Businesses need robust security measures to maintain a seamless user experience in this digital-first world.. One critical aspect of this security is Know Your Customer (KYC) verification. Traditionally, KYC has been a manual, time-consuming process.

However, with advancements in technology, automated KYC verification is becoming the norm, offering quick and accurate verification of customer identities. This guide will explore the benefits of automated KYC verification for businesses, focusing on how it enhances efficiency, compliance, and customer satisfaction.

Key Problems with Manual KYC in Business Operations

Despite being a crucial part of onboarding and compliance, manual KYC (Know Your Customer) processes often hinder operational efficiency for businesses. Here are the primary challenges associated with traditional KYC:

- Time-Consuming Processes: Manual verification requires significant time to collect, review, and authenticate customer documents, leading to long onboarding cycles and potential customer dissatisfaction.

- High Operational Costs: Manual processes involve extensive human resources for data collection, verification, and compliance checks, increasing operational expenses for businesses.

- Increased Error Rates: Human involvement in data entry and document verification often results in mistakes, leading to incorrect KYC outcomes and compliance risks.

- Risk of Fraud and Document Forgery: Manual verification makes it difficult to detect sophisticated fraud attempts or forged documents, increasing the risk of identity theft and financial fraud.

- Poor Customer Experience: Lengthy and cumbersome KYC processes can frustrate customers, leading to higher drop-off rates during onboarding and diminished user satisfaction.

- Compliance and Regulatory Risks: Failure to maintain accurate and timely KYC records manually can result in non-compliance with regulatory requirements, leading to hefty fines and reputational damage.

- Limited Scalability: Manual KYC processes are not scalable, making it difficult for businesses to handle high customer volumes during peak periods or expansion phases.

What is Automated KYC Verification?

Automated KYC verification uses advanced technology to streamline the KYC process. Instead of manually verifying documents and identities, automated systems can quickly and accurately process this information, reducing the time and cost associated with compliance. This technology is essential for businesses that need to adhere to regulatory requirements while maintaining high levels of customer service.

Manual vs. Automated KYC Verification

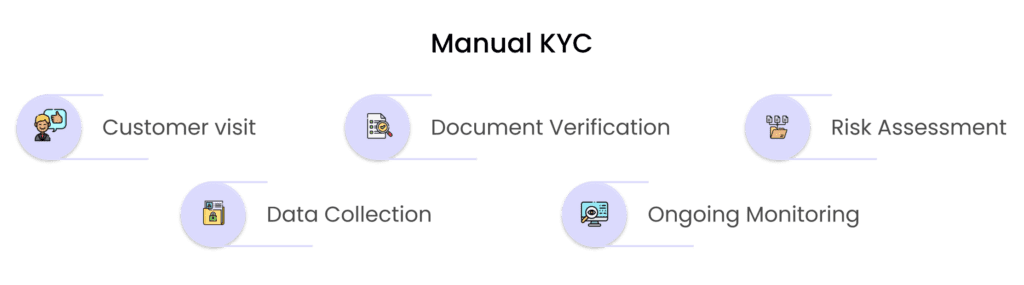

Manual KYC Verification

Manual KYC verification involves several steps:

- Data Collection: Customers provide personal information and identification documents.

- Document Verification: Employees manually verify the authenticity of the documents.

- Risk Assessment: Customers are checked against watchlists and databases to identify potential risks.

- Ongoing Monitoring: Customer activities are monitored to detect suspicious transactions.

While manual KYC can be effective, it is often slow and prone to human error. This method can also be costly due to the need for dedicated staff to handle the verification process.

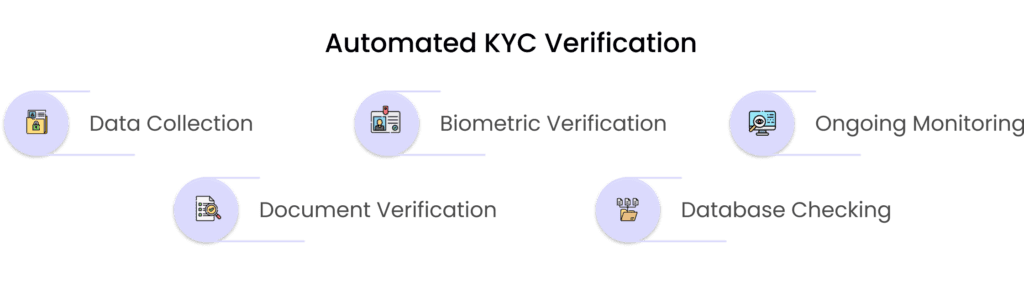

Automated KYC Verification

Automated KYC verification simplifies the process through technology:

- Data Collection: Customers upload or scan photos of ID documents.

- Document Verification: Advanced algorithms verify the authenticity of the documents.

- Biometric Verification: Customers take a selfie to confirm their identity, with systems performing liveness checks to ensure they are real.

- Database Checking: Customers are automatically compared to watchlists and databases.

- Ongoing Monitoring: Machine learning and data analysis continuously monitor customer activities for suspicious behavior.

This automated approach significantly reduces the time and cost associated with KYC verification while improving accuracy and compliance.

Benefits of Automated KYC Verification

1. Efficient Operations

Automated KYC verification drastically reduces the time required for customer onboarding and verification. What used to take days can now be completed in minutes, enhancing the customer experience and allowing businesses to operate more efficiently.

2. Cost-Effective

By reducing the need for manual intervention, automated KYC systems lower operational costs. Businesses can save on labor and reduce the paperwork involved in the verification process, making it more cost-effective.

3. Continuous Compliance

Automated KYC solutions offer perpetual KYC (pKYC), continuously monitoring and updating customer information. This ensures that businesses remain compliant with regulations, manage risks better, and maintain accurate customer profiles.

4. Enhanced Security

Advanced security features in automated KYC systems help prevent identity theft and money laundering. This added layer of protection benefits both financial institutions and their customers, fostering trust and security in business relationships.

5. Improved Customer Experience

Faster verification processes lead to a better customer experience. Customers appreciate fast, seamless onboarding, which can increase satisfaction and loyalty.

Use Cases of Automated KYC Verification

Digital Customer Onboarding

Online lenders and financial institutions use automated KYC to simplify the application process. Applicants can digitally upload their documents, and their identities are verified in minutes, streamlining the procedure and enhancing user experience.

Financial Services

Banks, investment firms, and other financial institutions utilize automated KYC to assess risks and verify customer identities. Automation helps these businesses follow stringent financial regulations like AML/CTF, reducing customer onboarding costs and time.

E-Commerce

Online marketplaces, such as Amazon and eBay, use automated KYC to verify seller identities and prevent fraudulent activities. This increases security and builds customer confidence in the platform.

Healthcare

In healthcare, automated KYC processes ensure compliance with regulations like the Health Insurance Portability and Accountability Act (HIPAA). This protects patient information and ensures only authorized personnel have access to critical data.

Cryptocurrency

Cryptocurrency platforms require efficient KYC verification to follow regulations and prevent money laundering. Automated KYC services can verify users quickly, helping these platforms maintain compliance and avoid sanctions.

Choosing the Best Automated KYC Solution

When selecting an automated KYC solution, consider the following factors:

- Integration: The solution should easily integrate with your existing systems.

- Document Coverage: Ensure the solution can verify a wide range of documents.

- Security: Look for advanced security features to prevent fraud.

- Scalability: The solution should scale with your business as it grows.

- User-Friendliness: The system should be easy for both customers and employees to use.

Evaluating vendors based on these criteria will help you find a solution that meets your business needs and ensures seamless onboarding without compromising security.

Conclusion

Automated KYC verification is revolutionizing how businesses handle customer verification and compliance. By leveraging advanced technology, businesses can reduce costs, increase efficiency, and enhance security while providing a better customer experience. When choosing an automated KYC solution, prioritize security, scalability, and ease of use to stay ahead of fraudsters and ensure regulatory compliance. This proactive approach will build customer trust and loyalty, positioning your business for success in the digital age.

For more information on how Deepvue.tech can help you implement automated KYC verification solutions, visit our website or contact our team today.

FAQs

What is Automated KYC Verification?

Automated KYC Verification is the use of advanced technology to streamline the Know Your Customer (KYC) process. This involves the rapid and accurate verification of customer identities through automated systems, reducing the need for manual intervention and minimizing the time and cost associated with compliance.

How does Automated KYC Verification improve efficiency?

Automated KYC verification significantly reduces the time required for customer onboarding and verification. Instead of days, the entire process can be completed in minutes. This efficiency not only enhances the customer experience but also allows businesses to operate more effectively and allocate resources to other critical areas.

Is Automated KYC Verification secure?

Yes, automated KYC verification systems are designed with advanced security features to prevent identity theft, fraud, and money laundering. These systems use biometric verification, liveness checks, and continuous monitoring to ensure the authenticity of customer identities and safeguard sensitive information.

How does Automated KYC Verification ensure compliance?

Automated KYC solutions offer continuous monitoring and updating of customer information, known as perpetual KYC (pKYC). This ensures that businesses remain compliant with regulatory requirements, manage risks better, and maintain accurate customer profiles. Automated systems also reduce the risk of human error, ensuring flawless adherence to regulations.

Can Automated KYC Verification be customized for different industries?

Absolutely. Automated KYC solutions can be tailored to meet the specific needs of various industries, including banking, financial services, e-commerce, healthcare, and cryptocurrency platforms. These solutions can verify a wide range of documents and integrate with existing systems to provide seamless, industry-specific compliance and security.