A dormant account is a bank or money account that has not experienced any activity for a long time, usually from six months to a number of years, based on the policies of the institution. Such accounts, abandoned by their owners, may be risky to both the owners of the accounts and financial institutions. For individuals, dormant accounts could result in lost funds or lost chances of effectively managing finances. Dormant accounts may be at risk for fraud or identity theft if not adequately watched for by banks.

Dormant accounts are prone to potential fraud, unclaimed funds, or even regulatory problems, and their identification and control are therefore of great significance. The starting point towards improved financial well-being and security is to understand what a dormant account is. The correct handling of dormant accounts ensures that customer monies are protected, records are kept up-to-date, and legal compliance is maintained.

What is a Dormant Account?

A dormant account is a bank or financial account that has seen no customer-driven transactions, such as deposits, withdrawals, or transfers, over a period of time, usually 1 to 2 years. Even though the account is open, it is deemed inactive since there has not been any activity from the account holder.

According to a recent report by the Reserve Bank of India (RBI), there are over 10 crore dormant accounts in the country, holding nearly ₹35,000 crore in unclaimed deposits.

Difference between Dormant and Inactive Accounts

- Dormant Account: An account that has seen no customer activity over a long period of time and typically requires the customer to reinstate it by conducting a transaction or by contacting the bank. It is typically subject to special restrictions or monitoring because it has been inactive.

- Inactive Account: Used sometimes interchangeably with dormant, but usually an account that has little or no movement within a shorter time span, or accounts with little activity but not yet dormant. Inactive accounts may not have the same impediments or official classification as dormant accounts.

Reasons for Account Dormancy

- Lack of Customer-Driven Transactions: An account is said to be dormant when the customer fails to perform any transactions, for example, deposits, withdrawals, or transfer of funds, for an extended period. Without a transaction, the bank identifies the account as inactive or dormant to minimize threats such as fraud or misuse.

- General Misconceptions about Dormancy: Some customers have the impression that merely checking their account balance or getting statements are considered Dormant account activity, while most banks expect actual monetary transactions to maintain the account active. Others argue that dormant accounts are automatically closed, but actually, they get frozen with limited access until reactivated by the customer.

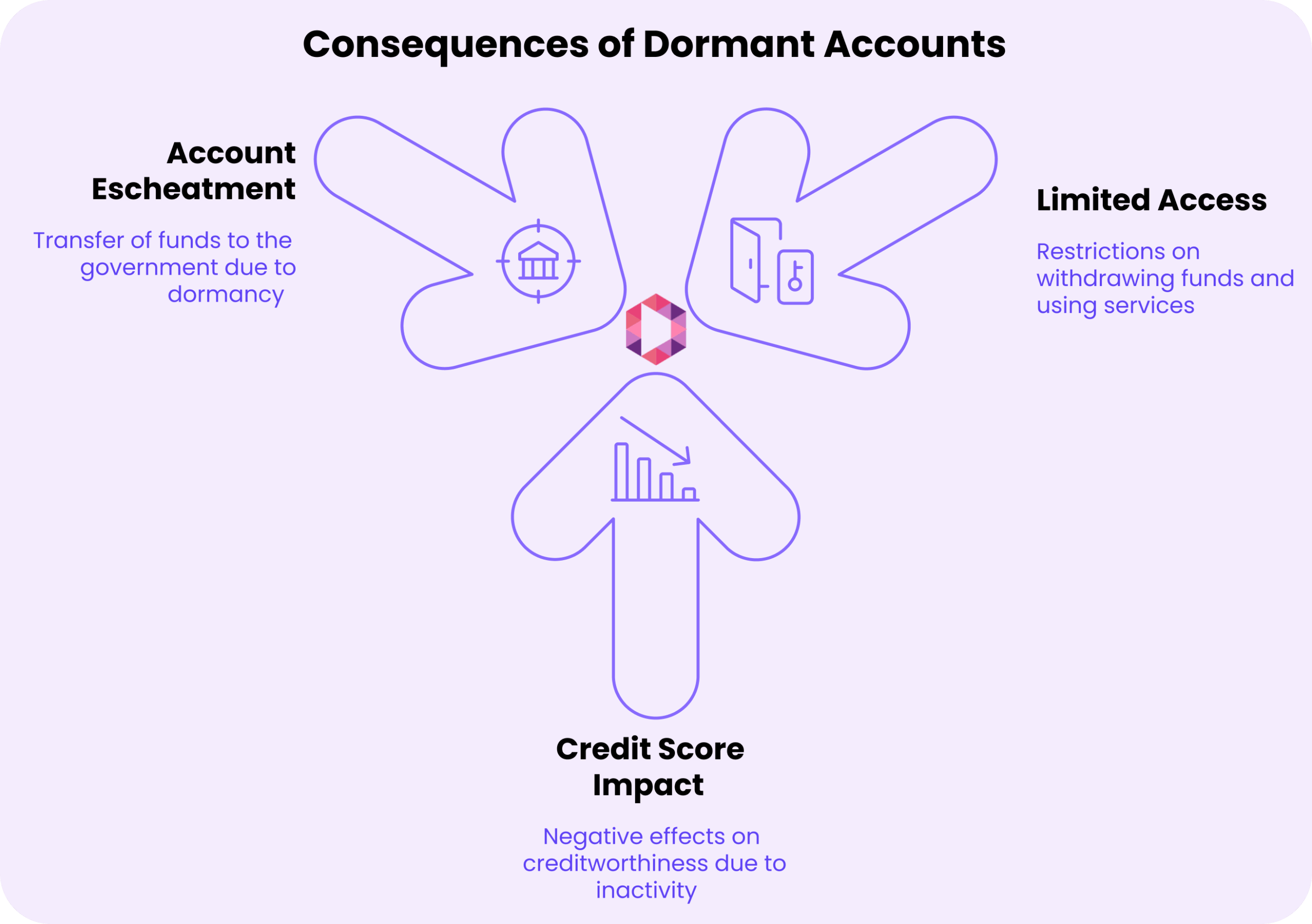

Consequences of Having a Dormant Account

- Limited Access to Money and Services: Once you have a dormant account, banks can limit your access to the account. You may not be able to withdraw funds, transact, or utilize related services until you re-register the account by confirming your identity or contacting the bank.

- Effect on Credit Scores: Dormant accounts, particularly credit accounts, can have a negative effect on your credit score. Inactivity can decrease your credit utilization percentage or make lenders perceive you as less active, which in turn can affect your creditworthiness.

- Risk of Account Escheatment: Financial institutions can move the money to the government if an account is left dormant for a very long time under escheatment laws. Retrieval of funds later can be extremely lengthy and may also be complicated with the need to pursue legal or administrative processes.

How to Manage and Prevent Dormant Accounts?

- Make Periodic Transactions: Keep your account running by making small withdrawals, deposits, or transfers on a regular basis. Even a minimal transaction every few months may avoid your account from getting dormant.

- Take Advantage of Auto Debit Facilities: Arrange for automatic payments or transfers such as utility bills, subscriptions, or EMIs. This creates active movement in your account and prevents dormancy.

- Stay Informed about Bank Policies: Review your bank’s policies on dormancy accounts, such as periods of inactivity and fees. Being informed allows you to act on time to prevent closure of the account or avoid charges.

Steps to Reactivate a Dormant Account

Internet Banking Options

- Log in to your internet banking portal using your credentials.

- Search for the option to activate or reactivate your inactive account.

- Go through the instructions on the screen, which will prompt you to verify your identity via OTP or security questions.

- Make any required e-KYC transactions online, if possible, to activate the account instantly.

Calling Customer Service

- Call your bank’s customer service line.

- Inform the customer representative that you would like to make a dormant account active.

- Provide the necessary details, such as account number, identification, and answer security questions.

- Adhere to their instructions, which may involve providing documents or filling out formalities.

Visiting a Bank Branch

- Visit the nearest branch of your bank with valid photo identification (like Aadhaar, passport, or driver’s license).

- Ask the bank officer to activate your dormant account.

- Complete any forms needed and provide supporting documents for identification purposes.

- You might be required to deposit or withdraw a minimal amount to open the account.

- Your account will be reactivated and ready for use once it has been processed.

Importance of Maintaining Active Accounts

- Financial Stability: Maintaining active accounts ensures ongoing access to your money and financial services, which enhances easy money handling and avoids disruption in payments of bills or deposits of income.

- Avoiding Extra Charges and Fines: Inactive accounts can attract maintenance charges, penalty fees, or even be shut down by the bank, which is a source of inconvenience and potential additional expenses. Staying active prevents these unnecessary expenses.

- Sustaining Credit Scores: Open accounts, particularly credit accounts, help your credit history and credit utilization rate. Closing down or allowing accounts to become inactive can decrease your credit score and affect your capacity for obtaining future loans or credit.

Conclusion: Staying Proactive with Account Activity

Dormant accounts, though not active, need proper attention to avoid loss of money and security threats. With the realization of their significance and adherence to proper management guidelines, account holders and financial institutions can keep money safe and available when required. For financial institutions, the identification and management of dormant accounts in a timely manner ensures compliance and customer confidence.

Our bank account verification bank API provides an additional level of security by verifying account status in real-time and allows businesses to identify inactivity ahead of time. This forward-looking vision provides smoother compliance, mitigates fraud risks, and facilitates current account engagement.

FAQs

What happens if my account is dormant?

The account may be restricted from transactions, and the bank may classify it as inactive, which could lead to additional monitoring or freezing until reactivation.

Can a dormant bank account be reactivated?

Yes, most likely, a dormant account can be reactivated by going to the bank and undertaking the necessary verification or transaction procedures.

For how long is a bank account dormant?

Normally, a bank account would be deemed dormant after 12 to 24 months of inactivity, depending on the bank’s policy.

What is the definition of a dormant account?

A dormant account refers to an account that has no deposits, withdrawals, or other money movement in it for a long time and hence is inactive.