Merchant Category Codes (MCC) are crucial for payments and financial services. If you’ve set up a card program or run a business that accepts payments, you’ve likely come across these four-digit codes. Let’s dive into what MCCs are, how they work, and why they’re significant for businesses, especially in the Indian market.

What is a Merchant Category Code (MCC)?

A merchant category code (MCC) is a four-digit number given to a business by payment card networks such as Visa, Mastercard or Rupay which denotes the main goods or services that the business provides. Initially developed for tax purposes, MCCs have now become so vital in the ecosystem of payment processing. They help in transaction categorization and interchange fees determination, tax reporting besides even rewards systems.

How are MCCs Used in Transactions?

MCCs play a pivotal role in how transactions are processed. Here’s how they are used:

1. Interchange Rates

These are fees paid by merchants to the card-issuing banks for facilitating card transactions. The interchange rate of any particular business depends on its MCC as different businesses carry different kinds of risk levels . For instance, a supermarket might have lower interchange rates than an online gaming platform due to lesser fraud risks involved.

2. Cardholder Fees

Some MCCs allow merchant businesses to charge additional fees from customers holding cards. For example government services may impose service charges on card payments.

3. High-Risk Merchant Identification

Payment processors use MCCs to evaluate riskiness of businesses whereby high-risk companies like telemarketers often get charged more fees due to higher levels of fraud and chargebacks.

4. Chargeback Protection

Fraud protection level that a company gets is also affected by its MCC. High-risk MCCs such as those used by telemarketing companies or online pharmacies may receive less protection due to more likelihood of fraud taking place.

5. Tax Reporting

They provide information needed for taxation thus helping both consumers using credit cards and their respective companies know what transactions have to be declared on a tax return.

How MCCs Can Boost Credit Card Rewards?

- MCCs are four-digit codes assigned to businesses based on the type of goods or services they offer. Credit card issuers use these codes to determine bonus rewards eligibility.

- Many credit cards offer higher rewards for specific MCC categories like dining, groceries, travel, and gas. Knowing a merchant’s MCC helps you use the right card for maximum rewards.

- If a store’s MCC aligns with a bonus category on your credit card, you can earn extra points, miles, or cashback instead of the standard rate.

- Some merchants may not have the expected MCC. For example, a restaurant inside a hotel may be coded as “Hotel” rather than “Dining,” affecting your rewards.

- Some banks provide MCC details on transaction histories. Third-party tools and forums also help identify MCCs for different businesses.

Why are MCCs Important?

MCCs offer several benefits for businesses and card programs:

1. Setting Spending Controls

Businesses can use MCCs to set spending limits on issued cards. For instance, a company can restrict employees from using corporate cards at non-work-related businesses.

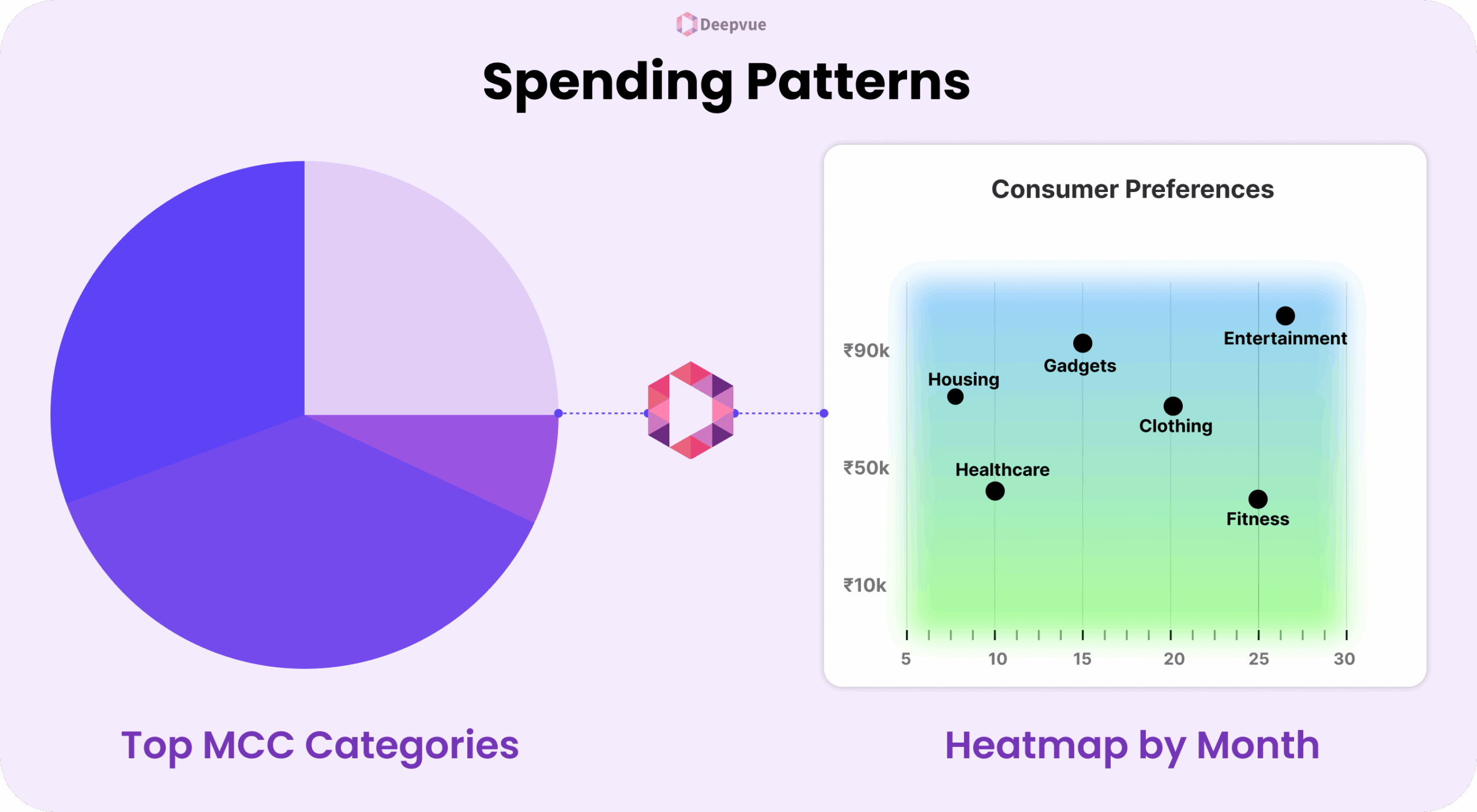

2. Gathering Data on Cardholder Spend

MCCs provide valuable data on where and how cardholders are spending their money. This data can help businesses tailor their offerings and marketing strategies.

3. Rewarding Cardholders

Rewards programs often rely on MCCs to determine eligible transactions. For example, a card might offer extra points for purchases made at travel-related MCCs.

How to View MCC for Transactions?

To view MCC (Merchant Category Codes) for transactions, check your transaction details through online banking, mobile banking apps, or monthly statements. Some banks and financial institutions display MCCs alongside each transaction. Alternatively, you can contact customer support for specific MCC information. Business account holders may access transaction reports or merchant statements that include MCCs. Additionally, credit card networks like Visa and MasterCard provide MCC lookup tools for reference.

Businesses can view MCCs for each transaction through their payment processor’s dashboard or API. For example, Deepvue.tech provides detailed transaction data, including the MCC, helping businesses analyze spending patterns and optimize their financial operations.

MCC List in India

While the exact MCCs can vary slightly between card networks, here is a general breakdown of common MCC ranges in India:

- 0001–1499: Agricultural services

- 1500–2999: Contracted services

- 4000–4799: Transportation services

- 4800–4999: Utility services

- 5000–5599: Retail outlet services

- 5600–5699: Clothing shops

- 5700–7299: Miscellaneous shops

- 7300–7999: Business services

- 8000–8999: Professional services and membership organizations

- 9000–9999: Government services

Enhancing Your Card Program with MCCs

Understanding and leveraging MCCs can significantly enhance your card program. Here’s how:

1. Customizing Spending Controls

By using MCCs, you can tailor spending controls to match your business operations. For instance, a firm giving travel allowances may limit usage of cards to travel-related MCCs only.

2. Optimizing Rewards Programs

MCCs allow businesses to fine-tune their rewards programs. When specific MCCs are rewarded with gifts or cash back, this encourages purchases in preferred categories such as office supplies or travel.

3. Analyzing Transaction Data

MCCs provide a wealth of data that can be used to analyze transaction patterns. This insight can help businesses make informed decisions about marketing strategies and customer engagement.

How to Get the Right MCC Code for Your Business?

- Contact your merchant service provider or acquiring bank to determine the MCC code assigned to your business.

- Refer to MCC code lists provided by Visa, Mastercard, or your payment processor to identify the most suitable category for your business.

- If your business is misclassified, ask your payment processor to update your MCC code with proper documentation explaining your business activities.

- Ensure the assigned MCC code aligns with credit card network classifications, as different networks may categorize businesses slightly differently.

- Your bank may help you select the most appropriate MCC code, especially if it affects fees, chargebacks, or tax reporting.

- Regularly review transactions to ensure that your MCC code accurately reflects your business type and does not negatively impact processing fees or customer rewards eligibility.

Deepvue.tech’s Merchant Category Classification API

Deepvue.tech offers a comprehensive Merchant Category Classification API that utilizes deep learning to identify MCCs from retail stock photographs of your merchants. This automated system enhances productivity, saves time, and minimizes errors during merchant onboarding.

What is Automated Merchant Category Verification?

Automated merchant category classification is the process of identifying and categorizing merchant stock images into their underlying categories. Traditionally, this task was done manually, but with Deepvue.tech’s API, it’s streamlined through computer vision and deep learning. This automation improves productivity and reduces the time and resources required for merchant onboarding.

Key Features of Deepvue.tech’s Merchant Category Classification API:

- Accurate Predictions: High accuracy in identifying merchant categories.

- Train Using Your Own Data: Customizable training with your specific data set.

- No-Code, Flexible, and Easy to Use: User-friendly interface requiring minimal technical knowledge.

- Customizable Categories: Tailor the classification to fit your business needs.

Benefits:

- Minimize Risk During Merchant Onboarding: Check merchant categories quickly to lower onboarding risk.

- Quick Turnaround Time (TAT): Validate PAN cards and get clean data in 15 seconds or less.

- Manage Purchase Orders: Saves money and avoids human errors by reducing verification time with OCR-enabled API.

- Redirect Operations for Critical Tasks: High uptime and success rates ensuring uninterrupted business operations.

Conclusion

Merchant Category Codes (MCCs) are an integral part of the payments processing ecosystem, providing various benefits ranging from setting spending controls to optimizing rewards programs. By understanding and leveraging MCCs, businesses can improve their card programs while gaining insights into their financial processes. Subsequently, this enables them to refine their strategies further thus enhancing financial management particularly for organizations operating within India that should be well familiarized with local MCC lists.

For more information on how MCCs can benefit your business and to get detailed transaction insights, visit Deepvue.tech – your partner in financial integrations and insights.

FAQs

What are Merchant Category Codes (MCCs)?

These are four digit numbers assigned by payment card networks used to classify the types of goods or services sold by a business. They are used during transaction processing for interchange fee calculations, setting spending limits etc.

How do MCCs affect interchange fees?

The interchange rate is influenced by the MCC that a company has. The level of risk associated with different MCCs affects the interchange rate as well. As an example, firms operating in less risky sectors may face lower interchange fees than those in high-risk sectors.

Can businesses choose their own MCCs?

MCCs are not chosen by businesses themselves. Payment processors are responsible for allocating MCCs based on what type of goods or services they primarily provide. Nevertheless, if they fulfill the requirements for such an MCC, enterprises can ask their payment processor to assign them a specific one.

How can businesses view their MCC for transactions?

A business can see its MCC either through its payment processor’s dashboard or API. For example, Deepvue.tech provides transaction-level data including the merchant category code (MCC), which is helpful for businesses wanting to do financial performance analysis and optimization).

Why are MCCs important for rewards programs?

MCCs are crucial for rewards programs as they help determine eligible transactions for rewards. For example, if a card offers extra points for travel-related purchases, the MCC helps identify qualifying transactions, ensuring cardholders receive their rewards.