Address verification might not be the most exciting part of financial operations, but its significance cannot be overstated. In a business founded on trust, accuracy, and compliance, verifying a customer’s address as correct and current is an essential step toward avoiding fraud, staying compliant, and providing frictionless service.

But address verification is more than a simple string match against a database. There are variations in address formats, it is subject to human error, and there are complexities from around the world. If left unchecked, incorrect address data can contribute to compliance failures, communication breakdowns, and lost brand reputations.

Why is Address Verification Important?

- Prevention of Fraud: Address verification prevents the possibility of a person other than the account or card owner making a transaction, thereby minimizing the risk of identity theft and fraud.

- Regulatory Compliance: Several industries, particularly financial services, need to validate customer addresses to meet KYC (Know Your Customer) and AML (Anti-Money Laundering) requirements.

- Customer Experience Betterment: Proper address verification helps ensure that communications, statements, and deliveries arrive on time and as expected, resulting in an improved and more consistent experience.

Methods of Address Verification

- Proof of Address Documents: Users are asked to upload official documents, like utility bills, bank statements, or government-issued letters, that clearly show their name and residential address.

- AI-Powered Document Analysis: Sophisticated AI algorithms check documents uploaded for authenticity, tampering, or forgery detection and automatically extract and verify address data with high accuracy.

- Geolocation Data: Geolocation from devices (such as GPS or IP address) with the user’s permission is utilized to validate by matching whether the user’s location is the same as their stated address, providing an additional level of confirmation.

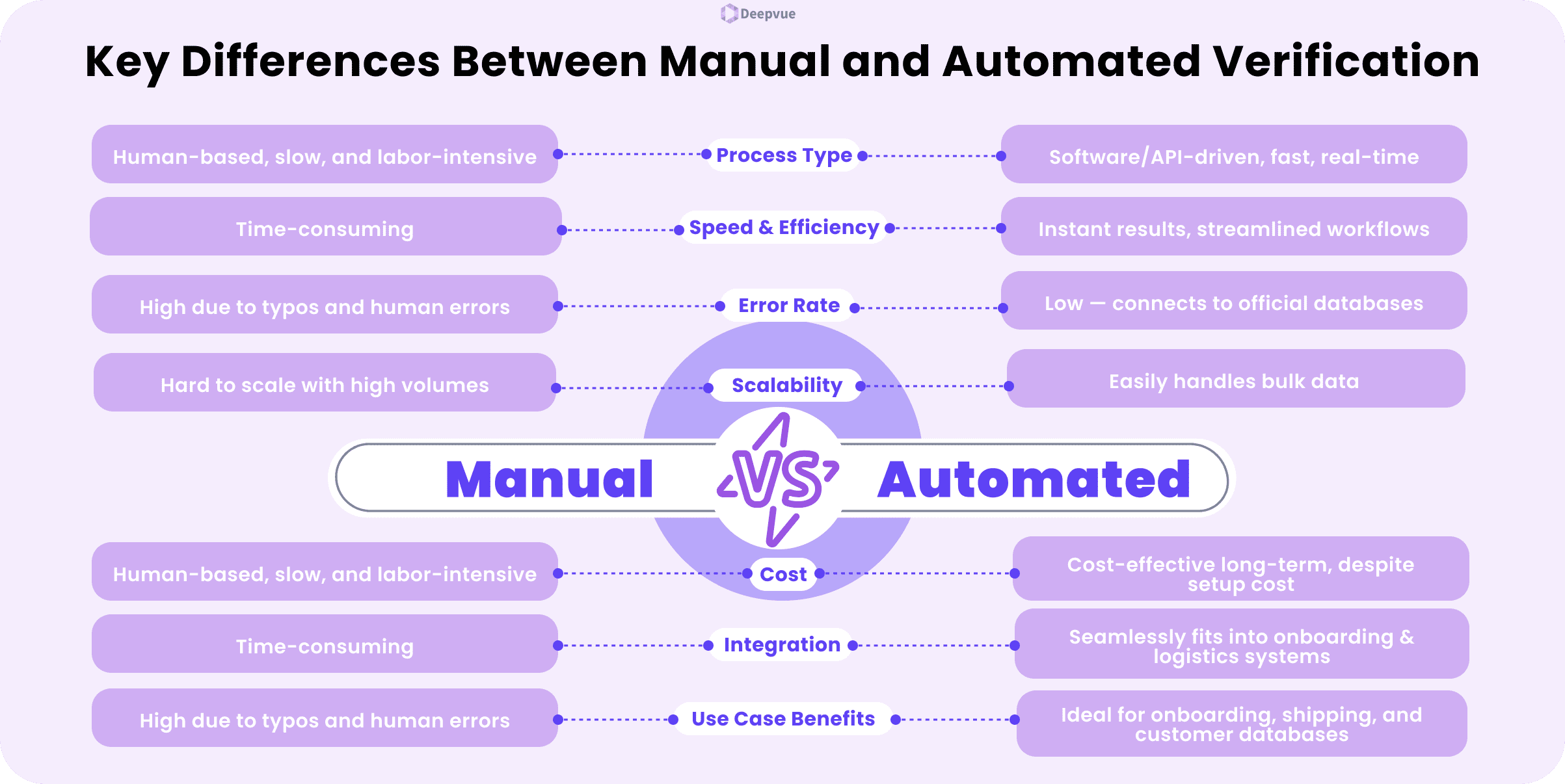

Manual vs. Automated Address Verification

Manual address verification requires human labor to validate and verify address information, which tends to be error-prone and time-consuming. Automated address verification employs software utilities or APIs to verify, normalize, and correct address information immediately, enhancing speed and accuracy.

Effectiveness of Automated Solutions

Automated address verification processes handle high data volumes in real-time, dramatically cutting turnaround time. They are fully integrated into business processes and facilitate quick form filling, dispatching, and onboarding customers with minimal manual effort.

Error Reduction in Automated Processes

Automation greatly reduces errors caused by typos, inconsistent formats, or outdated databases. Such systems usually connect to official postal databases (e.g., USPS, Royal Mail, etc.), which provide accurate and standardized addresses each time.

Cost Implications

Though automated systems entail initial integration costs, they end up saving money in the long term through minimizing manual handling, fewer failed deliveries, and optimizing business efficiency. Reduced errors translate into reduced costs for returns, customer care, and regulatory matters.

Industry Applications of Address Verification

- Banking Industry: Banks apply address verification to achieve KYC (Know Your Customer) compliance, fraud prevention, and proper customer records during account opening and loan applications.

- E-commerce and Shipping: E-commerce websites and logistics companies depend on address verification to minimize delivery errors, avoid fraudulent transactions, and enhance customer satisfaction through timely and accurate order completion.

- Real Estate Transactions: Address verification plays a vital role in real estate to verify property ownership, authenticate client identities, and avoid title fraud in the sale, leasing, and mortgage approval of properties.

Challenges in Address Verification

- Paperwork Management: Physical documents hold a higher probability of loss or damage, human error, delays in processes, and difficulty maintaining organized records in case of audit or customer complaint.

- Data Storage Security: Sensitive customer information must be stored in a highly secure cybersecurity environment. Without adequate encryption, access controls, and timely security updates, systems are left exposed to intrusions, data leakage, and cyberattacks.

- Maintaining Customer Data Privacy: Protecting information of a personal nature means being compliant with regulations such as GDPR or CCPA. Firms need to have stringent data handling practices, restrict access, and provide transparency to uphold customer confidence and prevent legal action.

Best Practices for Effective Address Verification

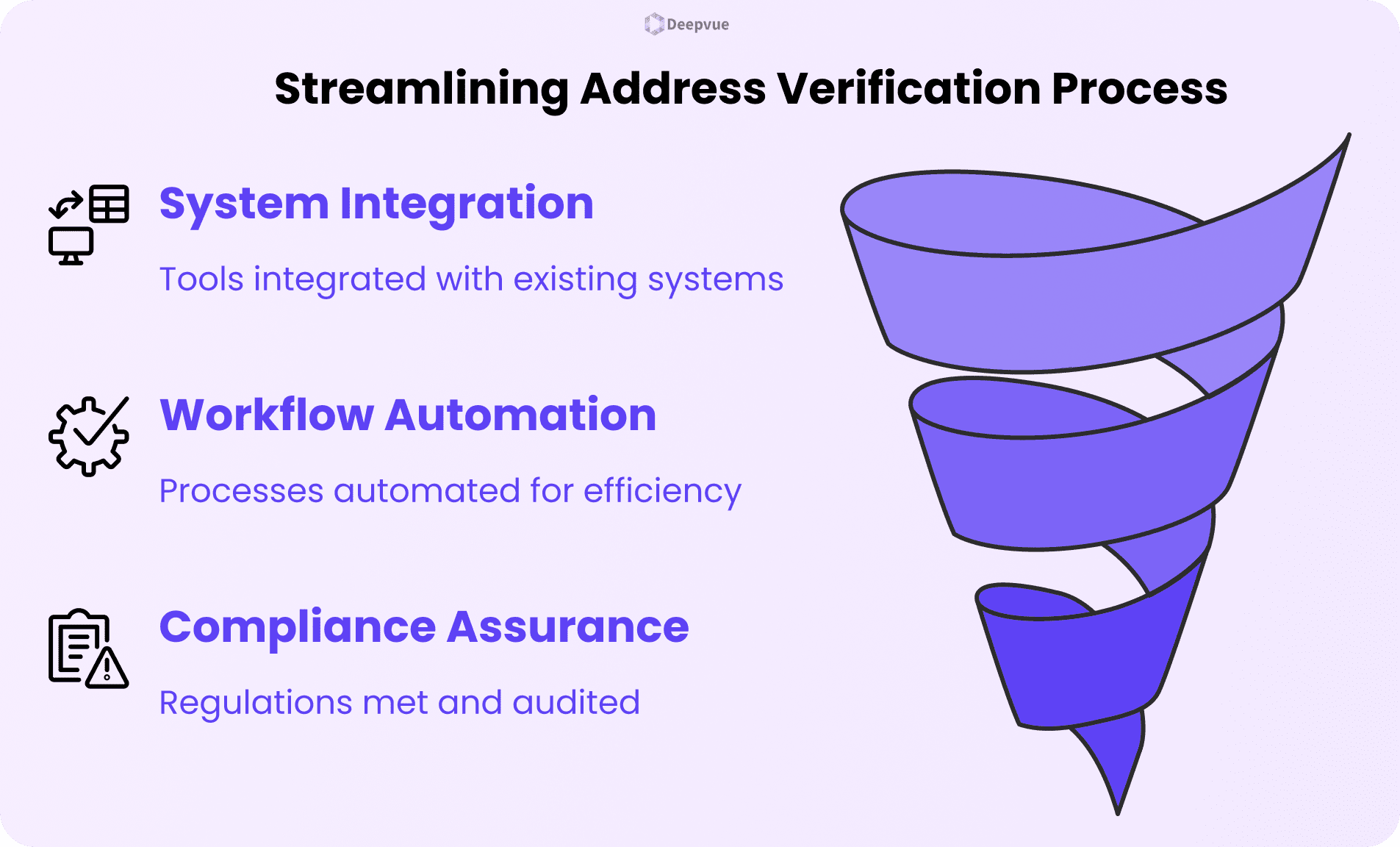

Integration with Existing Systems

- Select address verification tools that are easy to integrate through APIs or SDKs.

- Make sure it’s compatible with your CRM, onboarding, and payment tools.

- Implement middleware or integration platforms to seamlessly link legacy systems.

- Allow bi-directional data synchronization to maintain records up-to-date on all platforms.

Streamlining the Verification Process

- Automate verification workflows to reduce manual intervention and errors.

- Use real-time validation and decision-making to accelerate onboarding.

- Minimize user friction with auto-fill and data pre-population features.

- Embed verification into current forms or apps to ensure the process remains seamless.

Compliance with KYC and AML Regulations

- Make sure address verification tools comply with regulatory expectations in your region.

- Have clear audit trails of verification attempts and results in place.

- Incorporate address checks within a more extensive Customer Due Diligence (CDD) approach.

- Update your verification rules constantly by changing KYC/AML policies.

Conclusion

Accurate address verification is a cornerstone of secure and compliant financial operations. By investing in a robust address verification service, organizations can minimize the risk of fraud, reduce onboarding friction, and stay ahead of evolving regulatory requirements. The outcome is not only smoother operations but also more robust customer relationships founded on trust and transparency.

Our Aadhaar Verification API streamlines and secures the address verification process by authenticating user information directly with UIDAI records. It guarantees that the submitted data is accurate, tamper-proof, and government-verified. Our API is designed to easily integrate with your onboarding or verification workflows, remaining compliant while providing a secure and hassle-free customer experience.

FAQs

Why is address verification important in financial services?

Address verification avoids fraud, helps comply with AML and KYC regulations, and authenticates proper customer communication, critical for customer trust and regulatory penalties.

How does address verification aid in regulatory compliance?

It confirms customer identities and marks inconsistencies that could reveal suspicious transactions, enabling institutions to comply with international regulatory standards such as AML and FATF guidelines.

What are the standard practices employed for address verification?

Methods include document-based verification (e.g., utility bills), third-party data checks, postal address databases, and real-time verification APIs.

What is address verification used for?

The reason for address verification is to check the validity of a customer’s address in order to match it against official documents. This serves to prevent fraud, meet regulatory requirements, and facilitate smooth communication for transactions and legal issues.

Why are banks required to verify their address?

Address verification is required by banks to meet Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance. Address verification serves to authenticate customer identities, allowing for a lower risk of fraud and ensuring correct routing of transactions and communications.