An Ultimate Beneficial Owner is a person who, directly or indirectly, owns or exercises control over a legal entity, even though their name may not be recorded on formal documents. They enjoy the advantage of the company’s assets, profits, or voting rights, usually possessing at least 25% interest, but sometimes this percentage varies across jurisdictions. Knowing the UBOs is important to avoid money laundering, fraud, and tax evasion. Most illegal actors operate behind intricate corporate structures to conceal their identities and route money secretly.

For companies, not knowing and disclosing UBOs may result in penalties under the law, loss of reputation, and stakeholder trust. Here in this blog, we’ll be discussing what is a UBO, the primary regulations related to identifying UBOs, and why businesses should abide by such rules.

Definition of Ultimate Beneficial Owner (UBO)

An Ultimate Beneficial Owner (UBO) is an individual who actually owns, controls, or derives benefit from a company or legal entity, though the ownership might be indirect. A UBO is usually:

- A person with material ownership – Typically having 25% or greater shares or voting rights in an organization.

- Someone who has decision-making power – They may not necessarily own shares, but they dictate business decisions.

- An individual who is enjoying the company – An individual who derives financial benefits (e.g., profits or dividends) from the organization.

Related Read: What is the difference between a beneficial owner and an ultimate beneficial owner?

Importance of Identifying UBOs

- Legal Requirements and Compliance: UBO identification helps to comply with international requirements like the Financial Action Task Force (FATF) guidelines, Know Your Customer (KYC) obligations, and local financial regulations.

- Fight Against Financial Crimes: Transparency in business ownership structures can prevent financial crimes such as fraud, corruption, tax evasion, and terrorist funding by making available the actual people behind business operations.

- Improving Anti-Money Laundering (AML) Measures: Awareness of the UBOs enhances AML efforts, enabling financial institutions and companies to spot suspicious transactions, prevent criminal activities, and meet due diligence obligations.

- Shielding Against Legal Sanctions and Reputation Losses: Companies that do not know UBOs expose themselves to legal risks, regulatory sanctions, and reputational loss.

Challenges in UBO Identification

Identifying the UBO is fraught with a lot of challenges, such as obtaining accurate information on the beneficial owner or owners. Corporations at times have complex ownership and shareholding structures, making it extremely difficult to identify the Ultimate Beneficial Owner. Getting the required information from third parties can be quite challenging at times, particularly if there is a language barrier or if they are unresponsive.

If the ownership or shareholding changes, it is difficult to get accurate data. This calls for effective data management and a defined procedure for recording and documenting improvements. Also, the process of identifying UBOs differs across countries. Hence, businesses should have complete knowledge of the requirements so that they don’t precede compliance problems.

Strategies for UBO Identification

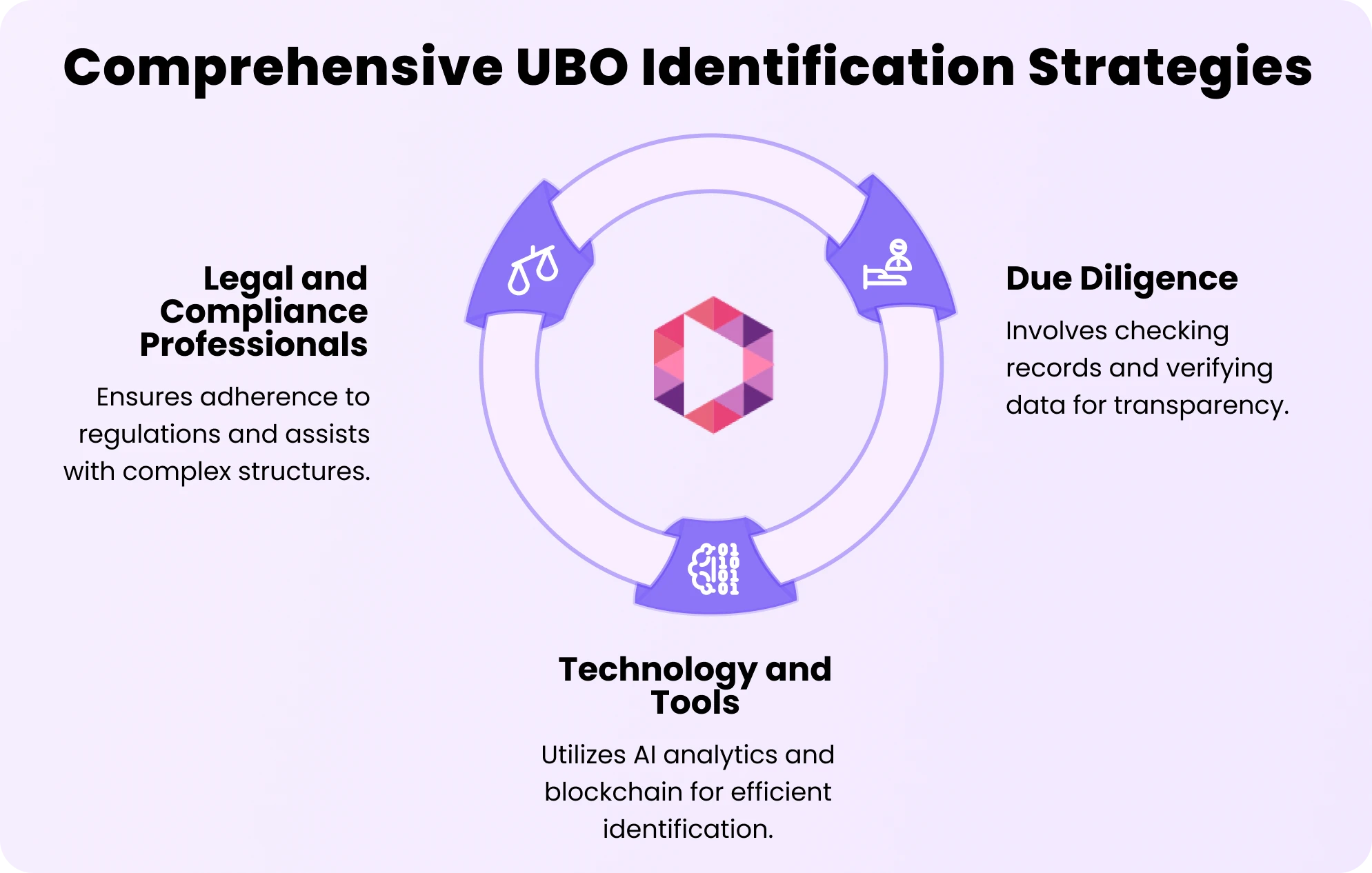

- Due diligence involves checking business registration records, examining ownership structures, and cross-verifying data with regulatory watchlists. It also involves requesting statements from shareholders and other stakeholders for transparency.

- Using technology and tools facilitates efficient UBO identification through the application of AI-powered analytics, blockchain technologies, and automated screening capabilities. Transactional monitoring software and embedded KYC/AML tools can facilitate suspicious activity detection.

- Working with legal and compliance professionals is important to comply with local and global regulations. Legal practitioners assist in the interpretation of intricate ownership structures, while compliance specialists aid in policy updates and regular risk assessments.

The Role of UBOs in Corporate Governance

Ultimate Beneficial Owners (UBOs) play a crucial role in corporate governance by influencing decision-making, ensuring transparency, and maintaining regulatory compliance. Their governance functions are important because they provide strategic directions, monitor financial and operational integrity, and ensure that the firm complies with legal and ethical requirements. Through UBO disclosure, corporations enhance transparency and reduce risks of money laundering, fraud, and tax evasion.

Regulatory authorities globally, such as the Financial Action Task Force (FATF) and the Anti-Money Laundering Directives of the European Union, focus on the identification and tracking of UBOs to avoid illicit practices. Due to this, businesses are required to establish robust governance structures to identify and deal with UBO relationships to satisfy local and international laws while ensuring the integrity and reputation of the organization.

Best Practices for UBO Disclosure

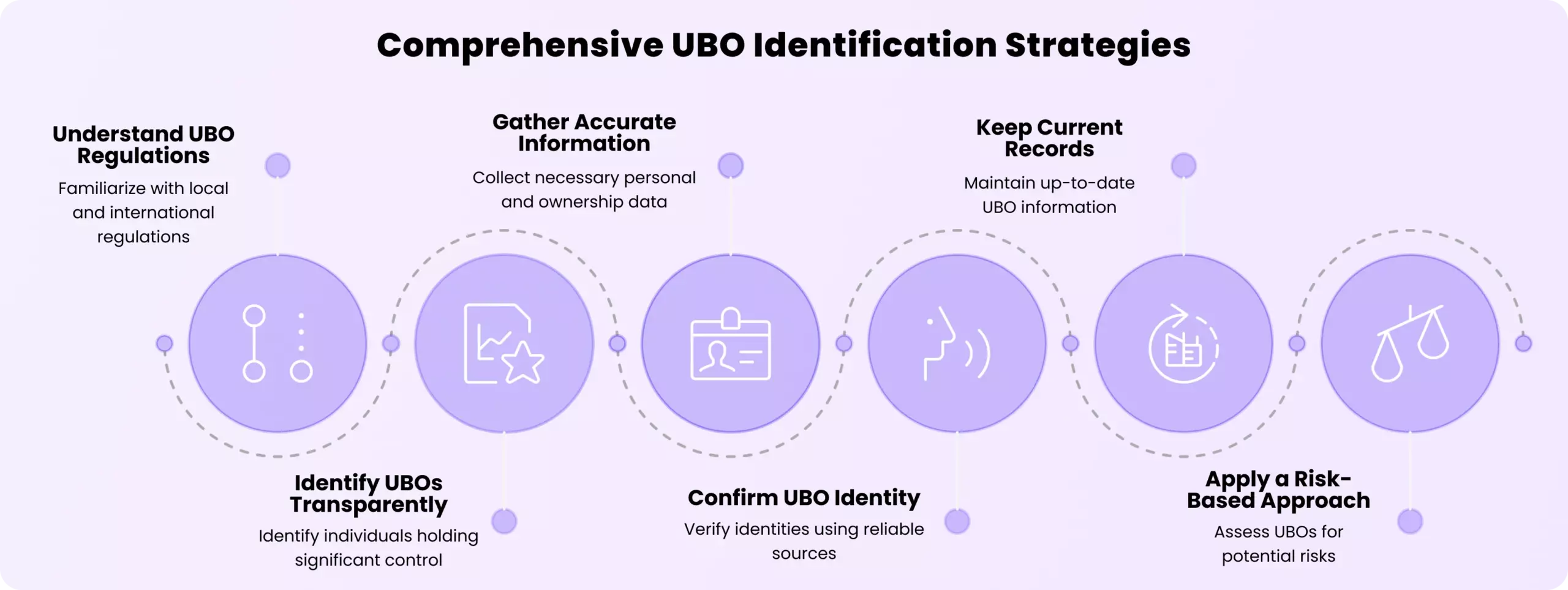

- Understand UBO Regulations: Get familiar with local and international regulations, like FATF, FinCEN, and EU AML directives.

- Identify UBOs Transparently: Identify those who hold or control 25% or more of a company or exercise substantial influence.

- Gather Accurate Information: Get full legal names, dates of birth, nationalities, residential addresses, and percentages of ownership.

- Confirm UBO Identity: Apply government IDs, utility bills, or independent sources to verify identities.

- Keep Current Records: Update UBO data regularly to account for changes in ownership and to comply.

- Apply a Risk-Based Approach: Evaluate UBOs for the likelihood of risks, including politically exposed persons (PEPs) or individuals connected with high-risk jurisdictions.

The Impact of Globalization on UBO Understanding

With globalization, companies function in several jurisdictions, and hence it becomes increasingly difficult to trace the actual individuals who effectively own or benefit from a firm. This has led to more regulatory action across the world, with governments and financial institutions seeking to prevent money laundering, tax evasion, and other forms of illegal financial activity. International organizations such as the Financial Action Task Force (FATF) and the European Union have imposed stricter ultimate beneficial owner rules, increasing corporate ownership structure transparency. Globalization has also propelled the demand for uniform ultimate beneficial owner rules to help with compliance and due diligence by multinational companies.

Conclusion: The Significance of UBO Awareness in Business

As global regulations tighten, organizations must prioritize UBO identification to comply with Anti-Money Laundering (AML) laws, Know Your Customer (KYC) policies, and other financial regulations. For companies, adherence to UBO legislation is necessary to prevent legal sanctions, reputational damage, and business interruptions.

Failure to disclose UBOs may lead to serious legal repercussions, reputational loss, and financial sanctions. Companies that actively undertake effective UBO identification procedures not only reduce risks but also enhance their reputation with investors, financial institutions, and regulatory bodies.

FAQs

Who is the ultimate beneficial owner (UBO) of a company?

An Ultimate Beneficial Owner (UBO) is the ultimate owner or controller of a company, even if not named on the official records. The UBO enjoys the company’s profits, assets, or voting rights, normally having a minimum of 25% ownership, subject to local laws.

What is the difference between a beneficial owner and a UBO?

A beneficial owner derives the benefits of ownership, although the legal title is in another name. A UBO, on the other hand, is the top-level person who controls the entity but may be buried behind several layers of ownership.

How to Identify the UBO?

Identification of UBO requires examination of corporate structures, ownership documents, and account data to follow individuals with significant control. Companies need to carry out Know Your Customer (KYC) and Anti-Money Laundering (AML) checks, checking shareholder information and indirect ownership relationships.

How are trends across the globe shaping the future of UBO analysis?

More stringent AML rules, digital verification of identity, and data transparency legislation are increasing the stringency of UBO disclosure. Authorities are making public UBO registers mandatory, while artificial intelligence-based compliance systems are enhancing precision in detecting concealed ownership.

Why is UBO scanning necessary?

UBO scanning prevents fraud, tax evasion, and money laundering through the detection of concealed beneficiaries. Adherence to UBO rules safeguards businesses against legal consequences, monetary fines, and reputational harm.