Businesses have become highly aware that understanding their customers and business partners goes beyond mere financial transactions. Every year, millions of dollars flow through financial systems untraced, despite efforts by regulatory bodies to limit illegal activities.

To counter these threats effectively, businesses must implement robust procedures to understand the entities/individuals they engage with, particularly those with higher risks. This is where Enhanced Due Diligence (EDD) comes into play.

Understanding Enhanced Due Diligence (EDD)

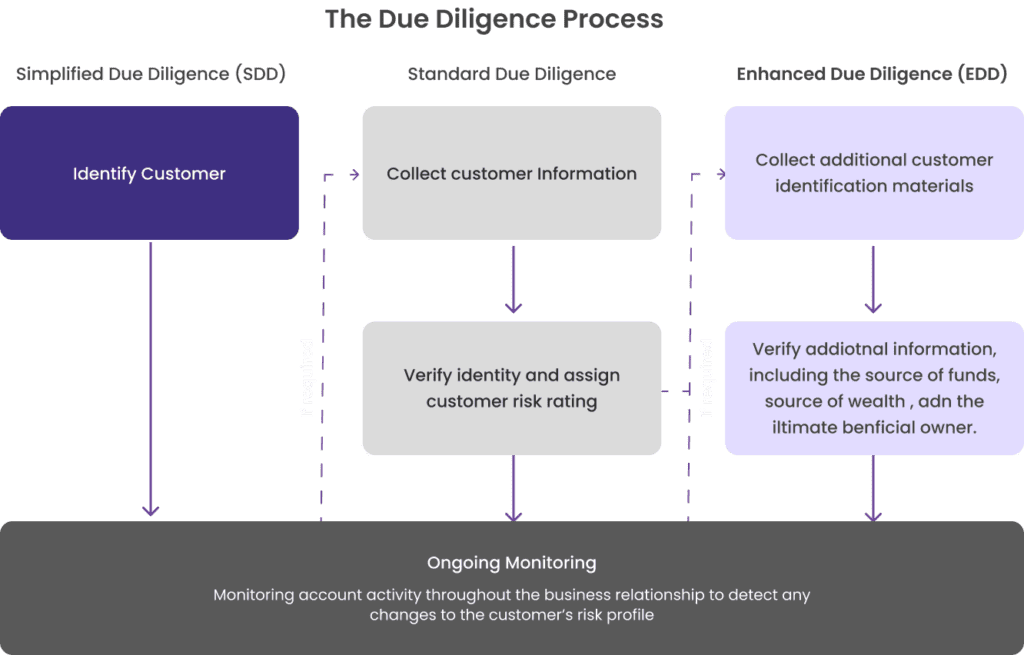

Enhanced Due Diligence (EDD) is an advanced risk assessment process designed to gather and analyze detailed information about high-risk customers or business relationships. The primary goal of EDD is to identify and mitigate potential financial crimes such as money laundering and terrorist financing.

EDD is a more comprehensive & extended version of the standard Customer Due Diligence (CDD) processes, which involves more rigorous checks and additional measures to ensure compliance.

Why is Enhanced Due Diligence Important?

Enhanced Due Diligence is important for businesses that want to maintain robust compliance with Anti-Money Laundering (AML) regulations. By conducting EDD, businesses can:

1. Prevent financial frauds: EDD helps in identifying and preventing money laundering, terrorist financing, and other financial frauds by thoroughly scrutinizing high-risk customers.

2. Ensure compliance: Regulatory bodies require businesses to conduct EDD to comply with AML and Know Your Customer (KYC) guidelines, especially when dealing with high-risk entities.

3. Protect reputation: By implementing EDD, companies protect their reputation by avoiding partnerships with illicit businesses.

4. Manage risks: EDD provides a deeper understanding of the risks associated with high-risk customers, enabling better risk management and decision-making.

EDD vs. CDD: What’s the Difference?

While both CDD and EDD aim to assess customer risk, the scope and intensity of these processes differ significantly:

- Scope of Application: CDD is a routine procedure applied to all customers to scan their risk profile. EDD, on the other hand, is reserved for high-risk customers who pose a greater potential threat.

- Information Depth: EDD involves collecting more detailed information compared to CDD. This includes extensive background checks and continuous monitoring.

- Regulatory Requirements: Regulatory bodies often mandate EDD for high-risk industries or customers, whereas CDD is a standard requirement for all customers.

- Focus on High-Risk Factors: EDD specifically considers factors such as beneficial ownership, source of funds, and the nature of the business, which are not as thoroughly checked in CDD.

When is Enhanced Due Diligence Required?

Enhanced Due Diligence is typically required in situations where there is a higher risk of financial fraud. These situations include:

- High-Risk Customers: Individuals or businesses that pose a higher risk due to their background, activities, or geographical location.

- Large Transactions: Transactions involving significant money that may require closer scrutiny.

- Complex Ownership Structures: Businesses with complicated ownership structures that could potentially hide fraudulent transactions.

- Suspicious Activities: Any activity that raises suspicion of money laundering or terrorist financing.

How to Conduct Enhanced Due Diligence

Conducting Enhanced Due Diligence involves several key steps:

1. Collecting Detailed Customer Information: Gather comprehensive information about the customer, including their name, date of birth, address, and identification documents.

2. Beneficial Ownership Verification: Identify and verify the beneficial owners of the business to ensure there are no hidden risks.

3. Understanding the Business: Determine the nature and purpose of the business to assess its legitimacy.

4. Monitoring Transactions: Continuously monitor transactions for any unusual or suspicious activity.

5. Enhanced Identity Verification: Use advanced verification methods, such as biometric checks or additional documentation, to ensure the customer’s identity is accurate.

6. Risk Assessment: Evaluate various risk factors, including the customer’s geographical location, industry, and transactional behavior.

7. Ongoing Monitoring: Implement a system for ongoing monitoring to ensure that any changes in the customer’s risk profile are detected and addressed promptly.

Key Components of Enhanced Due Diligence

Enhanced Due Diligence involves several important components that differentiate it from standard due diligence:

Risk Assessment

EDD focuses on assessing the risk level associated with specific customers. This involves a detailed evaluation of the customer’s risk profile, considering factors such as their background, industry, and geographical location.

Information Depth

EDD requires more extensive information gathering compared to standard due diligence. This includes obtaining detailed customer data, understanding ownership structures, and verifying the source of funds.

Detailed Documentation

EDD mandates careful documentation of the due diligence process. This ensures that every step taken to verify the customer’s identity and assess their risk is duly recorded and can be reviewed if necessary.

Regulatory Compliance

Regulatory authorities often require EDD for certain high-risk businesses or customer categories. EDD ensures that businesses comply with these regulatory requirements by implementing additional verification and monitoring measures.

Focus on Politically Exposed Persons (PEPs)

EDD puts special emphasis on identifying and scrutinizing Politically Exposed Persons (PEPs) and individuals in positions of influence who may pose a higher risk of involvement in fraudulent activities.

Best Practices for Enhanced Due Diligence

To effectively implement Enhanced Due Diligence, businesses should follow these best practices:

Employ a Risk-Based Approach

Adopt a risk-based approach to due diligence, tailoring EDD measures to the specific risks associated by each customer.

Obtain Comprehensive Information

Gather detailed information from different sources to ensure a thorough understanding of the customer and their transactions.

Verify the Source of Funds

Ensure that the customer’s source of funds is legitimate and free from any connections to illegal activities.

Use Advanced Verification Methods

Implement advanced identity verification techniques, such as biometric checks or additional documentation requirements, to enhance the accuracy of customer verification.

Monitor Continuously

Establish a continuous monitoring system to detect any changes in the customer’s risk profile or suspicious activities in real-time.

Challenges in Conducting Enhanced Due Diligence

Conducting Enhanced Due Diligence can be challenging due to several factors:

- Data Quality: Ensuring the accuracy and reliability of the information can be difficult, especially when dealing with complex ownership structures or international entities.

- Resource Intensive: EDD requires significant resources, including time, manpower, and technology, to gather and analyze detailed information.

- Regulatory Compliance: Keeping up with changing regulatory requirements and ensuring compliance can be challenging for businesses operating in multiple jurisdictions.

- Balancing Thoroughness and Efficiency: Striking a balance between thorough due diligence and maintaining efficient business operations can be challenging, especially for high-volume transactions.

Leveraging Technology for Enhanced Due Diligence

To overcome these challenges, businesses can leverage technology to streamline the EDD process.

- Automated Data Collection: Automating the data collection process ensures accuracy and reduces the time required to gather information.

- Real-Time Monitoring: Implementing real-time monitoring systems helps detect suspicious activities promptly and allows for immediate action.

- Advanced Analytics: Utilizing advanced analytics and machine learning algorithms enhances the ability to identify and assess risks more effectively.

- Regulatory Compliance Tools: Technology solutions can help businesses stay compliant with regulatory requirements by automating the verification and reporting processes.

Examples of Industries that Must Employ EDD

Certain industries are naturally more prone to financial frauds and therefore must implement EDD measures more rigorously. These include:

- Money Services Businesses (MSBs): Due to the high volume of cash transactions.

- Investment Firms: To prevent fraudulent investment schemes and ensure compliance.

- Casinos and iGaming: To avoid the laundering of illegal funds through gambling activities.

- Correspondent Banking: Given the risks associated with international transactions and relationships with foreign banks.

- Cryptocurrency Exchanges: Due to the anonymity and global nature of cryptocurrency transactions.

10 Examples of Customers Who Always Require EDD

Here are ten situations where EDD is typically necessary:

- Politically Exposed Persons (PEPs): High-risk individuals due to their influential positions.

- Known Criminals: Customers with a history of criminal activity.

- Anonymous Transactions: Businesses that engage in transactions without face-to-face interaction.

- Cash-Intensive Businesses: Entities with a significant volume of cash transactions.

- Offshore Firms: Companies with operations in high-risk jurisdictions.

- Nominee Shareholders: Entities with shareholders acting as nominees or shares held in bearer form.

- Non-Residents: Customers who are not domiciled in the country of operation.

- Third-Party Payments: Transactions involving payments from unknown third parties.

- Private Banking: Institutions facilitating high-value transactions with unknown third parties.

- Sanctioned Countries: Customers operating in or from countries under sanctions or with high corruption rates.

EDD Requirements for Collecting Data About High-Risk Customers

When conducting EDD, businesses must gather additional data to ensure a thorough risk assessment. Key information to collect includes:

- Business Information: Detailed information about the customer’s business activities, ownership structure, and key stakeholders.

- Beneficial Ownership: Identifying individuals who ultimately own or control the customer entity.

- Source of Funds: Verifying the legal sources of the customer’s wealth and funds.

- Enhanced Identity Verification: Implementing robust identity checks, including additional documentation and verification methods.

- Risk Indicators: Evaluating various customer-specific risk factors, such as geographic location, industry, transactional behavior, and past regulatory or legal issues.

Conclusion

Enhanced Due Diligence (EDD) is a vital component of a robust AML program, enabling businesses to identify and mitigate risks associated with high-risk customers. By implementing EDD, companies can ensure compliance with regulatory requirements, prevent frauds, and protect their reputation. Leveraging technology can significantly enhance the efficiency and effectiveness of the EDD process, allowing businesses to stay ahead in the ever-evolving landscape of financial compliance.

Understanding and conducting EDD not only helps in complying with regulations but also in building a secure and trustworthy business environment. By following best practices and utilizing advanced technologies, businesses can effectively manage the risks associated with high-risk customers and ensure a safe and compliant operation.

To learn more about how Deepvue’s Verification Suite can enhance your online verification process, visit Deepvue.tech and explore their range of APIs designed to ensure accuracy and efficiency.

FAQs

What is Enhanced Due Diligence (EDD)?

Enhanced Due Diligence (EDD) is a detailed risk assessment process used to gather and analyze information about high-risk customers to prevent financial fraud like money laundering and terrorist financing.

Why is Enhanced Due Diligence important for businesses?

EDD is crucial for preventing financial fraud, ensuring regulatory compliance, protecting company reputation, and managing risks associated with high-risk customers.

When is Enhanced Due Diligence required?

EDD is required for high-risk customers, large transactions, complex ownership structures, and any suspicious activities that could indicate financial fraud.

How is Enhanced Due Diligence conducted?

EDD involves collecting detailed customer information, verifying beneficial ownership, understanding the business’s nature, monitoring transactions, using advanced verification methods, and conducting ongoing risk assessments.

What are the challenges in conducting Enhanced Due Diligence?

Challenges include ensuring data quality, managing resource-intensive processes, staying compliant with changing regulations, and balancing thoroughness with efficiency. But, technology can help streamline the EDD process.