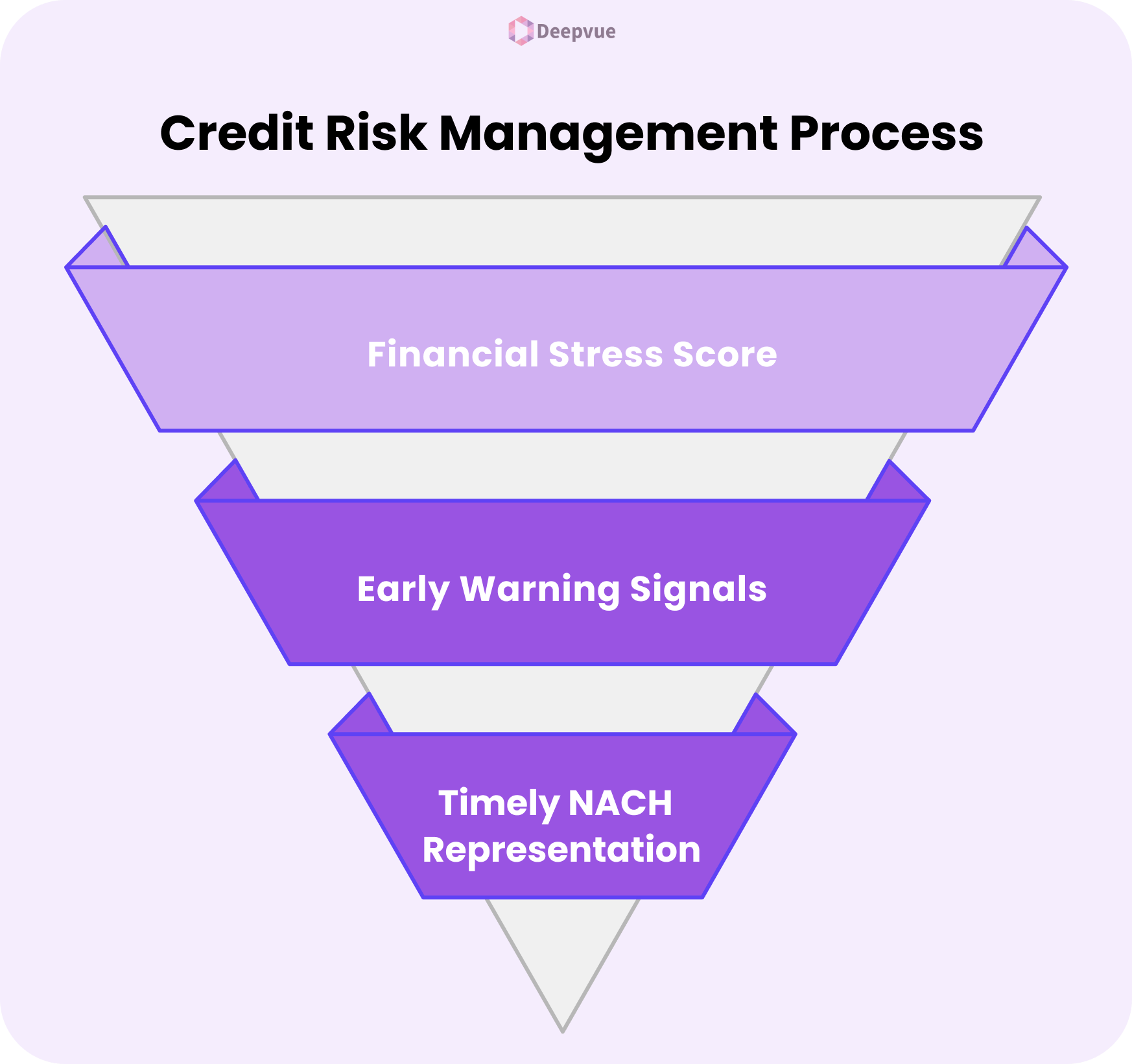

1. Financial Stress Score Calculation

Traditional credit scores don’t account for real-time financial volatility. Our platform calculates a dynamic financial stress score based on transaction behavior, income consistency, and spending patterns. This enables lenders to monitor a borrower’s capacity to repay credit in real time, providing early warning of increasing risk before default.

2. Early Warning Signals Post-Disbursal

Risk does not end at loan approval. Our system tracks borrower accounts for post-disbursal stress signs like late salary credits, cheque bounces, large unexplained withdrawals, and delayed EMIs. Such automated flags give lenders early warnings to act before the issue gets out of hand, decreasing both losses and oppressive collections.

3. Timely Representation of NACH for the DPD Accounts

Through an explicit consent for daily account balance checks, our platform enables automated and real-time account balance monitoring of the borrowers. This helps lenders with more accurately timed representation of NACH of the amount due more than one day from the due dates, and thus helps in overall collections at the individual, portfolio level.

To learn more about our solutions, contact our sales team.

Conclusion

One-time credit risk scoring made sense in a world where data was scarce and decisions took weeks. That world is gone. With real-time monetary information at hand and the lives of borrowers changing day by day, static scoring will no longer suffice.

It exposes lenders to unwarranted risk, rewards worse borrowers, and allows fraud to be perpetrated. The solution is clear: towards continuous, data-driven risk assessment. The tools are available. The frameworks are in place. The question is whether lenders are willing to change.

FAQ:

What is one-time credit risk scoring?

It’s a static credit judgment of a borrower at a point in time, usually loan application or underwriting. It doesn’t consider future financial developments.

What risks do lenders take with one-time scoring?

They risk lending to borrowers who become high-risk overnight or bypass early warning signs of default. It also exposes them to fraud and synthetic identities.

How does the ongoing credit risk evaluation function?

It applies real-time or periodic data refreshes, such as bank transactions, GST returns, or income trends, to dynamically modify a borrower’s risk profile.

What technologies support dynamic credit scoring?

APIs, Account Aggregators, AI/ML models, and other data sources, such as utility bills or electronic payments, facilitate real-time credit evaluations.

Does dynamic scoring assist in curbing fraud?

Yes. Continuous monitoring identifies unusual activity or abrupt changes in spending patterns, enabling lenders to alert to potential fraud in its early stages.