Payment Service Providers (PSPs) have become the driving force for electronic payment processing for both consumers and merchants. Serving as a middleman between the merchant, consumer, and financial institutions, PSPs assist in the smooth transaction of online payments across numerous channels such as credit cards, e-wallets, and bank transfers.

RAs are instrumental in ensuring the compliance and legitimacy of PSPs with national and international financial systems. They supervise the registration and licensing of PSPs, impose compliance with legal systems, and ensure transparency and security in payments.

Understanding Payment Service Providers (PSPs)

Payment Service Providers (PSPs) are third-party companies that enable businesses to accept electronic payments from customers. They serve as facilitators between merchants, consumers, banks, and card networks to swiftly and securely process transactions. PSPs enable numerous payment options including credit/debit cards, digital wallets, bank transfers, and others.

A survey by Businesswire indicates that 70% of customers like digital payment methods, and McKinsey studies indicate that 62% of consumers have more than one digital payment vehicle.

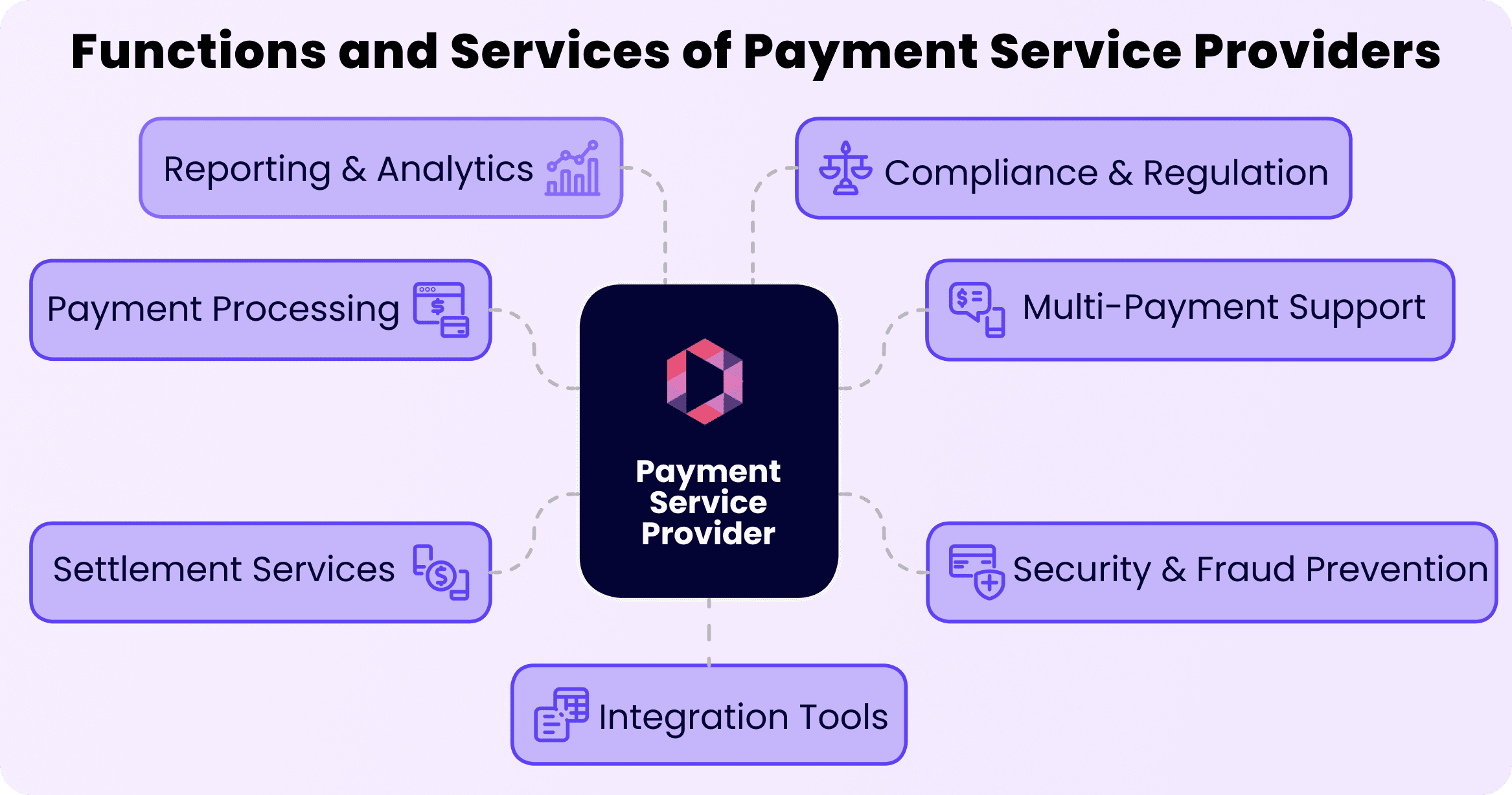

Key Functions and Services

- Payment Processing: Ensure safe transactions among buyers and sellers.

- Multi-Payment Support: Process payments from multiple sources such as cards, wallets, UPI, and bank transfers.

- Security & Fraud Prevention: Provide encryption, tokenization, and fraud detection software.

- Settlement Services: Facilitate on-time transfer of funds from the customer’s bank to the merchant’s account.

- Reporting & Analytics: Offer reports on transactions, dashboards, and business performance insights.

- Compliance & Regulation: Assist companies to meet PCI DSS, KYC, and other regulatory requirements.

- Integration Tools: Provide APIs, SDKs, and plugins for simple integration of payment gateways on websites or applications.

Differentiating PSPs from Other Financial Entities

PSPs vs. Payment Gateways

| Feature | PSPs (Payment Service Providers) | Payment Gateways |

| Definition | Companies that handle the complete payment process | Technology that transmits payment data to processors/banks |

| Function | Collect, process, and settle payments for merchants | Authorize and securely transfer cardholder data |

| Scope | End-to-end service including gateway, processing, and settlement | Focused on transmitting data between merchant and processor |

| Services Included | Fraud protection, analytics, recurring billing | Mainly payment authorization and data transfer |

| Examples | PayPal | Razorpay Gateway |

PSPs vs. Payment Processing Systems

| Feature | PSPs (Payment Service Providers) | Payment Processing Systems |

| Definition | Third-party companies that manage the entire payment transaction | Systems that move funds between the customer and merchant banks |

| Function | Combine gateway, processor, and merchant account into one solution | Handle transaction approval and fund transfers |

| Scope | All-in-one service including payment acceptance and settlement | Core infrastructure for handling payments |

| Services Provided | Several tools such as analytics, dashboards, and fraud protection | Exclusive to transaction routing, approval, and clearing |

| Examples | PayPal | VisaNet, Mastercard Network |

How PSPs Work?

- The customer makes a payment by inputting their payment details during checkout.

- The PSP retrieves and encrypts the payment information and forwards them to the acquiring bank.

- The acquiring bank submits the transaction to the card network in question (e.g., Visa, Mastercard).

- The card network forwards the transaction to the issuer bank (customer’s bank).

- The issuing bank verifies funds and accepts or declines the transaction.

- The transaction is sanctioned through the network to the merchant, completing the transaction in real-time.

Settlement and Reconciliation of Transactions

- After a transaction is authorized, the issuing bank sends money to the acquiring bank, typically in a few working days.

- The PSP consolidates the payments and transfers the funds to the merchant’s account, less any fees.

- Settlement reports are produced to reflect on which transactions were executed, refunded, or failed.

- Reconciliation entails comparing the settlement reports to the merchant’s sales records to verify all payments have been accounted for.

Registration Process of PSPs

Registration authorities ensure that there is trust and stability in the financial system. They have the mandate to oversee the PSPs’ operation, ensuring that they meet regulatory requirements and consumer protection standards. They prevent fraud, money laundering, and other financial crimes by setting and enforcing rules. They also offer a framework that allows innovation while protecting the interests of the users. Further, registration ensures a level playing field between the service providers and encourages confidence among consumers, merchants, and other stakeholders in the payment sector

Criteria and Compliance Requirements

- Must be a legally registered business entity with a clear ownership and governance structure.

- Should maintain sufficient capital reserves as prescribed by the regulatory body.

- Should have strong IT security and data protection mechanisms.

- Must have anti-money laundering (AML) and know your customer (KYC) policies in place.

- Should have customer grievance redressal and fraud response systems.

- Subject to frequent audits, report of compliance, and regulatory examinations.

Advantages of Using PSPs

- Ease of Setup and Integration: PSPs provide easy-to-use platforms that are simple to set up and integrate with websites, apps, and e-commerce platforms without requiring significant technical expertise.

- Access to Multiple Markets and Currencies: PSPs enable companies to receive payments in different currencies, and it simplifies transactions with global customers as well as entry into new global markets.

- Analytics and Reporting Capabilities: Many PSPs offer robust dashboards and reporting features that enable firms to monitor transactions, monitor performance, and make informed decisions.

Challenges Faced by PSPs

- Transaction Reconciliation Problems: Inability to reconcile incoming and outgoing transactions on multiple channels. Inaccuracies and delays in bank and card network settlement reports.

- Regulatory Compliance Management: Regulations continually changing in various geographies (e.g., PSD2, AML, GDPR). Must maintain KYC (Know Your Customer) and AML (Anti-Money Laundering) compliance.

Regulatory Framework and Obligations

Companies need to have open and transparent interactions with regulatory bodies like financial regulators, data protection organizations, and the law enforcement agencies. This involves reporting in a timely manner breaches, fraud cases, or failures in compliance. Companies may also be mandated to undergo audits, investigations, or file routine compliance reports with these organizations.

Organizations are legally required to adhere to financial regulations like anti-money laundering (AML) regulations, know your customer (KYC) rules, tax compliance, and accounting principles. They are further required to ensure compliance with protection of data statutes like the GDPR or CCPA, depending on the country’s jurisdiction. Compliance failure may invite penalties, judicial action, a loss of reputation, or operation restrictions.

Related Read: The Role of AI in Enhancing Customer Experience During KYC Verification

Conclusion

PSPs offer the technology and infrastructure that drive secure, fast, and convenient payment experiences, while Registration Authorities ensure these services operate within a trusted and regulated framework. For consumers and business alike, the knowledge of PSPs is a key to decision-making regarding payments solutions and regulation.

Deepvue’s API suite provides a one-stop solution for identity verification, banking compliance, and risk checking. The APIs facilitate real-time document verification like Aadhaar, PAN, and GST registrations in compliance with regulatory requirements.

FAQ

What is a PSP payment service provider?

A Payment Service Provider (PSP) is an intermediary firm that allows businesses to accept electronic payments, such as credit/debit cards, UPI, wallets, and net banking, in one single platform.

What are the roles of PSP?

PSPs enable safe and cost-effective processing of payments, process transaction settlements, ensure regulatory compliance, and offer fraud protection tools and APIs for merchants.

What is PSP registration?

PSP registration is the procedure by which a payment facilitator is authorized by a governing body, for example, RBI in India, to operate lawfully and provide payment services in a financial network.

What is a PSP in UPI?

In UPI, a PSP is a financial institution or firm that brings customers into the UPI network through providing them facilities to send and receive money with UPI applications, managing the technical and monetary parts of a transaction.

What are the Benefits of Using PSP in UPI?

Usage of a PSP in UPI makes transactions more prompt, provides utmost security, ensures smooth association with bank accounts, and effective infrastructure for merchants and customers for digital payments efficiently.