Running a successful business feels great—until tax season sneaks up and one small mistake throws everything off balance. That’s where the Tax Deduction and Collection Account Number (TAN) becomes your reliable compliance ally. Issued by India’s Income Tax Department, this ten-digit alpha-numeric number is tasked with ensuring the accuracy of tax deductions and collections.

TAN verification ensures that tax withheld or collected is correctly allocated, keeping you in good standing and establishing credibility. This blog discusses TAN verification, its procedure, its advantages, and why it’s a must for businesses.

What is TAN Verification?

TAN verification is the process of checking the validity of a TAN against the database of the Income Tax Department. This will guarantee that the information related to the TAN is accurate and corresponds to the official records. It is a significant step to prevent mistakes in tax returns and prevent penalties or legal issues. For companies that regularly deduct or collect tax, TAN information verification prior to filing returns prevents delays and ensures proper tax credit distribution to the correct recipients.

Why is TAN Verification Important?

- Compliances of Laws: The Indian Income Tax Act makes TAN responsible for submitting the TDS/TCS returns. The wrong use of TAN incurs substantial penalties and diverts business activities.

- Correct Tax Transactions: Verification of TAN guarantees the payment of proper tax or collection and charging of proper tax to the correct accounts, reducing errors in tax credits.

- Prevention of Penalties: Inaccurate information about TAN can result in the tax return rejection. This may invite fines, thereby generating financial and reputation loss.

- Effective Tax Administration: TAN verification makes the tax procedures less burdensome and time-consuming while keeping stakeholders’ confidence intact through compliance.

Step-by-Step Process of TAN Verification

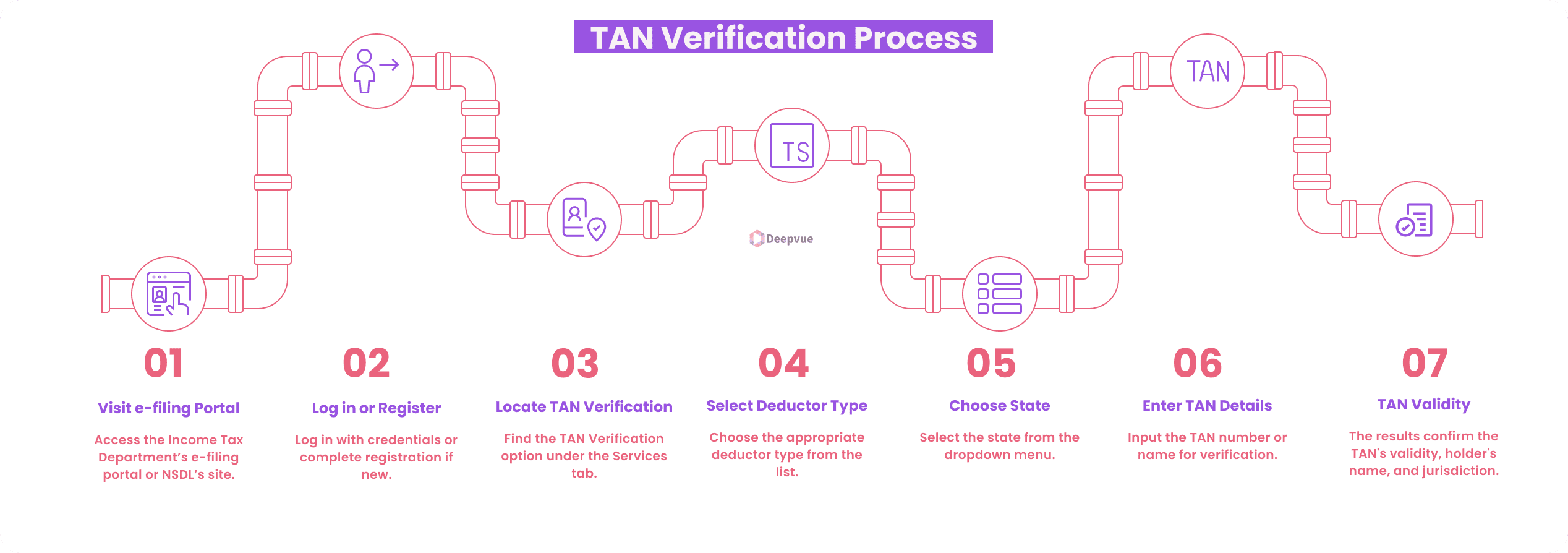

It is easy to verify TAN by using the official e-filing website or other approved websites. Follow these steps:

Step 1: Go to the e-filing website of the Income Tax Department or the official NSDL TAN verification website.

Step 2: If already registered, sign in with your credentials. Fresh users need to go through an easy registration procedure to access the site.

Step 3: Once logged in, locate the “TAN Verification” option under the “Services” tab.

Step 4: Now, choose the “Deductor Type” from the deductor category as shown below:

- Statutory Body/ Local Authorities/ Autonomous Bodies

- Firms/ AOP (Trust)/AOP/ Artificial Judicial Person/ Body of Individuals

- Branch of individual business/ Hindu Undivided Family (Karta)

- Branch of firms/ AOP (Trust)/ AOP/ Artificial Judicial Person/Body of Individuals

- Individual/ Hindu Undivided Family (Karta)

- Branch of Company

- Company

- Central or State Government

Step 5: Next, choose “State” from the option that drops down.

Step 6: Enter the TAN Number or Name as you see fit. After verifying the number against its database, the system will show the results.

Step 7: The verification results will confirm whether the TAN is valid and provide associated details such as the name of the holder and jurisdiction.

If you frequently verify TANs or need to handle bulk verifications, consider partnering with third-party providers. They offer APIs and tools for seamless bulk verification, allowing easy integration with your system for enhanced efficiency and accuracy.

TAN Verification by Name

TAN (Tax Deduction and Collection Account Number) verification by name allows users to confirm the validity of a TAN using the deductor’s name and location. This method is useful when the TAN number is unknown or needs to be cross-checked. It can be done through the Income Tax Department’s official website or NSDL’s TAN search facility, where you enter the deductor’s name, state, and category (e.g., company, firm) to retrieve the registered TAN details.

TAN Verification by Number

TAN verification by number is the process of checking the validity and correctness of a TAN using the 10-digit alphanumeric TAN itself. This is useful to verify the TAN quoted on TDS certificates, challans, or financial documents. You can verify the TAN via the NSDL-TIN website by simply entering the TAN number to view the associated deductor details such as name, category, and jurisdiction.

Benefits of TAN Verification

- Tax Filing Precision: TAN verification guarantees each tax deduction or receipt is immediately linked to the accurate account in order not to make mistakes during filing.

- Legal Guarantee: Guaranteed TAN information assures companies that they will not be sanctioned for tax avoidance and that everything proceeds normally.

- Fraud Prevention: The authentication of TAN assists the company in evading fraud or identity abuse risks in tax dealings.

- Efficiency in Time and Resources: Proper verification reduces tax filing delays and avoids the necessity of making repeated corrections.

- Enhanced Credibility: Tax compliance by valid TAN verification establishes credibility with the stakeholders, including customers, suppliers, and regulatory agencies.

How TAN Verification Prevents Tax Fraud & Errors?

TAN verification is important for the avoidance of tax fraud and mistakes through ensuring that the collection and deducting of taxes are accounted for. Confirming whether a TAN belongs to the genuine entity whose authorization it is to deduct or collect taxes prevents fraudulent processes where false or inaccurate tax deductions would be undertaken.

Furthermore, TAN verification helps to eliminate the misuse of identities in tax filings by ensuring that only valid TANs are used, making it difficult for unauthorized entities to manipulate tax records. The process increases transparency in financial transactions, ensuring that tax deductions are properly recorded and traceable by tax authorities.

Conclusion: Streamline Tax Compliance with Verified TAN

TAN verification is not a formality. It is a key aspect of effective and compliant tax administration. Confirming TAN information will prevent mistakes, avoid the inconvenience of reversed payments, and maintain a positive image of openness and dependability.

The mantra should be easy for companies: check TAN regularly, comply with the rules, and simplify the tax process. TAN checking through our API is an easy, hassle-free exercise that will reap benefits in the long term. Our TAN verification API enables organizations to eliminate manual errors, ensuring accuracy while filing TCS/TDS and saving valuable time.

Explore our TDS compliance check API to validate TAN details in a jiffy, error-free TDS filing, and take the lead in tax compliance.

FAQ:

What happens if my TAN details are incorrect?

If the TAN details are invalid, your returns of TDS/TCS are liable to get rejected, besides attracting penalties due to non-compliance.

How often should I verify my TAN?

It’s advisable to verify TAN details before every tax filing or whenever significant changes occur in business operations.

What details are needed for TAN verification?

You need your TAN and basic information, such as the name and address linked to it, to verify its validity.

How can I verify my TAN?

By entering the TAN details, TAN can be verified through the Income Tax Department\u2019s e-filing portal or authorized platforms like the NSDL\u2019s website.

Why is TAN verification necessary?

It ensures compliance with tax regulations, prevents penalties for incorrect TAN usage, and helps maintain accurate tax records.