MSMEs are the backbone of all economies across the globe, propelling innovation, jobs, and regional development. MSMEs contribute nearly 30% of the country’s GDP and employ millions in the Indian economy. Despite their crucial role in the economy, MSMEs have generally faced many challenges in accessing formal credit. Amongst these include lack of documentation, uncertainty, and perceived financial risk, all of which discourage lending to such business enterprises.

Udyam Verification is emerging as a solution to bridge this gap. Providing a simple and reliable way to verify MSMEs, increases the trust quotient, simplifies the lending process, and minimizes the risk quotient. Let’s understand what Udyam verification is all about and what makes it capable of changing the game in MSME lending for businesses and institutions.

What is Udyam Registration?

Udyam Registration is a government initiative in India aimed at streamlining the registration process for Micro, Small, and Medium Enterprises (MSMEs). Launched on July 1, 2020, under the Ministry of Micro, Small, and Medium Enterprises, it replaces the earlier MSME registration process and Udyog Aadhaar Memorandum. The objective is to provide a simplified, digital, and paperless registration process for MSMEs to obtain a unique identification number known as the Udyam Registration Number (URN).

What is Udyam Verification?

Udyam verification refers to the confirmation of the registration of an MSME under the guidelines issued by the Ministry of Micro, Small, and Medium Enterprises, Government of India. This confers a unique identification number called the Udyam Registration Number upon every business for recognition as a micro, small, or medium enterprise.

Key Features of Udyam Verification

- Identity Authentication: The business entity is authenticated using Aadhaar, PAN, and GSTIN.

- Validation Classification Validates the investment and turnover limit for determining the size of the business (micro, small, or medium).

- Documented Recognition: Grants a government-issued certificate that authenticates the MSME’s status.

How Udyam Registration Works for MSMEs?

- Visit the Udyam Registration Portal: Access the official portal at https://udyamregistration.gov.in.

- New Registration: If you are an applicant for the first time, then click on “For New Entrepreneurs who are not Registered yet as MSME.”

- Enter Aadhaar Details: Fill in your Aadhaar number and authenticate it with a one-time password generated on the registered mobile number.

- Fill in Business Details: Mandatory details include the name of the business, PAN, type of organization, and location along with the bank’s details.

- Provide Investment and Turnover Information: Add details on plant and machinery investment and also the annual turnover of the business.

- Verify and Submit: After filling out the application form, verify your information and submit it.

- Receive Udyam Registration Number: Upon successful submission, a unique Udyam Registration Number will be issued. You can download the registration certificate for your records.

Importance of Udyam Registration Verification

Udyam Registration Verification confirms that a business is officially recognized as an MSME by the government. This verification helps businesses access benefits like government schemes, priority loans, subsidies, and easier participation in government tenders. It also builds trust with customers, suppliers, and financial institutions by proving the legitimacy of the enterprise. Additionally, verifying Udyam registration protects businesses from fraud by ensuring their information is accurate and secure in the official records.

How to Check the Udyam Registration Status?

- Go to the official Udyam Registration website at https://udyamregistration.gov.in.

- Open the home page of your dashboard. Tap on Verify Udyam Registration in the Menu.

- Enter your 19-digit Udyam Registration Number in the space provided. Do not key in any spaces or have any errors.

- Enter the displayed captcha code to confirm that you are a human.

- Click the “Verify” button as a way forward.

- The portal will reflect the status of your Udyam registration, which will include the validity and other details.

Present Challenges in MSME Lending

Before dwelling on the merits of Udyam Verification, let us consider the current pain points present in MSME lending.

- Trust Deficit: Most MSMEs are informal. Thus they may lack legitimate financial records or credit history. This creates suspicion about their reliability.

- Time-Consuming Processes: Verifying business credentials through traditional methods requires a lot of paperwork and manual assessment, thereby delaying loan approval.

- Risk of Fraud: Without the interposed check from a central system, fraudulent entities may be onboarded by lenders.

- Limited Access to Formal Credit: Research has established that most MSMEs raise finances from informal sources as formal financiers are not willing to give them credit.

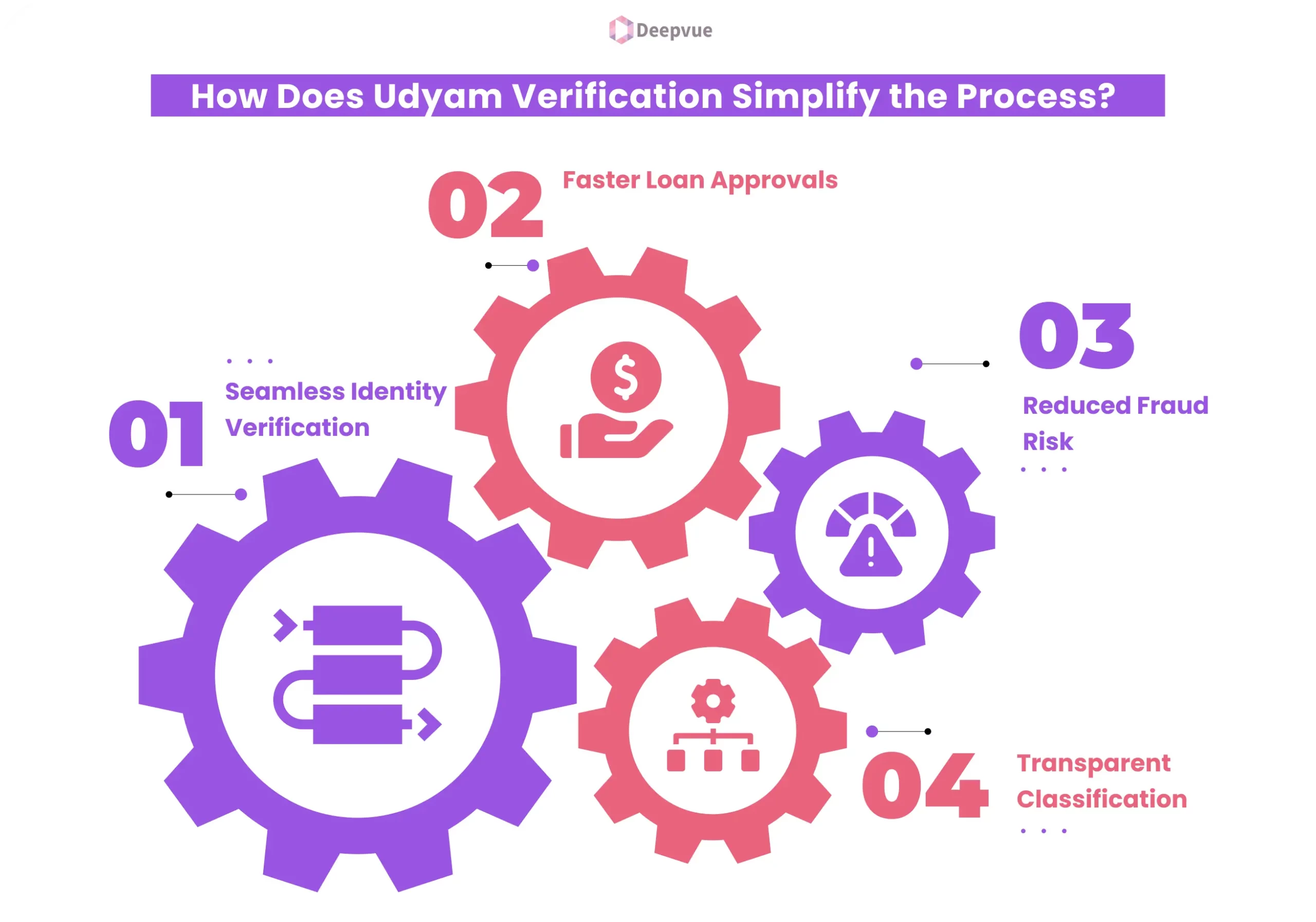

How Does Udyam Verification Simplify the Process?

Udyam Online Verification has been designed to eliminate the problem using a centralized and trusted verification process. Here’s how this changes the nature of lending:

- Seamless Identity Verification: Udyam Online Verification integrates essential business information such as Aadhaar, PAN, GSTIN, and key financial numbers for an overall MSME profile. This will considerably reduce the need for supplementary documentation through paperwork by both lenders and borrowers.

- Faster Loan Approvals: Access to verified and standardized data has promoted the speedy evaluation of loans. Overall, turnaround times are highly reduced so that funds can reach the MSMEs when they are most required.

- Reduced Fraud Risk: The government-issued Udyam Registration Certificate ensures that only genuine businesses qualify for MSME benefits. This is reassuring to the creditors and not prone to fraudulent loaning.

- Transparent Classification: The proper classification of MSMEs is accurate because loan schemes/benefits fall under specific rules, thereby providing equal lending opportunities.

Transformative Impact on MSME Lending

Udyam Verification adoption can have a ripple effect throughout the MSME lending ecosystem. Here’s how it might play out:

- Building Trust: Udyam certificate verification gives lenders confidence in the credibility of a borrower. Trust opens the doors to formal credit for those borrowers who have never borrowed before and more comprehensive financial access to everyone.

- Encouraging Wider Financial Inclusion: Through simplification of the lending process, Udyam Verification allows MSMEs to access loans best tailored to fit their needs, thus promoting much wider financial inclusion in rural and less accessible areas.

- Reduced Cost of Operations for Lenders: Udyam certificate verification reduces the administrative workload of financial institutions. Thus, it is cost-effective, and they will be able to service more MSMEs without increasing overheads.

- Develop Growth for MSMEs: Access to credit promptly enables MSMEs to invest in business expansion, adopt new technology, and improve their competitiveness in the marketplace.

Closing the Gap in MSME Financing

Udyam Verification is more than just a registration process; it is a pivotal tool in reshaping MSME lending. It thus fills this gap between MSMEs and financial institutions by displaying transparency and reducing fraudulent activities, thereby accelerating loan approvals.

Access to formal credit and government benefits, open to MSMEs, provides a secure framework within which lenders can evaluate the borrowers. This helps bring about an all-win situation that promotes economic development as well as financial integration.

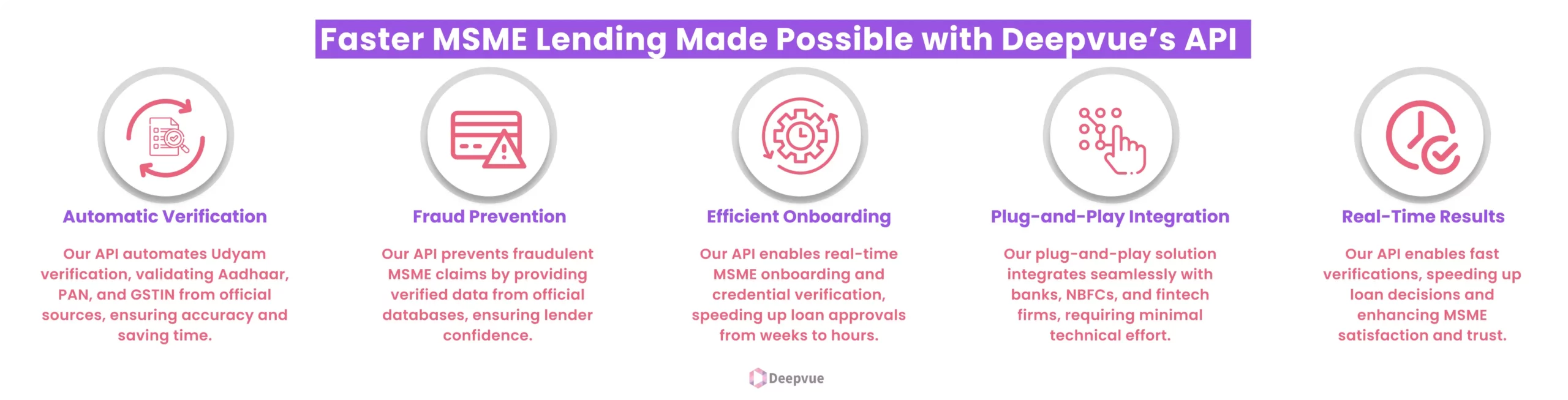

Deepvue’s API for Faster MSME Lending Using Udyam Verification

At Deepvue, our Udyam Verification API streamlines and enhances MSME lending by providing safe, fast, and reliable verification solutions. It is used to deal with some of the principal problems that have arisen in the process of lending.

1. Automatic Verification

Our API automates the entire Udyam verification, thus not involving any kind of manual check. It fetched and validated crucial details like Aadhaar, PAN, and GSTIN from genuine government sources and ensured accuracy while saving valuable time and resources.

2. Fraud Prevention

The risk related to fraudulent claims for MSME lending is high. Our API eliminates the possibility of fraudulent applications by enabling verified data to be received straight from official databases, hence giving lenders confidence to make their decisions.

3. Efficient Onboarding

Onboarding the MSMEs with inefficient processes can discourage them from applying for a loan. With our API, lenders onboard the business in real-time and verify all their credentials, which makes loan approvals faster than weeks to hours.

4. Plug-and-Play Integration

We have designed it for simplicity and seamless integration into existing systems. Whether a bank, NBFC, or a fintech firm, our plug-and-play solution is hassle-free with minimal technical effort.

5. Real-Time Results

Our API gives the lender instant verifications, and thereby he can make a decision faster. MSMEs receive timely finance with this, which boosts customer satisfaction along with trust in the service.

FAQ:

What is Udyam Verification?

Udyam Verification is used to ascertain the MSME’s Udyam Registration to evidence its business existence to the government.

Why does Udyam Verification become essential for MSME lending?

Udyam Verification provides lenders with the credibility of MSMEs, thereby reducing loan approval time as well as risks.

How does Udyam Verification benefit MSMEs?

Udyam Verification makes access to credit easier and increases credibility, allowing MSMEs to access benefits through schemes of the Government.

What are the verified details through Udyam Verification?

Udyam Verification process verifies identity (Aadhaar, PAN), GSTIN, business classification, and financial parameters.

How Does Udyam Verification Reduce Frauds?

Udyam Verification contains government-verified data so that only valid businesses get registered with little fraudulent claims.